Advent of recent ecosystem tokens is a part of projects to refine decentralized governance and building up participation

Conversion of Maker (MKR) and Dai (DAI) to the yet-to-be-rolled-out tokens shall be not obligatory for holders

Ethereum decentralized finance (DeFi) protocol MakerDAO has been present process a significant transformation in step with its pre-communicated strategic ‘endgame’ plan. This week, MakerDAO offered two new tokens with placeholder names, NewStable (NST) and NewGovToken (NGT), representing upgraded variations of the present ecosystem tokens – DAI and MKR.

The transfer goals to modernize the MakerDAO ecosystem through bettering governance and bolstering the protocol’s steadiness.

The way forward for MakerDAO

DAI, introduced in 2017, is the third-largest stablecoin with a marketplace capital of $5.365 billion, in keeping with CoinMarketCap. The stablecoin supplies a solid foreign money for DeFi lending and borrowing transactions. It’s generated through locking collateral into sensible contracts known as Vaults, which assists in keeping the price solid and unbiased of centralized regulate.

MKR, however, facilitates decentralized governance through making sure the machine stays solid and self-regulated. MKR could also be the remaining lodge useful resource to rebalance the machine in circumstances of unhealthy debt or insolvency, aligning governance members with the machine’s steadiness.

NewStable (NST) improves on DAI, MakerDAO’s crypto-backed stablecoin pegged to the U.S buck, through bettering its steadiness options. DAI house owners will have the ability to transition to the brand new stablecoin providing on a 1:1 foundation. NST will reinforce compliance with real-world property – A transfer the DAO hopes will building up its adoption amongst institutional customers.

NewGovToken (NGT) dietary supplements the governance token, MKR, thru higher incentives for governance participation. MakerDAO specified a re-denomination scheme permitting MKR holders to replace their tokens at a 1: 24,000 NGT ratio. This technique seeks to widen the involvement of customers in MakerDAO’s governance through enabling customers to carry vital quantities of NGT.

Endgame transformation

The ‘Endgame’ plan used to be first proposed in Would possibly 2022 and licensed through a governance vote in August 2022. In March 2024, MakerDAO Founder Rune Christensen supplied the primary vital replace bearing on the three-phase transformation roadmap at the ecosystem governance discussion board.

In its newest replace this week, Maker reiterated that each units of tokens will exist in parallel “until governance comes to a decision differently” someday.

Maker’s crew, in an August 22 put up on X (Twitter), additionally stated,

“The ecosystem will sooner or later discover techniques to distinguish DAI and NewStable, with DAI specializing in crypto-native use circumstances and NewStable focused on mass adoption.”

MakerDAO additionally showed that the conversion between tokens shall be not obligatory, and customers who make a decision to transition to the brand new pair can revert to the unique tokens in the event that they select. Thursday’s announcement, alternatively, didn’t give you the explicit date for the roll-out of the brand new tokens.

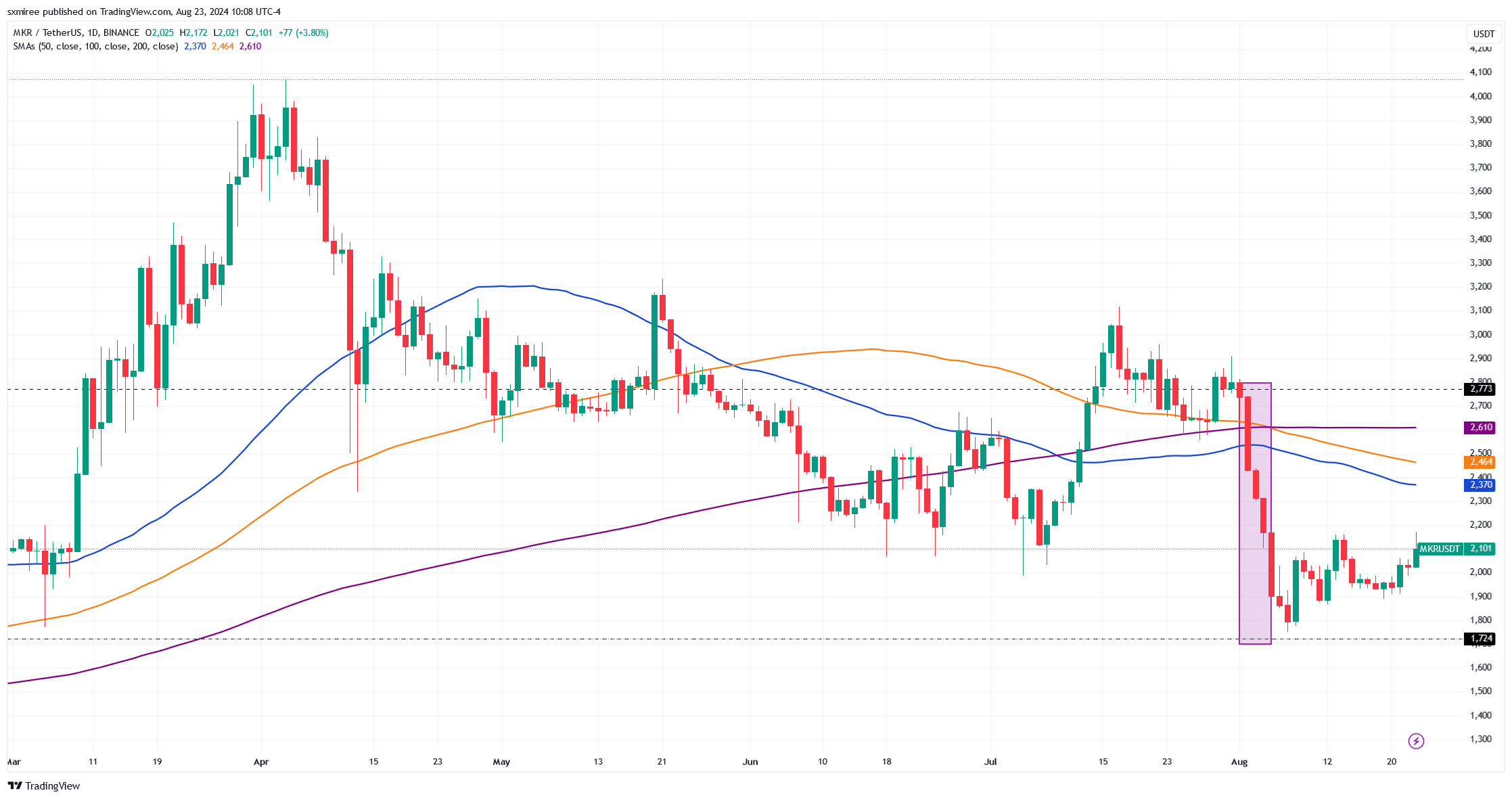

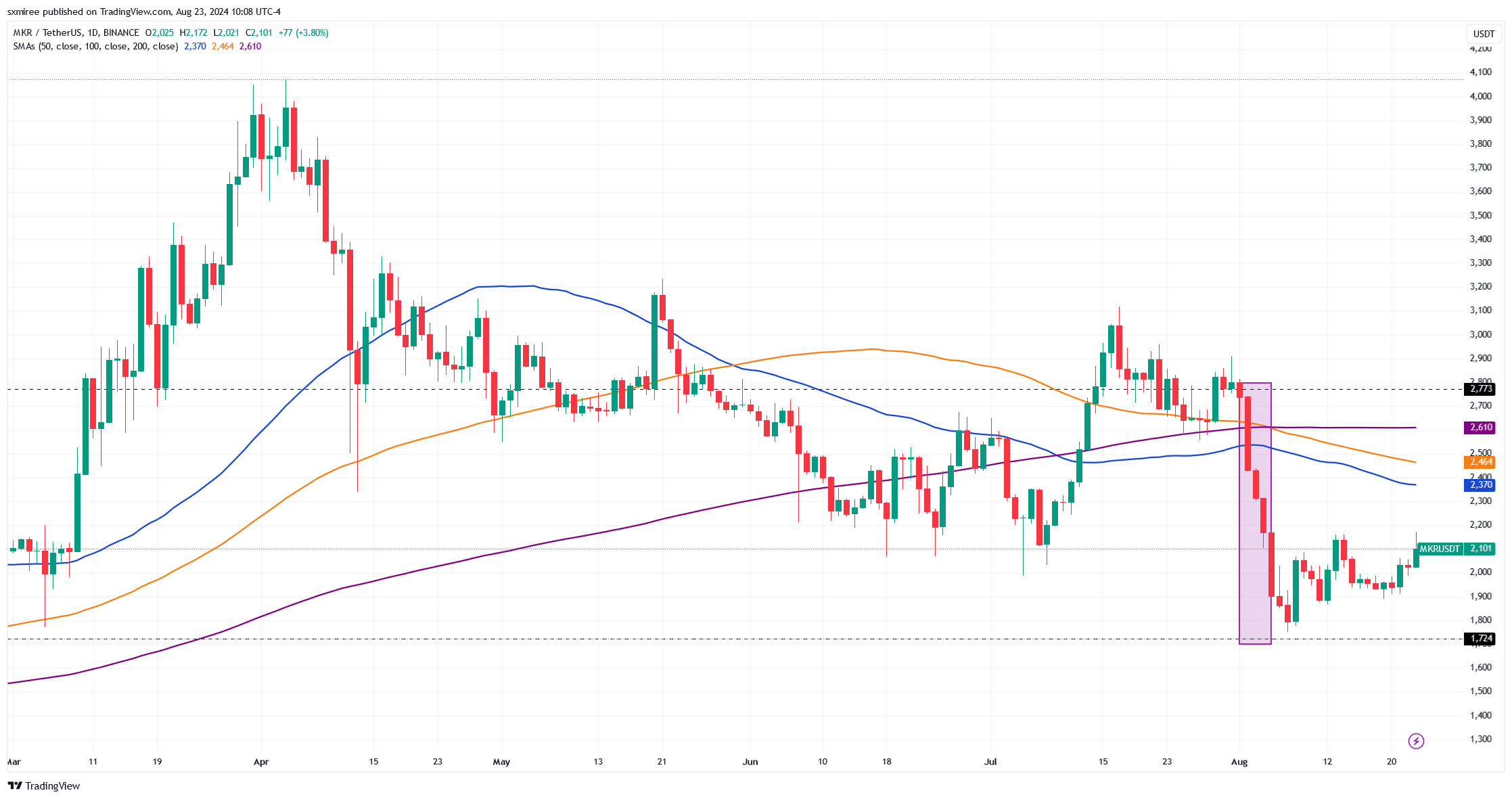

MKR’s value motion

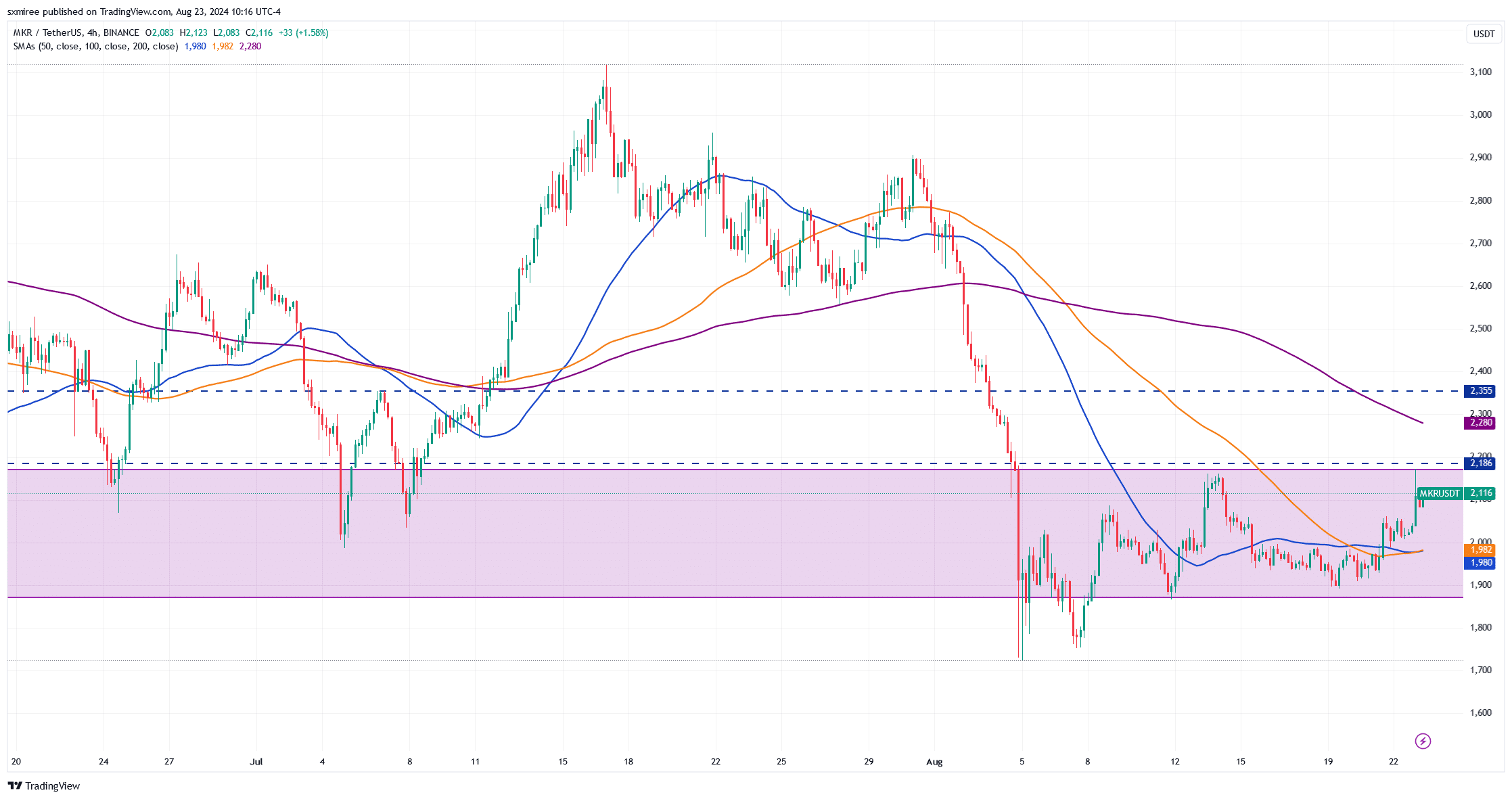

MKR used to be a number of the tokens significantly suffering from the worldwide marketplace crash between 3-5 August. Actually, MKR’s value chart on TradingView published the token shedding from $2,773 on 1 August to $1,724 on 5 August – Marking its easiest 4-day loss since early April.

Supply: TradingView

Supply: TradingView

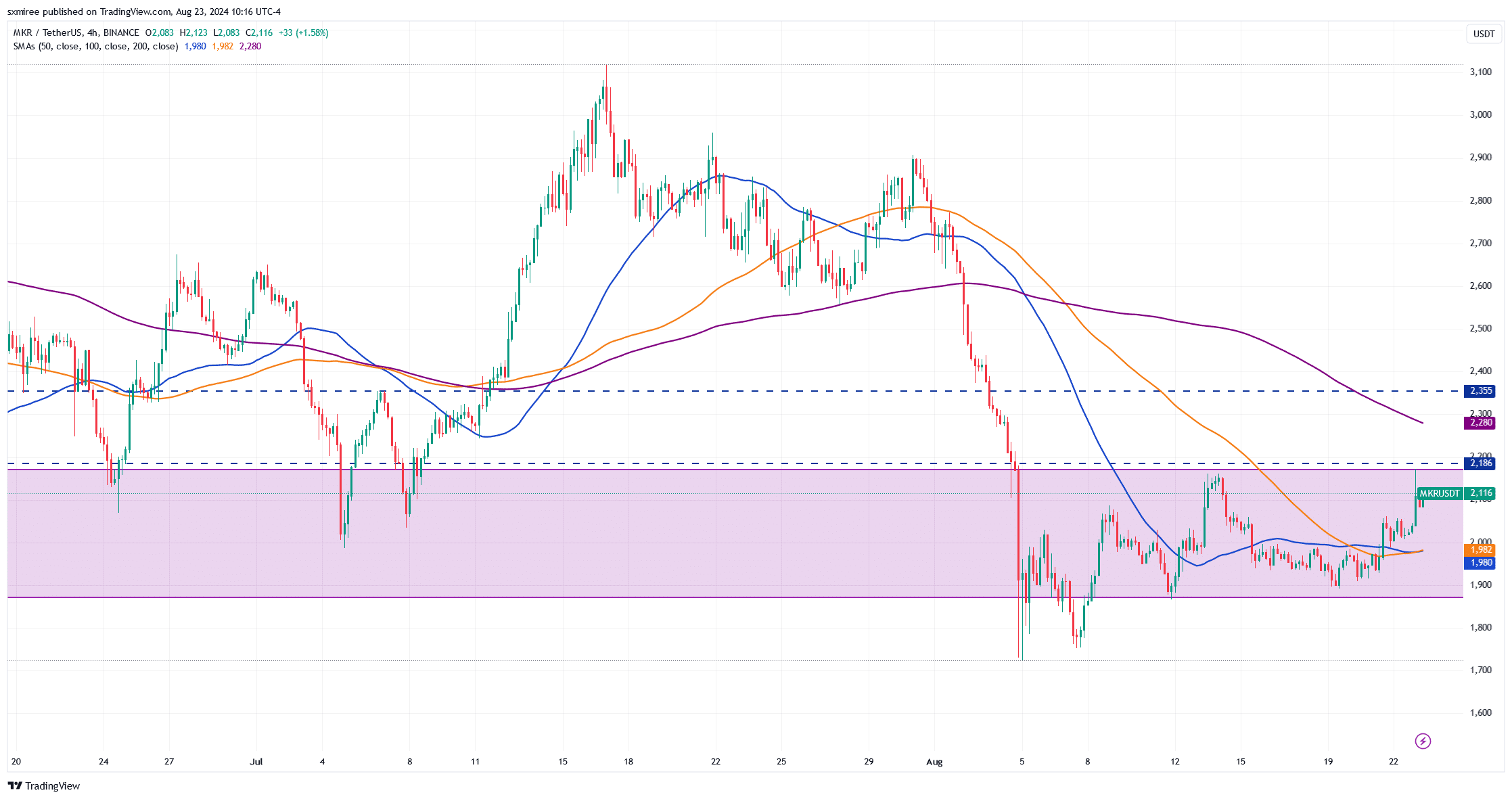

Even though MKRD/USDT has since recovered to climb above $2,100, the pair stays confined between the $1,870 and $2,170 vary. That is the place it has traded over the past two weeks.

Marketplace bulls may just goal the resistance simply above its press time vary at $2,185, a degree the place MKR used to be rejected on 14 August.

Supply: TradingView

Supply: TradingView

Triumphing over this hurdle would pave methods to assault the following goal of $2,354. This stage up to now posed a problem in June and July.

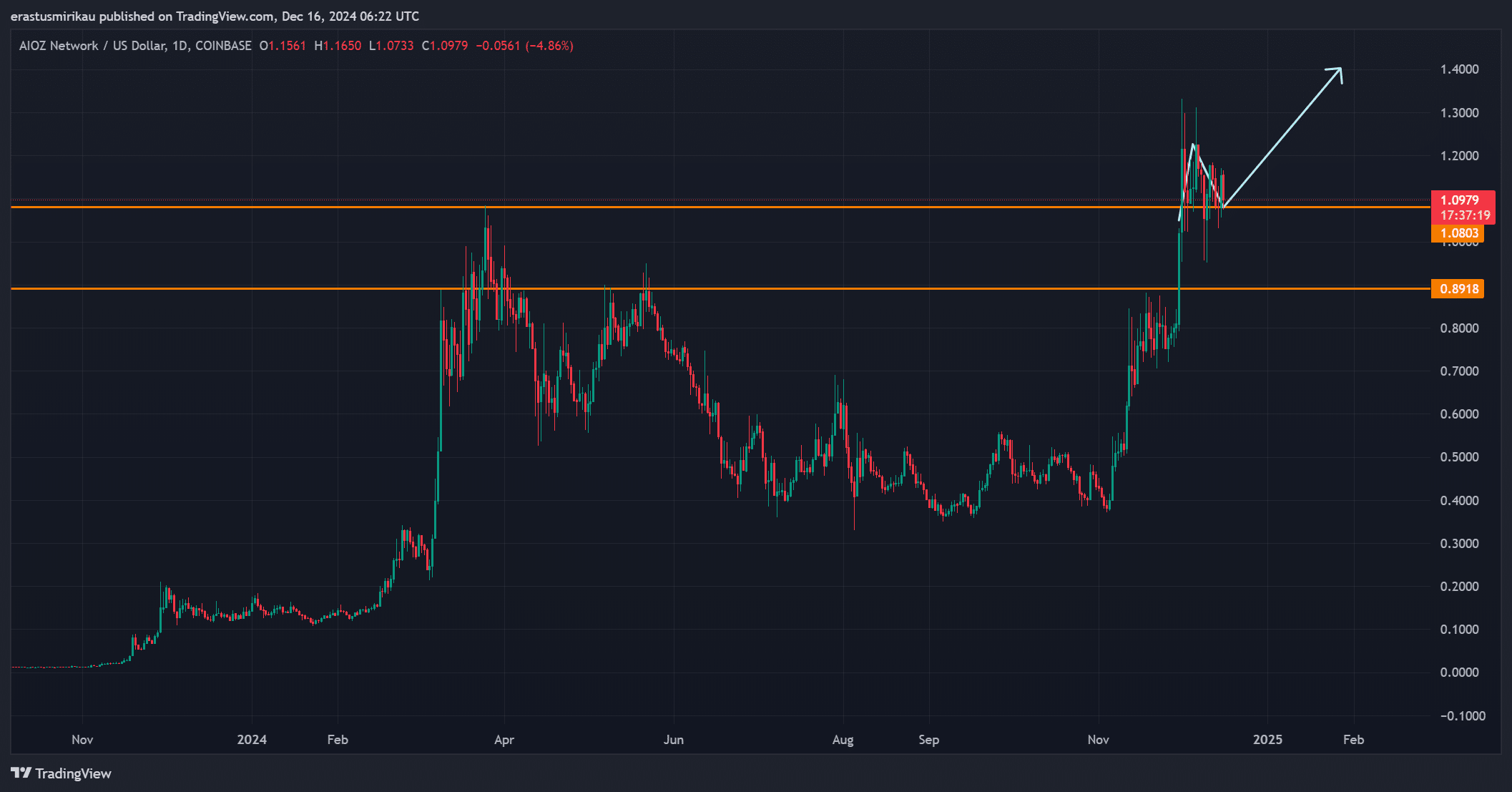

Earlier: Can AAVE’s value maintain its uptrend? Those are the standards that say so!

Subsequent: Right here’s this analyst’s case for LINK’s value ‘bottoming out’ to rally quickly