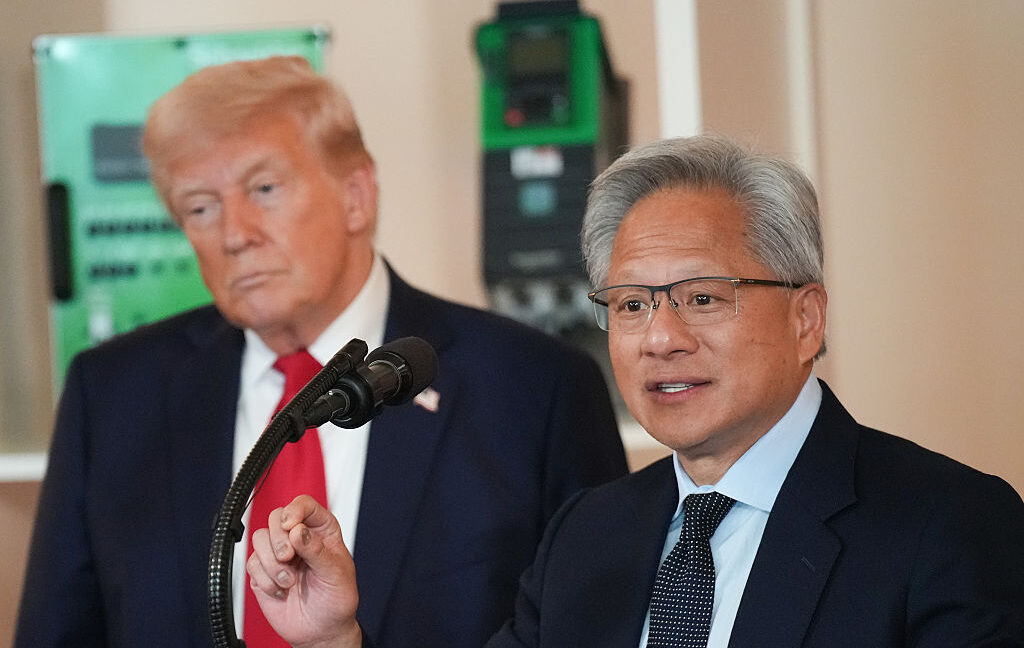

Nvidia’s (NVDA) 3rd quarter profits record out Wednesday noticed the chipmaker as soon as once more blow away Wall Boulevard forecasts. And analysts around the Boulevard have been fast to reward the consequences, which confirmed the arena’s greatest public corporate proceeding to get pleasure from the AI increase. Wedbush’s Dan Ives, one in every of Nvidia’s largest fanatics on Wall Boulevard, stated the corporate’s fiscal 3rd quarter profits reported after the bell Wednesday have been “flawless” and “must be framed and hung within the Louvre” in a observe to buyers Thursday. Ives, together with his standard aptitude, additionally steadily refers to Nvidia CEO Jensen Huang because the “Godfather of AI” and the corporate’s newest Blackwell AI chip because the “LeBron” of semiconductors. “We consider the trail to $4 trillion marketplace cap and past is now laid out by way of Nvidia and that is bullish for the wider tech rally into year-end and 2025,” Ives wrote in other places in his record. Nvidia’s monetary effects for the quarter ended Oct. 27 crowned expectancies around the board. And whilst different analysts didn’t pass as far as to suggest Nvidia’s print as worthy of a effective artwork exhibition, analysts at funding companies together with JPMorgan, DA Davidson, and Bernstein each and every raised their worth objectives at the inventory following Wednesday’s record. “NVIDIA is easily inside of its approach to increase enlargement into subsequent 12 months given hyperscaler remark round further investments in AI compute and the corporate’s skill to ship even with manufacturing setbacks,” wrote DA Davidson analyst Gil Luria in his personal observe to buyers Thursday. Luria is moderately bearish on Nvidia and has cautioned about dangers to the corporate’s enlargement, together with the potential for an AI bubble and Nvidia’s prime focus of earnings amongst moderately few Giant Tech shoppers. However following Nvidia’s 3rd quarter effects, Luria raised his worth goal at the inventory to $135 from $90, although he maintained his Impartial ranking. JPMorgan’s Harlan Sur reiterated his Purchase ranking on Nvidia stocks and raised his worth goal to $170 from $155, noting persisted sturdy call for for Nvidia’s Hopper chips whilst tech companies race to shop for its newest Blackwell lineup. William Stein of Truist Securities, who additionally maintains a Purchase ranking on Nvidia inventory, wrote in a observe overdue Wednesday, “NVDA stays *the* AI corporate owing to its tradition of innovation, ecosystem of incumbency, and big funding in device, pre-trained fashions, and services and products.” In spite of the beat, stocks of Nvidia have been off about 1% on Thursday and lagging the wider marketplace. The inventory was once up by way of part a share level on the marketplace shut. Tale Continues Analysts attributed the slip in stocks to the corporate’s in-line steerage for the present quarter. Stein, for his phase, countered any destructive sentiment at the inventory, writing, “NVDA’s larger self assurance within the Blackwell ramp must crush the drag at the inventory from a This autumn earnings steerage quantity that was once simply ‘just right’ slightly than ‘nice’.” Nvidia previous this 12 months behind schedule manufacturing of its newest Blackwell AI chips from the 3rd quarter to the fourth quarter, given design flaws that the corporate stated have since been resolved. A record from the Knowledge this week relating to overheating problems with Nvidia’s newest servers, which each and every come with 72 Blackwell chips, renewed fears of delays and despatched the inventory down. However Nvidia dispelled the ones anxieties, no less than within the eyes of analysts. In a observe titled “Faux Information?”, Evercore ISI analyst Mark Lipacis wrote, ”In step with our personal resources, NVDA reiterated Blackwell manufacturing in complete steam because it now anticipates JanQ shipments forward of prior expectancies.” Nvidia CEO Jensen Huang prior to a 3-hitter between the San Francisco Giants and the Arizona Diamondbacks in San Francisco, Tuesday, Sept. 3, 2024. (AP Photograph/Jeff Chiu) · ASSOCIATED PRESS Nvidia stocks have come below force now and then all through fresh months, with fears AI spending from Giant Tech companies may just hit a wall. Uncertainty surrounding how Trump 2.0 industry insurance policies may just impact the corporate, which sells specialised chips to China below the present industry restrictions, has additionally entered the image. Gross sales to China made up 14% of Nvidia’s knowledge heart earnings all through the corporate’s fiscal 12 months ended Jan. 28, 2024. “Chip Conflict” creator Christopher Miller instructed Yahoo Finance that semiconductors shouldn’t take too giant successful from price lists immediately, although they will come below force if price lists on electronics assembled in China reminiscent of PCs and telephones — which use the chips — motive call for for the ones merchandise to wane. “The alternate in management isn’t going to make a large distinction [for chipmakers],” Miller stated. Nvidia additionally has a bonus in the truth that it’s increasing into different markets past compute merchandise for AI device builders, Voltron Knowledge’s box leader generation officer Rodrigo Aramburu instructed Yahoo Finance. “NVIDIA is in point of fact smartly located,” Aramburu stated. “[It’s] in additional puts than AI.” Truist Securities’ Stein stated this week he expects Nvidia to unlock a shopper CPU, which is used for “conventional” computing, subsequent 12 months, “opening up vital further [total addressable market].” Laura Bratton is a reporter for Yahoo Finance. Apply her on X @LauraBratton5. Click on right here for the most recent generation information that may have an effect on the inventory marketplace Learn the most recent monetary and trade information from Yahoo Finance