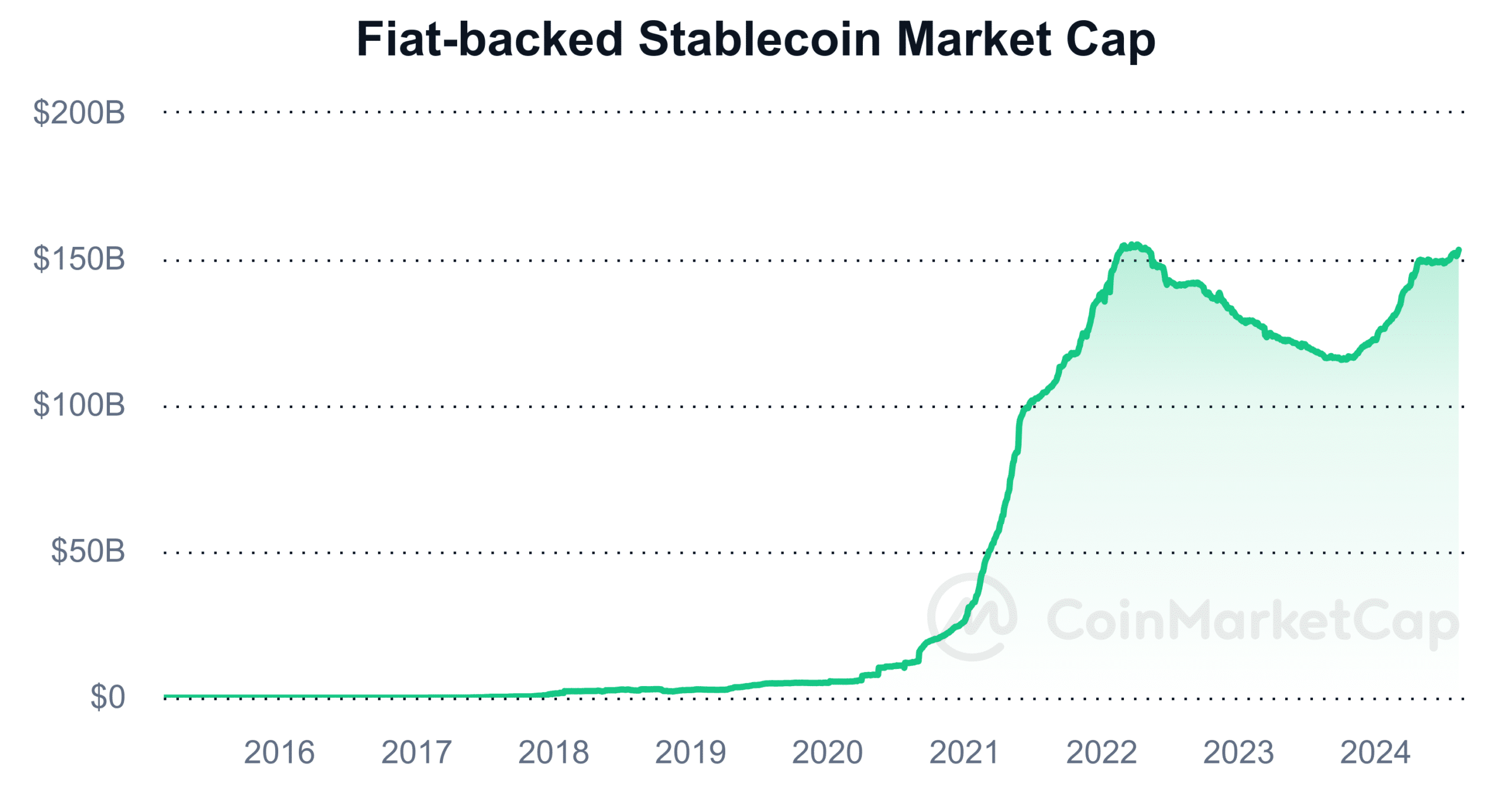

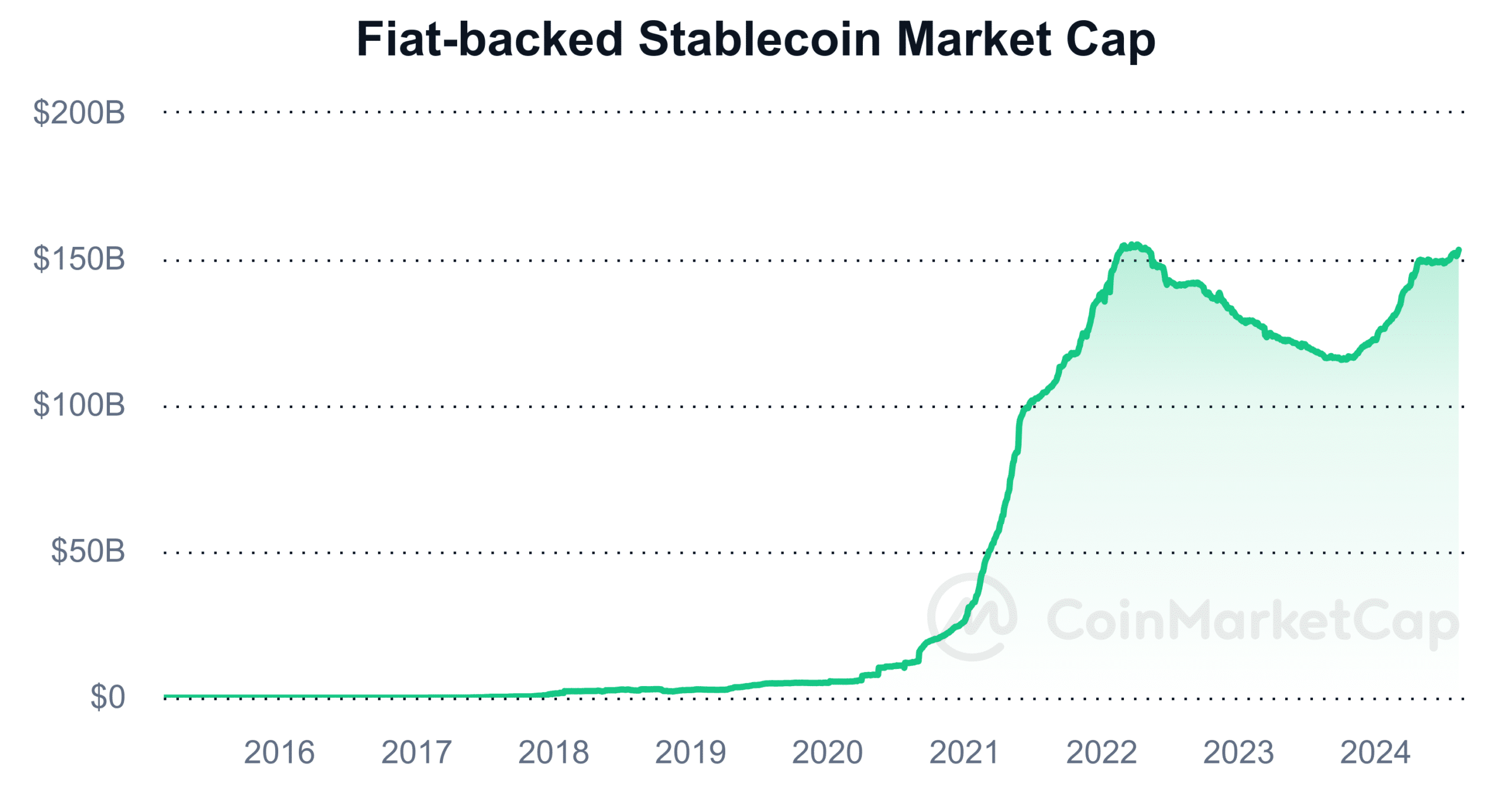

The stablecoin marketplace cap has hit its second-highest mark in historical past.

USDT held over part of the marketplace cap at press time.

Amid a basic downtrend within the total cryptocurrency marketplace capitalization, the stablecoin sector exhibited contrasting conduct, reaching a record-high marketplace cap.

This divergence highlighted the original dynamics inside other segments of the crypto marketplace.

Stablecoin marketplace cap hits list

The stablecoin marketplace capitalization has proven exceptional expansion beginning in overdue 2020, aligning with the wider growth of the marketplace.

This expansion used to be in large part pushed via rising passion in decentralized finance (DeFi) and a much wider acceptance and usage of stablecoins.

The marketplace cap for stablecoins reached its zenith on the onset of 2022, touching the $154 billion mark. Alternatively, this height used to be adopted via a noticeable retreat in marketplace cap, losing to round $116 billion.

Supply: CoinMarketCap

Supply: CoinMarketCap

Regardless of this downturn, the marketplace cap confirmed indicators of stabilization and restoration because it greater in 2024. As of this writing, the stablecoin marketplace cap used to be round $153.2 billion, carefully coming near its all-time excessive.

Conceivable causes for the rise

The expansion within the stablecoin marketplace capitalization is an important indicator of liquidity within the cryptocurrency marketplace. It facilitates more straightforward access and go out for buyers and buyers.

Moreover, a upward thrust in stablecoin marketplace capitalization, particularly all the way through sessions of broader marketplace uncertainty, regularly displays a flight to protection throughout the crypto ecosystem.

Buyers turning to stablecoins, that are most often pegged to strong belongings like america buck, recommend a wary way.

Conversely, a lower available in the market cap of stablecoins, paired with an influx of price range into different, extra unstable cryptocurrencies, can sign a bullish sentiment amongst buyers. This shift regularly signifies an greater possibility urge for food.

USDT, USDC dangle dominant marketplace stocks

AMBCrypto’s research of the stablecoin marketplace confirmed that it used to be ruled via Tether [USDT] and USD Coin [USDC].

As of press time, Tether’s marketplace cap stood at over $115 billion, keeping up its place because the main stablecoin via a substantial margin.

When put next, USDC held a marketplace cap of over $34 billion, firmly putting it as the second one maximum dominant stablecoin.

An in depth take a look at the adjustments in marketplace cap published that USDT has skilled notable will increase lately. One important leap took place across the eighth of July, when its marketplace cap surged from $114 billion to $115 Billion.

Following this, there was a slight uptick in its marketplace cap, now recorded at roughly $115.4 Billion.

Earlier: Defined – What came about after Solana’s safety vulnerability

Subsequent: CBOE re-submits submitting for Spot Bitcoin ETF Choices to SEC – What subsequent?