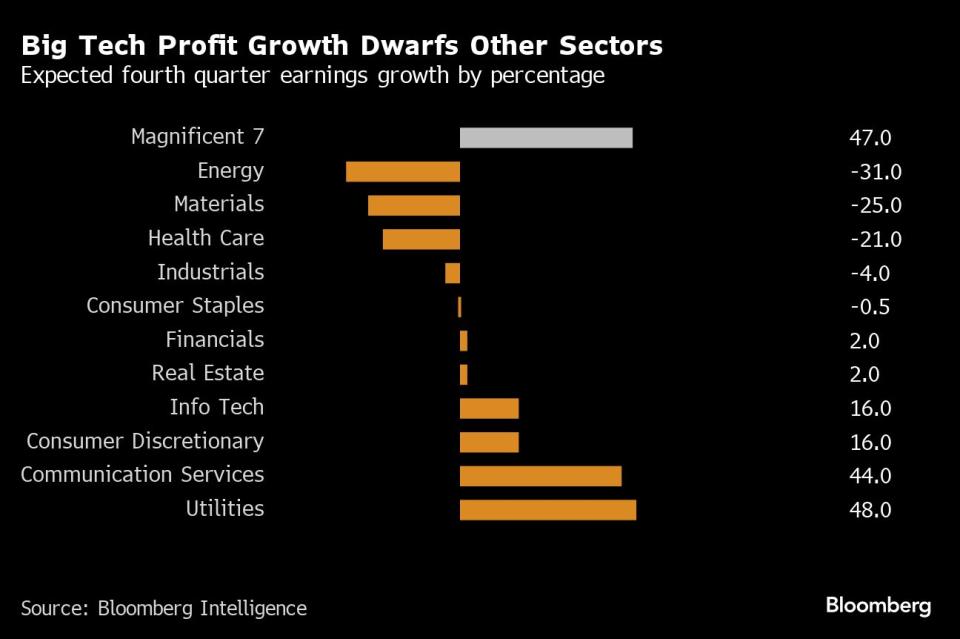

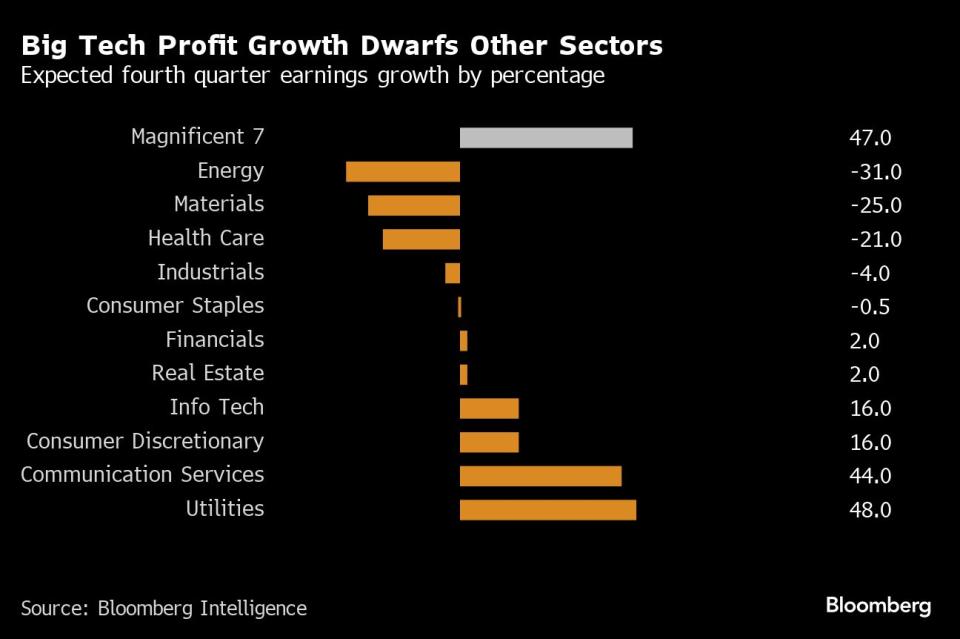

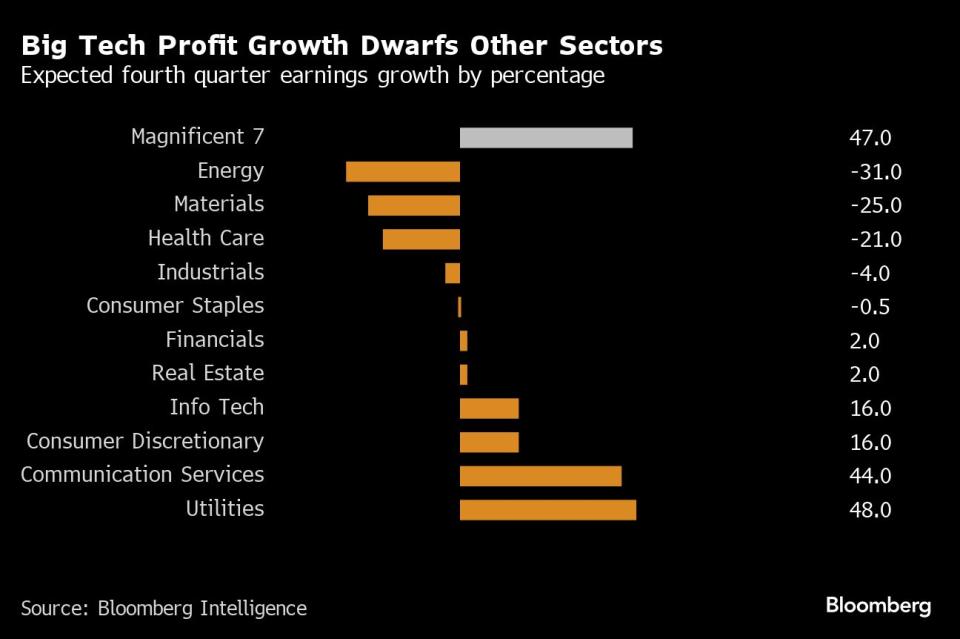

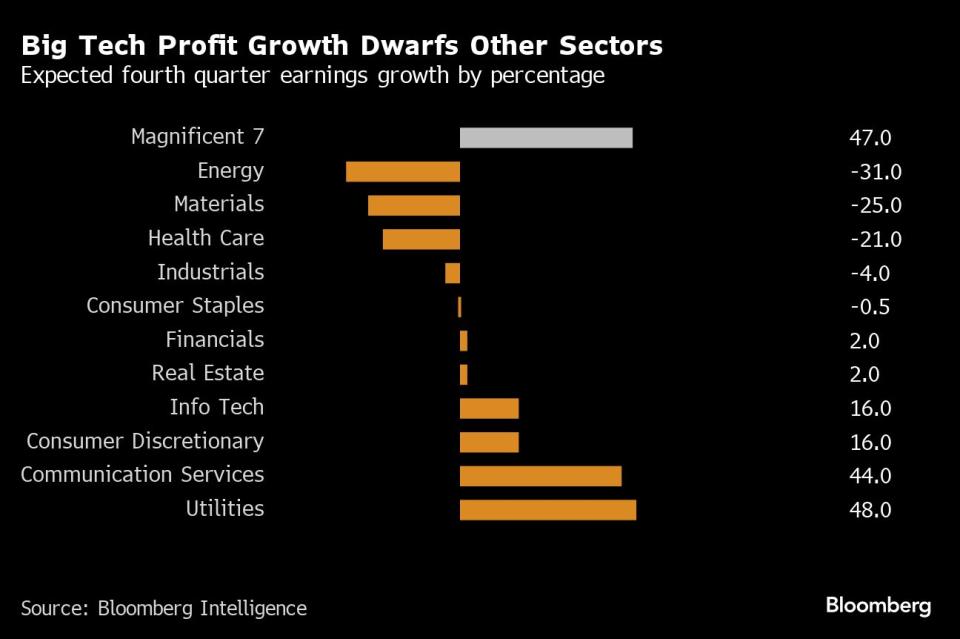

(Bloomberg) — Bets on america inventory marketplace rally broadening out past a handful of tech behemoths this 12 months are bumping into a well-recognized fact: Those self same megacaps stay Company The usa’s in all probability supply of benefit enlargement.Maximum Learn from BloombergTech’s fourth quarter profits season kicks off this week with effects from Netflix Inc., Tesla Inc. and Intel Corp. The so-called Magnificent Seven are anticipated to ship blended benefit enlargement of about 46%, in line with information compiled by way of Bloomberg Intelligence. That’s down fairly from the 3rd quarter’s 53% growth, however it nonetheless dwarfs virtually the entire primary sectors within the S&P 500 Index.Bearing in mind how essential those firms are to the full inventory marketplace — they accounted for nearly all of final 12 months’s 24% advance and drove the S&P 500 to an all-time top on Friday — profits season doesn’t somewhat get going till they display up with their effects.“The dominant enlargement available in the market is coming from Giant Tech,” mentioned Anthony Saglimbene, leader marketplace strategist at Ameriprise Monetary. “In the event that they disappoint, that’s an actual chance to the full marketplace.”Bulls are banking on sturdy profits studies to re-ignite a rally within the S&P 500 Index that has slowed just a little to begin the 12 months after 2023’s torid tempo. Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com, Nvidia Corp., Tesla and Meta Platforms Inc. accounted for approximately two-thirds of that achieve.Apple, one of the vital pillars of final 12 months’s rally after including just about $1 trillion in marketplace price, has limped out of the gate in 2024 amid issues about its enlargement potentialities. Its maximum cutting edge product in years, the $3,499 Imaginative and prescient Professional headset, is ready to start delivery subsequent month however is not likely to supply a jolt to gross sales any time quickly.Tale continues

In the meantime, Microsoft has driven deeper into document territory on emerging expectancies that its increasing lineup of AI-infused tool merchandise will gasoline larger income. The Redmond, Washington-based corporate mentioned on Jan. 15 it’s going to price $20 a month for a shopper model of its AI assistant.Converting LeadershipLooking on the inventory marketplace as a complete, the S&P 500 has had a bumpy journey to begin the 12 months, falling in early January ahead of emerging to a brand new document on Friday. Buyers are seeking to assess the energy of america financial system and decide when the Federal Reserve will get started reducing its benchmark rate of interest, which is sitting on the perfect for the reason that dot-com generation.The S&P 500’s management has modified in contemporary weeks, with Complicated Micro Gadgets Inc., Broadcom Inc., Eli Lilly & Co. and Merck & Co. some of the maximum outstanding level gainers up to now in 2024. In the meantime Tesla, which is down greater than 15% since New Yr’s, has grow to be the heaviest drag at the S&P, with Apple shut in the back of.For tech buyers, one large query is how a lot the AI craze will give a contribution to profits after which spill over into inventory costs. Nvidia, which is the most efficient inventory within the S&P 500 this 12 months and final, dominates the marketplace for chips utilized in AI computing and is predicted to publish fourth-quarter income of greater than $10 billion, up from $1.4 billion a 12 months in the past.With out Nvidia, the S&P 500 Data Era Index’s projected fourth quarter benefit enlargement can be greater than lower in part, in line with Wendy Soong, an analyst with Bloomberg Intelligence.“We expect extra firms are prone to to find techniques to monetize their AI publicity, and buyers might be in search of proof on how firms can care for or toughen their margins,” Solita Marcelli, leader funding officer for the Americas at UBS International Wealth Control, wrote in a analysis be aware on Jan. 17. “We’re best within the first innings of the AI tale.”Crowding ConcernsAt the similar time, indicators of crowded positioning in tech are elevating issues concerning the chance of a unload if effects from one of the vital giants disappoint. A world fund supervisor survey from Financial institution of The usa Corp. this month confirmed the commonest business is being lengthy Giant Tech and different tech enlargement shares.To Matt Maley of Miller Tabak + Co., contemporary buying and selling has proven that Giant Tech is using the marketplace once more and the heavy focus is a “caution flag” for buyers that can come again to chew them.“When the fast-money hedge finances have such massive concentrated positions, it leaves the marketplace very liable to a momentary surprise,” mentioned Maley, the company’s leader marketplace strategist.In spite of this arrange, the choices marketplace is pricing in “nearly no chance” for megacap shares, in line with Brian Donlin, head of fairness derivatives technique at Stifel Nicolaus.Ameriprise Monetary’s Saglimbene is assured that any selloff can be rather brief lived because the appeal of Giant Tech shares are not likely to dim.“Over the longer term, buyers will glance to those firms and gravitate again to them as a result of they in point of fact do have the expansion, the habitual income and the opportunity of larger enlargement sooner or later,” he mentioned. “No different sector provides that more or less runway for profits.”—With the help of Carly Wanna, Isabelle Lee and Ryan Vlastelica.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

In the meantime, Microsoft has driven deeper into document territory on emerging expectancies that its increasing lineup of AI-infused tool merchandise will gasoline larger income. The Redmond, Washington-based corporate mentioned on Jan. 15 it’s going to price $20 a month for a shopper model of its AI assistant.Converting LeadershipLooking on the inventory marketplace as a complete, the S&P 500 has had a bumpy journey to begin the 12 months, falling in early January ahead of emerging to a brand new document on Friday. Buyers are seeking to assess the energy of america financial system and decide when the Federal Reserve will get started reducing its benchmark rate of interest, which is sitting on the perfect for the reason that dot-com generation.The S&P 500’s management has modified in contemporary weeks, with Complicated Micro Gadgets Inc., Broadcom Inc., Eli Lilly & Co. and Merck & Co. some of the maximum outstanding level gainers up to now in 2024. In the meantime Tesla, which is down greater than 15% since New Yr’s, has grow to be the heaviest drag at the S&P, with Apple shut in the back of.For tech buyers, one large query is how a lot the AI craze will give a contribution to profits after which spill over into inventory costs. Nvidia, which is the most efficient inventory within the S&P 500 this 12 months and final, dominates the marketplace for chips utilized in AI computing and is predicted to publish fourth-quarter income of greater than $10 billion, up from $1.4 billion a 12 months in the past.With out Nvidia, the S&P 500 Data Era Index’s projected fourth quarter benefit enlargement can be greater than lower in part, in line with Wendy Soong, an analyst with Bloomberg Intelligence.“We expect extra firms are prone to to find techniques to monetize their AI publicity, and buyers might be in search of proof on how firms can care for or toughen their margins,” Solita Marcelli, leader funding officer for the Americas at UBS International Wealth Control, wrote in a analysis be aware on Jan. 17. “We’re best within the first innings of the AI tale.”Crowding ConcernsAt the similar time, indicators of crowded positioning in tech are elevating issues concerning the chance of a unload if effects from one of the vital giants disappoint. A world fund supervisor survey from Financial institution of The usa Corp. this month confirmed the commonest business is being lengthy Giant Tech and different tech enlargement shares.To Matt Maley of Miller Tabak + Co., contemporary buying and selling has proven that Giant Tech is using the marketplace once more and the heavy focus is a “caution flag” for buyers that can come again to chew them.“When the fast-money hedge finances have such massive concentrated positions, it leaves the marketplace very liable to a momentary surprise,” mentioned Maley, the company’s leader marketplace strategist.In spite of this arrange, the choices marketplace is pricing in “nearly no chance” for megacap shares, in line with Brian Donlin, head of fairness derivatives technique at Stifel Nicolaus.Ameriprise Monetary’s Saglimbene is assured that any selloff can be rather brief lived because the appeal of Giant Tech shares are not likely to dim.“Over the longer term, buyers will glance to those firms and gravitate again to them as a result of they in point of fact do have the expansion, the habitual income and the opportunity of larger enlargement sooner or later,” he mentioned. “No different sector provides that more or less runway for profits.”—With the help of Carly Wanna, Isabelle Lee and Ryan Vlastelica.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.