A federal pass judgement on in Texas has blocked a brand new executive rule that will slash bank card late-payment fees, a centerpiece of the Biden management’s efforts to clamp down on “junk” charges. Pass judgement on Mark Pittman of the U.S. District Court docket for the Northern District of Texas on Friday granted an injunction sought via the banking business and different trade pursuits to freeze the constraints, that have been scheduled to take impact on Would possibly 14.

In his ruling, Pittman cited a 2022 resolution via the U.S. Court docket of Appeals for the 5th Circuit that discovered that investment for the Client Monetary Coverage Bureau (CFPB), the federal company set to implement the bank card rule, is unconstitutional.

Click on right here to view similar media.

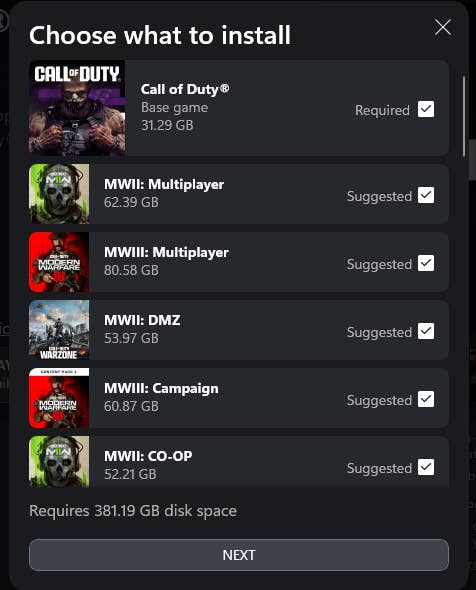

click on to enlarge

The rules, followed via the CFPB in March, search to cap past due charges for bank card bills at $8, in comparison with present past due charges of $30 or extra. Even if a bane for shoppers, the costs generate about $9 billion a yr for card issuers, in line with the company.After the CFPB on March 5 introduced the ban on what it referred to as “over the top” bank card past due charges, the American Bankers Affiliation (ABA) and U.S. Chamber of Trade filed a criminal problem. The ABA, an business business staff, applauded Pittman’s resolution.”This injunction will spare banks from having to right away agree to a rule that obviously exceeds the CFPB’s statutory authority and can result in extra past due bills, decrease credit score rankings, larger debt, lowered credit score get right of entry to and better APRs for all shoppers — together with nearly all of card holders who pay on time every month,” ABA CEO Rob Nichols mentioned in a observation. Client teams blasted the verdict, pronouncing it is going to harm bank card customers around the U.S.

“Of their newest in a stack of complaints designed to pad file company earnings on the expense of everybody else, the U.S. Chamber were given its approach for now, making sure households get price-gouged slightly longer with bank card past due charges as prime as $41,” Liz Zelnick of Responsible.US, a nonpartisan advocacy staff, mentioned in a observation. “The U.S. Chamber and the large banks they constitute have corrupted our judicial machine via venue buying groceries in courtrooms of least resistance, going out in their method to keep away from having their lawsuit heard via a good and impartial federal pass judgement on.”

“Junk charges” value American citizens billions yearly

Consistent with client advocates that make stronger the CFPB’s late-fee rule, bank card issuers hit consumers with $14 billion in late-payment fees in 2019, accounting for smartly over part their commission income that yr. Monetary business critics say such past due charges goal low- and moderate-income shoppers, specifically other folks of colour.In spite of Pittman’s keep on Friday, analysts mentioned the criminal combat over past due charges is prone to proceed, with the case most likely heading to the Ultimate Court docket. “We imagine this opens the door for the CFPB to hunt to raise the initial injunction if the Ultimate Court docket regulations within the coming weeks that Congress correctly funded the company,” Jaret Seiberg of TD Cowen Washington Analysis Workforce mentioned in a record following the verdict. “It’s why we imagine this isn’t the tip of the combating over whether or not the cost reduce will take impact ahead of complete attention of the deserves of the lawsuit.”

—With reporting via CBS Information’ Alain Sherter

Extra from CBS Information

Kate Gibson

Kate Gibson is a reporter for CBS MoneyWatch in New York.