Uniswap’s CEO receives SEC’s Wells realize, very similar to Coinbase.

Ripple’s resilience gives courses for Uniswap.

Amidst the continuing criminal fight between Ripple [XRP] and the Safety and Trade Fee (SEC), the highlight has now became to Uniswap Labs.

At the tenth of April, Uniswap’s [UNI] CEO, by way of an X (Previously Twitter) publish, knowledgeable the crypto group that he had won a Wells realize from the SEC.

Uniswap CEO’s power optimism

Expressing his considerations, Hayden Adams, Uniswap’s CEO, in a up to date dialog with the “Bankless” podcast, famous,

“The SEC is largely taking very competitive stances and principally seeking to close down crypto.”

He additional make clear the Wells realize referring to Uniswap’s interfaces. This coincided with a up to date courtroom ruling involving Coinbase’s classification as a dealer.

He mentioned,

“They simply misplaced in courtroom like two weeks in the past with Coinbase proper? It didn’t like move to trial and so they misplaced in courtroom, it misplaced on the earliest imaginable degree that you’ll be able to lose.”

The comparability underscores the importance of the ruling and suggests a possible precedent for Uniswap’s case.

Uniswap to practice Ripple’s footsteps

Moreover, Stuart Alderoty, Ripple’s CLO mentioning complaint towards SEC highlighted,

“The SEC continues to lose. The 2nd Circuit Court docket of Appeals refused to rethink their resolution in Govil which held that if a purchaser suffers no monetary loss, the SEC isn’t entitled to disgorgement from the vendor.”

This means that Uniswap may wish to take some notes from Ripple’s resilience playbook. Significantly, in spite of regulatory hurdles, Ripple sustained certain buying and selling momentum till the hot marketplace downturn.

Taking into account the hot crypto massacre, many tokens skilled important double-digit declines. Alternatively, some traders looked as if it would take hold of the chance to acquire extra XRP.

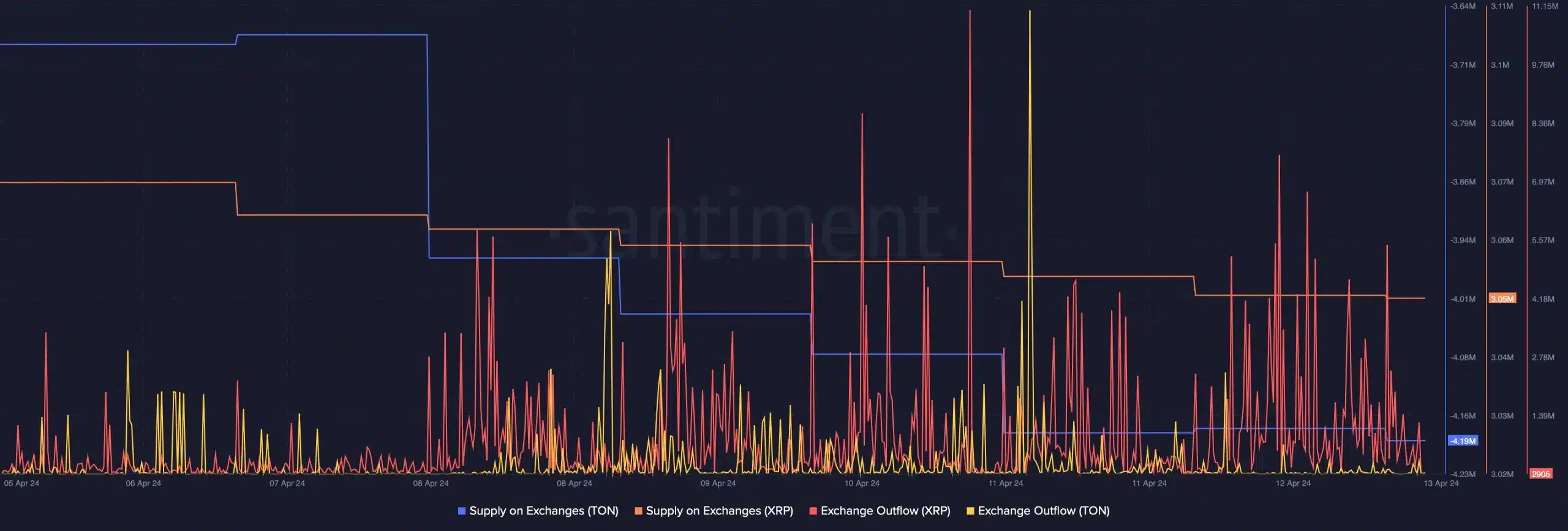

This was once underlined by means of AMBCrypto’s research of Santiment’s knowledge, in which XRP alternate outflows greater in the previous couple of days.

This indicated that in spite of the full marketplace decline, positive traders considered the drop in costs as a purchasing alternative.

What’s lies forward for Uniswap?

Within the face of those demanding situations, UNI skilled an important decline of 12.64% during the last 24 hours, signaling a consolidation segment.

The weekly chart printed a pointy 28.21% lower, plummeting from $11 to $7 in simply 3 days.

As Uniswap’s criminal fight’s length stays unsure, the query stays unresolved: How a ways will the SEC move?

Alternatively, with endured resilience and studying from different altcoins, particularly XRP, UNI token holders may foresee an important worth upward push within the coming days.