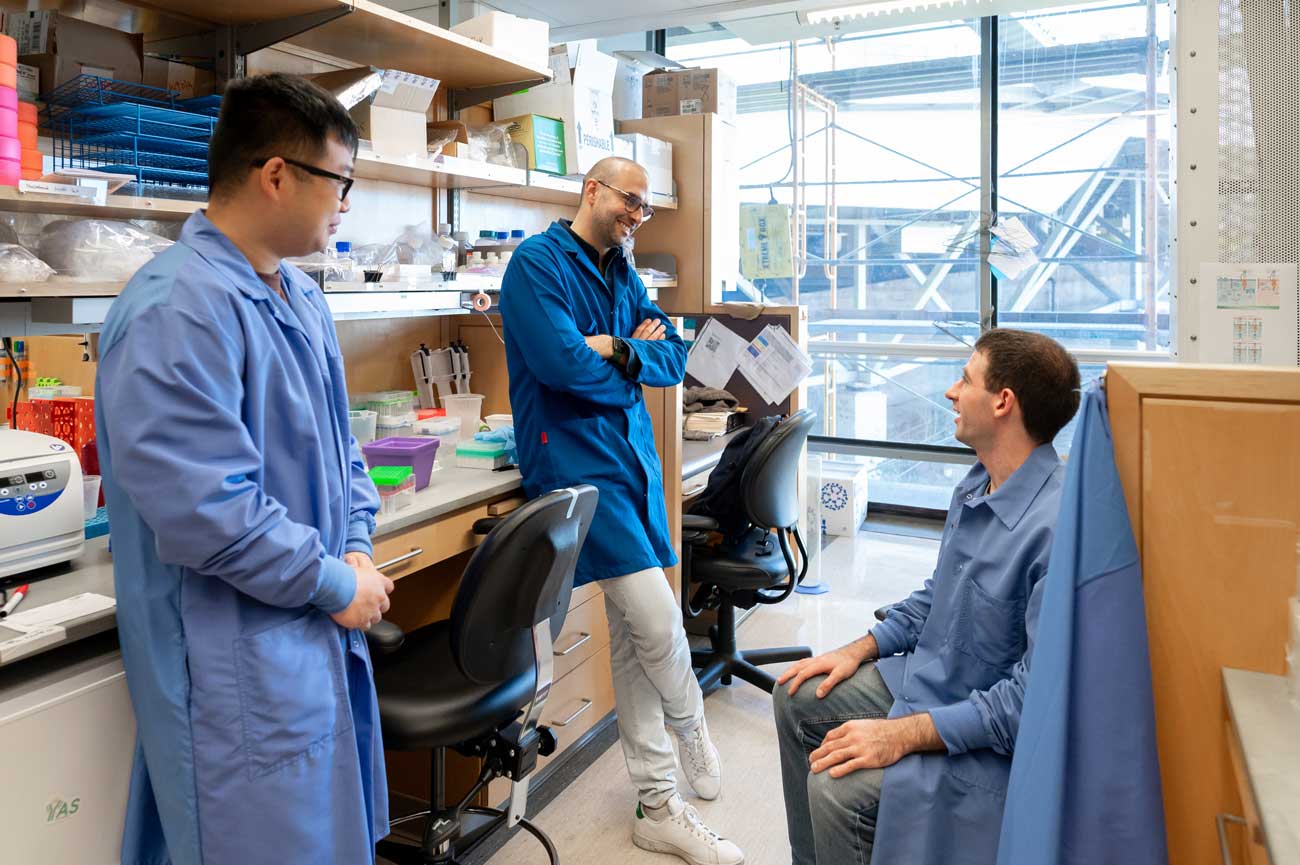

Getty ImagesThe husband of a BP worker has been charged with insider buying and selling in america following claims he overheard main points of calls made by means of his spouse whilst operating from house. The USA Securities and Alternate Fee alleged Tyler Loudon made $1.76m (£1.39m) in unlawful earnings.The regulator claimed Mr Loudon heard a number of of his spouse’s conversations about BP’s takeover of TravelCenters and acquired stocks within the company.BP has declined to remark.The SEC stated: “We allege that Mr Loudon took benefit of his faraway operating stipulations and his spouse’s believe to make the most of knowledge he knew used to be confidential.”His spouse – a mergers and acquisitions supervisor at BP – labored at the oil massive’s takeover of TravelCenters. The SEC stated Mr Loudon bought 46,450 stocks of TravelCenters inventory, with out his spouse’s wisdom, prior to the deal used to be made public in February remaining yr. Following the announcement, TravelCenters percentage value rose just about 71% and Mr Loudon allegedly straight away bought all of his newly-bought stocks for a benefit, the SEC stated.DivorceIn a criticism by means of the regulator, all the way through deal negotiations between TravelCenters and BP in 2022, Mr Loudon and his spouse labored in house places of work inside 20 ft of one another.”Because of this, they regularly overheard and witnessed each and every different’s work-related conversations and video meetings.” She additionally labored at the deal when the couple stayed in a “small Airbnb” in Rome, stated the criticism.Mr Loudon confessed to his spouse about purchasing the TravelCenters stocks after the Monetary Trade Regulatory Authority started asking questions concerning the BP deal and who used to be “within the know”.Consistent with the submitting, he stated he obtained the inventory as a result of “he sought after to make sufficient cash in order that she didn’t need to paintings lengthy hours anymore”.His spouse – who used to be “surprised by means of this revelation” – reported the buying and selling to her manager at BP.Her e mail and texts have been reviewed by means of BP and it discovered no proof that she knowingly leaked the details about the deal to her husband or knew he had obtained the stocks.However “BP nevertheless terminated her employment,” stated the submitting. Consistent with the regulator’s criticism, Mr Loudon’s spouse moved out of the home and ceased all touch with him. In June, she initiated divorce court cases. ‘Efficient surveillance’In a remark, the SEC stated Mr Loudon didn’t deny the allegations and agreed to pay a penalty. He additionally faces attainable felony fees and if convicted, may face a jail sentence. Throughout the pandemic, when many staff have been not able to paintings within the place of work, UK regulator the Monetary Behavior Authority (FCA) warned about managing insider buying and selling dangers when operating from house. With operating from house now cemented into many organisations operating patterns, the FCA has stated the “want for efficient surveillance always” remained vital.

Getty ImagesThe husband of a BP worker has been charged with insider buying and selling in america following claims he overheard main points of calls made by means of his spouse whilst operating from house. The USA Securities and Alternate Fee alleged Tyler Loudon made $1.76m (£1.39m) in unlawful earnings.The regulator claimed Mr Loudon heard a number of of his spouse’s conversations about BP’s takeover of TravelCenters and acquired stocks within the company.BP has declined to remark.The SEC stated: “We allege that Mr Loudon took benefit of his faraway operating stipulations and his spouse’s believe to make the most of knowledge he knew used to be confidential.”His spouse – a mergers and acquisitions supervisor at BP – labored at the oil massive’s takeover of TravelCenters. The SEC stated Mr Loudon bought 46,450 stocks of TravelCenters inventory, with out his spouse’s wisdom, prior to the deal used to be made public in February remaining yr. Following the announcement, TravelCenters percentage value rose just about 71% and Mr Loudon allegedly straight away bought all of his newly-bought stocks for a benefit, the SEC stated.DivorceIn a criticism by means of the regulator, all the way through deal negotiations between TravelCenters and BP in 2022, Mr Loudon and his spouse labored in house places of work inside 20 ft of one another.”Because of this, they regularly overheard and witnessed each and every different’s work-related conversations and video meetings.” She additionally labored at the deal when the couple stayed in a “small Airbnb” in Rome, stated the criticism.Mr Loudon confessed to his spouse about purchasing the TravelCenters stocks after the Monetary Trade Regulatory Authority started asking questions concerning the BP deal and who used to be “within the know”.Consistent with the submitting, he stated he obtained the inventory as a result of “he sought after to make sufficient cash in order that she didn’t need to paintings lengthy hours anymore”.His spouse – who used to be “surprised by means of this revelation” – reported the buying and selling to her manager at BP.Her e mail and texts have been reviewed by means of BP and it discovered no proof that she knowingly leaked the details about the deal to her husband or knew he had obtained the stocks.However “BP nevertheless terminated her employment,” stated the submitting. Consistent with the regulator’s criticism, Mr Loudon’s spouse moved out of the home and ceased all touch with him. In June, she initiated divorce court cases. ‘Efficient surveillance’In a remark, the SEC stated Mr Loudon didn’t deny the allegations and agreed to pay a penalty. He additionally faces attainable felony fees and if convicted, may face a jail sentence. Throughout the pandemic, when many staff have been not able to paintings within the place of work, UK regulator the Monetary Behavior Authority (FCA) warned about managing insider buying and selling dangers when operating from house. With operating from house now cemented into many organisations operating patterns, the FCA has stated the “want for efficient surveillance always” remained vital.

Husband 'made hundreds of thousands' by means of eavesdropping on BP spouse