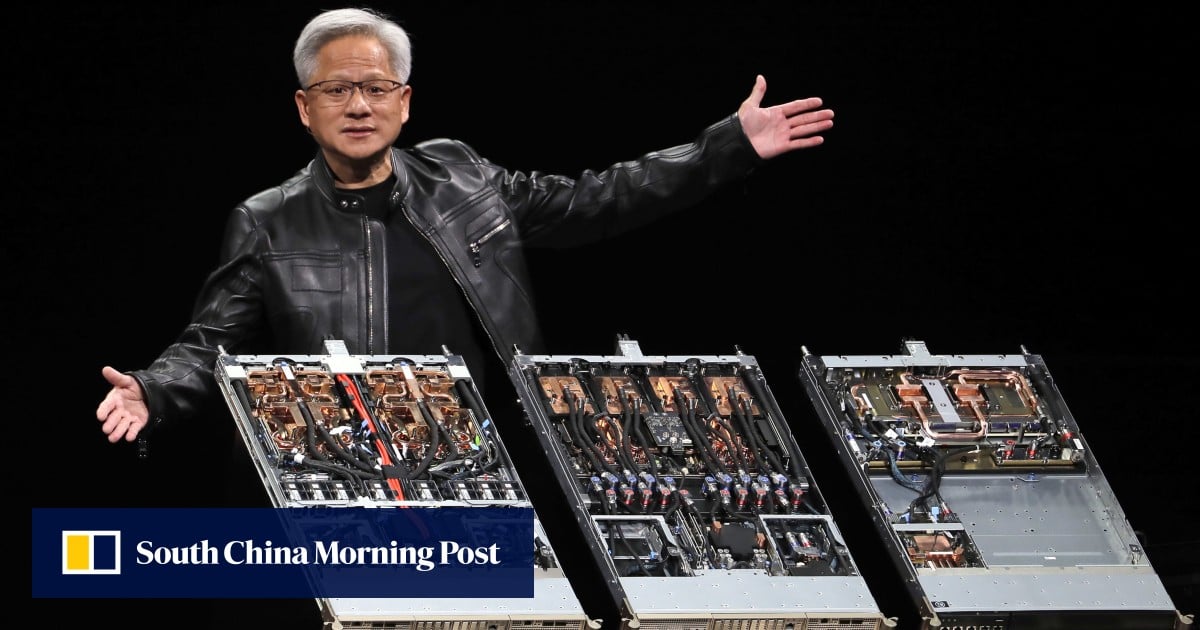

Nvidia (NVDA 1.92%) has develop into a inventory marketplace large because of its dominance in one in all lately’s highest-growth markets: synthetic intelligence (AI), a $200 billion marketplace that analysts say is heading for $1 trillion through the tip of the last decade. The tech corporate has nearly constructed an empire of AI services together with {hardware}, tool, networking equipment, and extra — to serve each and every AI buyer alongside each and every step in their AI adventure. Leader Govt Officer Jensen Huang has even known as the corporate the “on ramp” to the AI global.

And Nvidia’s crown jewel is its graphics processing gadgets (GPUs), the quickest chips round that energy an important AI duties akin to the learning and inferencing of fashions. Shoppers, together with the arena’s greatest tech companie,s Microsoft and Amazon, rush to Nvidia for its newest merchandise, serving to the corporate herald billions of greenbacks in profits. If truth be told, within the lately closed fiscal 12 months, Nvidia reported a triple-digit achieve in income to greater than $130 billion, a file.

The stocks have adopted, hovering 1,500% over 5 years. The drawback of all of that is, at a undeniable level, Nvidia’s inventory traded at ranges many buyers regarded as pricey. However, in fresh weeks, as shares declined on considerations concerning the basic financial system, so did Nvidia — and its valuation. If truth be told, the inventory is buying and selling at its lowest in terms of ahead profits estimates in additional than a 12 months. Has the inventory develop into too affordable to forget about? Let’s to find out.

Symbol supply: Getty Photographs.

Nvidia’s trail from gaming to AI

First, a snappy abstract of the Nvidia tale to this point. This tech celebrity wasn’t all the time the middle of the marketplace’s consideration. In its previous days, it served principally the video gaming business with its GPUs — however because it was transparent that those chips may well be helpful in different places, Nvidia advanced the parallel computing platform CUDA to make that occur.

And when GPUs began serving the AI group, neatly, the remainder is historical past. AI shoppers have flocked to Nvidia for those most sensible acting chips, and here is a excellent instance in their recognition, from Oracle co-founder Larry Ellison’s remark final 12 months. He mentioned he and Tesla leader Elon Musk took out Nvidia’s Huang for dinner and “begged” him for extra chips. It is because call for for the goods is top. If truth be told, call for for the corporate’s newest innovation, the Blackwell structure, has been so top that it is reached “insane” ranges, Huang informed CNBC in an interview a couple of months in the past.

Within the corporate’s fresh profits name, it mentioned Blackwell introduced in $11 billion in income throughout its first quarter in the marketplace. And on the identical time, regardless that the release for this kind of complicated customizable product is expensive, Nvidia nonetheless was once in a position to stay gross margin above 70%, appearing top profitability on gross sales.

Nvidia’s fresh headwinds

In fresh weeks, regardless that, Nvidia inventory has confronted numerous headwinds. First, as start-up DeepSeek introduced it had skilled its type on Nvidia’s lower-priced GPUs, buyers anxious others would possibly practice — leading to possible income declines for Nvidia. Then, the Trump management’s purpose to stay with — and in all probability even toughen –export controls on chips to China proved to be any other problem for Nvidia. In spite of everything, President Trump’s release of price lists on imports from 3 key buying and selling companions deepened considerations about financial progress and the profits of businesses that, like Nvidia, manufacture items out of doors the US.

Because of this, Nvidia inventory slid about 14% over the last month. And this has introduced valuation down — Nvidia now trades at handiest 24 instances ahead profits estimates, it is most cost-effective stage in additional than a 12 months.

Is Nvidia dust affordable lately?

Now, let’s get again to our query: Is Nvidia too affordable to forget about, or are the headwinds I have discussed explanation why to place the brakes on purchasing this AI participant? Neatly, the DeepSeek factor can have dissipated as main Nvidia shoppers lately spoke in their AI making an investment plans — and there hasn’t been a unmarried signal of scaling again. If truth be told, AI spending is hovering. Meta Platforms, as an example, says it intends to spend up to $65 billion this 12 months on its scale up and can finish the 12 months with 1.3 million GPUs.

As for the chip export controls, they’ve weighed on Nvidia’s income in China since they had been applied in 2022. Nonetheless, Nvidia, as discussed above, continues to record important income progress because it excels in different portions of the arena.

In spite of everything, let’s imagine Trump’s price lists. They may weigh on Nvidia and lots of different U.S. corporations, however you must remember the fact that the present business conflict is a brief problem. And Trump has not on time the price lists on merchandise integrated within the United States-Mexico-Canada Settlement, suggesting there could also be some flexibility of their implementation.

Having a look at Nvidia, particularly, all main indicators glance certain. The corporate’s reported blowout profits quarter after quarter, and its marketplace management and concentrate on innovation counsel that might proceed for slightly a while. All of which means, at lately’s worth, Nvidia is simply too affordable to forget about and looks as if a screaming purchase for long-term buyers.

Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adria Cimino has positions in Amazon, Oracle, and Tesla. The Motley Idiot has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.