Gold’s file highs in Q1 steered that risk-off sentiment has ruled.

BTC has already proven resilience, consolidating close to highs whilst gold surged.

Analysts speculate that with Gold [XAU] hitting new highs in Q1 and outperforming Bitcoin [BTC] throughout industry tensions, a possible most sensible may shift capital into menace property.

If this rotation happens, may BTC achieve momentum to reclaim $100k in Q2?

Doable rotation from Gold to BTC

Gold’s 70% surge over 16 months has driven its marketplace cap to $20.75 trillion, now $1.25 trillion above the blended most sensible 10 property. Because of this, analysts await a capital shift if a neighborhood most sensible bureaucracy.

The Financial institution of The us survey reinforces the speculation – 58% of fund managers obese gold, whilst most effective 3% again BTC. This has restricted Bitcoin’s enchantment as a hedge, but a shift in positioning may provide upside momentum.

On the other hand, macro-driven volatility stays a key variable. BTC is buying and selling 10% under its New Yr rally, whilst gold has prolonged positive aspects by way of 17%.

Significantly, XAU’s vertical growth aligned with BTC’s corrective segment, suggesting liquidity displacement.

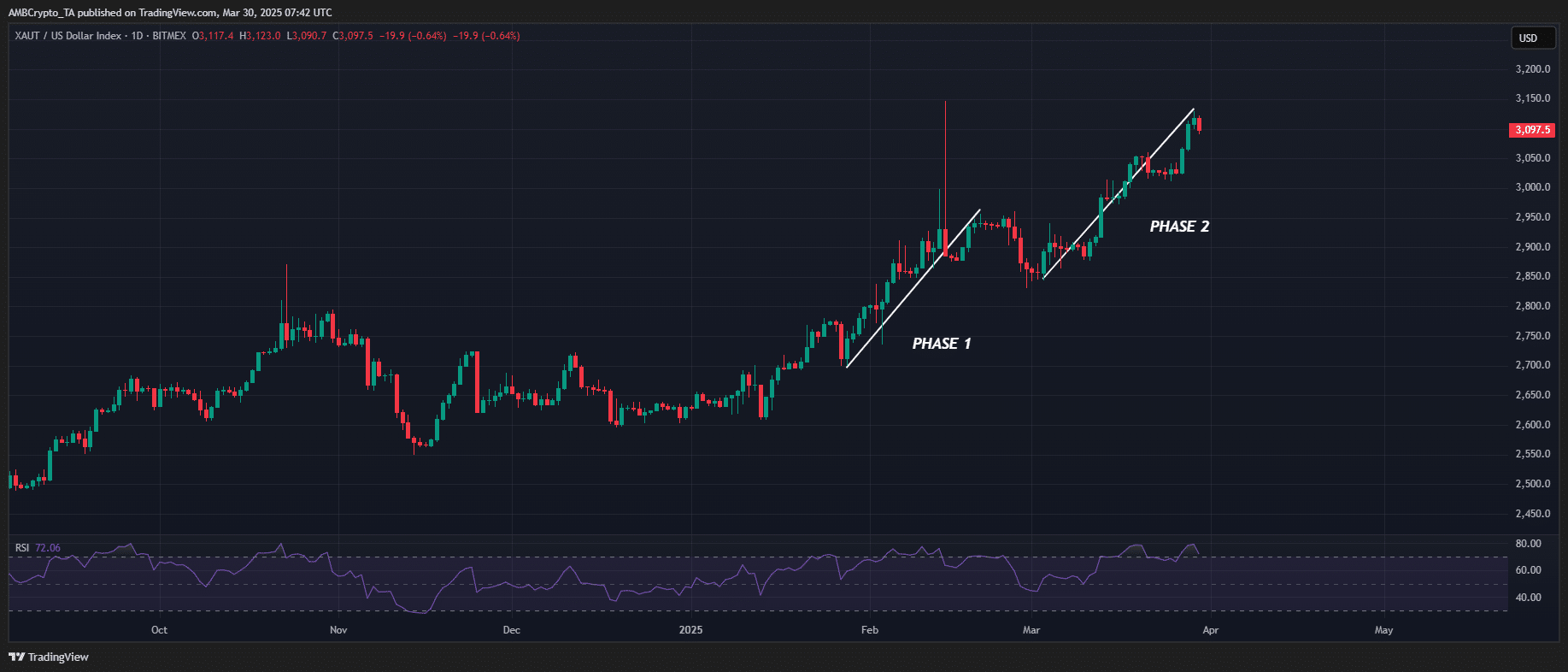

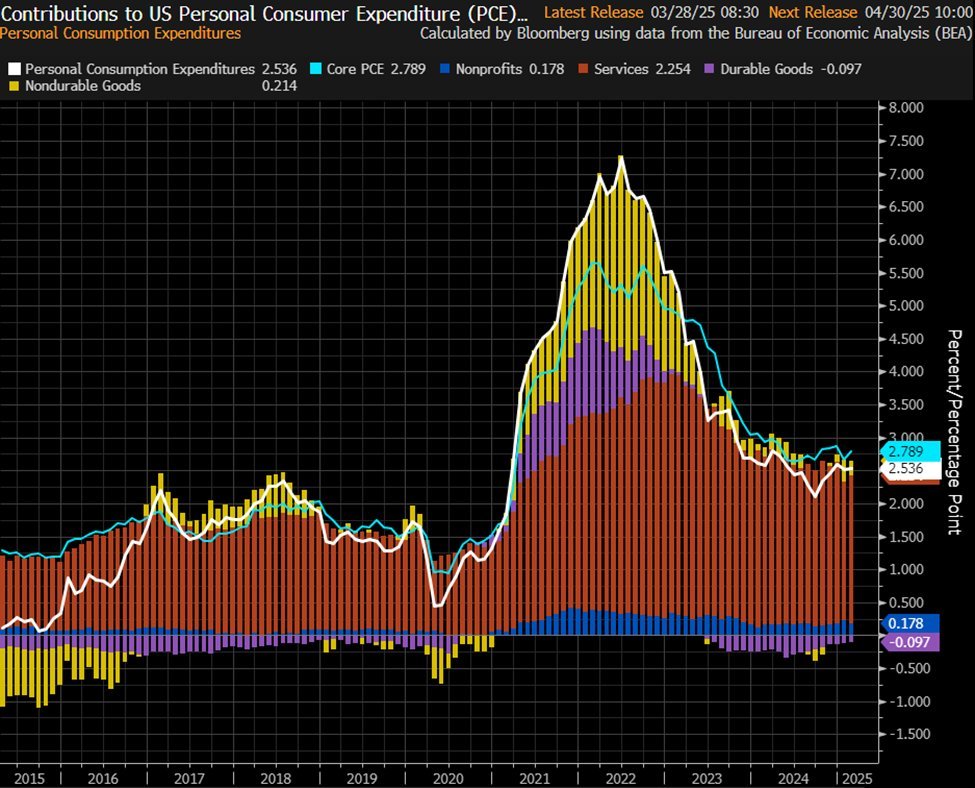

Supply: TradingView (XAU/USD)

Supply: TradingView (XAU/USD)

Put merely, on two distinct market-wide retracements, gold published new all-time highs whilst BTC misplaced key structural toughen, signaling inverse liquidity rotation.

On the other hand, Gold’s contemporary pullback noticed its Relative Power Index (RSI) retrace into the bullish call for zone sooner than surging to a contemporary ATH of $3,097.

With RSI now within the ‘excessive’ overbought zone, the danger of a corrective transfer will increase.

A decline in gold call for may cause capital rotation into menace property. May just this possible shift function a catalyst for Bitcoin to reclaim its safe-haven narrative in Q2?

The actual take a look at for Bitcoin lies forward

Gold’s rally from $1,820 in October 2023 to $3,100 this week is little short of historical. Up +16% YTD, it’s outperforming shares, currencies, or even the U.S. greenback – in spite of emerging rates of interest.

Historically, a more potent USD must push gold decrease. The straightforward explanation why? A robust greenback makes Treasury yields extra sexy. However as an alternative, call for for gold has surged, breaking marketplace norms.

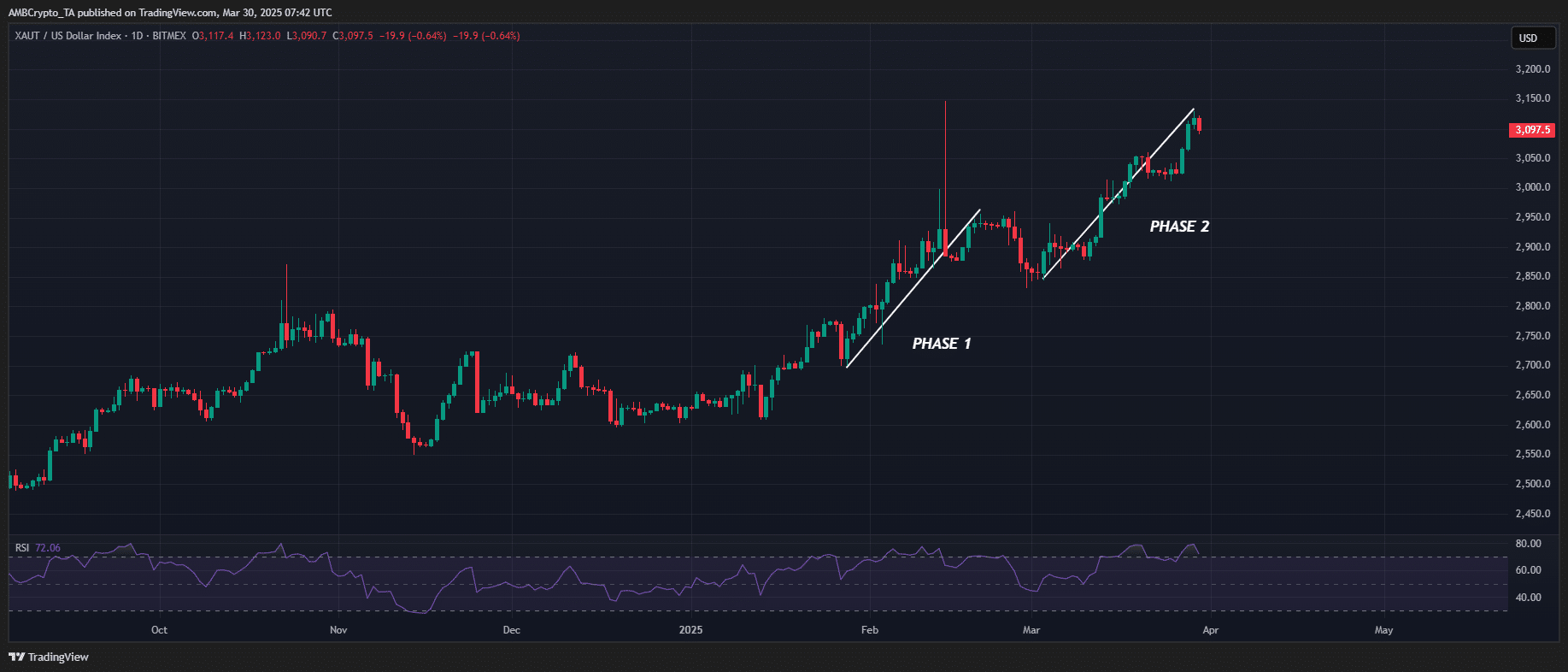

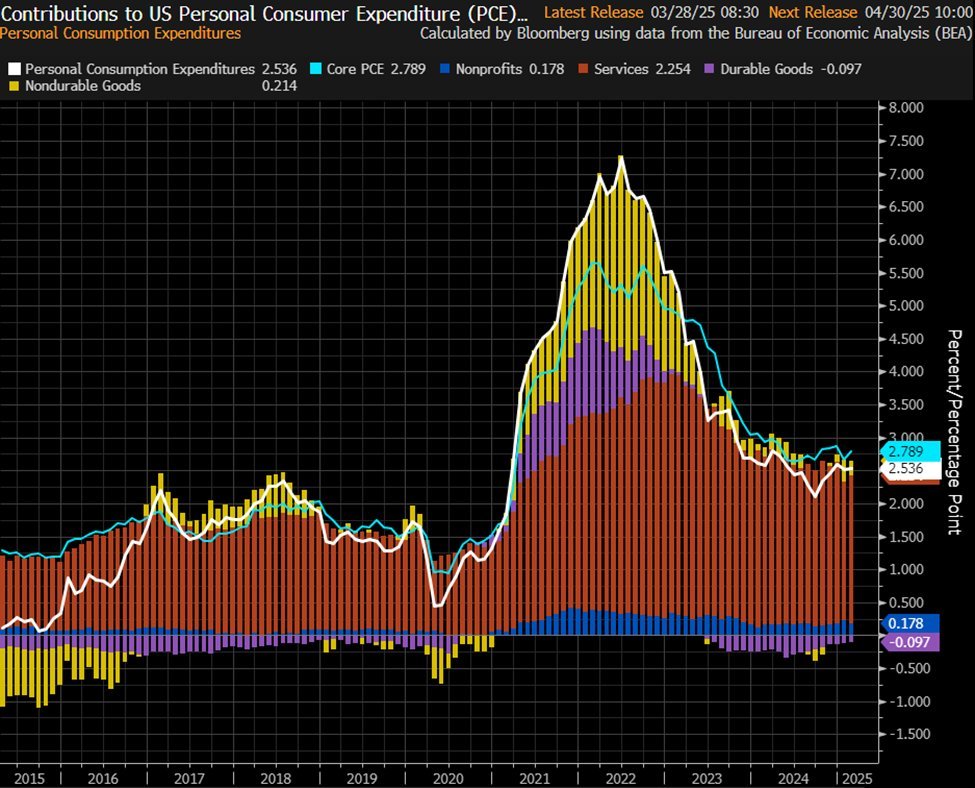

On the identical time, inflation is heating up. 1-month annualized PCE inflation simply jumped above 4.0%, whilst 6-month figures are actually at 3.1%. As inflation erodes purchasing energy, gold’s enchantment as a secure haven is most effective rising.

Supply: Bloomberg

Supply: Bloomberg

As inflation rebounds, XAU has hit 50 all-time highs up to now one year. In reality, ZeroHedge reported that bodily gold call for has surged along escalating industry tensions, reinforcing its position as a macro hedge.

In January, U.S. gold imports hit a file $30.4 billion. This represents a 2x building up from 2020 pandemic ranges.

For BTC to problem XAU’s dominance, a Bitcoin Strategic Reserve would wish to be established.

With out this type of mechanism, expectancies for BTC to reclaim $100k stay speculative, with menace property nonetheless dealing with liquidity constraints.

In spite of RSI overextension, XAU’s value motion continues to showcase sturdy call for absorption. This makes a pullback not likely — specifically with the approaching ‘reciprocal’ tariff announcement, a key macro menace tournament.

In this type of local weather, Bitcoin’s structural take a look at lies forward, as Gold stays located to increase value discovery into new all-time highs.

Subsequent: Is Bitcoin’s rebound close to as key house rises? Assessing…