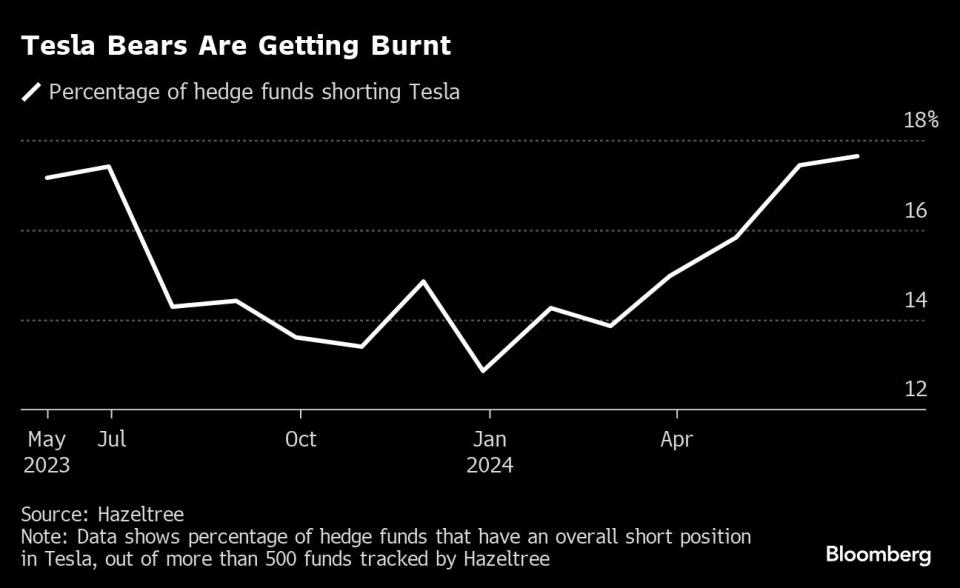

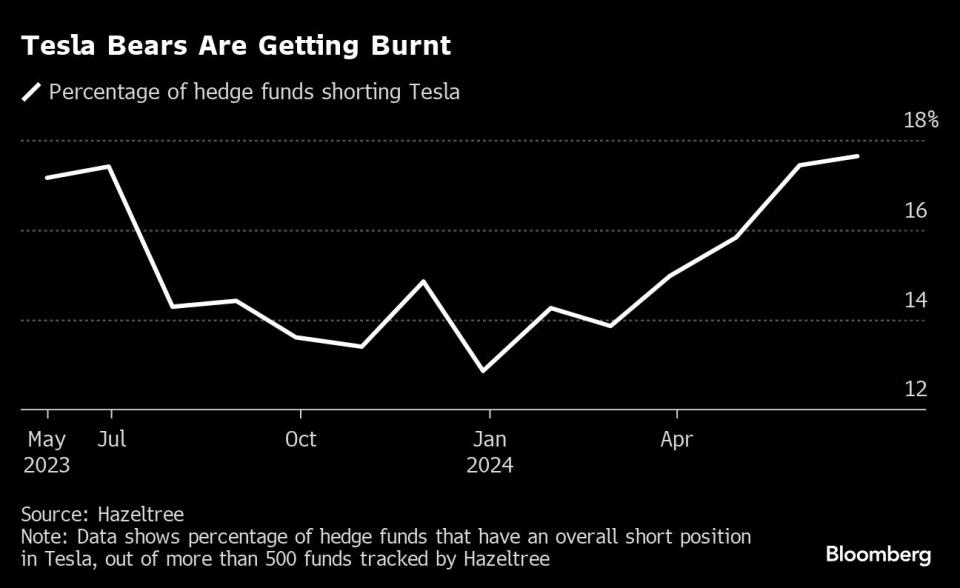

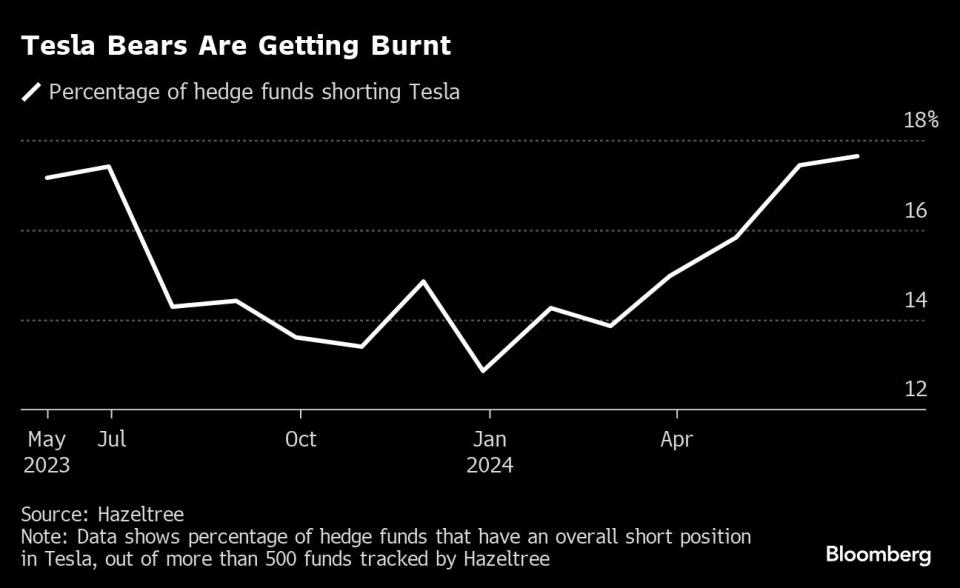

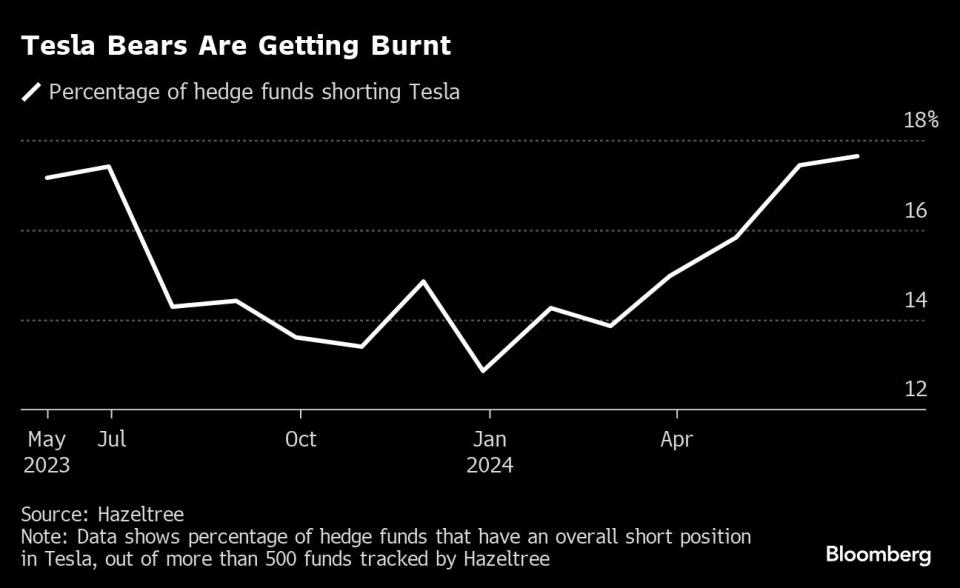

(Bloomberg) — Hedge price range piled into brief bets towards Tesla Inc. (TSLA) proper ahead of the electrical automobile maker unveiled a suite of numbers that brought on a hefty share-price rally.Maximum Learn from BloombergAbout 18% of the 500-plus hedge price range tracked by means of knowledge supplier Hazeltree had an general brief place on Tesla on the finish of June, the absolute best share in additional than a yr, in line with figures shared with Bloomberg. That compares with just below 15% on the finish of March.The ones contrarian bets now threaten to saddle the hedge price range at the back of them with losses. Tesla’s newest vehicle-sales effects, printed on July 2, published second-quarter deliveries figures that beat reasonable analyst estimates, despite the fact that gross sales had been down. Buyers pounced at the information, using the corporate’s stocks to a six-month excessive. Because the starting of June, Tesla’s percentage charge has now soared about 40%.Tesla is prone to see its benefit margins toughen, helped by means of decrease manufacturing and uncooked subject matter prices, in line with Morningstar Inc.’s Seth Goldstein, one of the crucial best 3 analysts protecting the inventory in a Bloomberg rating that tracks charge suggestions.The corporate will most likely “go back to learn enlargement” subsequent yr, he mentioned in a observe to shoppers. However how Tesla handles the marketplace’s intensifying center of attention on inexpensive EVs shall be key, he added.The improvement feeds into an ongoing sense of uncertainty round tips on how to deal with the broader EV marketplace, amid a sea of conflicting dynamics. The trade — a key plank within the international race to succeed in internet 0 emissions by means of 2050 — advantages from beneficiant tax credit. But it’s additionally contending with important hurdles within the type of tariff wars or even id politics, with some customers rejecting EVs as a type of “woke” shipping.In the USA, Donald Trump has mentioned that if he turns into president once more after November’s election, he’ll undo present regulations supporting battery-powered cars, calling them “loopy.” That mentioned, Trump is a “massive fan” of Tesla’s Cybertruck, in line with Elon Musk, the EV massive’s leader government officer.

In the meantime, the checklist of inside disruptions at Tesla is lengthy. In April, Musk advised group of workers to brace for primary task cuts, with gross sales roles amongst the ones affected. And the Cybertruck, Tesla’s first new client fashion in years, has been sluggish to ramp up.Tale continuesFor that explanation why, some hedge fund managers have determined the inventory is off bounds altogether. Tesla is “very tough for us to put,” mentioned Fabio Pecce, leader funding officer at Ambienta the place he oversees $700 million, together with managing the Ambienta x Alpha hedge fund.Mainly, it’s now not transparent whether or not traders are coping with “a best corporate with a really perfect control crew” or whether or not it’s “a challenged franchise with poor company governance,” he mentioned.On the other hand, “if Trump wins, it’s really going to be very certain” for Tesla, regardless that “clearly now not wonderful for EVs and renewables generally,” he mentioned. That’s as a result of Trump is predicted to impose “huge price lists in opposition to the Chinese language gamers,” which might be “really helpful” to Tesla, Pecce mentioned.Buyers ended 2023 pointing out they’d most likely retreat farther from inexperienced shares generally, and EVs in particular, in line with a Bloomberg Markets Reside Pulse survey. Nearly two-thirds of the 620 respondents mentioned they deliberate to keep away from the EV sector, with as regards to 60% anticipating the iShares International Blank Power exchange-traded fund to increase its slide in 2024. The ETF has misplaced 13% to this point this yr after sinking greater than 20% in 2023.

In the meantime, the checklist of inside disruptions at Tesla is lengthy. In April, Musk advised group of workers to brace for primary task cuts, with gross sales roles amongst the ones affected. And the Cybertruck, Tesla’s first new client fashion in years, has been sluggish to ramp up.Tale continuesFor that explanation why, some hedge fund managers have determined the inventory is off bounds altogether. Tesla is “very tough for us to put,” mentioned Fabio Pecce, leader funding officer at Ambienta the place he oversees $700 million, together with managing the Ambienta x Alpha hedge fund.Mainly, it’s now not transparent whether or not traders are coping with “a best corporate with a really perfect control crew” or whether or not it’s “a challenged franchise with poor company governance,” he mentioned.On the other hand, “if Trump wins, it’s really going to be very certain” for Tesla, regardless that “clearly now not wonderful for EVs and renewables generally,” he mentioned. That’s as a result of Trump is predicted to impose “huge price lists in opposition to the Chinese language gamers,” which might be “really helpful” to Tesla, Pecce mentioned.Buyers ended 2023 pointing out they’d most likely retreat farther from inexperienced shares generally, and EVs in particular, in line with a Bloomberg Markets Reside Pulse survey. Nearly two-thirds of the 620 respondents mentioned they deliberate to keep away from the EV sector, with as regards to 60% anticipating the iShares International Blank Power exchange-traded fund to increase its slide in 2024. The ETF has misplaced 13% to this point this yr after sinking greater than 20% in 2023.

The Bloomberg Electrical Cars Worth Go back Index, whose individuals come with BYD Co., Tesla and Rivian (RIVN) Automobile Inc., is down about 22% to this point in 2024. On the similar time, the metals and minerals had to produce batteries are on the mercy of wildly risky commodities markets, with speculators frequently seeking to make a snappy dollar on shifts in delivery and insist. Worth volatility approach some battery producers are having to regulate to a marketplace through which their benefit margins had been getting badly squeezed.Towards that backdrop, extra conventional automakers are discovering themselves beneath power from shareholders to decelerate their capital expenditure on EVs, with fresh examples together with Porsche AG. Polestar Automobile Preserving UK Plc (PSNY), a high-end EV producer, has misplaced virtually 95% of its price since being spun out of Volvo Automotive AB two years in the past. Fisker Inc., some other luxurious EV maker, noticed its price burnt up beginning closing yr and has since filed for Bankruptcy 11 chapter coverage.Soren Aandahl, founder and CIO of Texas-based Blue Orca Capital, mentioned “valuations within the EV house are so beat up” that he’s now averting shorting the field. It’s not an obtrusive contrarian guess, as a result of the ones have a tendency to do highest if traders input “when issues are just a little bit upper,” he mentioned. However at this level, “numerous the air’s already pop out of the balloon.”However Eirik Hogner, deputy portfolio supervisor at $2.7 billion hedge fund Blank Power Transition, suggests there could also be extra ache to return for the broader EV trade. There are nonetheless “means too many” startups that stay “sub-scale” and with gross margins which might be merely “too low,” he mentioned. Consequently, the supply-demand dynamic of the EV marketplace “continues to be very detrimental.”“In the end, I feel you wish to have to look extra bankruptcies” ahead of the marketplace begins to appear more healthy, Hogner mentioned.—With the help of Craig Trudell.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

The Bloomberg Electrical Cars Worth Go back Index, whose individuals come with BYD Co., Tesla and Rivian (RIVN) Automobile Inc., is down about 22% to this point in 2024. On the similar time, the metals and minerals had to produce batteries are on the mercy of wildly risky commodities markets, with speculators frequently seeking to make a snappy dollar on shifts in delivery and insist. Worth volatility approach some battery producers are having to regulate to a marketplace through which their benefit margins had been getting badly squeezed.Towards that backdrop, extra conventional automakers are discovering themselves beneath power from shareholders to decelerate their capital expenditure on EVs, with fresh examples together with Porsche AG. Polestar Automobile Preserving UK Plc (PSNY), a high-end EV producer, has misplaced virtually 95% of its price since being spun out of Volvo Automotive AB two years in the past. Fisker Inc., some other luxurious EV maker, noticed its price burnt up beginning closing yr and has since filed for Bankruptcy 11 chapter coverage.Soren Aandahl, founder and CIO of Texas-based Blue Orca Capital, mentioned “valuations within the EV house are so beat up” that he’s now averting shorting the field. It’s not an obtrusive contrarian guess, as a result of the ones have a tendency to do highest if traders input “when issues are just a little bit upper,” he mentioned. However at this level, “numerous the air’s already pop out of the balloon.”However Eirik Hogner, deputy portfolio supervisor at $2.7 billion hedge fund Blank Power Transition, suggests there could also be extra ache to return for the broader EV trade. There are nonetheless “means too many” startups that stay “sub-scale” and with gross margins which might be merely “too low,” he mentioned. Consequently, the supply-demand dynamic of the EV marketplace “continues to be very detrimental.”“In the end, I feel you wish to have to look extra bankruptcies” ahead of the marketplace begins to appear more healthy, Hogner mentioned.—With the help of Craig Trudell.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.