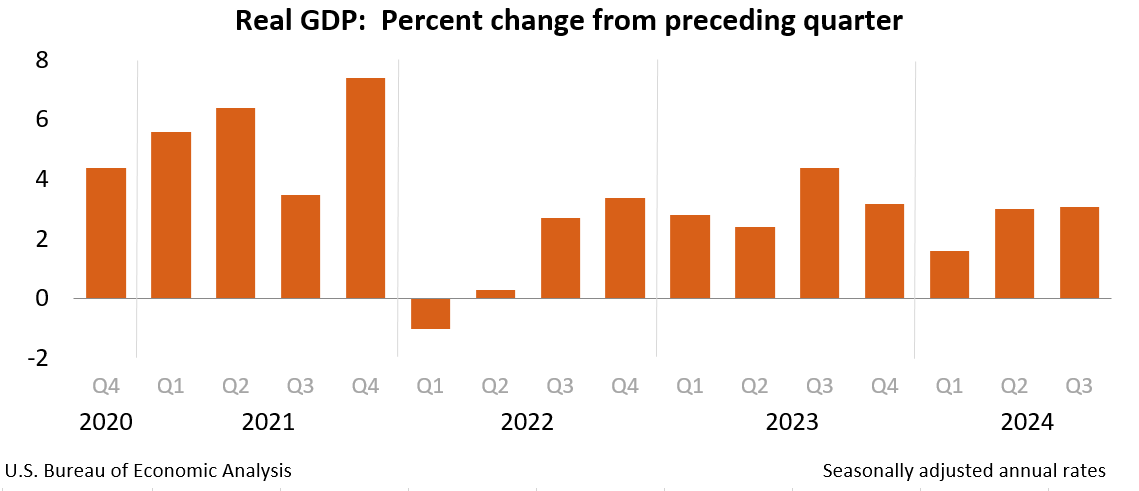

Actual gross home product (GDP) higher at an annual price of three.1 p.c within the 0.33 quarter of 2024 (desk 1), in step with the “0.33” estimate launched by means of the U.S. Bureau of Financial Research. In the second one quarter, actual GDP higher 3.0 p.c.

The GDP estimate launched as of late is in keeping with extra entire supply information than had been to be had for the “2d” estimate issued remaining month. In the second one estimate, the rise in actual GDP used to be 2.8 p.c. The replace essentially mirrored upward revisions to exports and shopper spending that had been in part offset by means of a downward revision to non-public stock funding. Imports, which can be a subtraction within the calculation of GDP, had been revised up (check with “Updates to GDP”).

The rise in actual GDP essentially mirrored will increase in shopper spending, exports, nonresidential mounted funding, and federal govt spending. Imports higher (desk 2).

In comparison to the second one quarter, the acceleration in actual GDP within the 0.33 quarter essentially mirrored accelerations in exports, shopper spending, and federal govt spending. Those actions had been in part offset by means of a downturn in personal stock funding and a bigger lower in residential mounted funding. Imports sped up.

Present greenback GDP higher 5.0 p.c at an annual price, or $358.2 billion, within the 0.33 quarter to a degree of $29.37 trillion, an upward revision of $20.6 billion from the former estimate (tables 1 and three). Additional info at the supply information that underlie the estimates is to be had within the “Key Supply Knowledge and Assumptions” document on BEA’s web site.

The cost index for gross home purchases higher 1.9 p.c within the 0.33 quarter, the similar as the former estimate (desk 4). The private intake expenditures (PCE) worth index higher 1.5 p.c, additionally the similar as prior to now estimated. With the exception of meals and effort costs, the PCE worth index higher 2.2 p.c, an upward revision of 0.1 share level.

Non-public Source of revenue

Present-dollar non-public source of revenue higher $191.7 billion within the 0.33 quarter, an upward revision of $15.8 billion from the former estimate. The rise essentially mirrored will increase in repayment and private present switch receipts (desk 8).

Disposable non-public source of revenue higher $141.5 billion, or 2.7 p.c, within the 0.33 quarter, an upward revision of $18.6 billion from the former estimate. Actual disposable non-public source of revenue higher 1.1 p.c, an upward revision of 0.3 share level.

Non-public saving used to be $936.6 billion within the 0.33 quarter, an upward revision of $2.1 billion from the former estimate. The private saving price—non-public saving as a share of disposable non-public source of revenue—used to be 4.3 p.c within the 0.33 quarter, the similar as the former estimate.

Gross Home Source of revenue and Company Income

Actual gross home source of revenue (GDI) higher 2.1 p.c within the 0.33 quarter, a downward revision of 0.1 share level from the former estimate. The common of actual GDP and actual GDI, a supplemental measure of U.S. financial task that similarly weights GDP and GDI, higher 2.6 p.c within the 0.33 quarter, an upward revision of 0.1 share level from the former estimate (desk 1).

Income from present manufacturing (company earnings with stock valuation and capital intake changes) diminished $15.0 billion within the 0.33 quarter, a downward revision of $4.9 billion from the former estimate (desk 10).

Income of home monetary firms higher $3.0 billion within the 0.33 quarter, an upward revision of $5.6 billion from the former estimate. Income of home nonfinancial firms higher $24.9 billion, a downward revision of $5.9 billion. Relaxation-of-the-world earnings diminished $42.9 billion, a downward revision of $4.6 billion. Receipts diminished $61.5 billion, and bills diminished $18.7 billion.

Updates to GDP

With the 0.33 estimate, upward revisions to exports and shopper spending had been in part offset by means of a downward revision to non-public stock funding. Imports had been revised up. For more info, check with the Technical Be aware. For info on updates to GDP, check with the “Further Data” phase that follows.

Advance Estimate

2d Estimate

3rd Estimate

(% trade from previous quarter)

Actual GDP

2.8

2.8

3.1

Present-dollar GDP

4.7

4.7

5.0

Actual GDI

…

2.2

2.1

Moderate of Actual GDP and Actual GDI

…

2.5

2.6

Gross home purchases worth index

1.8

1.9

1.9

PCE worth index

1.5

1.5

1.5

PCE worth index except for meals and effort

2.2

2.1

2.2

Actual GDP by means of Trade

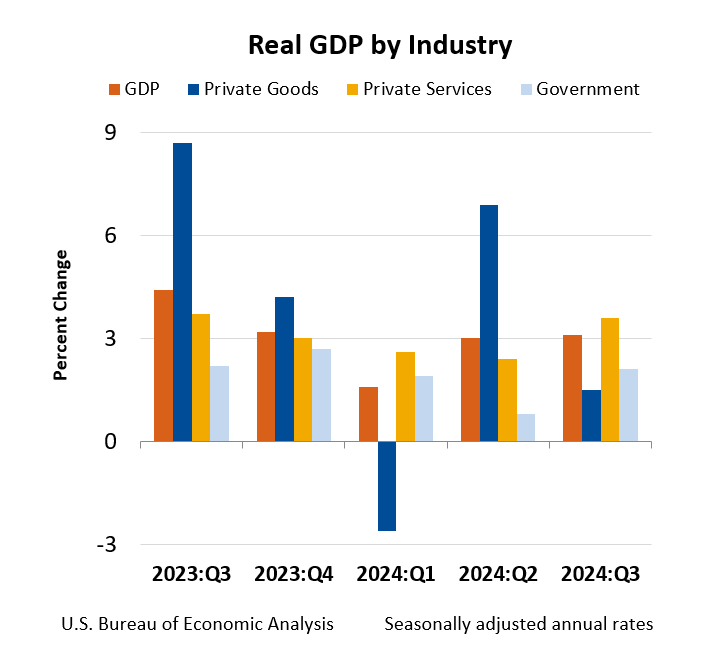

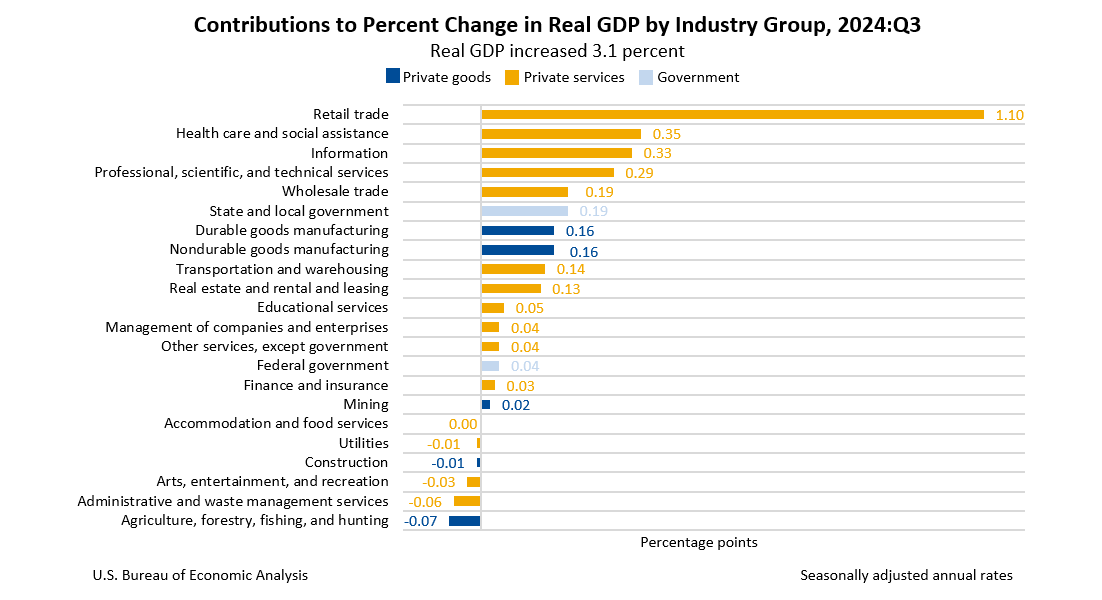

Lately’s unencumber contains estimates of GDP by means of business, or worth added—a measure of an business’s contribution to GDP. Personal goods-producing industries higher 1.5 p.c, personal services-producing industries higher 3.6 p.c, and govt higher 2.1 p.c (desk 12). General, 16 of twenty-two business teams contributed to the third-quarter build up in actual GDP.

Inside of personal goods-producing industries, the main members to the rise had been sturdy items production (led by means of different transportation apparatus) and nondurable items production (led by means of chemical merchandise) (desk 13).

Inside of personal services-producing industries, the main members to the rise had been retail industry (led by means of motor cars and portions sellers); well being care and social help (led by means of ambulatory well being care amenities); and data (led by means of information processing, web publishing, and different data amenities).

The rise in govt used to be led by means of an build up in state and native govt.

Gross Output by means of Trade

Actual gross output—basically a measure of an business’s gross sales or receipts, which contains gross sales to ultimate customers within the economic system (GDP) and gross sales to different industries (intermediate inputs)—higher 3.2 p.c within the 0.33 quarter. Personal goods-producing industries higher 0.6 p.c, personal services-producing industries higher 4.0 p.c, and govt higher 3.5 p.c (desk 16). General, 17 out of twenty-two business teams contributed to the rise in actual gross output.

* * *

Subsequent unencumber, January 30, 2025, at 8:30 a.m. EST

Gross Home Product, Fourth Quarter 2024 and Yr 2024 (Advance Estimate)

* * *

Be aware

Starting in January 2025, the GDP information unencumber fabrics will now not come with separate “Highlights” or “Technical Be aware” paperwork as a part of the discharge’s “Comparable Fabrics.” Data prior to now incorporated within the Highlights and the Technical Be aware will likely be to be had within the information unencumber or on BEA’s web site.

Unencumber Dates in 2025

Estimate

2024 This fall and

Yr 2024

2025 Q1

2025 Q2

2025 Q3

Gross Home Product

Advance Estimate

January 30, 2025

April 30, 2025

July 30, 2025

October 30, 2025

2d Estimate

February 27, 2025

Might 29, 2025

August 28, 2025

November 26, 2025

3rd Estimate

March 27, 2025

June 26, 2025

September 25, 2025

December 19, 2025

Gross Home Product by means of Trade

March 27, 2025

June 26, 2025

September 25, 2025

December 19, 2025

Company Income

Initial Estimate

—

Might 29, 2025

August 28, 2025

November 26, 2025

Revised Estimate

March 27, 2025

June 26, 2025

September 25, 2025

December 19, 2025