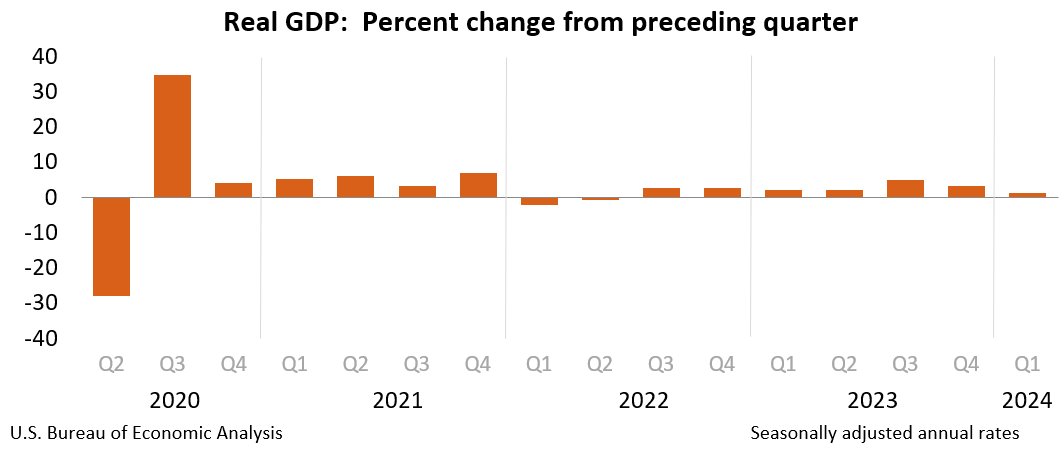

Actual gross home product (GDP) higher at an annual charge of one.3 p.c within the first quarter of 2024 (desk 1), in keeping with the “2d” estimate launched via the Bureau of Financial Research. Within the fourth quarter of 2023, actual GDP higher 3.4 p.c.

The GDP estimate launched these days is in accordance with extra entire supply knowledge than had been to be had for the “advance” estimate issued closing month. Within the advance estimate, the rise in actual GDP used to be 1.6 p.c. The replace essentially mirrored a downward revision to shopper spending (seek advice from “Updates to GDP”).

The rise in actual GDP essentially mirrored will increase in shopper spending, residential mounted funding, nonresidential mounted funding, and state and native govt spending that had been partially offset via a lower in non-public stock funding. Imports, which might be a subtraction within the calculation of GDP, higher (desk 2).

In comparison to the fourth quarter, the deceleration in actual GDP within the first quarter essentially mirrored decelerations in shopper spending, exports, and state and native govt spending and a downturn in federal govt spending. Those actions had been partially offset via an acceleration in residential mounted funding. Imports sped up.

Present‑greenback GDP higher 4.3 p.c at an annual charge, or $298.9 billion, within the first quarter to a degree of $28.26 trillion, a downward revision of $28.6 billion from the former estimate (tables 1 and three). Additional information at the supply knowledge that underlie the estimates is to be had within the “Key Supply Information and Assumptions” document on BEA’s web page.

The associated fee index for gross home purchases higher 3.0 p.c within the first quarter, a downward revision of 0.1 proportion level from the former estimate. The non-public intake expenditures (PCE) value index higher 3.3 p.c, a downward revision of 0.1 proportion level. Apart from meals and effort costs, the PCE value index higher 3.6 p.c, a downward revision of 0.1 proportion level.

Private Source of revenue

Present-dollar non-public source of revenue higher $404.4 billion within the first quarter, a downward revision of $2.6 billion from the former estimate. The rise within the first quarter essentially mirrored will increase in reimbursement (led via non-public wages and salaries) and private present switch receipts (led via govt social advantages to individuals) (desk 8).

Disposable non-public source of revenue higher $266.7 billion, or 5.3 p.c, within the first quarter, an upward revision of $40.5 billion from the former estimate. Actual disposable non-public source of revenue higher 1.9 p.c, an upward revision of 0.8 proportion level.

Private saving used to be $796.6 billion within the first quarter, an upward revision of $96.6 billion from the former estimate. The non-public saving charge— non-public saving as a proportion of disposable non-public source of revenue—used to be 3.8 p.c within the first quarter, an upward revision of 0.2 proportion level.

Gross Home Source of revenue and Company Earnings

Actual gross home source of revenue (GDI) higher 1.5 p.c within the first quarter, when put next with an build up of three.6 p.c (revised) within the fourth quarter. The common of actual GDP and actual GDI, a supplemental measure of U.S. financial process that similarly weights GDP and GDI, higher 1.4 p.c within the first quarter, when put next with an build up of three.5 p.c within the fourth quarter (desk 1).

Earnings from present manufacturing (company income with stock valuation and capital intake changes) reduced $21.1 billion within the first quarter, by contrast to an build up of $133.5 billion within the fourth quarter (desk 10).

Earnings of home monetary firms higher $73.7 billion within the first quarter, when put next with an build up of $5.9 billion within the fourth quarter. Earnings of home nonfinancial firms reduced $114.1 billion, by contrast to an build up of $136.5 billion. Leisure-of-the-world income higher $19.3 billion, by contrast to a lower of $8.9 billion. Within the first quarter, receipts higher $29.8 billion, and bills higher $10.5 billion.

Updates to GDP

With the second one estimate, downward revisions to shopper spending, non-public stock funding, and federal govt spending had been partially offset via upward revisions to state and native govt spending, nonresidential mounted funding, residential mounted funding, and exports. Imports had been revised up. For more info, seek advice from the Technical Notice. For info on updates to GDP, seek advice from the “Further Data” segment that follows.

Advance Estimate

2d Estimate

(% alternate from previous quarter)

Actual GDP

1.6

1.3

Present-dollar GDP

4.8

4.3

Actual GDI

…

1.5

Moderate of Actual GDP and Actual GDI

…

1.4

Gross home purchases value index

3.1

3.0

PCE value index

3.4

3.3

PCE value index apart from meals and effort

3.7

3.6

Updates to Fourth-Quarter Wages and Salaries

Along with presenting up to date estimates for the primary quarter, these days’s unencumber gifts revised estimates of fourth-quarter wages and salaries, non-public taxes, and contributions for presidency social insurance coverage, in accordance with up to date knowledge from the Bureau of Exertions Statistics Quarterly Census of Employment and Wages program. Wages and salaries at the moment are estimated to have higher $58.5 billion within the fourth quarter, a downward revision of $73.0 billion. Private present taxes at the moment are estimated to have higher $27.1 billion, a downward revision of $12.6 billion. Contributions for presidency social insurance coverage at the moment are estimated to have higher $8.3 billion, a downward revision of $9.6 billion. With the incorporation of those new knowledge, actual gross home source of revenue is now estimated to have higher 3.6 p.c within the fourth quarter, a downward revision of one.2 proportion issues from the prior to now revealed estimate.

* * *

Subsequent unencumber, June 27, 2024, at 8:30 a.m. EDT

Gross Home Product (3rd Estimate)

Company Earnings (Revised Estimate)

Gross Home Product via Trade

First Quarter 2024

* * *