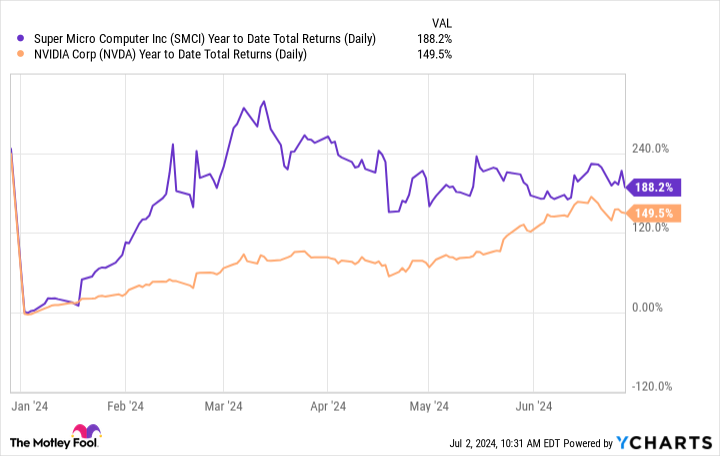

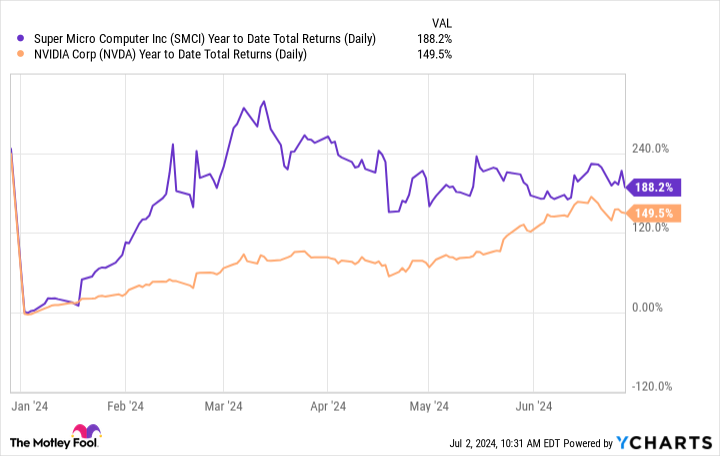

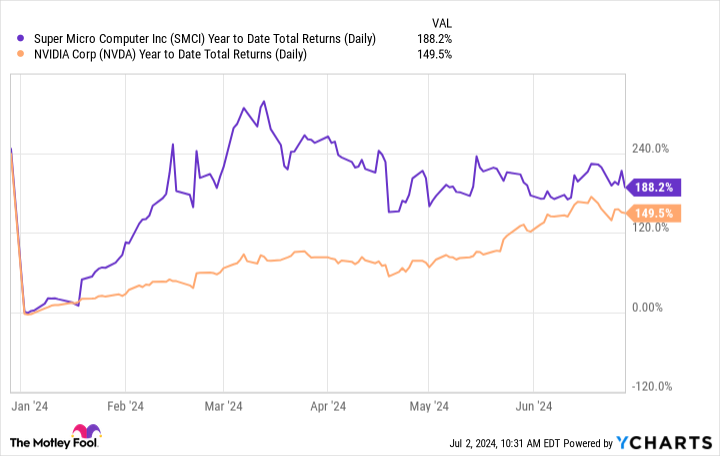

The bogus intelligence (AI) revolution is in complete swing, and the massive winner of that revolution is Nvidia (NASDAQ: NVDA).Smartly, perhaps it is the second-biggest.Nvidia is unquestionably the most-in-focus corporate on this planet at this time. Its GPUs are in hyper-demand as firms race to deploy AI. Without a doubt, Nvidia has been the largest winner of the preferred “Magnificent Seven” shares.Then again, one AI beneficiary in fact outpaced Nvidia within the first part to steer all the S&P 500 index.Tremendous Micro Laptop rides Nvidia’s coattails to steer the marketThe best-performing inventory within the S&P 500 within the first part of the 12 months wasn’t Nvidia, however moderately Tremendous Micro Laptop (NASDAQ: SMCI). Supermicro returned a whopping 188% within the first part of the 12 months, as opposed to simply 150% for Nvidia, dividends integrated. Now not simplest that, however whilst Nvidia ended the quarter close to year-to-date highs, Supermicro was once in fact considerably upper previous within the part, achieving a year-to-date acquire as massive as 331% at one level in mid-March!

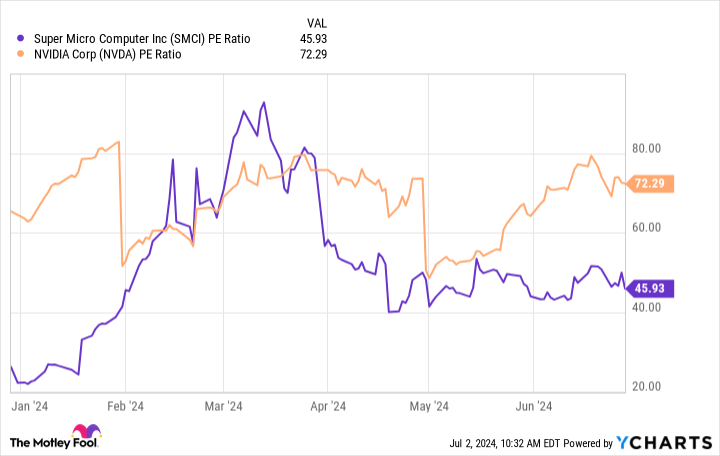

SMCI 12 months to Date General Returns (Day by day) ChartHow did Supermicro pull it off? It is in fact for a similar causes Nvidia endured to take off: torrid synthetic intelligence-related expansion. In reality, one may just say Supermicro, as a server-maker, rode a expansion wave on Nvidia’s again, as call for for Supermicro’s AI servers, which make up over 50% of its earnings and most commonly include Nvidia GPUs, took off. So Supermicro’s AI-fueled expansion was once most likely because of necessarily reselling Nvidia chips, with a small markup, indicated through Supermicro’s somewhat low 15.5% gross margins final quarter.Nvidia additionally in fact posted upper earnings expansion than Supermicro, at 262% expansion in Q2, as opposed to “simply” 200% expansion for Tremendous Micro Laptop final quarter.Then again, the inventory marketplace is not all the time precisely correlated with monetary effects, as we’ve got observed. So, now did Supermicro’s inventory arrange to drag off this kind of feat?

SMCI 12 months to Date General Returns (Day by day) ChartHow did Supermicro pull it off? It is in fact for a similar causes Nvidia endured to take off: torrid synthetic intelligence-related expansion. In reality, one may just say Supermicro, as a server-maker, rode a expansion wave on Nvidia’s again, as call for for Supermicro’s AI servers, which make up over 50% of its earnings and most commonly include Nvidia GPUs, took off. So Supermicro’s AI-fueled expansion was once most likely because of necessarily reselling Nvidia chips, with a small markup, indicated through Supermicro’s somewhat low 15.5% gross margins final quarter.Nvidia additionally in fact posted upper earnings expansion than Supermicro, at 262% expansion in Q2, as opposed to “simply” 200% expansion for Tremendous Micro Laptop final quarter.Then again, the inventory marketplace is not all the time precisely correlated with monetary effects, as we’ve got observed. So, now did Supermicro’s inventory arrange to drag off this kind of feat?

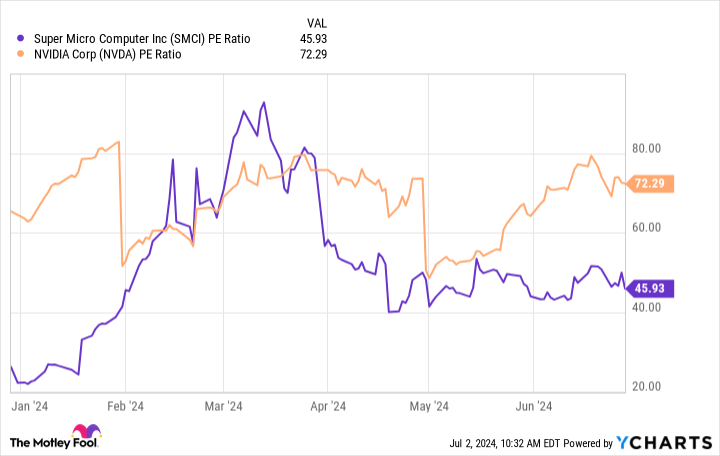

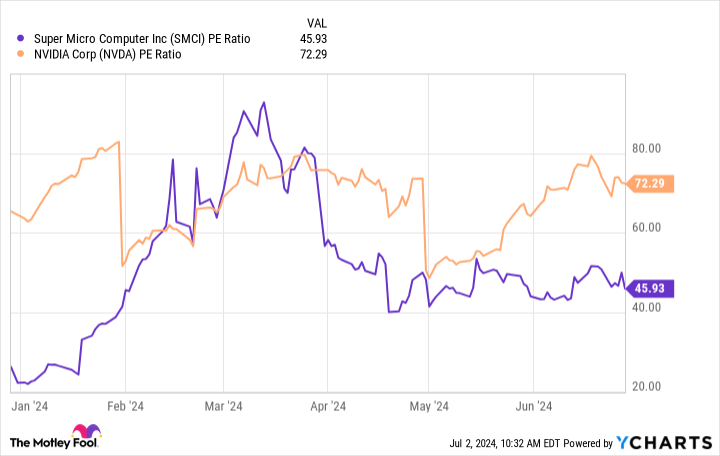

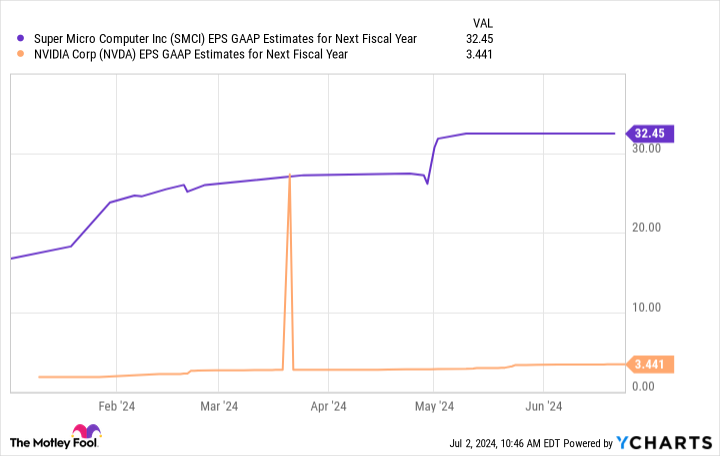

Symbol supply: Getty Photographs.Ranging from a decrease valuationWhile industry efficiency over the long run is the important thing determinant of long-term efficiency, valuation additionally issues, particularly within the momentary. And as we will see, Supermicro was once ranging from a miles decrease valuation this 12 months.On Jan. 1, Supermicro traded round 25 instances income, whilst Nvidia traded at 65 instances income. But all the way through the quarter, Supermicro’s valuation expanded to round 45 instances income — an 80% build up — whilst Nvidia’s P/E ratio expanded to 72 — an insignificant 8% build up.

Symbol supply: Getty Photographs.Ranging from a decrease valuationWhile industry efficiency over the long run is the important thing determinant of long-term efficiency, valuation additionally issues, particularly within the momentary. And as we will see, Supermicro was once ranging from a miles decrease valuation this 12 months.On Jan. 1, Supermicro traded round 25 instances income, whilst Nvidia traded at 65 instances income. But all the way through the quarter, Supermicro’s valuation expanded to round 45 instances income — an 80% build up — whilst Nvidia’s P/E ratio expanded to 72 — an insignificant 8% build up.

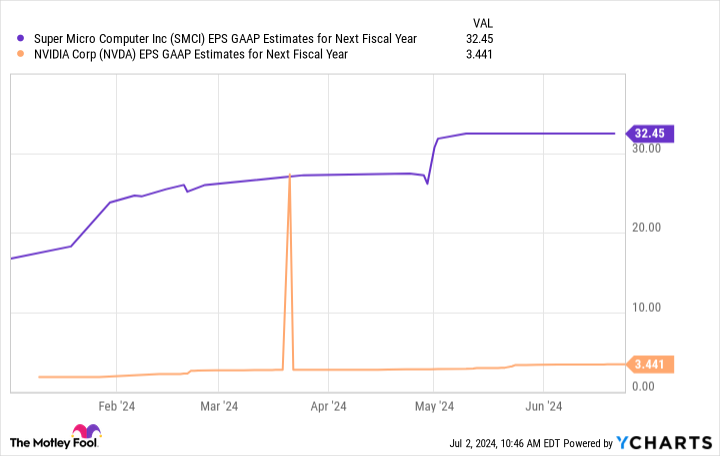

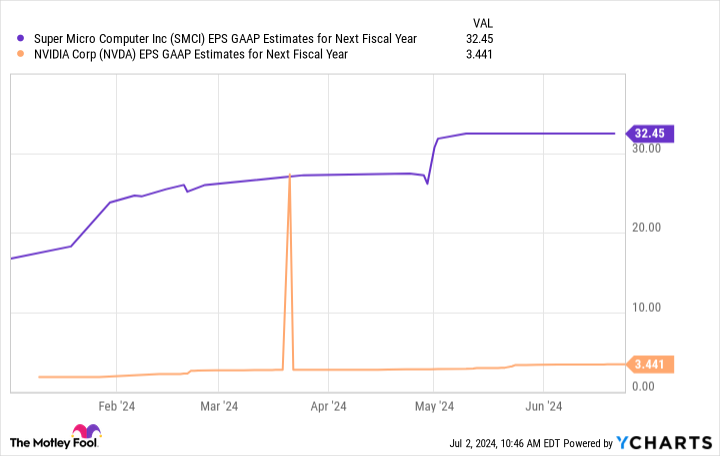

SMCI PE Ratio ChartMeanwhile, each firms noticed their long run income estimates upward thrust, and through kind of an identical quantity during the first part, with every inventory seeing its ahead income estimates from Wall Side road analysts 365 days out expanding through about 80% to 90%.Tale continues

SMCI PE Ratio ChartMeanwhile, each firms noticed their long run income estimates upward thrust, and through kind of an identical quantity during the first part, with every inventory seeing its ahead income estimates from Wall Side road analysts 365 days out expanding through about 80% to 90%.Tale continues

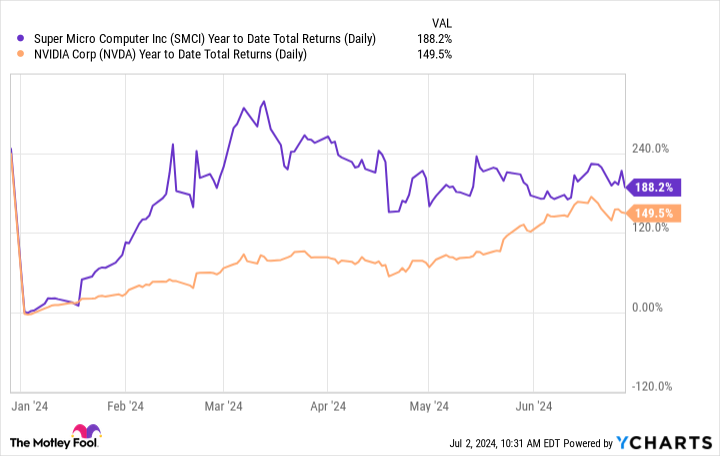

SMCI EPS GAAP Estimates for Subsequent Fiscal 12 months ChartThe income estimate will increase had been pushed through stellar income and expectancies from each firms all the way through the quarter. Supermicro’s estimates were given a large spice up early within the 12 months when it very much larger its ahead steering on its February income name. And whilst income estimates endured to upward thrust even after its Might 1 income document, the inventory offered off. This was once in all probability because of the prior quarter surroundings this kind of prime bar of expectancies.In the meantime, Nvidia endured to upward thrust as torrid expansion posted in each February and Might endured to defy the skeptics. Then again, as the corporate was once already affected by prime expectancies getting into the 12 months, it did not rally relatively as a lot after its February income, leaving “room” to wonder after its Might income.Thus, the outperformance from Supermicro in large part comes right down to beginning expectancies.Valuation mattersTrying to parse any lesson this is actually splitting hairs, as each shares have outperformed handily, and for a similar causes. Then again, one lesson to attract is that valuation issues. If an organization is a smart corporate however already trades at a prime valuation, it would possibly not upward thrust up to an organization that is probably not relatively as excellent, however is in a position to outperform beginning expectancies through a better stage.Call to mind it like some extent unfold in soccer. Marketplace valuations are necessarily “level spreads” on shares. You simplest win a chance in case your workforce wins the sport and beats the purpose unfold. In a similar way, in case your workforce loses however through lower than others assume, you continue to win the wager.Probably the most largest expansion buyers of all time, Phil Fisher, as soon as stated, “Each and every important worth transfer of any person commonplace inventory in terms of shares as an entire happens on account of a modified appraisal of that inventory through the monetary group.”As AI enthusiasm takes grasp and plenty of tech shares climb to very prime valuations, that is one thing to bear in mind as expectancies appear to have long past upper and better for AI winners this 12 months.Will have to you make investments $1,000 in Tremendous Micro Laptop at this time?Before you purchase inventory in Tremendous Micro Laptop, believe this:The Motley Idiot Inventory Marketing consultant analyst workforce simply recognized what they imagine are the 10 excellent shares for buyers to shop for now… and Tremendous Micro Laptop wasn’t certainly one of them. The ten shares that made the lower may just produce monster returns within the coming years.Imagine when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $761,658!*Inventory Marketing consultant supplies buyers with an easy-to-follow blueprint for good fortune, together with steering on construction a portfolio, common updates from analysts, and two new inventory alternatives every month. The Inventory Marketing consultant carrier has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Marketing consultant returns as of July 2, 2024Billy Duberstein and/or his shoppers positions in Tremendous Micro Laptop and has the next choices: brief January 2025 $1,840 calls on Tremendous Micro Laptop, brief January 2025 $110 places on Tremendous Micro Laptop, brief January 2025 $125 places on Tremendous Micro Laptop, brief January 2025 $130 places on Tremendous Micro Laptop, brief January 2025 $280 calls on Tremendous Micro Laptop, and brief January 2025 $85 places on Tremendous Micro Laptop. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.How This Chip Corporate Outperformed Nvidia within the First Part was once initially printed through The Motley Idiot

SMCI EPS GAAP Estimates for Subsequent Fiscal 12 months ChartThe income estimate will increase had been pushed through stellar income and expectancies from each firms all the way through the quarter. Supermicro’s estimates were given a large spice up early within the 12 months when it very much larger its ahead steering on its February income name. And whilst income estimates endured to upward thrust even after its Might 1 income document, the inventory offered off. This was once in all probability because of the prior quarter surroundings this kind of prime bar of expectancies.In the meantime, Nvidia endured to upward thrust as torrid expansion posted in each February and Might endured to defy the skeptics. Then again, as the corporate was once already affected by prime expectancies getting into the 12 months, it did not rally relatively as a lot after its February income, leaving “room” to wonder after its Might income.Thus, the outperformance from Supermicro in large part comes right down to beginning expectancies.Valuation mattersTrying to parse any lesson this is actually splitting hairs, as each shares have outperformed handily, and for a similar causes. Then again, one lesson to attract is that valuation issues. If an organization is a smart corporate however already trades at a prime valuation, it would possibly not upward thrust up to an organization that is probably not relatively as excellent, however is in a position to outperform beginning expectancies through a better stage.Call to mind it like some extent unfold in soccer. Marketplace valuations are necessarily “level spreads” on shares. You simplest win a chance in case your workforce wins the sport and beats the purpose unfold. In a similar way, in case your workforce loses however through lower than others assume, you continue to win the wager.Probably the most largest expansion buyers of all time, Phil Fisher, as soon as stated, “Each and every important worth transfer of any person commonplace inventory in terms of shares as an entire happens on account of a modified appraisal of that inventory through the monetary group.”As AI enthusiasm takes grasp and plenty of tech shares climb to very prime valuations, that is one thing to bear in mind as expectancies appear to have long past upper and better for AI winners this 12 months.Will have to you make investments $1,000 in Tremendous Micro Laptop at this time?Before you purchase inventory in Tremendous Micro Laptop, believe this:The Motley Idiot Inventory Marketing consultant analyst workforce simply recognized what they imagine are the 10 excellent shares for buyers to shop for now… and Tremendous Micro Laptop wasn’t certainly one of them. The ten shares that made the lower may just produce monster returns within the coming years.Imagine when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $761,658!*Inventory Marketing consultant supplies buyers with an easy-to-follow blueprint for good fortune, together with steering on construction a portfolio, common updates from analysts, and two new inventory alternatives every month. The Inventory Marketing consultant carrier has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Marketing consultant returns as of July 2, 2024Billy Duberstein and/or his shoppers positions in Tremendous Micro Laptop and has the next choices: brief January 2025 $1,840 calls on Tremendous Micro Laptop, brief January 2025 $110 places on Tremendous Micro Laptop, brief January 2025 $125 places on Tremendous Micro Laptop, brief January 2025 $130 places on Tremendous Micro Laptop, brief January 2025 $280 calls on Tremendous Micro Laptop, and brief January 2025 $85 places on Tremendous Micro Laptop. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.How This Chip Corporate Outperformed Nvidia within the First Part was once initially printed through The Motley Idiot

:max_bytes(150000):strip_icc()/GettyImages-2155472685-af661b5e61f34c47be945f46a3ac4e90.jpg)