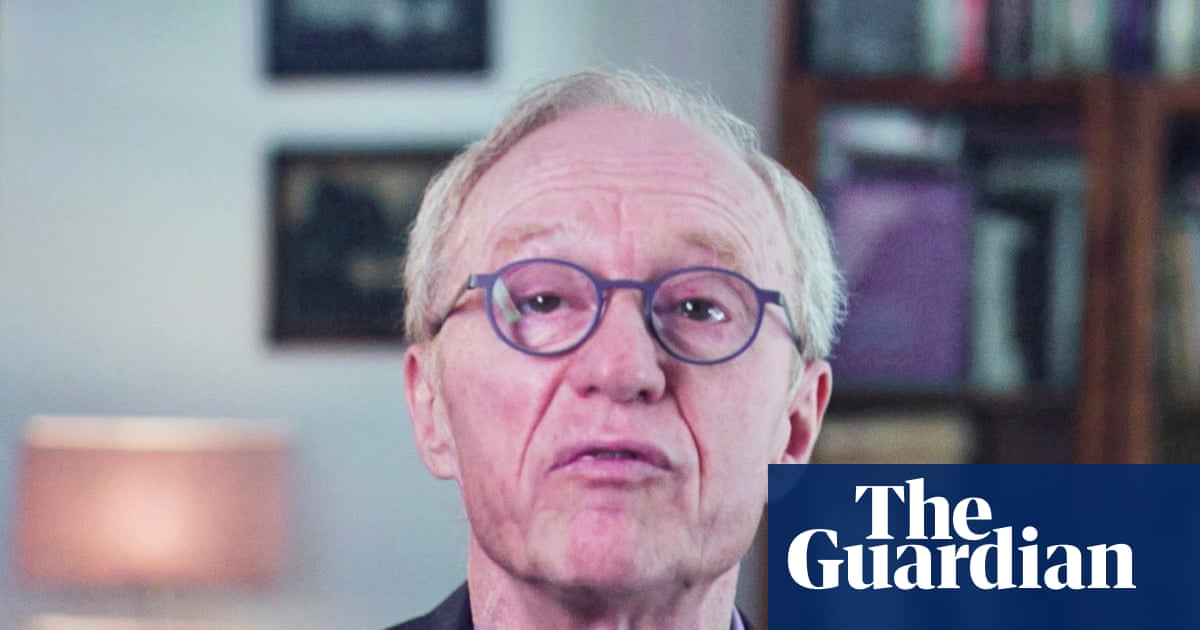

The Financial institution of England reduce rates of interest on Thursday for the 3rd time in about six months, amid indicators of susceptible financial expansion in Britain and an sudden slowdown in inflation.Policymakers reduce the important thing price 1 / 4 level to 4.5 p.c because the financial institution decreased its forecasts for financial expansion this yr. Two participants of the nine-person rate-setting committee voted to decrease charges by means of a bigger half-point transfer.Andrew Bailey, the governor of the central financial institution, stated policymakers would take “a steady and cautious technique to lowering charges additional” as they monitored financial trends in Britain and in a foreign country.The inflation price slowed rather to two.5 p.c in December, when economists have been anticipating the velocity to carry stable. Crucially, inflation within the products and services sector, which has been specifically cussed, slowed to 4.4 p.c from 5 p.c in November.At the same time as inflation has dropped considerably from its double digit highs simply a few years in the past, the Financial institution of England has been specifically wary in easing financial coverage. Final yr, it reduce charges not up to its opposite numbers in the US, Canada and the eurozone.British policymakers remained all in favour of lingering inflationary dangers, specifically as salary expansion remained reasonably sturdy, and unsure concerning the affect of new spending and tax adjustments by means of the federal government.Thanks to your persistence whilst we examine get right of entry to. In case you are in Reader mode please go out and log into your Occasions account, or subscribe for all of The Occasions.Thanks to your persistence whilst we examine get right of entry to.Already a subscriber? Log in.Need all of The Occasions? Subscribe.

Financial institution of England Cuts Passion Charges as British Economic system Weakens