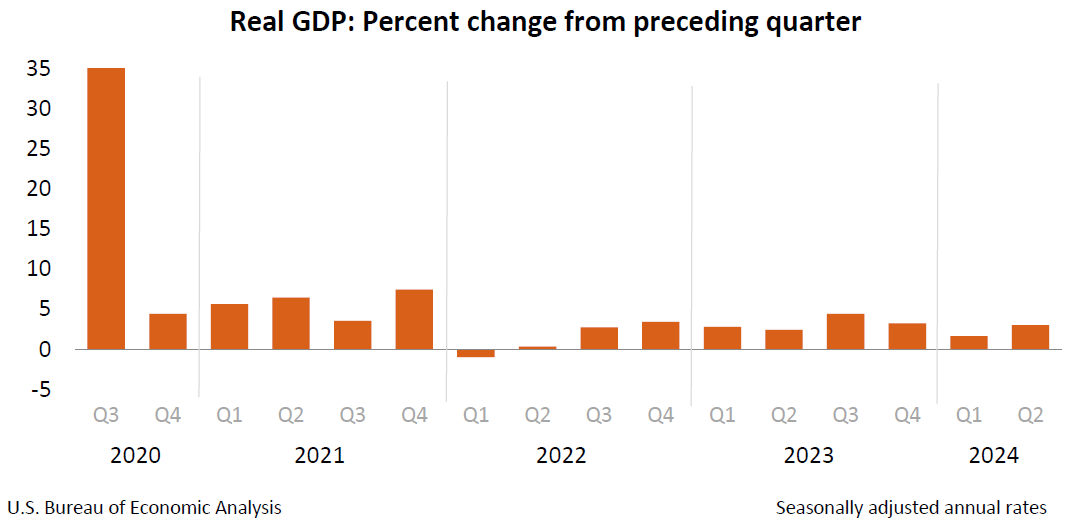

Actual gross home product (GDP) higher at an annual charge of three.0 % in the second one quarter of 2024 (desk 1), consistent with the “3rd” estimate launched through the U.S. Bureau of Financial Research. Within the first quarter, actual GDP higher 1.6 % (revised).

The GDP estimate launched nowadays is in response to extra whole supply information than had been to be had for the “moment” estimate issued final month. In the second one estimate, the rise in actual GDP was once additionally 3.0 %. The replace essentially mirrored upward revisions to non-public stock funding and federal executive spending that had been offset through downward revisions to nonresidential mounted funding and exports (discuss with “Updates to GDP”). Imports, which might be a subtraction within the calculation of GDP, had been revised up.

The rise in actual GDP essentially mirrored will increase in shopper spending, non-public stock funding, and nonresidential mounted funding. Imports higher (desk 2).

In comparison to the primary quarter, the acceleration in actual GDP in the second one quarterly essentially mirrored an upturn in non-public stock funding and an acceleration in shopper spending. Those actions had been partially offset through a downturn in residential mounted funding.

Present‑greenback GDP higher 5.6 % at an annual charge, or $392.6 billion, in the second one quarter to a degree of $29.02 trillion, a $9.5 billion greater building up than the former estimate (tables 1 and three). Additional information at the supply information that underlie the estimates is to be had within the “Key Supply Information and Assumptions” record on BEA’s web page.

The fee index for gross home purchases higher 2.4 % in the second one quarter, the similar as the former estimate (desk 4). The non-public intake expenditures (PCE) worth index higher 2.5 %, the similar as the former estimate. Except meals and effort costs, the PCE worth index higher 2.8 %, additionally the similar as the former estimate.

Non-public Source of revenue

Present-dollar private source of revenue higher $315.7 billion in the second one quarter, an upward revision of $82.1 billion from the former estimate. The rise essentially mirrored will increase in reimbursement and private present switch receipts (desk 8).

Disposable private source of revenue higher $260.4 billion, or 5.0 %, in the second one quarter, an upward revision of $77.3 billion from the former estimate. Actual disposable private source of revenue higher 2.4 %, an upward revision of one.4 proportion issues.

Non-public saving was once $1.13 trillion in the second one quarter, an upward revision of $74.3 billion from the former estimate. The non-public saving charge—private saving as a proportion of disposable private source of revenue—was once 5.2 % in the second one quarter, in comparison with 5.4 % (revised) within the first quarter.

Gross Home Source of revenue and Company Income

Actual gross home source of revenue (GDI) higher 3.4 % in the second one quarter, an upward revision of two.1 proportion issues from the former estimate. The typical of actual GDP and actual GDI, a supplemental measure of U.S. financial process that similarly weights GDP and GDI, higher 3.2 % in the second one quarter, an upward revision of one.1 proportion issues from the former estimate (desk 1).

Income from present manufacturing (company earnings with stock valuation and capital intake changes) higher $132.5 billion in the second one quarter, an upward revision of $74.9 billion from the former estimate (desk 10).

Income of home monetary companies higher $42.5 billion in the second one quarter, a downward revision of $4.0 billion from the former estimate. Income of home nonfinancial companies higher $108.8 billion, an upward revision of $79.6 billion. Relaxation-of-the-world earnings diminished $18.8 billion, a downward revision of $0.7 billion. In the second one quarter, receipts higher $4.4 billion, and bills higher $23.1 billion.

Updates to GDP

With the 3rd estimate, upward revisions to non-public stock funding and federal executive spending had been offset through downward revisions to nonresidential mounted funding, exports, shopper spending, and home mounted funding. Imports had been revised up. For more info, discuss with the Technical Notice. For info on updates to GDP, discuss with the “Further Knowledge” phase that follows.

Advance Estimate

2nd Estimate

3rd Estimate

(% exchange from previous quarter)

Actual GDP

2.8

3.0

3.0

Present-dollar GDP

5.2

5.5

5.6

Actual GDI

…

1.3

3.4

Moderate of Actual GDP and Actual GDI

…

2.1

3.2

Gross home purchases worth index

2.3

2.4

2.4

PCE worth index

2.6

2.5

2.5

PCE worth index apart from meals and effort

2.9

2.8

2.8

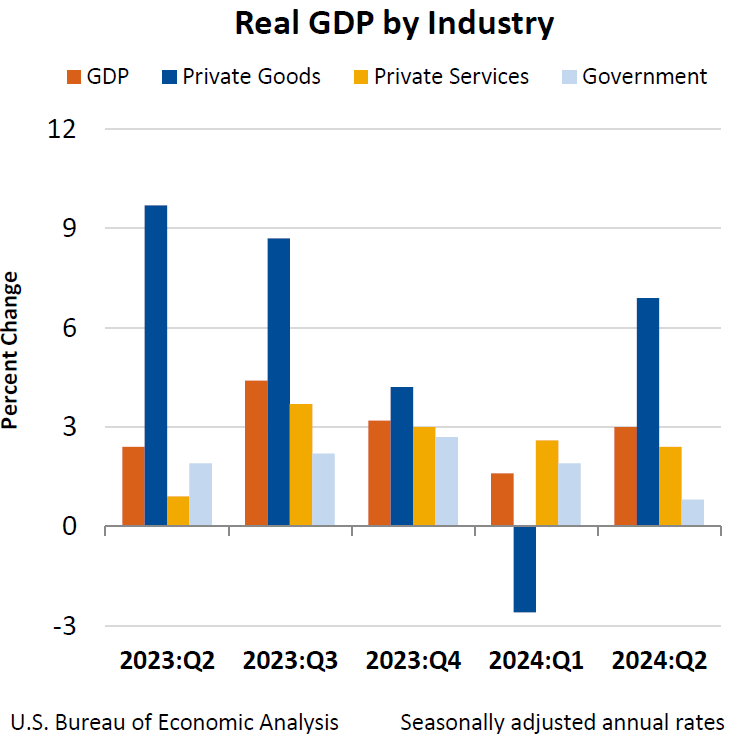

Actual GDP through Business

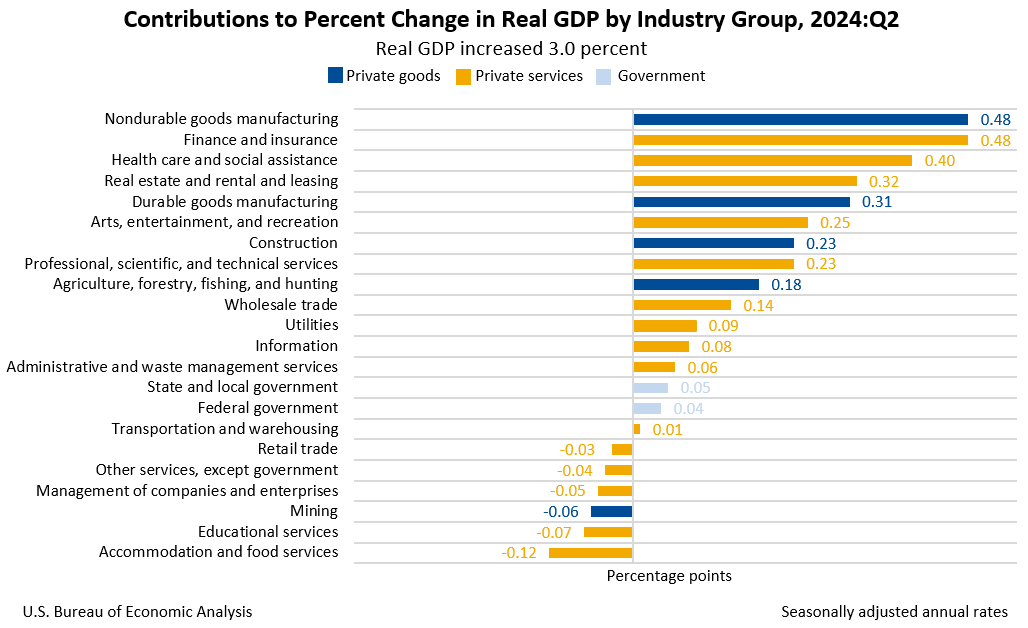

These days’s free up comprises estimates of GDP through business, or price added—a measure of an business’s contribution to GDP. Non-public goods-producing industries higher 6.9 %, non-public services-producing industries higher 2.4 %, and executive higher 0.8 % (desk 12). General, 16 of twenty-two business teams contributed to the second-quarter building up in actual GDP.

Inside of non-public goods-producing industries, the main participants to the rise had been nondurable items production (led through petroleum and coal merchandise) and sturdy items production (led through motor cars, our bodies and trailers, and portions) (desk 13).

Inside of non-public services-producing industries, the main participants to the rise had been finance and insurance coverage (led through Federal Reserve banks, credit score intermediation, and similar actions); well being care and social help (led through ambulatory well being care amenities); in addition to actual property and apartment and leasing (led through actual property).

The rise in executive mirrored will increase in state and native executive in addition to federal executive.

Gross Output through Business

Actual gross output—basically a measure of an business’s gross sales or receipts, which incorporates gross sales to ultimate customers within the economic system (GDP) and gross sales to different industries (intermediate inputs)—higher 1.8 % in the second one quarter. This mirrored an building up of two.1 % for personal goods-producing industries, an building up of one.7 % for personal services-producing industries, and an building up of two.2 % for presidency (desk 16). General, 18 of twenty-two business teams contributed to the rise in actual gross output.

Annual Replace of the Nationwide Financial Accounts

These days’s free up items effects from the yearly replace of the Nationwide Financial Accounts (NEAs), which come with the Nationwide Source of revenue and Product Accounts (NIPAs) and the Business Financial Accounts (IEAs). The replace comprises revised estimates for the primary quarter of 2019 in the course of the first quarter of 2024 and led to revisions to GDP, GDP through business, GDI, and their primary parts. The reference yr stays 2017.

With nowadays’s free up, maximum information are to be had via BEA’s Interactive Information utility at the BEA web page (www.bea.gov). Consult with “Knowledge on 2024 Annual Updates to the Nationwide, Business, and State and Native Financial Accounts” for the entire desk free up agenda and a abstract of effects via 2023, which incorporates data on method adjustments. A desk appearing the foremost present greenback revisions and their assets for every part of GDP, nationwide source of revenue, and private source of revenue could also be equipped. A piece of writing describing the replace in additional element shall be coming near near within the Survey of Present Trade.

The up to date estimates display that actual GDP higher at a median annual charge of two.3 % from 2018 to 2023, 0.2 proportion level upper than the prior to now printed estimate. Over the similar length, actual GDI higher at a median annual charge of two.2 %, 0.4 proportion level upper than prior to now printed. The typical of actual GDP and actual GDI over the similar length was once 2.3 %, 0.4 proportion level upper than prior to now printed.

For the length of monetary enlargement from the second one quarter of 2009 in the course of the fourth quarter of 2019, actual GDP higher at an annual charge of two.5 %, revised up 0.1 proportion level from the prior to now printed estimates. For the length of monetary contraction from the fourth quarter of 2019 via the second one quarter of 2020, actual GDP diminished at an annual charge of 17.5 %, the similar as prior to now estimated. For the length of monetary enlargement from the second one quarter of 2020 in the course of the first quarter of 2024, actual GDP higher at an annual charge of five.2 %, 0.3 proportion level upper than prior to now estimated.

Up to now printed estimates, which might be outdated through nowadays’s free up, are present in BEA’s archives.

Updates for the First Quarter of 2024

For the primary quarter of 2024, actual GDP is now estimated to have higher 1.6 % (desk 1), an upward revision of 0.2 proportion level from the prior to now printed estimate, essentially reflecting an upward revision to shopper spending that was once partially offset through downward revisions to non-public stock funding and home mounted funding.

The fee index for gross home purchases is now estimated to have higher 3.0 %, a downward revision of 0.1 proportion level. The PCE worth index higher 3.4 %, the similar as prior to now printed. Except meals and effort, the PCE worth index higher 3.7 %, the similar as prior to now printed.

First Quarter 2024

Earlier Estimate

Revised

(% exchange from previous quarter)

Actual GDP

1.4

1.6

Present-dollar GDP

4.5

4.7

Actual GDI

1.3

3.0

Moderate of Actual GDP and Actual GDI

1.4

2.3

Gross home purchases worth index

3.1

3.0

PCE worth index

3.4

3.4

PCE worth index apart from meals and effort

3.7

3.7

Non-public Source of revenue

Present-dollar private source of revenue is now estimated to have higher $536.4 billion within the first quarter, an upward revision of $139.6 billion from the former estimate. The revision essentially mirrored an upward revision to reimbursement (led through non-public wages and salaries) (desk 8).

Disposable private source of revenue higher $465.1 billion, or 9.2 %, within the first quarter, an upward revision of $224.9 billion from the former estimate. Actual disposable private source of revenue higher 5.6 %, an upward revision of four.3 proportion issues.

Non-public saving was once $1.15 trillion within the first quarter, an upward revision in exchange of $188.3 billion. The private saving charge—private saving as a proportion of disposable private source of revenue—was once 5.4 % (revised) within the first quarter.

Gross Home Source of revenue and Company Income

Actual GDI is now estimated to have higher 3.0 % within the first quarter (desk 1); within the prior to now printed estimates, first-quarter GDI was once estimated to have higher 1.3 %. The main contributor to the upward revision was once reimbursement, primarily based totally on new first-quarter salary and wage estimates from the Bureau of Hard work Statistics’ Quarterly Census of Employment and Wages. The typical of actual GDP and actual GDI is now estimated to have higher 2.3 % within the first quarter; within the prior to now printed estimates, the typical of GDP and GDI was once estimated to have higher 1.4 %.

Income from present manufacturing (company earnings with stock valuation and capital intake changes) is now estimated to have diminished $65.1 billion within the first quarter, a downward revison of $18.0 billion (desk 10).

Income of home monetary companies higher $57.4 billion, a downward revision of $7.6 billion. Income of home nonfinancial companies diminished $124.9 billion, a downward revision of $10.4 billion. Relaxation-of-the-world earnings higher $2.3 billion, the similar as prior to now estimated. Within the first quarter, receipts are actually estimated to have higher $25.7 billion, and bills are estimated to have higher $23.4 billion.

GDP through Business

Within the first quarter, actual price added for personal goods-producing industries is now estimated to have diminished 2.6 %, a downward revision of one.5 proportion issues. Non-public services-producing industries higher 2.6 %, an upward revision of 0.7 proportion level. Executive higher 1.9 %, a downward revision of 0.4 proportion level.

Actual gross output is now estimated to have higher 2.8 %, an upward revision of 0.3 proportion level. Non-public goods-producing industries higher 1.6 %, an upward revision of 0.4 proportion level. Non-public services-producting industries higher 3.3 %, an upward revision of 0.2 proportion level. Executive higher 2.3 %, an upward revision of 0.6 proportion level.

* * *

Subsequent free up, October 30, 2024, at 8:30 a.m. EDT

Gross Home Product, 3rd Quarter 2024 (Advance Estimate)

* * *

:max_bytes(150000):strip_icc()/GettyImages-2188460679-4f112c9e9def4df98120dc4919bbd105.jpg)

:max_bytes(150000):strip_icc()/WhattoExpectFromBitcoinandCryptocurrencyMarketsin2025-12ed9a9f2e8c42a5b2477933ea62fe0d.jpg)