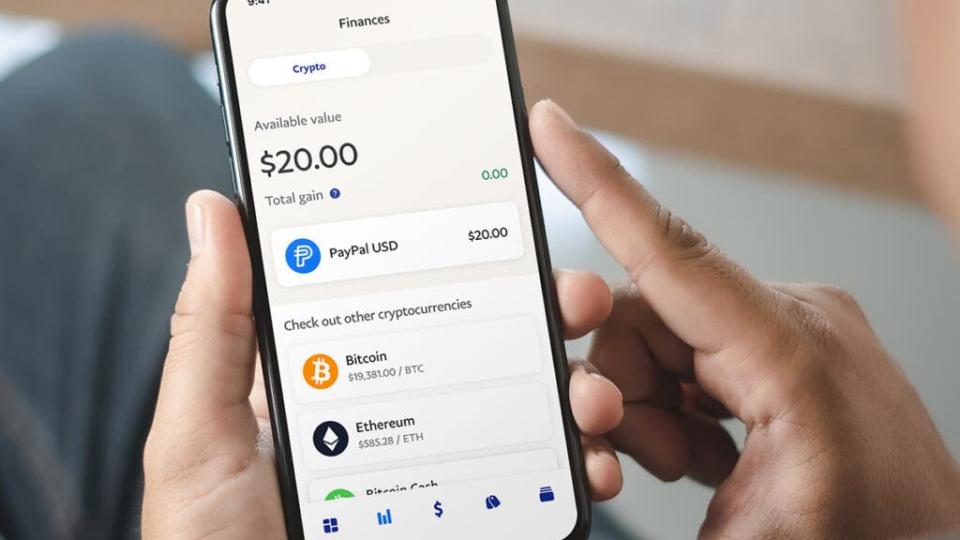

Fintech Large PayPal’s Q2 Income: Income And EPS Beat, Cost Volumes And Transactions Surge, Steering BoostPayPal Holdings Inc (NASDAQ:PYPL) reported fiscal second-quarter income enlargement of 8% 12 months over 12 months to $7.89 billion, beating the analyst consensus estimate of $7.81 billion.The corporate reported a quarterly adjusted EPS of $1.19, beating analyst consensus estimates of $0.98. The inventory worth won after the print.General fee volumes larger 11% year-over-year to $416.8 billion within the quarter.Cost transactions have been up 8% to $6.6 billion, and the fee transactions consistent with lively account larger 11% on a trailing 12-month foundation.General lively accounts diminished by way of 0.4% to 429 million. On a sequential foundation, lively accounts larger by way of 0.4%, or 1.8 million.The working margin expanded 126 foundation issues to 16.8%, and the adjusted working margin larger 231 bps to $18.5 billion.Working money waft was once $1.5 billion, and loose money waft was once $1.4 billion. PayPal held $18.3 billion in money and equivalents as of June 30, 2024.“PayPal delivered a powerful moment quarter and primary part, and I’m assured we’re on course. We delivered our absolute best transaction margin greenback enlargement since 2021, and we’re making stable growth on our strategic transformation whilst making an investment in innovation and working extra successfully,” CEO Alex Chriss stated.Outlook: PayPal expects third-quarter revenues to extend by way of a mid-single-digit proportion in comparison to $7.42 billion within the prior 12 months’s duration and the consensus of $7.81 billion.It expects adjusted EPS to develop within the prime single-digit proportion in comparison to $0.98 for the former 12 months’s duration and the consensus of $0.98.PayPal expects full-year 2024 adjusted EPS to extend by way of the low-mid-teens proportion (prior mid- to prime single-digit proportion) in comparison to $3.83 Y/Y. Present analyst estimates are calling for an EPS of $4.23 consistent with percentage.PayPal Holdings inventory misplaced over 22% within the closing 365 days. Analysts have projected upside from Venmo and PayPal virtual wallets.Worth Motion: PYPL stocks traded upper by way of 5.99% at $62.47 premarket at the closing test on Tuesday.Photograph courtesy of PayPal”ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Marketplace Recreation with the number 1 “information & the entirety else” buying and selling software: Benzinga Professional – Click on right here to begin Your 14-Day Trial Now!Get the newest inventory research from Benzinga?This newsletter Fintech Large PayPal’s Q2 Income: Income And EPS Beat, Cost Volumes And Transactions Surge, Steering Spice up initially gave the impression on Benzinga.com© 2024 Benzinga.com. Benzinga does now not supply funding recommendation. All rights reserved.

Fintech Large PayPal’s Q2 Income: Income And EPS Beat, Cost Volumes And Transactions Surge, Steering BoostPayPal Holdings Inc (NASDAQ:PYPL) reported fiscal second-quarter income enlargement of 8% 12 months over 12 months to $7.89 billion, beating the analyst consensus estimate of $7.81 billion.The corporate reported a quarterly adjusted EPS of $1.19, beating analyst consensus estimates of $0.98. The inventory worth won after the print.General fee volumes larger 11% year-over-year to $416.8 billion within the quarter.Cost transactions have been up 8% to $6.6 billion, and the fee transactions consistent with lively account larger 11% on a trailing 12-month foundation.General lively accounts diminished by way of 0.4% to 429 million. On a sequential foundation, lively accounts larger by way of 0.4%, or 1.8 million.The working margin expanded 126 foundation issues to 16.8%, and the adjusted working margin larger 231 bps to $18.5 billion.Working money waft was once $1.5 billion, and loose money waft was once $1.4 billion. PayPal held $18.3 billion in money and equivalents as of June 30, 2024.“PayPal delivered a powerful moment quarter and primary part, and I’m assured we’re on course. We delivered our absolute best transaction margin greenback enlargement since 2021, and we’re making stable growth on our strategic transformation whilst making an investment in innovation and working extra successfully,” CEO Alex Chriss stated.Outlook: PayPal expects third-quarter revenues to extend by way of a mid-single-digit proportion in comparison to $7.42 billion within the prior 12 months’s duration and the consensus of $7.81 billion.It expects adjusted EPS to develop within the prime single-digit proportion in comparison to $0.98 for the former 12 months’s duration and the consensus of $0.98.PayPal expects full-year 2024 adjusted EPS to extend by way of the low-mid-teens proportion (prior mid- to prime single-digit proportion) in comparison to $3.83 Y/Y. Present analyst estimates are calling for an EPS of $4.23 consistent with percentage.PayPal Holdings inventory misplaced over 22% within the closing 365 days. Analysts have projected upside from Venmo and PayPal virtual wallets.Worth Motion: PYPL stocks traded upper by way of 5.99% at $62.47 premarket at the closing test on Tuesday.Photograph courtesy of PayPal”ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Marketplace Recreation with the number 1 “information & the entirety else” buying and selling software: Benzinga Professional – Click on right here to begin Your 14-Day Trial Now!Get the newest inventory research from Benzinga?This newsletter Fintech Large PayPal’s Q2 Income: Income And EPS Beat, Cost Volumes And Transactions Surge, Steering Spice up initially gave the impression on Benzinga.com© 2024 Benzinga.com. Benzinga does now not supply funding recommendation. All rights reserved.