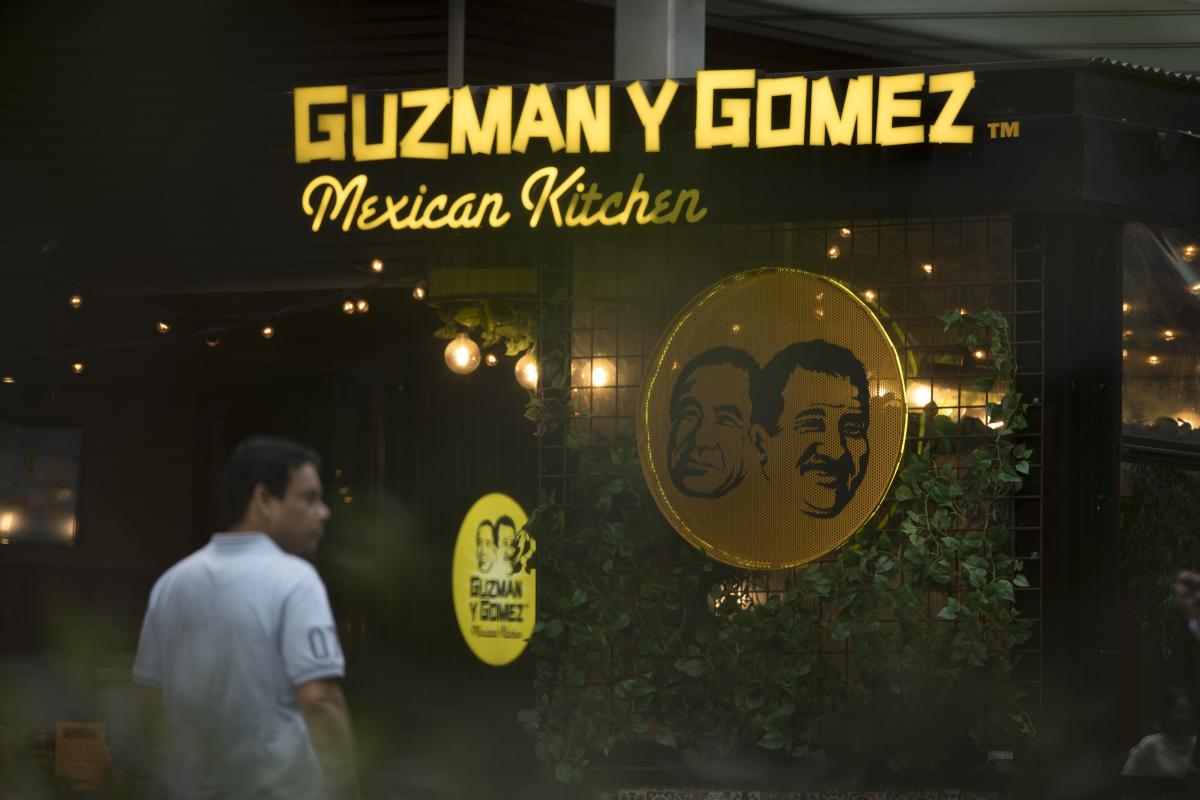

(Bloomberg) — When Steven Marks moved to Australia within the early 2000s, he was once struck by way of the standard of Mexican meals. It was once, in his opinion, dismal. The Lengthy Island local, a veteran of Steven Cohen’s SAC Capital and later Cheyne Capital, was once so appalled with the burritos and tacos that he resolved to begin his personal eating place.Maximum Learn from Bloomberg“Again then, Mexican meals was once one thing to have whilst you have been having a margarita,” stated Marks in an interview Wednesday. “I take note strolling into my place of work at some point and telling my industry spouse, ‘I were given the following giant concept. We’re gonna reintroduce Mexican meals to this nation.’”That changed into a truth in 2006, when he and youth pal Robert Hazan opened the primary Guzman y Gomez in Newtown, a suburb in Sydney’s internal west. Eighteen years later, the Mexican-themed fast-food chain has 185 eating places in Australia, 17 in Singapore, 5 in Japan and 4 in america, boasting community gross sales of A$759 million ($506 million) ultimate yr.Guzman y Gomez Ltd. stocks started buying and selling Thursday at the Australian Securities Trade beneath the ticker GYG with a valuation of A$2.2 billion. With a stake value greater than A$200 million on the providing value of A$22, Marks, 52, is the second-biggest shareholder after funding company TDM Enlargement Companions, consistent with the Bloomberg Billionaires Index.Stocks soared 36% to A$30 at 12:23 p.m. in Sydney at the corporate’s buying and selling debut.Taking over McDonald’sGYG’s providing will lift A$335.1 million, with A$200 million to fund growth plans and the remainder going to current shareholders. GYG needs to in the end develop to at least one,000 eating places in Australia, about the similar quantity as McDonald’s, and plans to open 30 to 40 new joints every yr.“I all the time known as GYG immediate meals. And everybody was once like, ‘No, no, you’re immediate informal, McDonald’s is immediate meals,’” Marks stated. “I stated, ‘McDonald’s isn’t meals.’”That didn’t deter Man Russo, the previous leader govt officer of McDonald’s Australia, from making an investment in 2009. He’s now GYG’s chairman and owns a stake value greater than A$140 million, consistent with the wealth index. His son, Gaetano Russo Jr, is the franchise proprietor of 3 GYG eating places.It’s now not the one circle of relatives connection: The son of GYG’s Co-CEO Hilton Brett has additionally has entered right into a letter of intent to change into the franchisee of a cafe later this yr.Tale continuesBrett was once appointed ultimate October, after the corporate indicated Marks could be stepping down as CEO because of a well being scare that became out to be minor. The resignation by no means came about.GYG’s A$2.2 billion valuation works out to A$10.6 million according to eating place. Via comparability, Chipotle Mexican Grill Inc., a staple of america fast-casual eating place scene, is valued at greater than A$40 million according to retailer, consistent with information compiled by way of Bloomberg.Financial MoatsLast week, GYG greater the scale of the preliminary proportion sale by way of nearly 40%, making it Australia’s biggest providing in just about a yr, information compiled by way of Bloomberg display.Analysts at Morningstar Inc. are wary at the corporate’s valuation, pronouncing it’s too early to grant GYG an “financial moat” — a aggressive merit conserving competitors at bay. They estimate stocks are value A$15 every, 32% less than GYG’s providing value.“We think Guzman will take care of sexy retailer economics over the following decade,” analysts lead by way of Johannes Faul wrote in a June 7 notice. “Then again, we wish to see company proof that the logo and retailer economics are retaining up as the shop roll out progresses to award a moat and lengthen our optimism past the following 10 years.”On a statutory foundation, GYG misplaced A$2.3 million ultimate yr and initiatives an extra A$16.2 million loss for 2024 prior to a benefit in 2025.Marks says he were given used to laborious paintings early. His father was once a “pool hustler from Miami Seashore” with dependancy problems who left Marks’s mom to boost him, his dual brother and his disabled older brother. By the point he was once 8, Marks was once doing peculiar jobs to fortify his circle of relatives.However a present for numbers helped him win a spot on the College of Pennsylvania. After graduating in 1994, he was once recruited “by way of a man named Stevie Cohen,” Marks stated. He landed a task at the equities table of Stamford, Connecticut-based SAC Capital, staying for 4 years prior to heading to Cheyne Capital in London.Marks stated he realized to “laser focal point and not compromise,” however in the end determined he was once in poor health of having a bet on folks’s companies. “I wish to have my very own,” he stated, “and that’s why I moved to Australia.”–With the aid of Andrew Heathcote.(Provides proportion efficiency after buying and selling debut in 5th paragraph.)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Former Hedge Fund Dealer Builds $135 Million Burrito Fortune