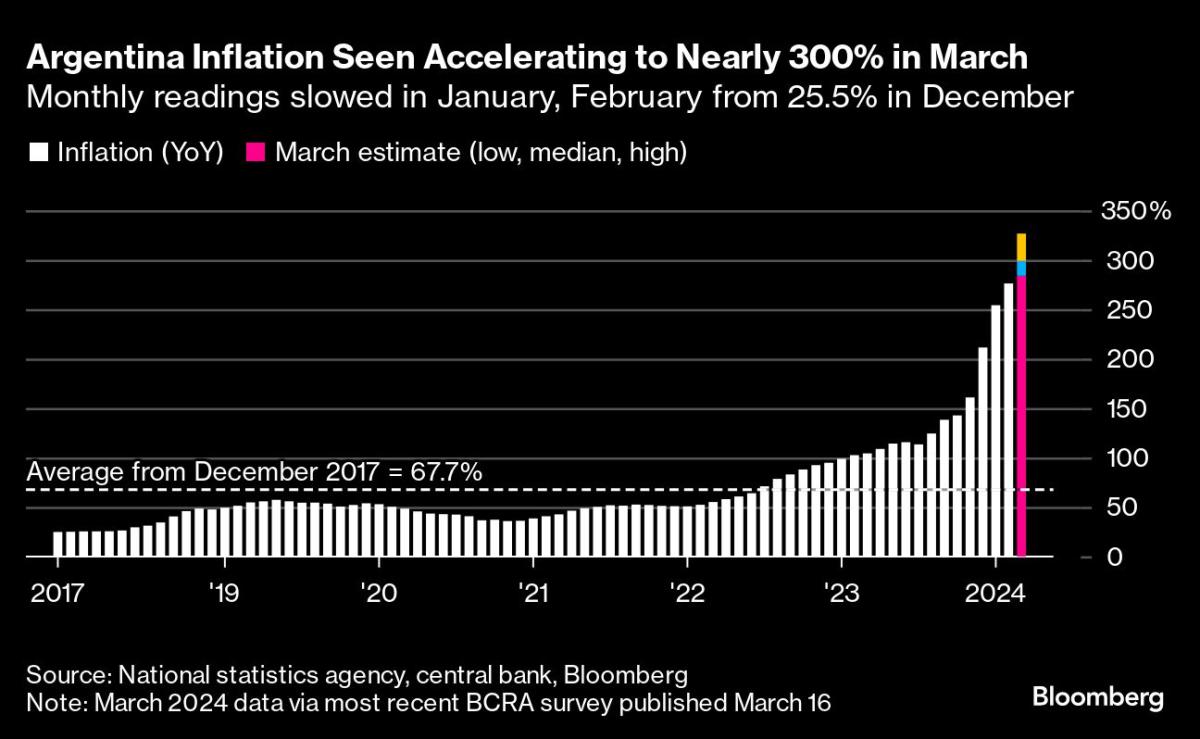

(Bloomberg) — US consumer-price knowledge within the coming week, arriving at the heels of unusually sturdy jobs numbers, is projected to turn a glacial slowdown in underlying inflation that explains the Federal Reserve’s wary solution to decreasing rates of interest.Maximum Learn from BloombergThe March core person fee index, a measure of underlying inflation that excludes meals and gas, is observed emerging 0.3% from a month previous after a zero.4% advance in February. Wednesday’s record is predicted to turn a identical build up within the general CPI.The core fee gauge is projected to have climbed 3.7% from a 12 months in the past, which might mark the smallest acquire since April 2021. Whilst the once a year determine is definitely beneath the 6.6% height reached in 2022, development extra not too long ago has been asymmetric.The carefully watched inflation figures practice the newest per month jobs record, which exceeded expectancies for a 5th instantly month. Whilst Fed officers have pointed to moderating exertions call for during the last 12 months as a conceivable precursor to price cuts, the 303,000 leap in March payrolls might elevate questions over the level of that cooling, and its implications for inflation.A lot of Fed officers talking during the last week had been constant of their messages that it’s suitable to attend till there’s a clearer indication that inflation is slowing towards their goal ahead of taking step one towards decreasing borrowing prices.What Bloomberg Economics Says:“The point of interest now shifts towards the inflation trajectory, these days a extra important issue within the Fed’s response serve as. We predict the March CPI record to turn a modest slowdown within the per month tempo of core inflation to 0.3% — which remains to be in keeping with the Fed’s annual core PCE inflation goal of two.0%. Although annual headline inflation flutters round 3.0% thru year-end, power disinflation within the core will have to permit the Fed to chop charges this summer season.”Tale continues— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For complete research, click on hereUS central bankers meet subsequent on April 30-Would possibly 1 and are broadly anticipated to carry charges stable. Mins in their March accumulating are due Wednesday, and buyers can even observe remarks from New York Fed President John Williams at an match on Thursday.Learn extra: Blowout Jobs Knowledge Lift Likelihood of Not on time, Fewer Fed Charge CutsA record Thursday on costs paid to US manufacturers is forecast to turn a extra reasonable per month advance. Nonetheless, contemporary will increase within the costs of crude oil, copper and a few different commodities counsel much less items disinflation within the coming months.Turning north, the Financial institution of Canada is broadly anticipated to care for its key coverage price at 5% on Wednesday, whilst revising financial projections to replicate stronger-than-expected enlargement at first of this 12 months and the long-term affects of the Trudeau govt’s cap on brief citizens.Somewhere else, central banks from New Zealand to the euro house to Peru also are set to carry, whilst economists are break up between a minimize and a pause in Israel. In the meantime, former Fed Chair Ben Bernanke is scheduled to ship a evaluate of Financial institution of England forecasting mistakes on Friday.Click on right here for what took place ultimate week and beneath is our wrap of what’s arising within the world economic system.AsiaA raft of central banks in Asia grasp conferences within the coming week, with government within the Philippines, New Zealand, Thailand and South Korea all anticipated to carry coverage stable.The point of interest will fall on any hints indicating when they may pivot to easing cycles, with RBNZ Governor Adrian Orr anticipated to present an replace Wednesday at the timeline for normalized charges as New Zealand’s economic system continues to wobble.In knowledge, China’s person inflation is projected to gradual to 0.4% in March, whilst the decline in manufacturer costs might deepen a tad to two.8%, backing the case for extra stimulus. Exports are anticipated to drop for a 2nd month.India will get inflation figures for March and business output for February.In Japan, money profits knowledge might display actual wages fell for a twenty third month in February, a pattern that’s anticipated to finish when salary hikes for the brand new fiscal 12 months — the largest in additional than 3 a long time — kick in.Europe, Heart East, AfricaThe Eu Central Financial institution is about to carry charges stable on Thursday in what’s universally anticipated to be the general such pause ahead of it embarks on financial easing in June. President Christine Lagarde’s phrases will probably be scoured for clues on what would possibly occur after that, with some officers already pushing for back-to-back strikes.After ultimate week’s weaker-than-anticipated inflation studying, policymakers received’t get a lot further knowledge forward of the assembly, despite the fact that the quarterly bank-lending survey on Tuesday might supply some perception.Eu finance chiefs are scheduled to collect for his or her common assembly in Luxembourg on the finish of the week. They’ll speak about exchange-rate and inflation tendencies and the area’s competitiveness.Turning east, Hungary is scheduled to submit mins of its newest coverage assembly, at which it reduced its benchmark by means of 75 foundation issues and mentioned it could proceed to dial again easing. Serbia is about to stay charges unchanged.Russia will get inflation knowledge on Wednesday, the similar day that Financial institution of Russia Governor Elvira Nabiullina might provide an annual record within the State Duma.In Britain, GDP figures on Friday are more likely to verify a 2nd month of enlargement in February, striking the economic system on course for a gentle restoration after the shallow recession in 2023. The BOE that day will free up a record from Bernanke, environment out suggestions for a way officers can toughen forecasting and communique after grievance they had been gradual to acknowledge the inflation disaster that began after the pandemic.Learn extra: Bernanke Pointers BOE Towards ‘State of affairs Forecasts’ Over Fed Dot PlotsIsrael’s price choice on Monday is perhaps an in depth name between a grasp and a 25 foundation level minimize. A lower would spice up the economic system because the six-month conflict in Gaza continues to weigh on intake and sectors from tourism to development. However it might additionally upload to power at the shekel, which has weakened since early March.Uganda is perhaps extra positive, with analysts predicting its financial coverage committee will depart the important thing price unchanged after expanding it by means of 50 foundation issues to ten% at an unscheduled assembly ultimate month. That’s as inflation has began to ease once more and the forex is strengthening in opposition to the buck.In the meantime, Zimbabwe will release its new forex — the ZiG — on Monday.Latin AmericaGetting the inflation genie again within the bottle is giving central bankers round global suits, as Chile’s Rosanna Costa, Mexico’s Victoria Rodriguez and Brazil’s Roberto Campos Neto can attest.Knowledge in Chile will most probably display person costs eased again close to January’s 3.8% studying after leaping in February. The central financial institution has marked up its 2024 forecast to a few.8% from 2.9%.In Mexico, the place the disinflation procedure has confirmed bumpy and persistent, the early consensus is for each the full-month and bi-weekly readings to have re-accelerated.Brazil, which if truth be told were given inflation beneath goal way back to ultimate June ahead of a 203 basis-point third-quarter surge, is more likely to see person costs print decrease for a 6th instantly month, firmly inside the central financial institution’s tolerance vary however nonetheless neatly above goal.Final up is Argentina, the place March per month knowledge out might put up a single-digit upward push, consistent with a member of President Javier Milei’s advisory council. Analysts surveyed by means of the central financial institution see it moderately over 14%, sizzling sufficient to ship the year-on-year print up inside of a cat’s whisker of 300%.Peru’s central financial institution on Thursday might opt for a 2nd instantly price pause at 6.25% after March inflation figures exceeded all economist estimates.–With the help of Robert Jameson, Brian Fowler, Laura Dhillon Kane, Reed Landberg, Paul Wallace, Monique Vanek, Tony Halpin and Alexander Weber.(Updates with Zimbabwe in EMEA phase.)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Glacial Inflation Slowdown Set to Again Fed Charge-Reduce Warning