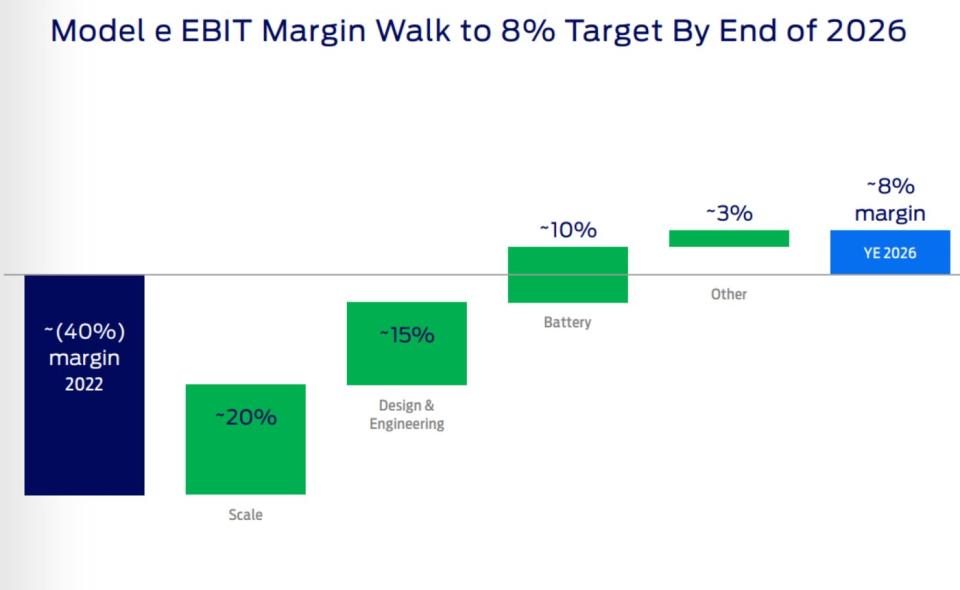

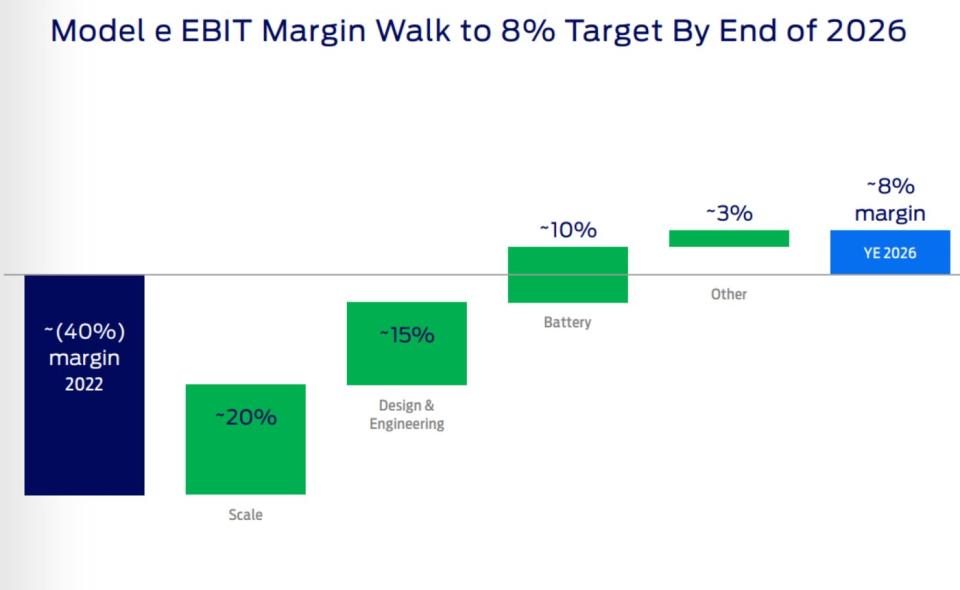

Ford Motor Corporate (NYSE: F) simply launched its fourth-quarter gross sales information for traders to chunk on earlier than the corporate releases its fourth-quarter and full-year 2023 effects later this month. The excellent news is that the corporate posted a report quarter for electrical car (EV) gross sales, however the unhealthy information is that suggests billions of losses within the close to time period.Here is why it is nonetheless a favorable building for Ford traders.Satan within the detailsFord’s 2023 U.S. gross sales jumped 7.1% to almost 2 million automobiles, led via power in its F-Sequence full-size vans, business automobiles, and a report 12 months with electrical automobiles.Let’s get started with the corporate’s maximum essential product, the truck that hauls income for the parents on the Blue Oval. Ford’s F-Sequence used to be The united states’s best-selling truck for the forty seventh consecutive 12 months and the best-selling car for the forty second consecutive 12 months. In equity, it is a name Ford will most probably proceed to carry, as its high competitor, Common Motors, arguably splits a few of its gross sales between two manufacturers of vans, the Chevrolet Silverado and the GMC Sierra.What is encouraging for traders is that the F-150 Lightning used to be the No. 1-selling electrical truck and the F-150 Hybrid the No. 1-selling full-size hybrid truck for the total 12 months. It is necessary for traders to peer that Ford’s power in full-size gasoline-powered vans can transition to EVs, as a result of full-size vans are a essential element for a fatter final analysis.Talking of EVs…That is a pleasant transition to every other essential element of Ford’s fourth-quarter and full-year gross sales: electrical automobiles. Ford’s EVs posted report fourth-quarter gross sales to pressure a report complete 12 months. Extra in particular, the Detroit icon offered just about 26,000 EVs all over the fourth quarter, up 24% in comparison to the 3rd quarter, to assist pressure an 18% acquire for the total 12 months.A lot of Ford’s EV gross sales acquire used to be pushed via the up to now discussed F-150 Lightning, which recorded a 74% gross sales build up in comparison to the prior 12 months’s fourth quarter, and a 55% build up for the total 12 months. Between the F-150 Lightning, Mustang Mach-E, and the E-Transit, Ford secured The united states’s No. 2 EV emblem for 2023.Tale continuesThe unhealthy newsHere’s the kicker about Ford’s report EV gross sales: The corporate continues to be burning money on every EV that rolls off its manufacturing line. If truth be told, Ford up to now estimated its EV industry unit, Type e, would lose more or less $4.5 billion in 2023.Control believes Ford will carry prices down sufficient and boost up manufacturing to churn income from its Type e unit via the top of 2026, however for now a report quarter in EV gross sales additionally manner a much less profitable full-year profits consequence.However as they are saying, the evening is darkest simply earlier than first light. Ford has to reach those quarterly data for EV gross sales in an effort to cut back overhead and prices in the end and achieve profitability. Necessarily, quarterly report EV gross sales manner non permanent ache for long-term good points.On Ford’s presentation for its pathway to eight% EBIT margins via the top of 2026, the largest chew of margin good points will come from scaling manufacturing/gross sales, with the remaining coming from a mix of design and engineering, in addition to decrease battery prices.

Ford Simply Misplaced Billions of Greenbacks on EVs. Right here's Why That's Excellent Information.