AMC Leisure (NYSE:AMC) theatres have noticed an explosion of latest guests over the last few days with queues stretching for miles outdoor its places. Cinemagoers were clambering over one every other simply looking to get into the newest screenings and that has despatched the inventory hovering by way of 135% over the primary two days of the week’s buying and selling.

Adequate, most effective such a statements holds true. Whilst AMC stocks have certainly skilled a powerful rally, the purpose in the back of it isn’t the frenzied call for, however reasonably the resurgence of meme shares.

The surprising go back of meme inventory firestarter Roaring Kitty led to 2021-flavored names piling on some unruly positive aspects, and AMC buyers (and the corporate itself) were reaping the rewards. It is still noticed how a lot mileage is left within the rally, then again, for the reason that as of Wednesday’s buying and selling consultation, the stocks had been in correction mode after the film theatre chain introduced it’ll factor elegance A inventory in change for notes.

The corporate additionally put the surge to excellent use previously, disclosing on Tuesday the finishing touch of a $250 million ATM program, concluding the fairness providing it had introduced on March 28.

As for a way the industry goes, when you strip the inventory of its meme credentials, there’s in reality now not a lot to shout about. A minimum of, that seems to be the take of Barrington analyst James Goss.

Having a look on the corporate’s fresh Q1 effects, overall income fell by way of not up to 1% year-over-year, whilst EBITDA confirmed a lack of -$31.6 million in comparison to the $7.1 million reported in the similar length a 12 months in the past. Moreover, Q2 has begun sluggishly, with fewer notable releases in comparison to 2023. The field workplace in April reduced by way of 50%, and Might’s efficiency has been in a similar fashion sluggish, no less than till the discharge of Kingdom of the Planet of the Apes. Total, Q2 field workplace income is down roughly 45% to-date.

Whilst later in the summertime, and in Q3 specifically, there are a couple of sexy motion pictures popping out, Goss thinks the “total unencumber quantity stays gentle.” Some releases were driven out to later within the 12 months or into 2025, indicating that the difficult atmosphere is more likely to persist all the way through maximum of 2024. Then again, this additionally units up the potential of a rebound subsequent 12 months.

Greater than anything else, even though, Goss issues out that because of AMC’s top leverage, “important uncertainty stays.”

“The present capital construction creates considerable uncertainty for fairness values, with its time period mortgage due in 2026,” Goss is going on to mention. “The new surge within the inventory items an extra alternative to boost fairness budget that may enhance liquidity and debt aid, ultimately shifting AMC to a construction that would facilitate institutional enhance.”

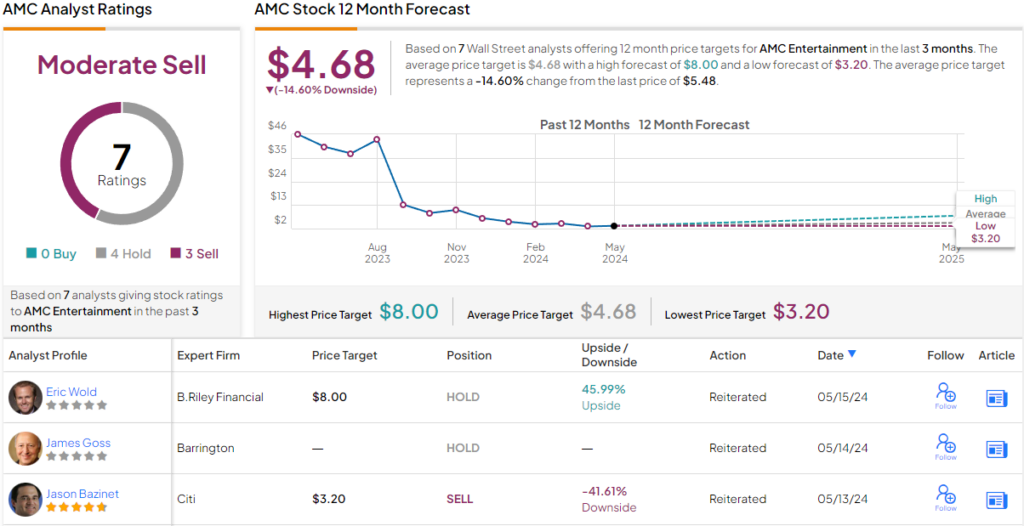

Accordingly, Goss maintained a Marketplace Carry out (i.e., Impartial) score on AMC stocks with no need a hard and fast worth goal in thoughts. (To observe Goss’s observe file, click on right here)

The remainder of the Side road is not more constructive. Of the opposite analysts who’ve just lately waded in with AMC critiques, the break up displays 4 Holds and three Promote suggestions, all culminating in a Average Promote consensus score. At $4.68, the common goal implies the stocks are overestimated to the music of ~15%. (See AMC inventory forecast)

To seek out excellent concepts for shares buying and selling at sexy valuations, discuss with TipRanks’ Best possible Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The evaluations expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. You will need to to do your personal research sooner than making any funding.

:max_bytes(150000):strip_icc()/GettyImages-2205311988-96b284e1e3ab441dae6b7723cbbb2e86.jpg)