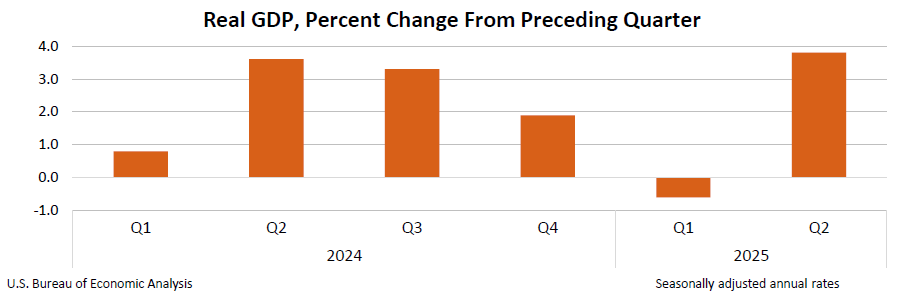

December CPI ex-food and energy remained unchanged at +0.3% compared to November’s +0.2% versus +0.1% in October, which was up from no change. The Q4 core CPI remained unchanged, showing a 3.3% annualized increase. The core six-month annualized CPI decreased to 3.0% from 3.3%, which is an important measure for the Fed. The US dollar initially decreased in response to the CPI revisions, partly due to relief that the revisions were not higher like last year.

As a reminder, Powell emphasized the significance of these changes that the Fed would closely monitor: “One piece of data I will be watching closely is the scheduled revisions to CPI inflation due next month. Recall that a year ago, when it looked like inflation was decreasing rapidly, the annual update to the seasonal factors erased those gains. In mid-February, we will get the January CPI report and revisions for 2023, potentially changing the picture on inflation. My hope is that the revisions confirm the progress we have seen, but good policy is based on data and not hope.” The January CPI report is expected next Thursday, with current estimates projecting a drop in the year-on-year reading to 2.9% from 3.4%, largely due to the rolling off of the +0.5% month-on-month reading from January 2023. The pre-revision year-on-year CPI chart is available, as well as the pre-revision month-on-month chart for reference.

Forexlive: US benchmark CPI revisions: December CPI revised to +0.2% from +0.3%

:max_bytes(150000):strip_icc()/GettyImages-2235491023-3d9cea1d65dc4d40884c5f134d512f81.jpg)