Attorneys for Sam Bankman-Fried declare in an attraction filed Friday that the imprisoned FTX founder used to be the sufferer of a hurry to judgment via a public that wrongly believed he used to be responsible of stealing billions of bucks from his shoppers and buyers sooner than he used to be even arrested.The attorneys filed papers with the second U.S. Circuit Courtroom of Appeals asking a three-judge panel to opposite Bankman-Fried’s conviction and assign the case to a brand new decide for a retrial, announcing the trial decide “imposed a draconian quarter-century sentence in this first-time, non-violent wrongdoer” when they contend he moved quickly the jury into attaining a one-day verdict to cap off a posh four-week trial.”Sam Bankman-Fried used to be by no means presumed blameless. He used to be presumed responsible — sooner than he used to be even charged. He used to be presumed responsible via the media. He used to be presumed responsible via the FTX debtor property and its attorneys. He used to be presumed responsible via federal prosecutors longing for fast headlines. And he used to be presumed responsible via the decide who presided over his trial,” the attorneys wrote.

They mentioned the passing of time has solid Bankman-Fried in a greater mild.”From day one, the present narrative — to start with spun via the attorneys who took over FTX, briefly followed via their contacts on the U.S. Legal professional’s Administrative center — used to be that Bankman-Fried had stolen billions of bucks of purchaser budget, pushed FTX to insolvency, and led to billions in losses,” the lawyer mentioned.

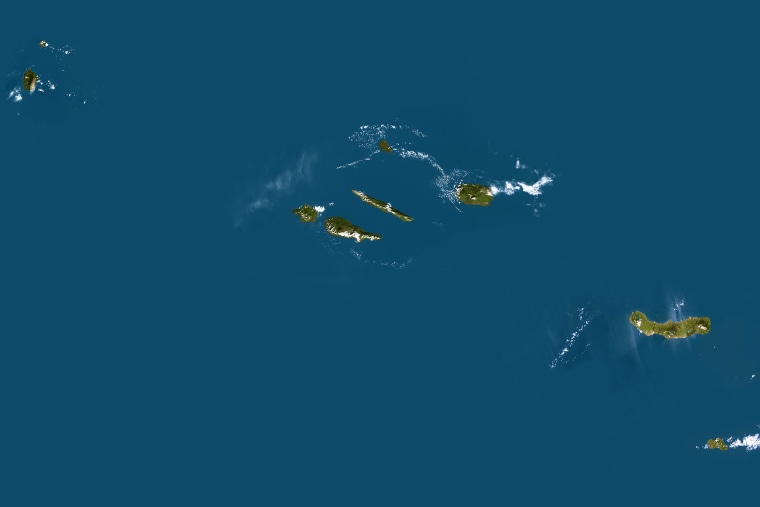

“Now, just about two years later, an excessively other image is rising — one confirming FTX used to be by no means bancrupt, and actually had belongings price billions to pay off its shoppers. However the jury at Bankman-Fried’s trial by no means were given to look that image,” they added.Bankman-Fried, 32, used to be convicted ultimate November of fraud and conspiracy, a yr after his corporations collapsed into chapter 11 as buyers rushed to withdraw budget. A jury concluded that a few of their cash have been improperly spent on actual property, investments, famous person endorsements, political contributions and extravagant existence.At its peak, FTX used to be handled as a pioneer and darling within the rising cryptocurrency business, with a Tremendous Bowl commercial, testimony via Bankman-Fried sooner than Congress and endorsements from celebrities comparable to quarterback Tom Brady and comic Larry David.Bankman-Fried used to be arrested in December 2022 following his extradition from the Bahamas, simply weeks after his corporate filed for chapter and days after a few of his former best executives started cooperating with federal prosecutors. A few of them testified towards him at trial.

He to start with remained beneath strict bail prerequisites at his folks’ house in Palo Alto, California, however Pass judgement on Lewis A. Kaplan in Long island revoked his bail in a while sooner than the trial after concluding that Bankman-Fried used to be seeking to affect most probably witnesses, together with an ex-girlfriend who had served as leader government at Alameda Analysis, a crypto hedge fund.The fallen rich person is serving a 25-year sentence after he used to be sentenced in March in what a prosecutor as soon as described as one of the crucial greatest monetary frauds in U.S. historical past.A prosecutor’s spokesperson declined to remark Friday.

Extra from CBS Information