Motion token has a bearish technical bias within the momentary, faces sell-pressure at $1

On-chain metrics steered bulls will also be hopeful of a restoration

Motion [MOVE] noticed a 5% hike in Open Pastime within the 24 hours ahead of press time. This was once accompanied by way of a three.3% worth acquire. All through this time, Bitcoin [BTC] won by way of 0.04%, with its OI shedding by way of 0.09% too.

In spite of the bearishness of Bitcoin, then again, the learned cap and provide distribution metrics published that MOVE could be gearing up for a restoration.

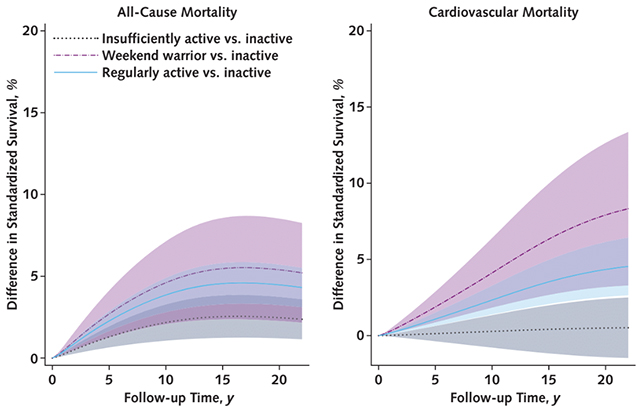

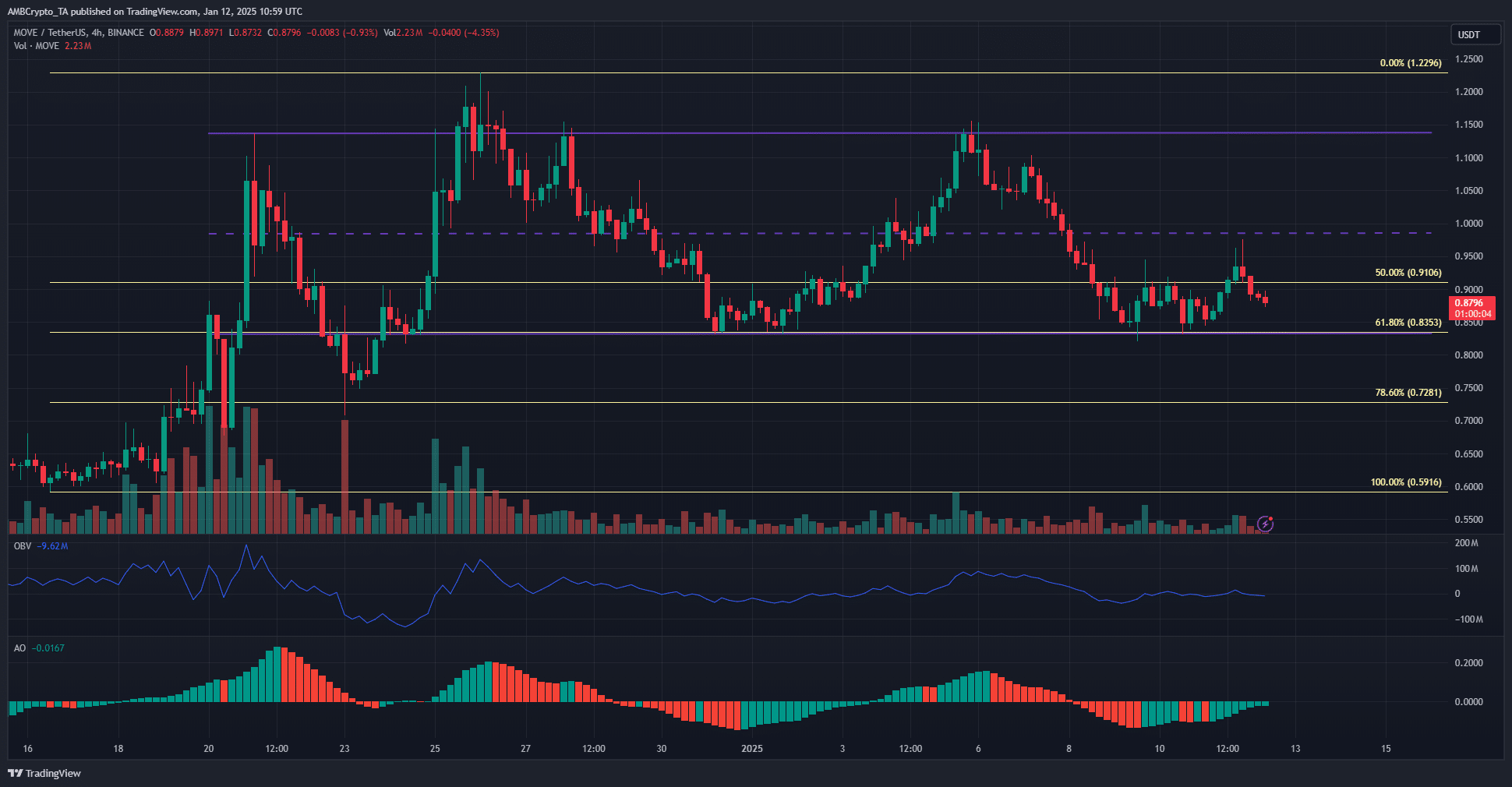

MOVE fluctuate formation outlines a very powerful beef up and resistance ranges

Supply: MOVE/USDT on TradingView

Supply: MOVE/USDT on TradingView

Over the last month, Motion token has traded inside a variety. It climbed from $0.83 to $1.13, with the mid-range point at $0.98. During the last 5 days, the mid-range point has adversarial bullish efforts at restoration. It additionally covered up with the mental $1-level, making it a more difficult problem for the consumers to triumph over.

The $0.8-$0.83 space is a beef up zone. The OBV has now not shaped new lows over the last two weeks – An encouraging sight. The promoting quantity was once now not overwhelming both. The Superior Oscillator confirmed bearish momentum was once the norm in fresh days, but it surely looked to be at the verge of forming a bullish crossover too.

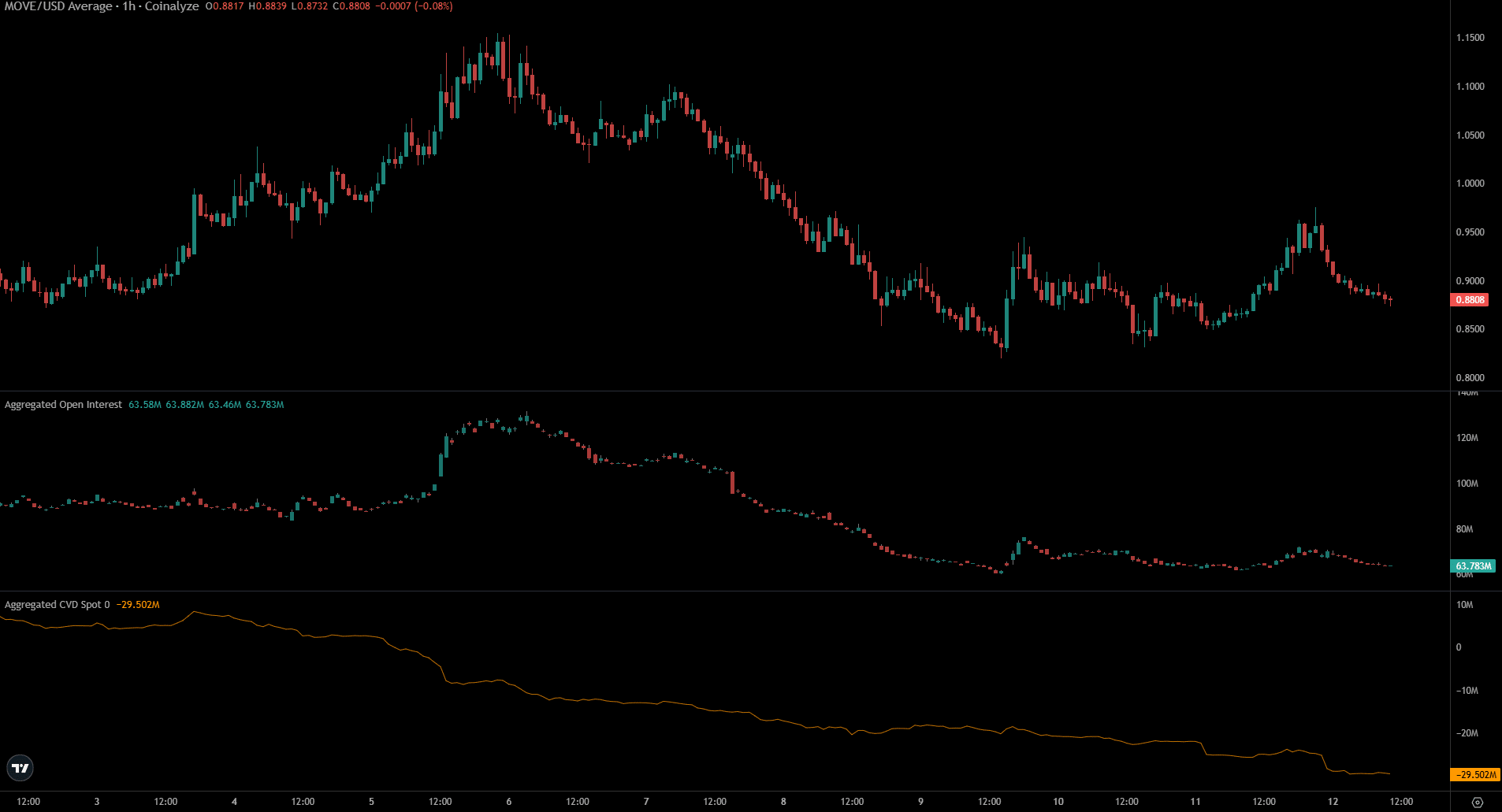

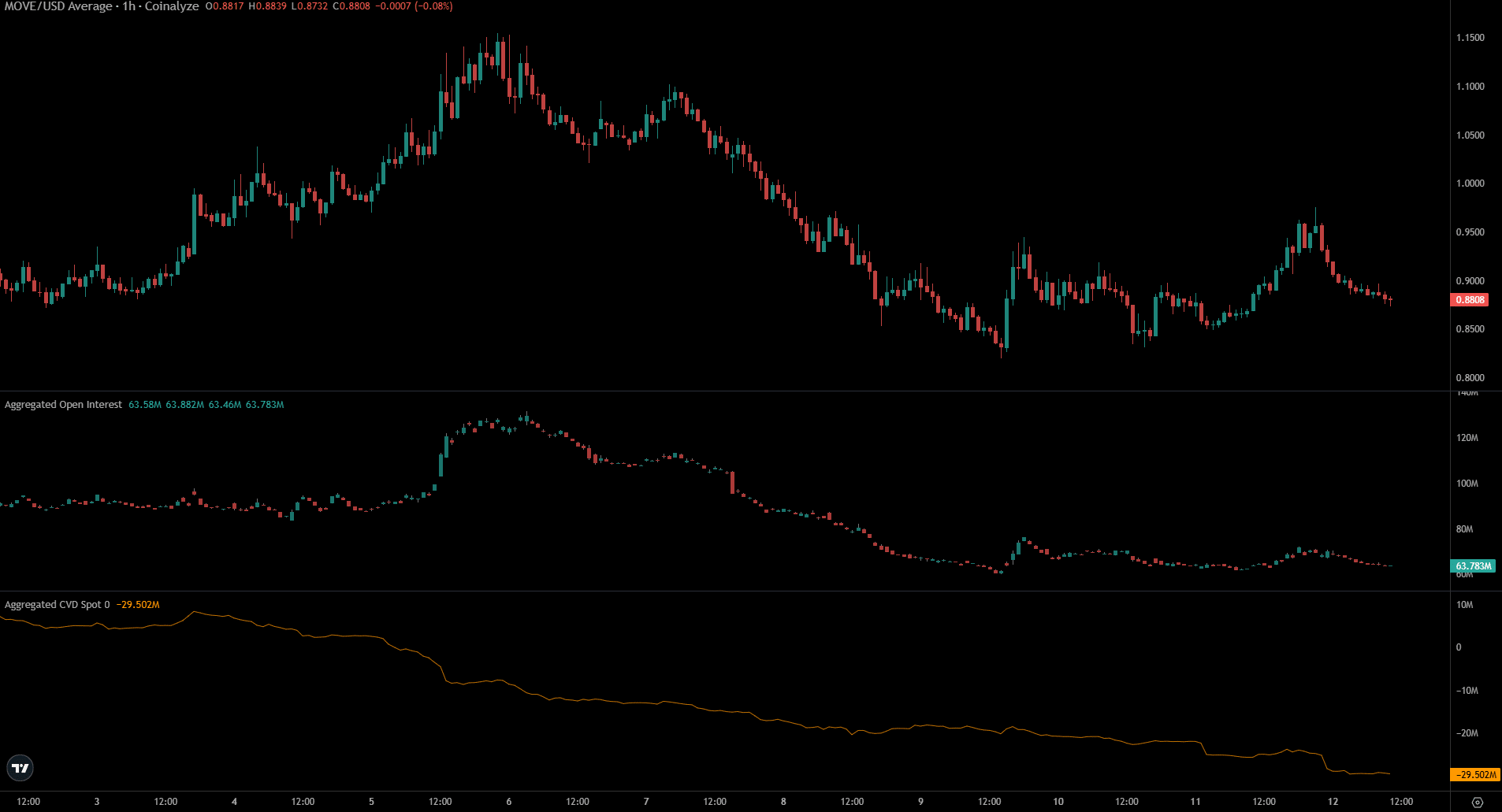

Supply: Coinalyze

Supply: Coinalyze

In the meantime, information from Coinalyze highlighted sturdy momentary bearish sentiment.

The Open Pastime has been trending decrease along the spot CVD. The 5% beneficial properties during the last 24 hours had been too little to counteract the prevalent promoting sentiment.

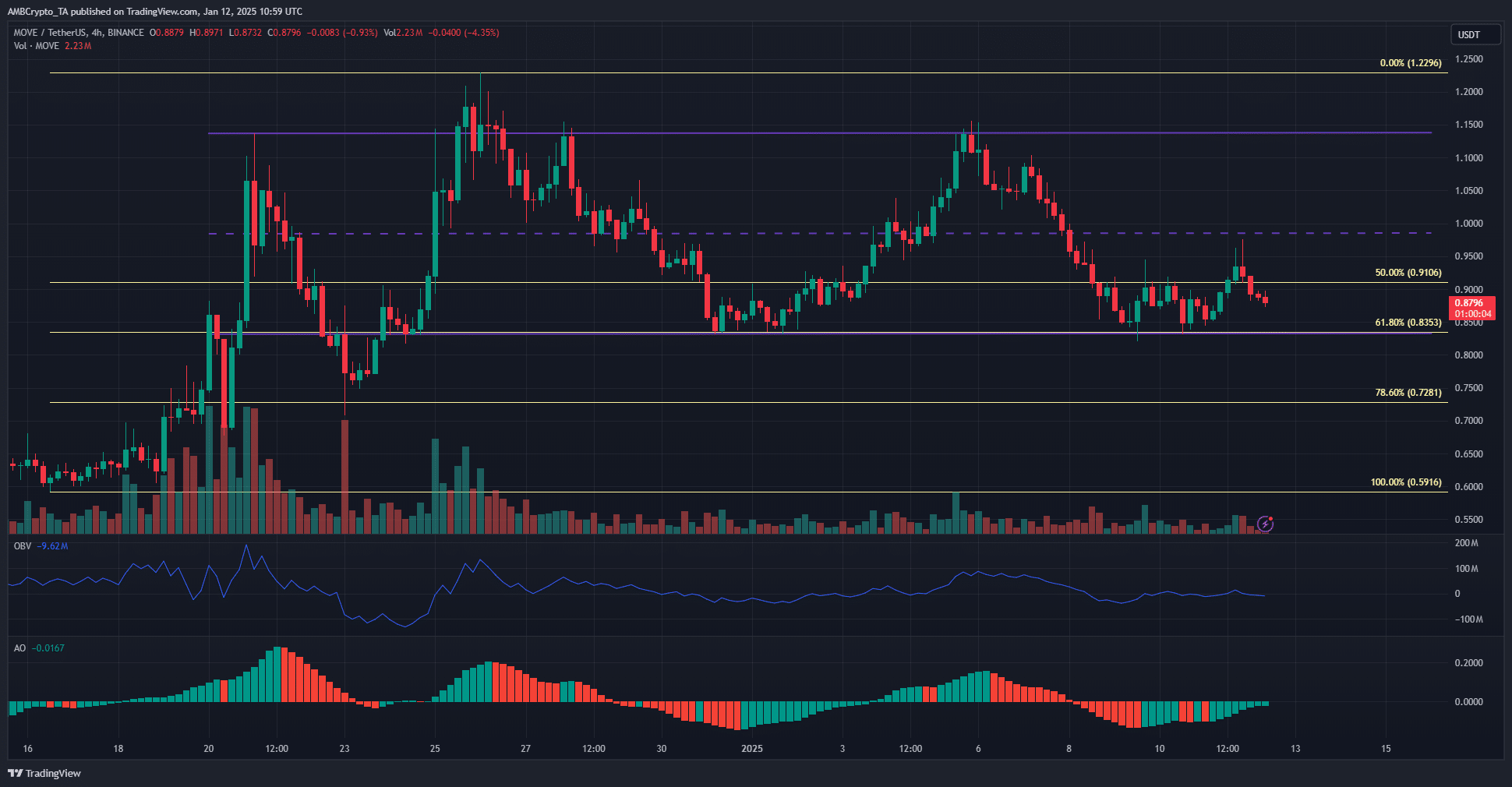

Quick-term learned cap underlines distribution developments

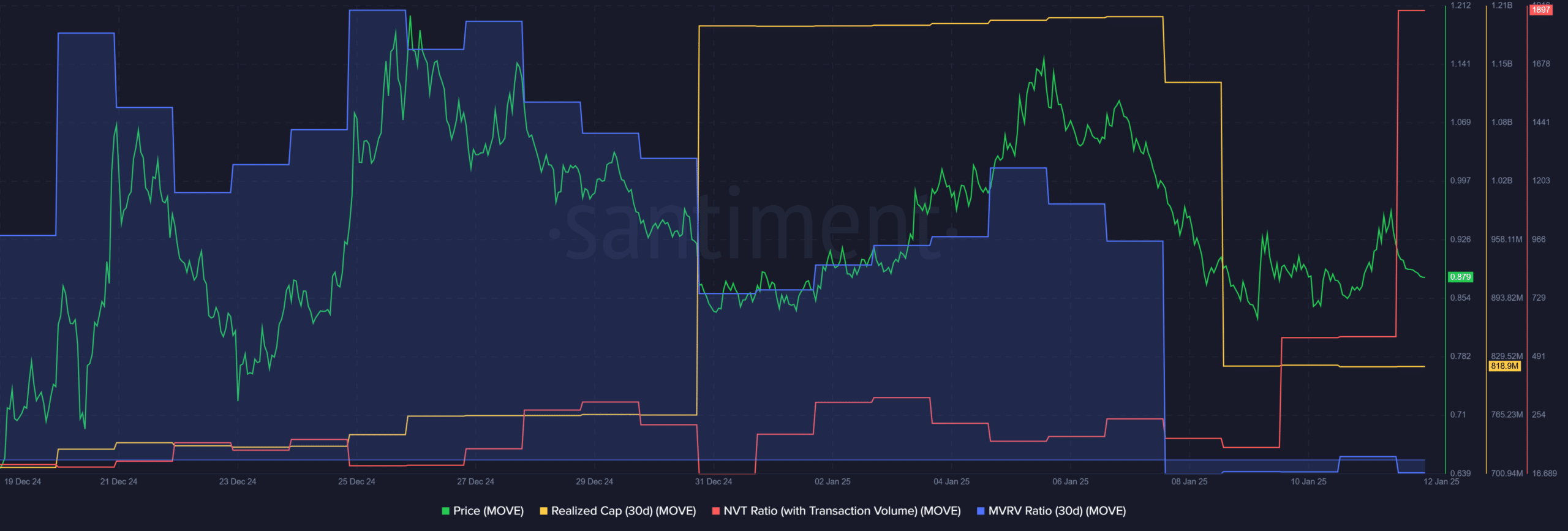

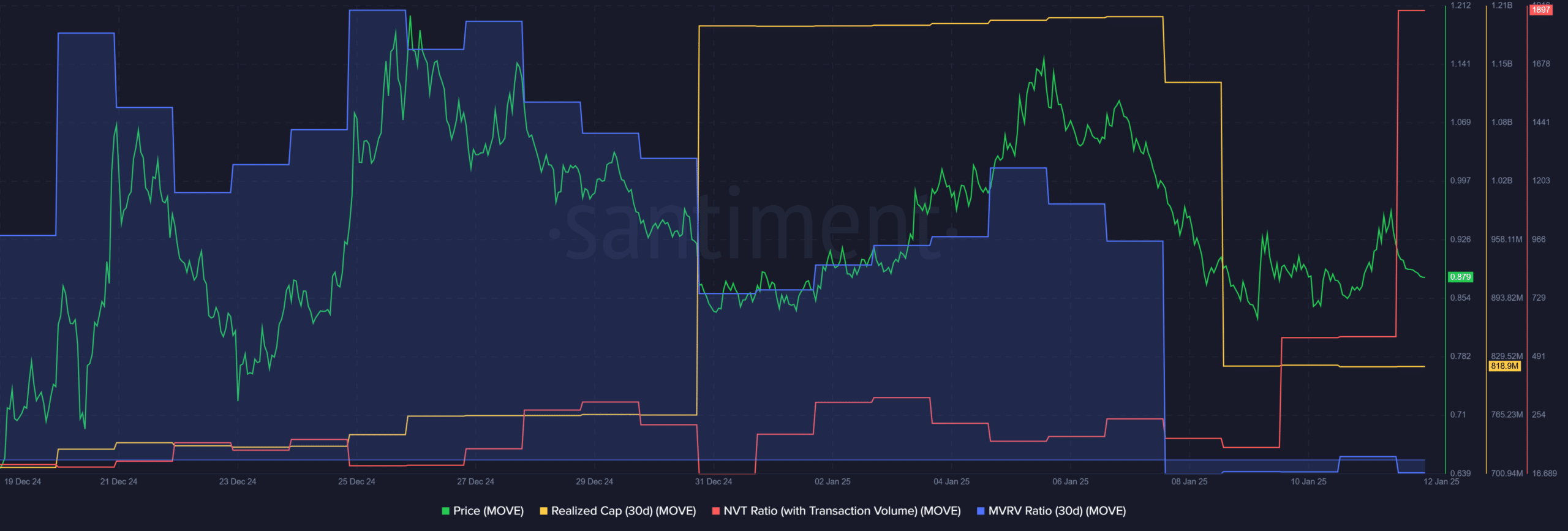

Supply: Santiment

Supply: Santiment

The NVT ratio noticed a pointy uptick lately. This indicated attainable overvaluation of the token, relative to its transaction quantity. The 30-day MVRV ratio was once at -4%, highlighting that MOVE holders had been at a minor loss.

The learned cap around the 30-day window noticed a steep fall remaining week, along its dwindling worth. For the reason that learned cap calculates the price of an asset in accordance with the associated fee at which every token was once remaining moved, this intended members had been transferring the token at decrease costs.

Supply: Santiment

Supply: Santiment

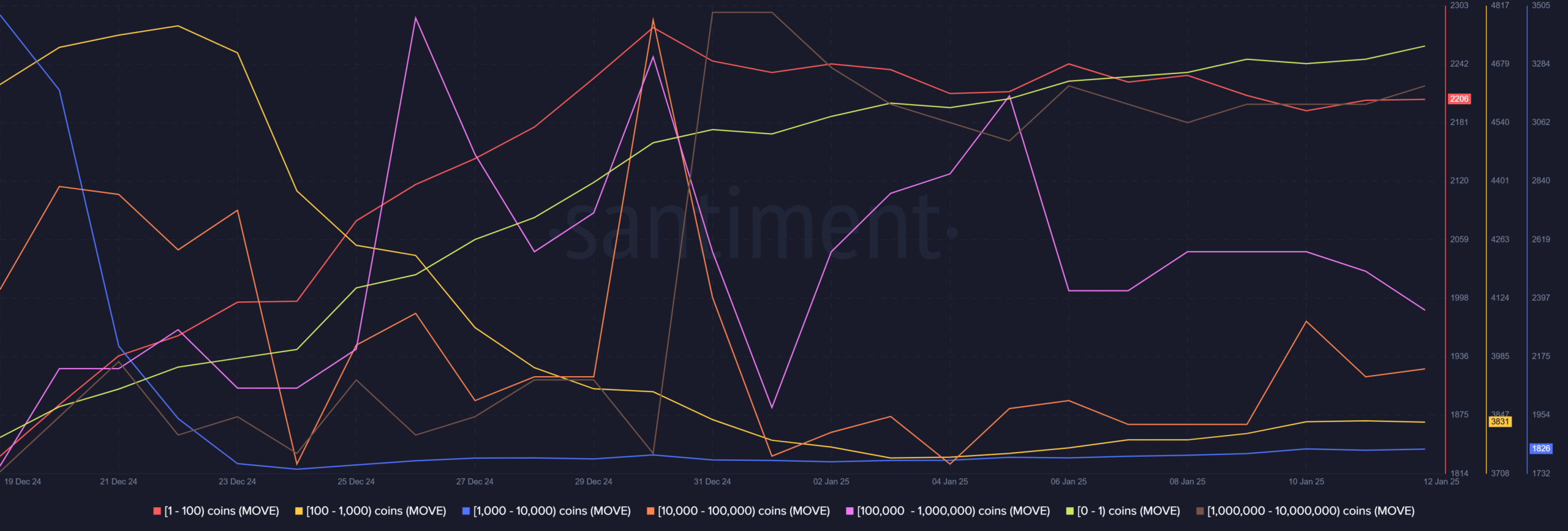

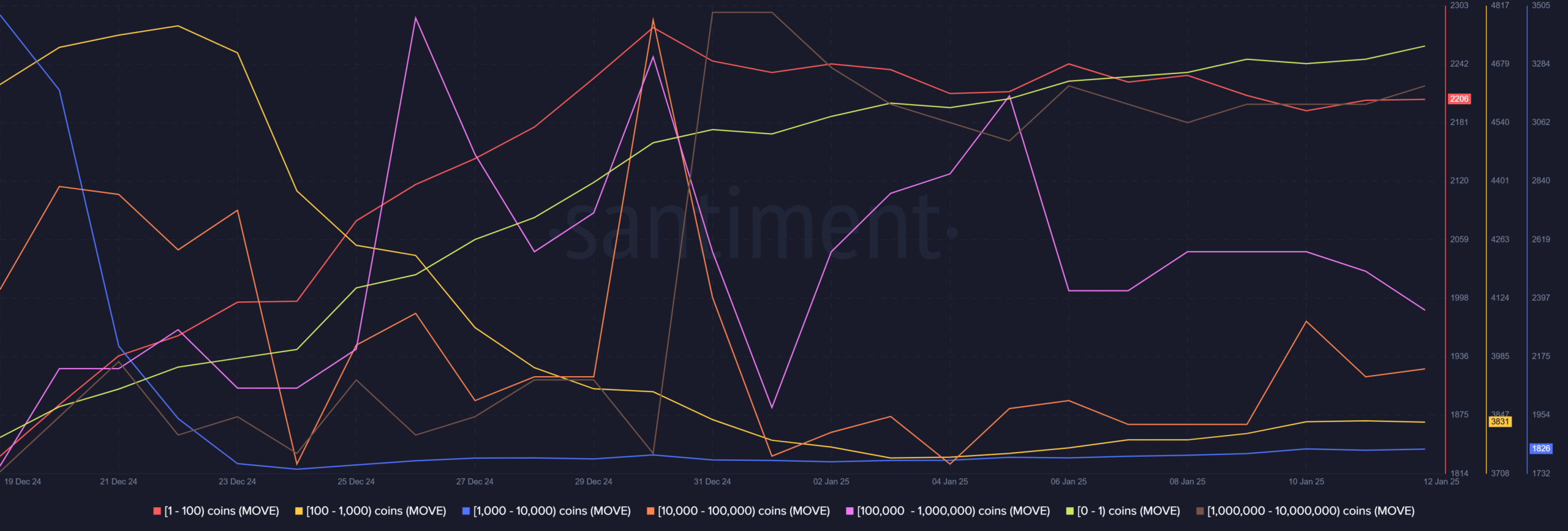

In any case, provide distribution research confirmed that aside from the wallets maintaining 100k-1 million MOVE, maximum different marketplace members had been purchasing extra. This whale cohort is arguably some of the maximum necessary holders. In spite of the downtick over the last week, their numbers had been nonetheless upper than it was once ahead of Christmas.

Learn Motion’s [MOVE] Value Prediction 2025-26

Total, the momentary bias was once bearish, and the OI trade was once now not sufficient for MOVE’s restoration. Thus, buyers can regulate the learned cap metric.

A unexpected spike could be a purchase sign. In the meantime, secure accumulation from some cohorts of holders additionally implied conviction.

Subsequent: Bitcoin – Is a ‘native backside’ in? THIS metric says so, however…