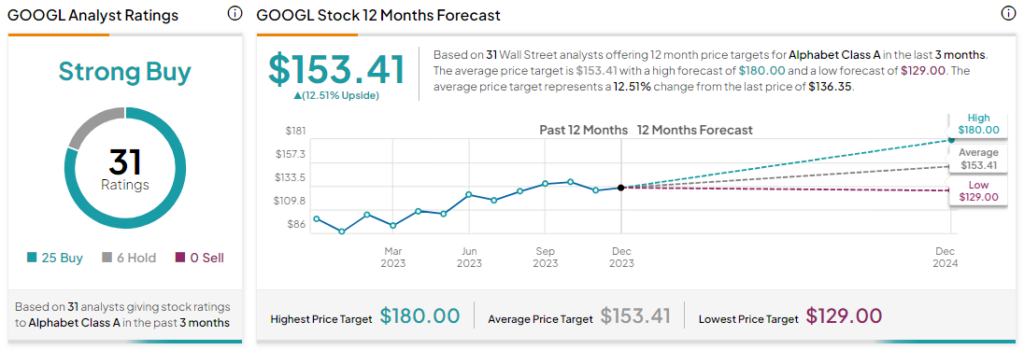

The combat for AI supremacy intensified when tech massive Google (NASDAQ:GOOGL) unveiled its flagship AI language style (LLM), Gemini. GOOGL stocks had been up in Thursday’s buying and selling after the scoop. The corporate has additionally integrated a brand new model of Gemini in its chatbot, Bard. It additionally hopes to release its flagship style early subsequent 12 months. The 3 Gemini fashions come with Extremely, Professional, and Nano. The corporate is trying out its Gemini Extremely style and can make it “to be had to choose consumers, builders, companions, and safety professionals and duties for early trying out and answers sooner than they’re dropped at builders and consumers early subsequent 12 months.” Gemini Professional is recently getting used at Bard for higher figuring out and making plans. Google additionally needs to run the Gemini Nano style on its Pixel telephones. Gemini Nano is a smaller model of the style, which can be utilized for smartphones and laptops. Google and Alphabet CEO Sundar Pichai mentioned, “I consider that the adjustments we’re seeing at this time with AI will probably be extra profound in our lives, a lot larger than the adjustments in cell phones or the Web.” Wall Side road Stays Upbeat on Gemini After the scoop, JP Morgan analyst Doug Anmuth stated the distinct enlargement of the Gemini emblem. The professional added that the other sizes of Gemini are utilized in other {hardware}, to handle the desire of the corporate for low cost fashions. Anmuth additionally mentioned that whilst there is also reservations in regards to the unencumber of the Extremely in 2024 and the restricted use of its Professional and Nano fashions, he used to be eager about the Gemini Professional powering Google’s generative AI chatbot, Bard. The professional mentioned, “Despite the fact that it’s nonetheless early days, the release of Gemini represents a brand new innovation for Google as we input the second one 12 months of Generative AI availability.” Anmuth reiterated his purchase with a value goal of $150 in keeping with percentage, representing a 9.7% upside from present ranges. What’s the Long term Worth of GOOGL? Analysts stay bullish on GOOGL inventory with a Robust Purchase consensus in response to 25 Buys and 6 Holds. Despite the fact that GOOGL inventory is up greater than 50% year-to-date, GOOGL’s moderate value of $153.41 implies a 12.5% possible upside from present ranges.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25803039/2190571551.jpg)