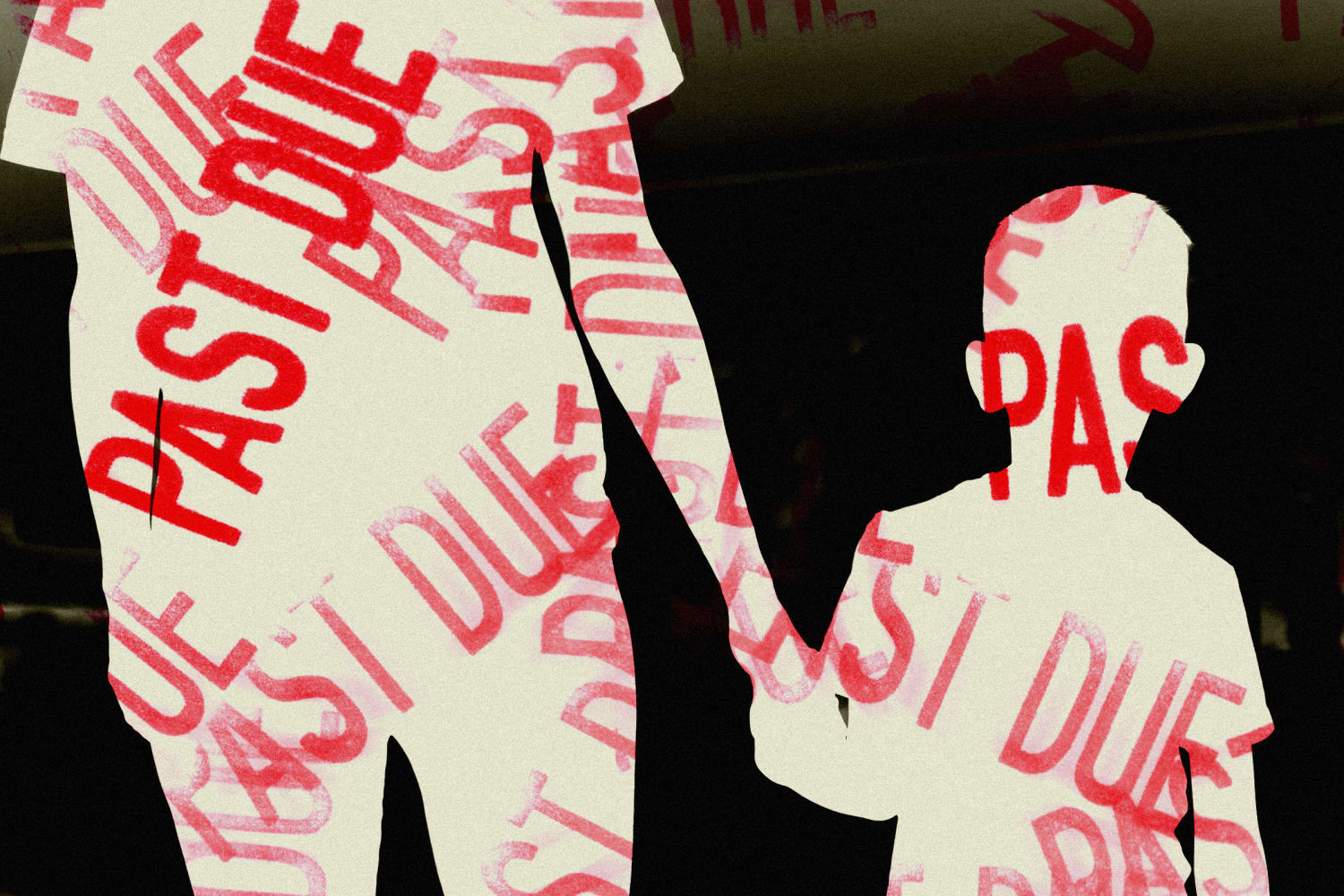

Folks with more youthful youngsters noticed a vital drop-off of their reported monetary well-being ultimate 12 months, in keeping with an annual complete find out about of American family price range launched by means of the Federal Reserve ultimate week.The Survey of Family Economics and Decisionmaking discovered a decline within the proportion of oldsters dwelling with youngsters underneath age 18 who felt financially protected, shedding from 69% in 2022 to 64% in 2023. That used to be additionally down from a file top of 75% in 2021.The present determine is now the bottom on file going again to 2015, the Fed survey information presentations.The Fed does no longer explicitly state the cause of the dramatic decline in sentiment amongst those that participated within the survey, even though it does word that the per 30 days kid care bills some households are going through have climbed to almost up to the price of hire.Professionals say that’s the product of 2 key contemporary occasions that experience destabilized many American households’ price range: the expiration of the pandemic-era expanded kid tax credit score — which noticed some households obtain per 30 days bills of as much as $250 in step with older kid and $300 in step with younger kid — and the sunsetting of toughen for kid care teams.Either one of the ones adjustments started to spread in 2022.Because the tax credit score expired, in keeping with the Columbia College Middle on Poverty and Social Coverage, “many households with youngsters have noticed a reversal of fortune … together with decrease disposable source of revenue and larger poverty, meals hardship, and monetary pressure — posing an ongoing problem for households national.”RecommendedIsmael Cid-Martinez, an economist with the Financial Coverage Institute, a left-leaning suppose tank, mentioned the aftereffects were glaring. Fewer oldsters say they may be able to get a hold of $400 in an emergency, they usually record extra circumstances of meals insufficiency.After 2021, Cid-Martinez mentioned, “oldsters’ financial savings started to dwindle.”Any other key pandemic program supplied larger monetary toughen to kid care facilities. That toughen, too, has ended with out being reinstated.Apart from the ones in a handful of states, maximum kid care organizations had been pressured to both elevate their costs or shut.This used to be referred to as the “kid care cliff.”On the subject of North Carolina, just about 1,800 kid care methods had been projected to near, in keeping with a forecast from the liberal-leaning Century Basis suppose tank.Julie Kashen, a senior fellow and the director for girls’s financial justice on the basis, mentioned any aid from Washington to handle the problem is now a protracted shot because of resistance from congressional Republicans in quest of to scale back the federal finances.“One legislator has mentioned supporting kid care is like supporting golden retrievers,” Kashen mentioned. “However then the query all the time turns into, ‘How are we going to pay for it?’”‘A minimum of doing ok’The Fed survey discovered that total, the monetary well-being for many American citizens quite worsened in 2023, with 72% reporting they had been “no less than doing ok” financially — down from 73% in 2022 and from the post-pandemic top of 78% in 2021. The velocity hasn’t been that low since 2016.Learn moreInflation remained the highest criticism amongst respondents, with the velocity of shock about top costs expanding from 33% to 35%. That compares with simply 8% bringing up inflation as a priority in 2016, the ultimate 12 months that query used to be requested.The survey persevered to turn {that a} vital proportion of American citizens stay immunized from any monetary issues in any respect, with 31% responding “none” to the query about the primary demanding situations they face. This is up from 28% in 2022, even though down from 53% in 2016.President Joe Biden has known inflation as an ongoing best fear amongst electorate, calling on shops to decrease their costs. This week, it seemed as even though Goal spoke back the decision when it introduced a plan to roll out worth cuts to five,000 on a regular basis pieces.But the latest NBC Information ballot discovered that extra electorate agree with Donald Trump than Biden to maintain inflation and the price of dwelling — even if many economists say Trump’s proposals to handle the placement would most probably result in costs going up.Rob Wile is a breaking trade information reporter for NBC Information Virtual.

Folks with younger youngsters reported monetary well-being drop-off in 2023 as inflation issues rose

:max_bytes(150000):strip_icc()/GettyImages-1926668948-0a7936b2874a494c96ecc717a8b03650.jpg)