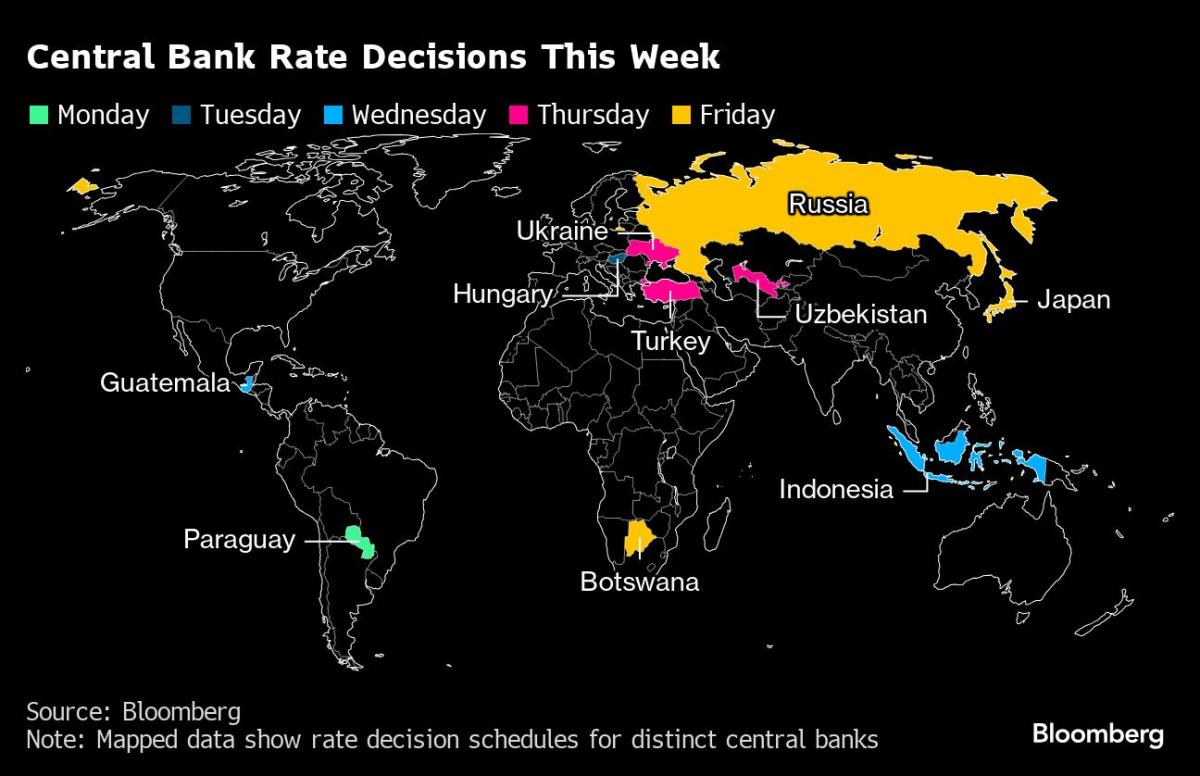

(Bloomberg) — Federal Reserve officers are about to get additional affirmation that development in opposition to inflation has stalled, supporting what seems to be a shift in tone to stay rates of interest upper for longer than prior to now expected.Maximum Learn from BloombergPolicymakers’ most popular inflation gauge — the non-public intake expenditures value index — most probably stayed increased in March, in line with knowledge due within the coming week.The measure is noticed accelerating relatively to two.6% on an annual foundation as power prices upward thrust. The core metric, which strips out power and meals, is anticipated to upward thrust 0.3% from the prior month after a equivalent acquire in February.Whilst the core PCE knowledge might not be as sturdy as the shopper value index — which crowned estimates and rattled markets previous this month — Fed Chair Jerome Powell and different officers have signaled that it’ll take longer for them to achieve the important self belief in a downward trajectory of inflation prior to reducing charges.Learn extra: Fed Resets Clock on Cuts and Questions If Charges Are Prime EnoughPolicymakers will follow the standard public-speaking blackout duration all the way through the approaching week, forward in their two-day assembly that concludes Might 1.The contemporary inflation numbers on Friday can be accompanied by way of March non-public spending and source of revenue figures. Towards a backdrop of wholesome task enlargement, economists venture some other cast acquire in family outlays for items and products and services. Source of revenue enlargement could also be forecast to boost up.Different knowledge for the week come with the federal government’s preliminary estimate of first-quarter enlargement, which most probably cooled from the prior duration’s powerful tempo however nonetheless ran above what policymakers deem is sustainable in the end.A composite gauge of process at producers and repair suppliers can also be launched, in addition to new-home gross sales. Later within the week, the College of Michigan will submit its ultimate April studying of person sentiment and inflation expectancies.What Bloomberg Economics Says:“Actual GDP most likely cooled to a couple of 2.7% tempo in 1Q following 4.2% reasonable enlargement in 2H23. That’s nonetheless above the longer-run sustainable tempo of one.8%, in line with FOMC projections, suggesting chronic inflationary pressures. Taking a look ahead, process can be challenged by way of weak spot in discretionary spending with shoppers an increasing number of delicate to costs amid increased inflation.”Tale continues— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For complete research, click on hereLooking north, the Financial institution of Canada’s abstract of deliberations will shed extra gentle at the debate between officers about what they wish to see prior to reducing charges. Retail gross sales for February and a flash estimate for March might ascertain indicators of a shopper slowdown firstly of the 12 months.In other places, the Financial institution of Japan’s determination can be scrutinized for hints of long run price hikes, Turkish officers might stay borrowing prices on grasp, Germany’s Ifo trade index would possibly sign development, and nations from Australia to Mexico are set to unlock inflation numbers.Click on right here for what came about ultimate week and underneath is our wrap of what’s bobbing up within the international economic system.AsiaThe BOJ will ship its newest value forecasts, little greater than a month after its first price hike since 2007.With Japan’s central financial institution extensively anticipated to stay coverage on grasp after mothballing its huge easing program, economists and buyers will scrutinize the forecasts and the BOJ’s characterization of inflation dangers for any hints at the tempo of long run price hikes.Endured weak spot within the yen will upload an additional layer of hysteria when Governor Kazuo Ueda speaks at a briefing after Friday’s determination.The week kicks off with Chinese language banks anticipated to stay their high rates of interest unchanged.Initial export figures from South Korea will supply a snapshot of the power of global trade. The trade-dependent country releases its gross home product figures on Thursday, with the economic system anticipated to have grown on the identical clip as the former 4 quarters.Indonesia’s central financial institution is more likely to stay borrowing prices unchanged at 6%.Singapore, Australia and Malaysia unlock inflation numbers all the way through the week, with the per 30 days figures from Down Beneath anticipated to turn the primary acceleration since September.Australia will minimize the expansion outlook for many main economies, together with key buying and selling spouse China, when it releases its finances subsequent month, Treasurer Jim Chalmers stated on Sunday.Europe, Center East, AfricaEuropean Central Financial institution President Christine Lagarde will ship a speech on Monday at Yale College as she extends her US talk over with after the World Financial Fund/International Financial institution conferences.Again in Europe, a number of colleagues are scheduled to talk within the coming days. Amongst them can be ECB Government Board participants Isabel Schnabel and Piero Cipollone, and governors together with Joachim Nagel, Francois Villeroy de Galhau and Fabio Panetta.Key euro-zone releases come with person self belief on Monday, the preliminary result of per 30 days purchasing-manager surveys on Tuesday, and the ECB’s consumer-expectations survey on Friday.Amongst main economies, Germany’s Ifo trade sentiment index on Wednesday can be a spotlight at a time when policymakers are watching a flip for the easier in Europe’s biggest economic system after a duration of stagnation and contraction.Tuesday is ready to be busy in the United Kingdom. PMI numbers can be launched in tandem with the ones of the euro zone, and the newest public finance knowledge are due then too. Financial institution of England Leader Economist Huw Tablet and fellow policymaker Jonathan Haskell are scheduled to talk that day.The Swiss Nationwide Financial institution will grasp its annual basic assembly on Friday, an afternoon after freeing income. The development attracted local weather activists prior to now, they usually may well be motivated this time by way of a parliamentary vote endorsing the central financial institution’s place to not take environmental dangers into consideration in its financial coverage.South Africa’s central financial institution on Tuesday will submit its biannual financial coverage overview, offering steerage on its inflation and interest-rate outlook.A number of financial choices are scheduled across the wider area:On Tuesday, Hungary is poised to additional sluggish cuts to the Ecu Union’s best price as officers confront a couple of dangers whilst seeking to protect the unstable forint.Two days later, Ukraine’s central financial institution will set coverage within the wake of slowing inflation.Additionally on Thursday, Turkish officers might stay the important thing price at 50% after a marvel hike ultimate month. Some analysts aren’t ruling out some other building up if policymakers see the inflation outlook deteriorating from the height they see of round 75% within the coming months.On Friday, the Financial institution of Russia is ready to handle its price at 16% after officers signaled “an extended duration” of tight financial prerequisites this 12 months amid consistently top inflation and irritating overseas commerce because of sanctions.The similar day, Botswana is expected to stay borrowing prices unchanged, with inflation underneath its 3% to six% goal vary.Latin AmericaIn Mexico, early-April inflation knowledge is most likely to spice up hypothesis that the central financial institution will pause at its Might assembly, as analysts be expecting that the mid-month print driven again up over 4.5%.Banxico Governor Victoria Rodriguez stated in a Bloomberg interview this weekend that the Mexican peso’s fresh bout of volatility following emerging tensions within the Center East isn’t a priority for inflation.Additionally on faucet are February GDP-proxy figures, very in all probability appearing a 5th immediately month-on-month decline, and the March hard work marketplace document.At the financial coverage entrance, Paraguay’s central financial institution is noticed trimming borrowing prices for a 9th immediately assembly, to five.75%, prior to taking a breather at its Might accumulating.Argentina studies its per 30 days finances effects for March, following consecutive surpluses in January and February at the again of President Javier Milei’s so-called surprise remedy financial measures. Analysts be expecting that very same austerity to weigh at the February GDP-proxy knowledge after January’s deeply unfavourable print.In Brazil, the central financial institution’s survey of analysts will most likely display additional erosion of inflation expectancies following the federal government’s proposal to water down its finances objectives.Latin The united states’s largest economic system may even serve up its March present account document, overseas direct funding, tax collections, and banking lending knowledge, at the side of its mid-month inflation document.The early consensus sees a sub-4% studying, smartly inside the 1.5%-to-4.5% tolerance vary however nonetheless smartly over the three% goal.–With the help of Robert Jameson, Paul Jackson, Piotr Skolimowski, Monique Vanek, Beril Akman and Tony Halpin.(Updates with Australian treasurer in Asia segment)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Fed’s Most well-liked Inflation Gauge Is Set to Again Fee-Minimize Persistence