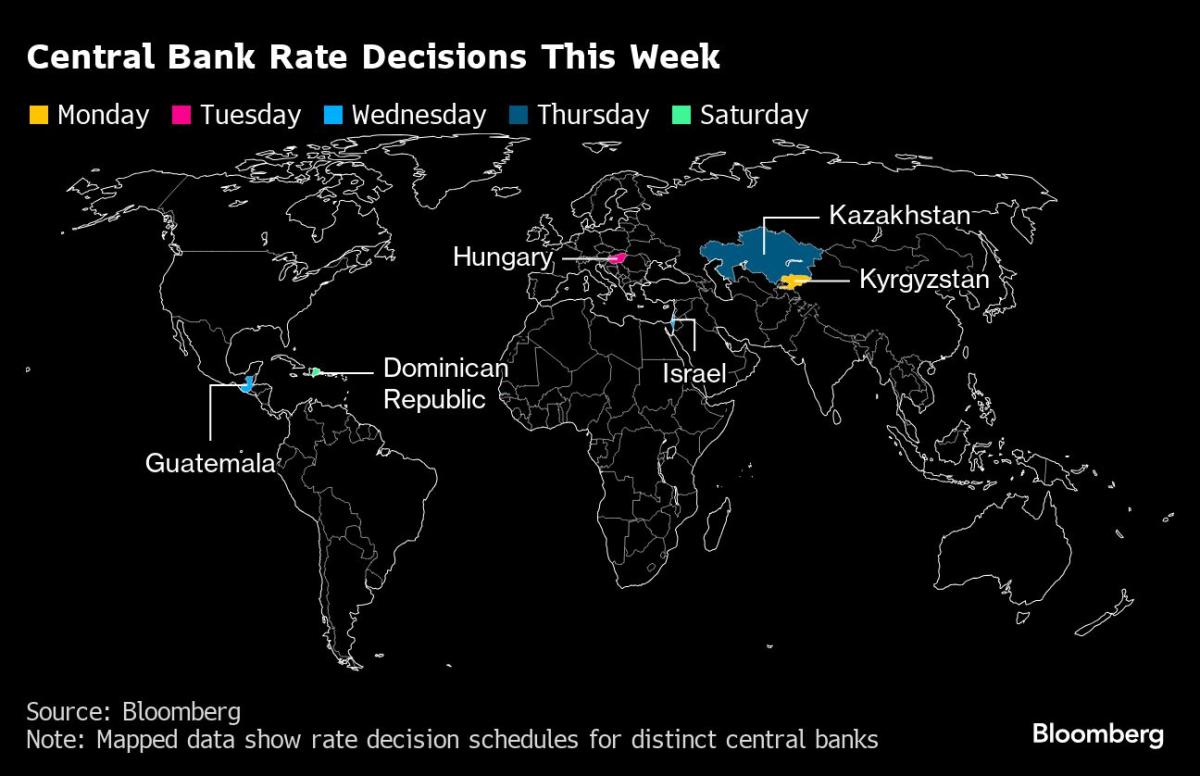

(Bloomberg) — US inflation figures within the coming week will beef up that long-awaited interest-rate cuts are coming quickly, whilst a studying on shopper spending is observed indicating that the central financial institution has been a success at retaining the growth intact.Maximum Learn from BloombergEconomists see the non-public intake expenditures value index except meals and effort — the Fed’s most popular measure of underlying inflation — emerging 0.2% in July for a moment month. That may pull the three-month annualized fee of so-called core inflation down to two.1%, a smidgen above the central financial institution’s 2% function.Economists within the Bloomberg survey additionally be expecting shopper outlays, unadjusted for value adjustments, to climb 0.5% — the most powerful advance in 4 months — in Friday’s record.Talking on the Jackson Hollow symposium, Fed Chair Jerome Powell stated fresh growth on inflation, pronouncing he’s received self assurance it’s on a trail again to two% and that “the time has come for coverage to regulate.”Friday’s remark marked a key turning level within the Fed’s two-year struggle in opposition to value pressures and underscored how the focal point has shifted towards dangers within the exertions marketplace — the opposite a part of the central financial institution’s twin mandate. Employment expansion has helped stay customers spending — a key to making sure growth of the economic system.On Thursday, the federal government will factor its first revision of second-quarter gross home product. Economists’ median projection requires a 2.8% annualized fee of expansion, unchanged from the prior studying.Different US information within the coming week come with July sturdy items orders on Monday and separate indexes of shopper self assurance on Tuesday and Friday.What Bloomberg Economics Says:“Powell’s very dovish cope with at Jackson Hollow was once track to marketplace avid gamers’ ears. He pledged the Fed would do ‘the entirety’ it could possibly to toughen a robust exertions marketplace, offering a ground for the economic system. We predict a little of a fact take a look at is so as.”— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou. For complete research, click on right here.Additional north, Canadian second-quarter GDP information would be the ultimate primary financial liberate prior to the central financial institution is predicted to decrease charges for a 3rd instantly assembly on Sept. 4.Initial information prompt 2.2% annualized quarterly expansion — upper than the central financial institution’s forecast of one.5% — bolstering its efforts to engineer a cushy touchdown whilst proceeding to decrease borrowing prices.Tale continuesInvestors might be additionally gazing for the newest tendencies to unravel a Canadian railway dispute that has tousled North American provide chains.In different places, the euro zone will record inflation for August not up to two weeks prior to the Ecu Central Financial institution subsequent makes a decision on financial coverage, whilst China’s central financial institution will set the speed on its one-year coverage loans. Fee selections come with Hungary and Israel.Click on right here for what came about prior to now week, and underneath is our wrap of what’s arising within the world economic system.AsiaThe week begins with a renewed focal point on China’s new financial framework, because the Other people’s Financial institution of China units the speed on its one-year coverage loans. After a wonder reduce in July, government are anticipated to carry the speed secure at 2.3%.Monday’s resolution comes after the PBOC signaled this month that it’s de-emphasizing the medium-term lending facility’s function as a coverage device, whilst raising the seven-day opposite repurchase fee to larger prominence.An afternoon later, China will get business benefit figures that can spur requires extra coverage steps to spice up the economic system, and Beijing sees reliable PMI numbers on Saturday.In different places, costs might be a theme.Australia’s trimmed imply inflation gauge for July will give its central financial institution recent proof to weigh because it considers whether or not or to not retain its hawkish rhetoric.Japan additionally will get a shopper inflation replace for the capital, a number one indicator for nationwide tendencies. Information on Friday would possibly display India’s year-on-year financial expansion slowed a tad in the second one quarter, and business figures are due all through the week from Thailand, Sri Lanka and Hong Kong. Kazakhstan’s central financial institution meets Thursday to come to a decision whether or not to chop its key fee for a 3rd consecutive assembly.Europe, Heart East, AfricaInflation information might be in focal point for Europe as neatly, with August numbers due from the area’s giant economies — Germany, France, Italy and Spain — along side a studying for the 20-nation euro zone as an entire.A slowdown is predicted for the bloc from July’s 2.6%, paving the way in which for the ECB to decrease rates of interest for the second one time this cycle when it meets in September.Such expectancies had been strengthened via the continent’s financial quandary. Whilst August’s Buying Managers’ Index were given an sudden spice up from the Paris Olympics, underlying weak spot is more likely to persist past that transient raise. The beginning of the week will see updates on output and sentiment in Germany — the area’s present vulnerable spot.Audio system more likely to touch upon financial coverage and the newest shifts within the economic system come with ECB Governing Council individuals Joachim Nagel and Klaas Knot, in addition to Government Board member Isabel Schnabel.In Japanese Europe, Hungary is predicted to stay rates of interest on cling at 6.75%. It’s a an identical tale within the Heart East, the place Israel’s central financial institution is observed retaining benchmark borrowing prices at 4.5%.In Africa, there’ll be August inflation readings from Kenya and Uganda, along side second-quarter GDP figures from Nigeria.Latin AmericaBrazil’s central financial institution on Monday posts its weekly survey of economists. Financial institution President Roberto Campos Neto this month mentioned inflation expectancies are unmoored and that officers are able to tighten financial coverage if wanted.Brazil’s mid-month inflation information on Tuesday would possibly display a slight easing from July’s 4.45%, nonetheless neatly above the three% goal. Analysts are marking up their interest-rate forecasts whilst investors are pricing in a hike once subsequent month.Fiscal slippage has put Brazil’s finances information — the July figures are slated for e-newsletter within the coming week — within the highlight. Economists surveyed via the central financial institution don’t see an annual nominal or number one finances surplus to the 2027 forecast horizon.The principle tournament in Mexico would be the central financial institution’s quarterly inflation record. New forecasts are not going so quickly after revisions made within the financial institution’s Aug. 8 post-decision verbal exchange, however policymakers would possibly re-evaluate GDP estimates.Chile’s June retail gross sales figures will most likely display a 7th consecutive certain year-on-year print after just about two years of declines.–With the help of Robert Jameson, Laura Dhillon Kane, Zoe Schneeweiss, Paul Richardson and Brian Fowler.(Updates with Canada rail dispute in tenth paragraph)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Fed’s Most popular Worth Gauge Is Set to Improve Fee Cuts

:max_bytes(150000):strip_icc()/GettyImages-2207954605-cacf07fd067a4c8d8b234f534f0e554c.jpg)