International’s biggest altcoin dropped underneath $3,000 at the again of adverse marketplace sentiment

Receding outflows may well be key now

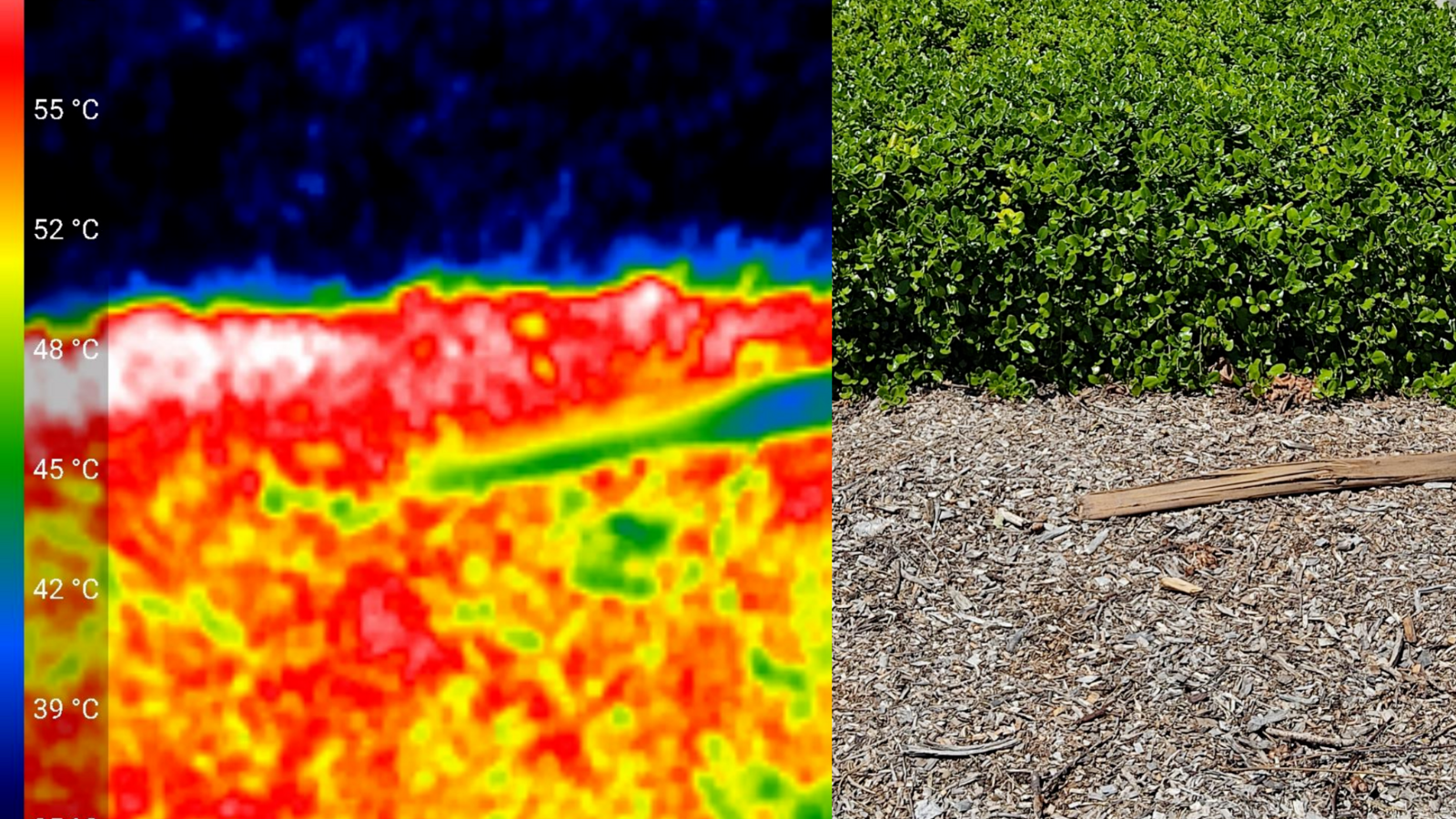

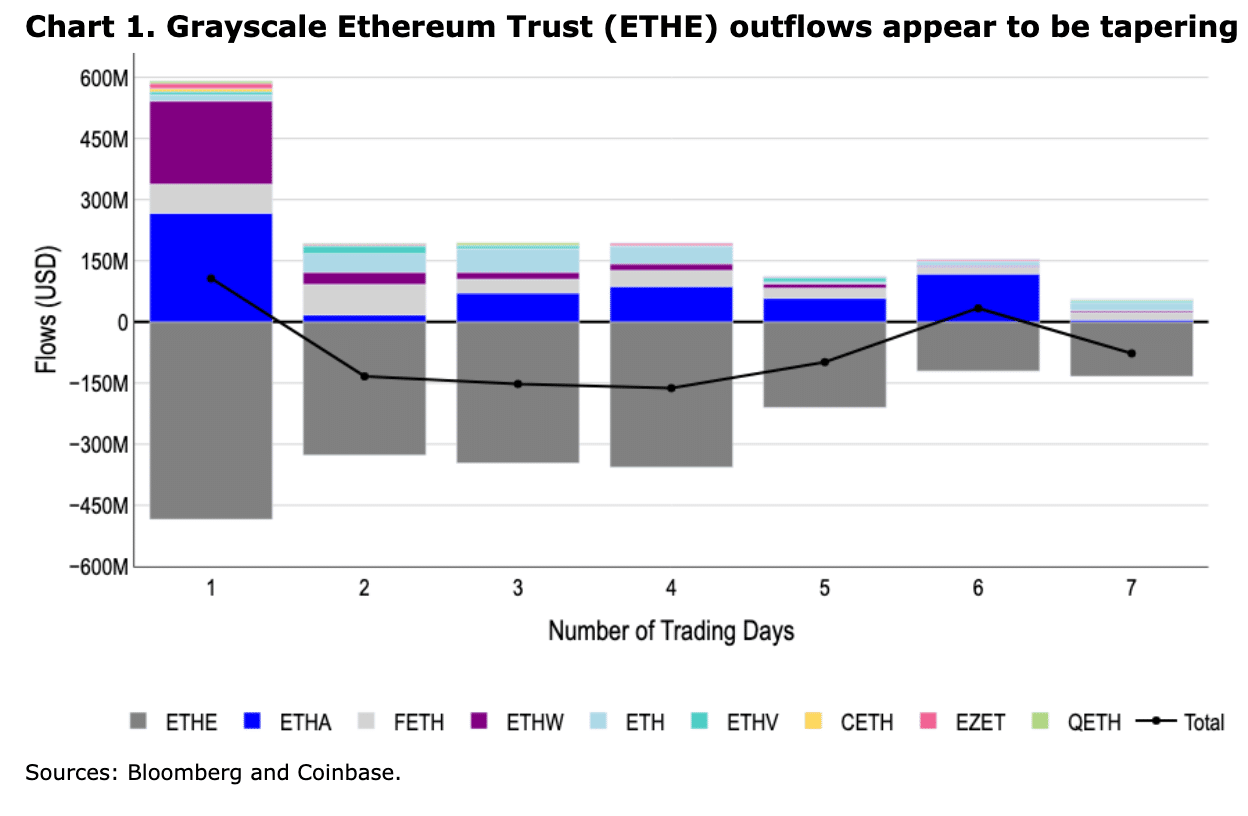

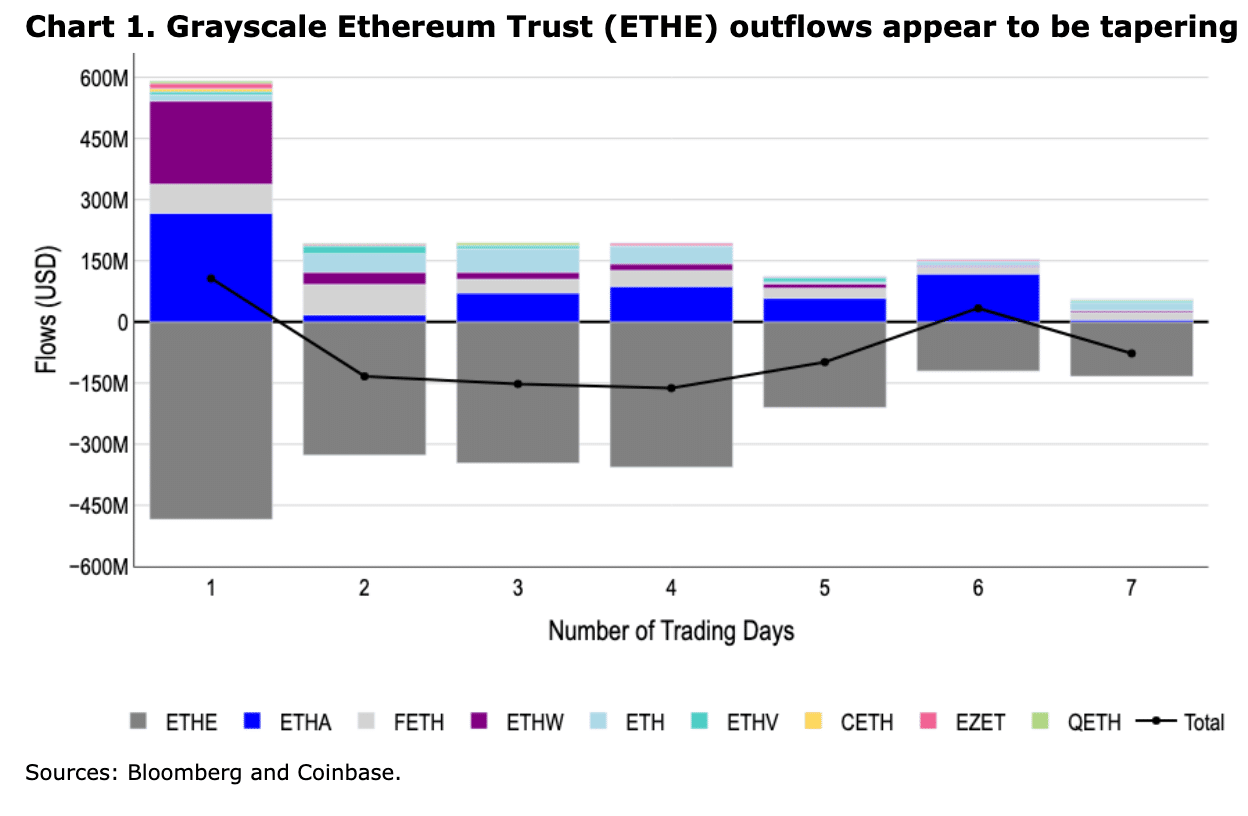

U.S spot Ethereum ETFs recorded a vital decline in outflows in the second one week of buying and selling, in comparison to its debut week. Within the first week, the goods noticed internet outflows of $341.3 million, completely pushed by means of Grayscale’s bleeding from its ETHE and Mini Consider (ETH) merchandise.

Specifically, ETHE drove $1.5 billion in outflows within the first week of buying and selling. On the other hand, the dumping declined in the second one week – An indication that ETHE outflows may well be ‘tapering,’ consistent with Coinbase analysts.

“Notice that the ETHE outflows were declining daily, which enhances our trust that those outflows were front-loaded in comparison to what we noticed with Grayscale Bitcoin Consider (GBTC) previous within the yr.”

Supply: Coinbase

Supply: Coinbase

Will tapering Grayscale outflows assist ETH’s worth?

For point of view, overall Grayscale outflows within the first week had been $1.94 billion—$1.5 billion from ETHE and a $448 million unload on Mini Consider (ETH).

In the second one week, ETHE noticed $603 million in outflows, whilst ETH shed $175.5 million. This supposed that outflows dropped underneath $800 million in the second one week. Briefly, the huge investor exodus from Grayscale eased as the second one week rolled in.

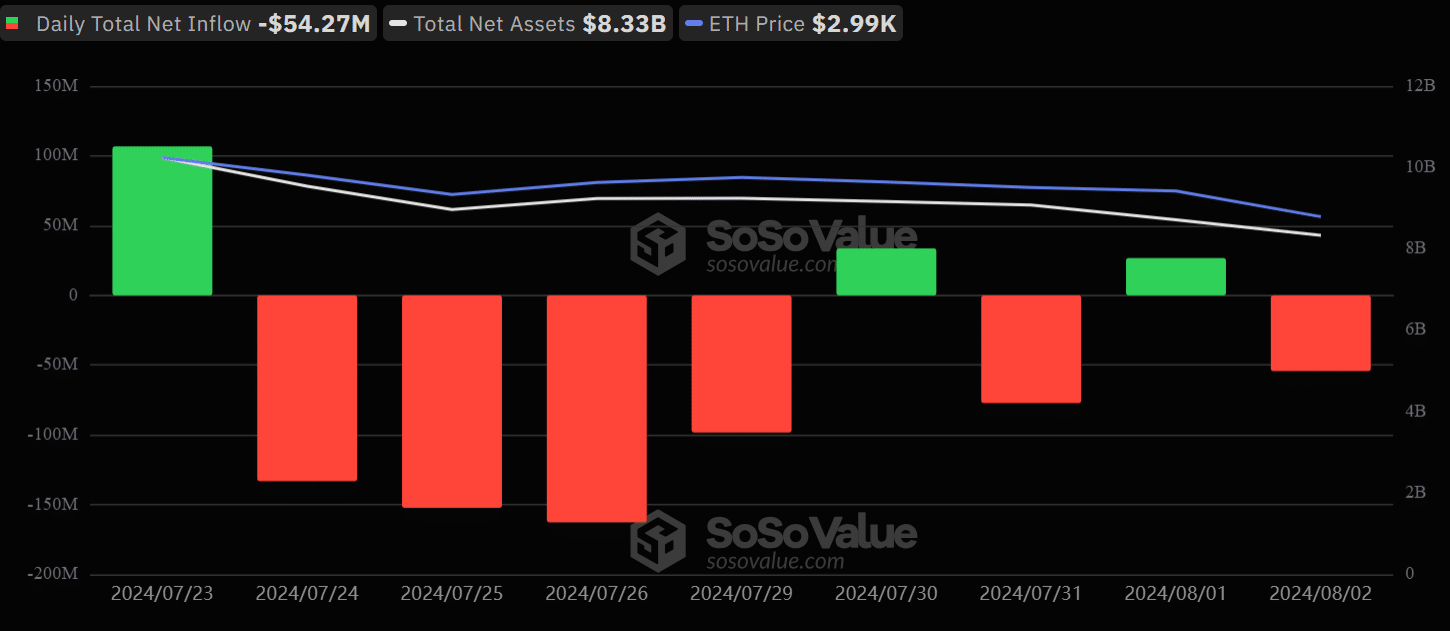

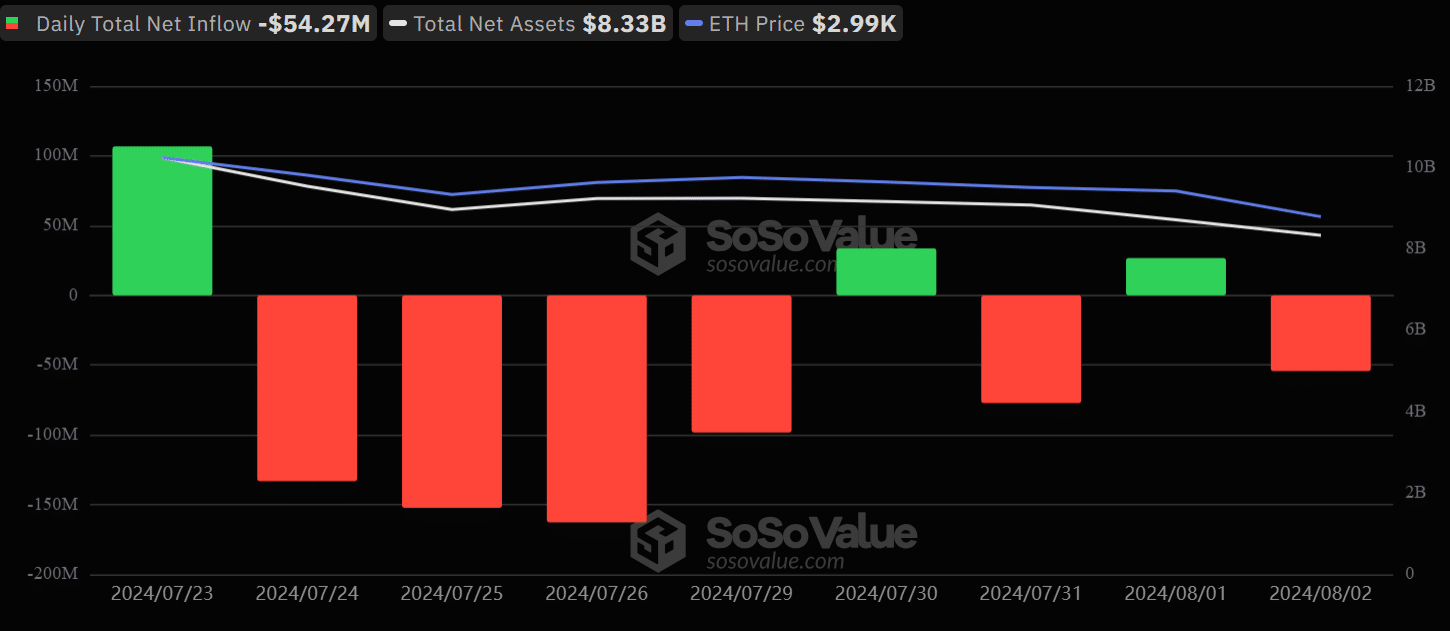

Supply: Soso Price

Supply: Soso Price

Actually, Coinbase analysts had in the past projected that Grayscale ETF outflows would ease by means of the second one week, evaluating their patterns to these of GBTC.

Whilst this projection appears to be enjoying out at this time, ETH’s worth has remained muted amidst wary investor sentiment around the U.S and Asian markets.

With the exception of ETHE, the spot ETH ETF has noticed over $1.5 billion, consistent with Farside Buyers knowledge. On the other hand, because of the marketplace’s overwhelming adverse sentiment, the altcoin’s worth dropped underneath $3k.

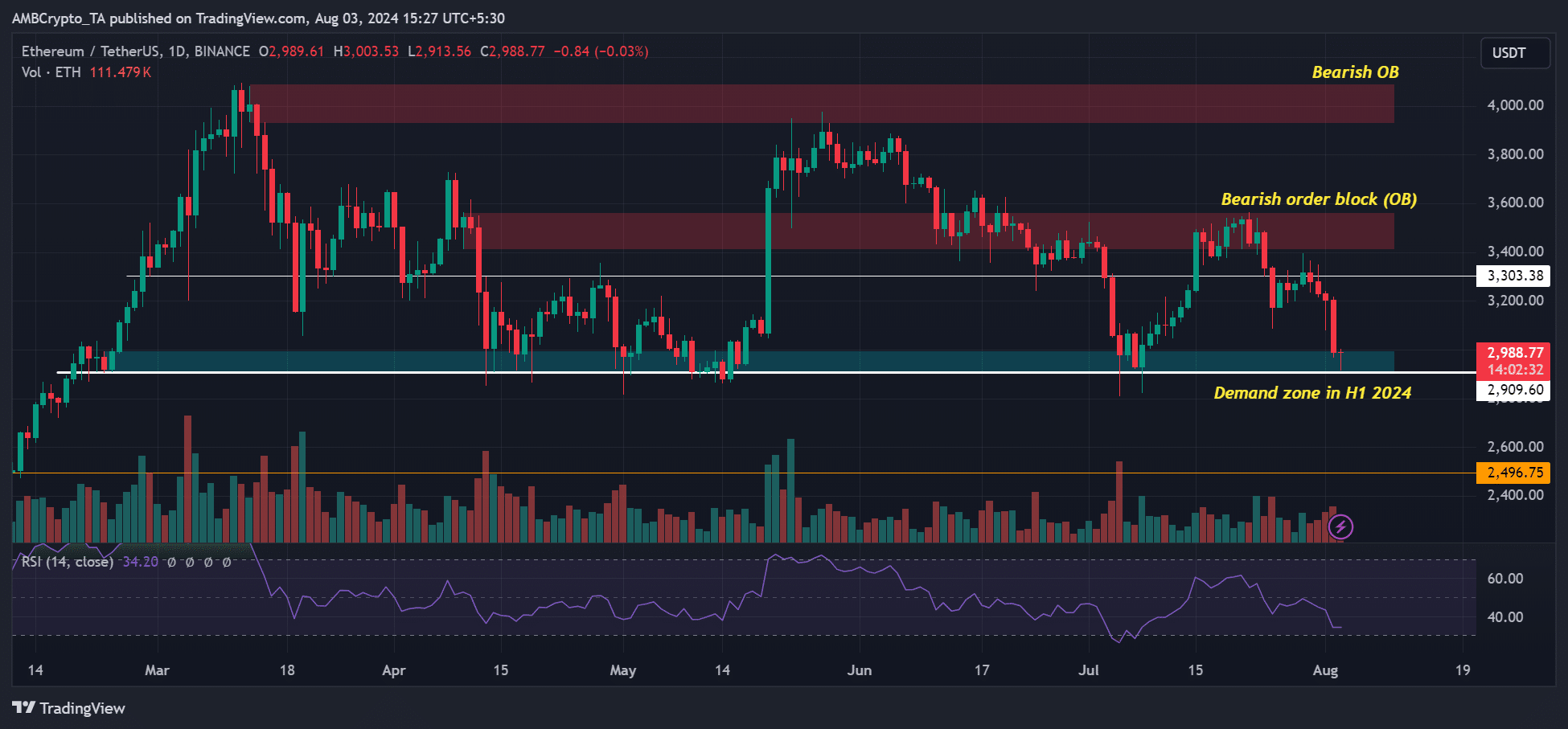

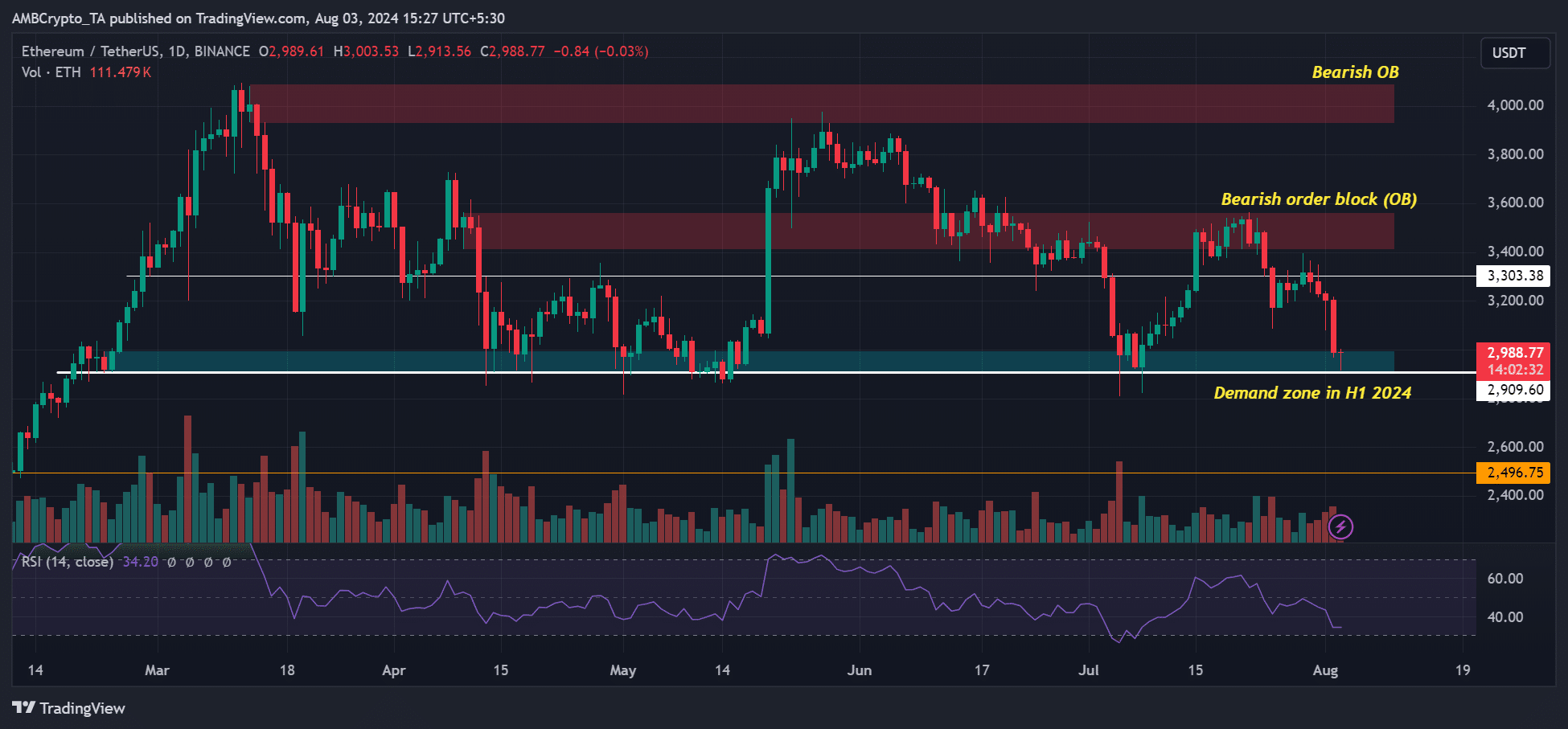

At press time, ETH appeared to be re-testing $3,000 at the charts, a degree which doubled as a a very powerful call for zone in 2024 for the 5th time. This has successfully reversed all its July good points.

Whether or not the tapering of Grayscale outflows will start up a rebound on the call for stage is still noticed even though.

Supply: ETH/USDT, TradingView

Supply: ETH/USDT, TradingView

Subsequent: $60K or $67K – Bitcoin’s subsequent worth goal may rely on this pattern