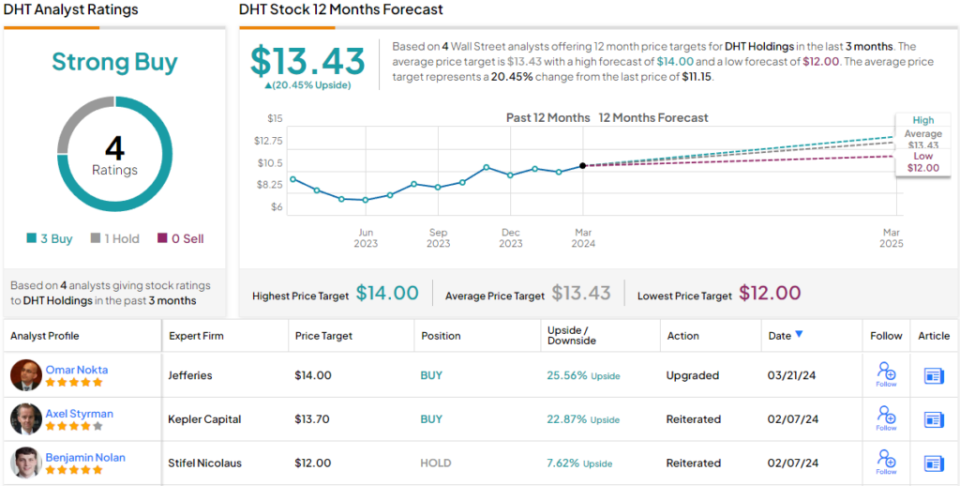

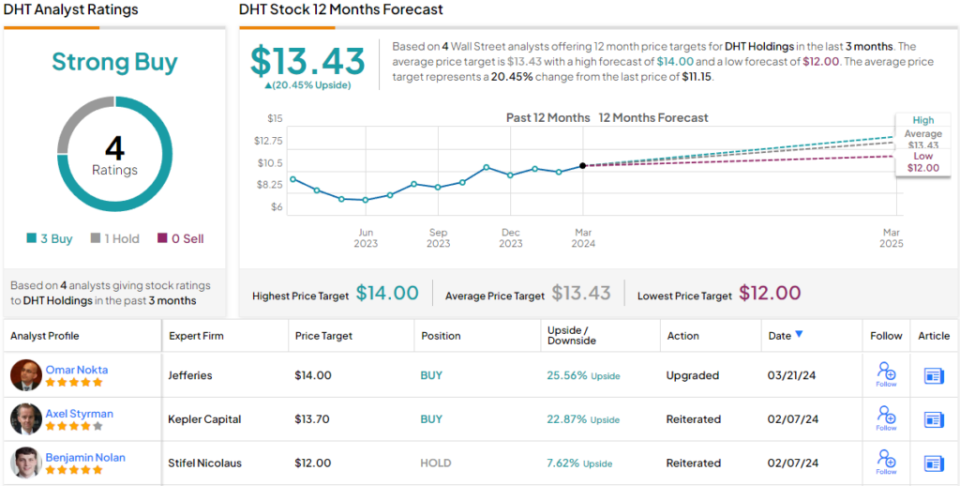

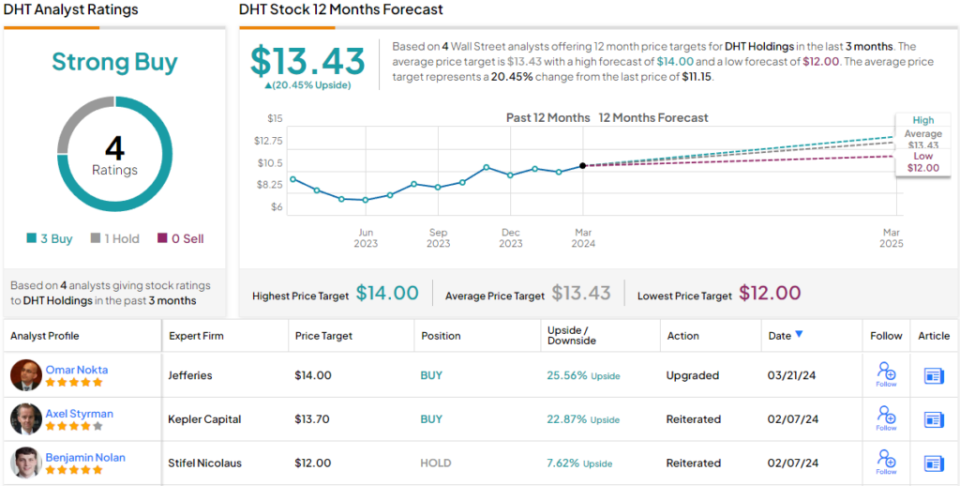

Traders are all the time in search of excessive returns, and at the moment the indicators are lining up in choose of the high-yield dividend phase. Dividend bills be certain a typical source of revenue circulation, without reference to marketplace stipulations, whilst excessive yields be offering the possibility of cast returns on funding.The dividend shares also are favorites of defensive buyers, tending to be much less unstable right through marketplace ups and downs. That’s the most important level at the moment – even if the consensus knowledge is suggesting that we’ll see an financial comfortable touchdown, there’s nonetheless an opportunity of an financial downturn.This background has knowledgeable a up to date observe from Desh Peramunetilleke, head of Microstrategy at funding financial institution Jefferies, who issues towards high-yield dividend shares as sound alternatives given nowadays’s stipulations.“After a difficult 2023,” the Jefferies group says, “the outlook for dividend methods has advanced. Fed is increasingly more leaning in opposition to June being the primary minimize, indicating that enlargement will turn into a larger problem than inflation. Then again, for the reason that a hard-landing is not likely, ultra-defensive bond-proxies may proceed to fight. As an alternative, we discover top quality yield as best-placed to seize the cycle.”Jefferies’ Omar Nokta, a 5-star analyst rated within the best 4% of the Boulevard’s inventory professionals, has adopted this line of idea with a number of particular selections – tagging 2 high-yielding dividend shares as buys, alternatives that are meant to go back as much as 8% dividend yield. We’ve used the TipRanks database to get the wider view of those shares, and located that they’ve earned Robust Purchase consensus rankings. Listed here are the detailsDHT Holdings (DHT)We’ll get started with a tanker corporate, DHT Holdings. This company is among the impartial operators within the international oceanic shipping sector, focusing on the carriage of crude oil. DHT’s title is the acronym for ‘double hull tankers,’ a contemporary mode of tanker development designed to advertise protection and save you leaks. The corporate is a pure-play operator of VLCC’s, or ‘very huge crude carriers,’ large tankers with rated within the vary of 299,000 to 320,000 dry weight tonnage (DWT). Those are the most important of the crude tankers plying the oceans nowadays.Tale continuesDHT’s fleet of 28 VLCCs is wholly owned by way of the corporate and operated totally on a constitution foundation. The superiority of long-term constitution contracts within the corporate’s operations type provides DHT a excessive stage of dependable mounted source of revenue.Fleet high quality is a crucial issue for oceanic tanker corporations, and DHT has a slightly younger fleet. All however 4 of its vessels had been inbuilt 2011 or later, with the 5 youngest vessels afloat having been inbuilt 2018. The corporate’s fleet contains a complete of 28 VLCCs, together with 4 tankers for which the corporate has lately entered into development agreements. Those 4 vessels are to be constructed at South Korean shipyards and can gross 320,000 DWT every. Each and every send has a median value of $128,500,000 and might be delivered in 2026.In its remaining quarterly monetary effects, from 4Q23, DHT reported a complete of $94.5 million in adjusted internet revenues, a complete that used to be down 19% year-over-year however used to be $1 million higher than have been anticipated. The corporate’s EPS, by way of GAAP measures, got here to 22 cents consistent with percentage. This used to be 1 cent above the forecast – and it totally coated the corporate’s most up-to-date dividend declaration.The dividend, amounting to 22 cents consistent with commonplace percentage, used to be declared at the side of the This fall effects. This dividend fee represented a fifteen.7% building up from the former fee and used to be despatched out to commonplace shareholders on February 28. The annualized fee of $0.88 consistent with commonplace percentage yields an 8% go back.Jefferies analyst Omar Nokta is inspired by way of the standard of DHT’s ships and operations, writing: “DHT is a pure-play VLCC shipowner with publicity to the spot marketplace, with its eco-design and scrubber-equipped vessels situated for oversized income possible. We see more potent dynamics forward for tankers, particularly with rising non-OPEC manufacturing volumes and the possibility of further OPEC+ exports. We predict shareholders to have the benefit of its dividend payout ratio of 100% of quarterly income.”Taking this ahead, Nokta provides DHT a ranking of Purchase, an improve from Cling, and a worth goal of $14 that issues towards a one-year upside possible of ~26%. (To observe Nokta’s monitor file, click on right here)General, this inventory’s Robust Purchase consensus ranking is in accordance with 4 fresh analyst opinions, that spoil down to three Buys and 1 Cling. The stocks are buying and selling for $11.15, and the $13.43 moderate goal value implies the stocks will achieve ~20% within the subsequent twelve months. (See DHT inventory forecast)

Traders are all the time in search of excessive returns, and at the moment the indicators are lining up in choose of the high-yield dividend phase. Dividend bills be certain a typical source of revenue circulation, without reference to marketplace stipulations, whilst excessive yields be offering the possibility of cast returns on funding.The dividend shares also are favorites of defensive buyers, tending to be much less unstable right through marketplace ups and downs. That’s the most important level at the moment – even if the consensus knowledge is suggesting that we’ll see an financial comfortable touchdown, there’s nonetheless an opportunity of an financial downturn.This background has knowledgeable a up to date observe from Desh Peramunetilleke, head of Microstrategy at funding financial institution Jefferies, who issues towards high-yield dividend shares as sound alternatives given nowadays’s stipulations.“After a difficult 2023,” the Jefferies group says, “the outlook for dividend methods has advanced. Fed is increasingly more leaning in opposition to June being the primary minimize, indicating that enlargement will turn into a larger problem than inflation. Then again, for the reason that a hard-landing is not likely, ultra-defensive bond-proxies may proceed to fight. As an alternative, we discover top quality yield as best-placed to seize the cycle.”Jefferies’ Omar Nokta, a 5-star analyst rated within the best 4% of the Boulevard’s inventory professionals, has adopted this line of idea with a number of particular selections – tagging 2 high-yielding dividend shares as buys, alternatives that are meant to go back as much as 8% dividend yield. We’ve used the TipRanks database to get the wider view of those shares, and located that they’ve earned Robust Purchase consensus rankings. Listed here are the detailsDHT Holdings (DHT)We’ll get started with a tanker corporate, DHT Holdings. This company is among the impartial operators within the international oceanic shipping sector, focusing on the carriage of crude oil. DHT’s title is the acronym for ‘double hull tankers,’ a contemporary mode of tanker development designed to advertise protection and save you leaks. The corporate is a pure-play operator of VLCC’s, or ‘very huge crude carriers,’ large tankers with rated within the vary of 299,000 to 320,000 dry weight tonnage (DWT). Those are the most important of the crude tankers plying the oceans nowadays.Tale continuesDHT’s fleet of 28 VLCCs is wholly owned by way of the corporate and operated totally on a constitution foundation. The superiority of long-term constitution contracts within the corporate’s operations type provides DHT a excessive stage of dependable mounted source of revenue.Fleet high quality is a crucial issue for oceanic tanker corporations, and DHT has a slightly younger fleet. All however 4 of its vessels had been inbuilt 2011 or later, with the 5 youngest vessels afloat having been inbuilt 2018. The corporate’s fleet contains a complete of 28 VLCCs, together with 4 tankers for which the corporate has lately entered into development agreements. Those 4 vessels are to be constructed at South Korean shipyards and can gross 320,000 DWT every. Each and every send has a median value of $128,500,000 and might be delivered in 2026.In its remaining quarterly monetary effects, from 4Q23, DHT reported a complete of $94.5 million in adjusted internet revenues, a complete that used to be down 19% year-over-year however used to be $1 million higher than have been anticipated. The corporate’s EPS, by way of GAAP measures, got here to 22 cents consistent with percentage. This used to be 1 cent above the forecast – and it totally coated the corporate’s most up-to-date dividend declaration.The dividend, amounting to 22 cents consistent with commonplace percentage, used to be declared at the side of the This fall effects. This dividend fee represented a fifteen.7% building up from the former fee and used to be despatched out to commonplace shareholders on February 28. The annualized fee of $0.88 consistent with commonplace percentage yields an 8% go back.Jefferies analyst Omar Nokta is inspired by way of the standard of DHT’s ships and operations, writing: “DHT is a pure-play VLCC shipowner with publicity to the spot marketplace, with its eco-design and scrubber-equipped vessels situated for oversized income possible. We see more potent dynamics forward for tankers, particularly with rising non-OPEC manufacturing volumes and the possibility of further OPEC+ exports. We predict shareholders to have the benefit of its dividend payout ratio of 100% of quarterly income.”Taking this ahead, Nokta provides DHT a ranking of Purchase, an improve from Cling, and a worth goal of $14 that issues towards a one-year upside possible of ~26%. (To observe Nokta’s monitor file, click on right here)General, this inventory’s Robust Purchase consensus ranking is in accordance with 4 fresh analyst opinions, that spoil down to three Buys and 1 Cling. The stocks are buying and selling for $11.15, and the $13.43 moderate goal value implies the stocks will achieve ~20% within the subsequent twelve months. (See DHT inventory forecast)

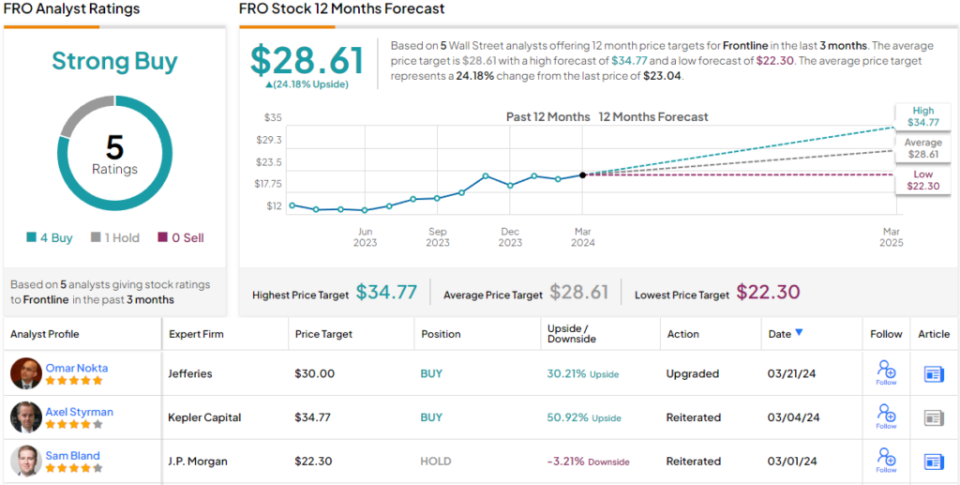

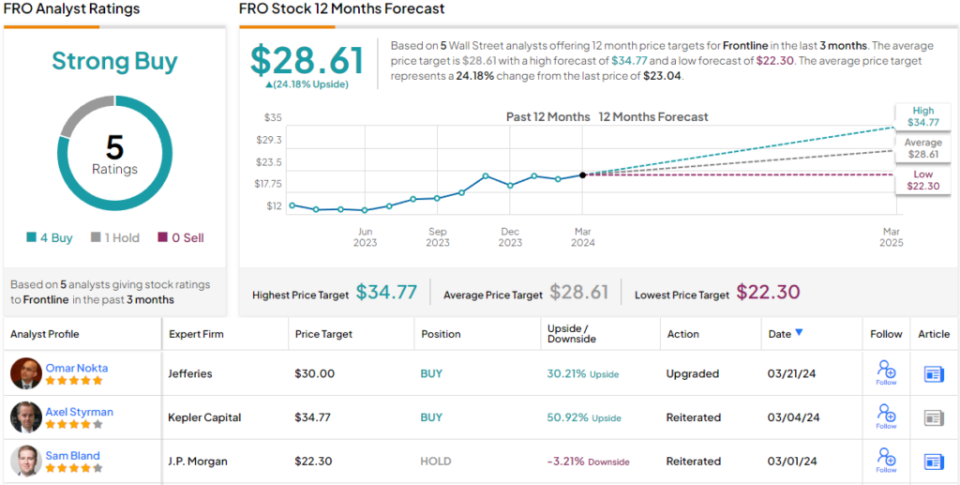

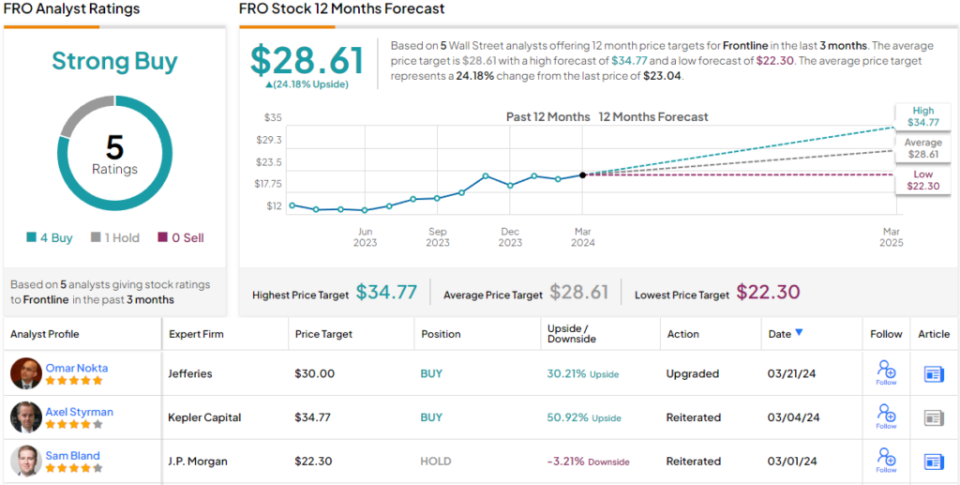

Frontline (FRO)The following inventory on Jefferies’ checklist is Frontline, one of the crucial global’s biggest tanker corporations. Frontline carries each crude oil and subtle merchandise and operates one of the crucial trade’s biggest and most current fleets. The corporate has 86 vessels afloat, with the oldest inbuilt 2009 and 20 inbuilt 2020 or later. The fleet consists of 43 VLCCs, the most important class of ocean-going tanker, and likewise contains 25 Suezmax vessels, rated at 157,000 DWT and the most important that may transit the Suez canal, in addition to 18 LR2/Aframax tankers, rated at 110,000 DWT.Frontline has been in operation since 1985 and has noticed cast successes in fresh quarters. Revenues had been up remaining 12 months in comparison to the prior 12 months, emerging 27% from $1.44 billion in 2022 to $1.83 billion in 2023. The corporate’s inventory additionally noticed robust positive factors, greater than 60% within the remaining twelve months and just about 17% for the year-to-date.With the fourth quarter of 2023 at the back of us, we will be able to take a look at Frontline’s income for that quarter. The corporate had $415 million on the best line, down 21% year-over-year and greater than $5 million underneath the forecast. On a greater observe, the corporate’s adjusted benefit for the quarter, at $102.2 million, got here to 46 cents consistent with percentage.This used to be greater than sufficient to hide the common percentage dividend, which used to be declared on February 28 for a fee on March 27, at a price of 37 cents consistent with percentage. This declaration represents a 23% building up from the former quarter, and the annualized dividend, of $1.48, provides a yield of 6.4%. Frontline has a historical past of fixing its dividend fee to stay it in step with present income.In his protection for Jefferies, analyst Nokta is inspired by way of the corporate’s talent to constantly deal with a excessive dividend payout ratio. He says of the inventory, “Frontline is among the biggest crude tanker operators on this planet with a tender fleet and excessive scrubber publicity. We see more potent dynamics forward for tankers, particularly with rising non-OPEC manufacturing volumes and the possibility of further OPEC+ exports. We predict dividends to stay a central a part of the Frontline tale and be expecting shareholders to have the benefit of its unofficial dividend payout ratio of 80% of quarterly income.”Having a look forward, Nokta provides this inventory, like DHT above, an upgraded ranking, from Cling to Purchase. His value goal right here, set at $30, suggests a possible one-year upside of 30%.All in all, Frontline has 5 fresh analyst opinions, together with 4 Buys to one Cling, for a Robust Purchase consensus ranking from the Boulevard’s analysts. The inventory’s moderate goal value of $28.61 and its present buying and selling value of $23.04 in combination indicate a one-year achieve of 24%. (See FRO inventory forecast)

Frontline (FRO)The following inventory on Jefferies’ checklist is Frontline, one of the crucial global’s biggest tanker corporations. Frontline carries each crude oil and subtle merchandise and operates one of the crucial trade’s biggest and most current fleets. The corporate has 86 vessels afloat, with the oldest inbuilt 2009 and 20 inbuilt 2020 or later. The fleet consists of 43 VLCCs, the most important class of ocean-going tanker, and likewise contains 25 Suezmax vessels, rated at 157,000 DWT and the most important that may transit the Suez canal, in addition to 18 LR2/Aframax tankers, rated at 110,000 DWT.Frontline has been in operation since 1985 and has noticed cast successes in fresh quarters. Revenues had been up remaining 12 months in comparison to the prior 12 months, emerging 27% from $1.44 billion in 2022 to $1.83 billion in 2023. The corporate’s inventory additionally noticed robust positive factors, greater than 60% within the remaining twelve months and just about 17% for the year-to-date.With the fourth quarter of 2023 at the back of us, we will be able to take a look at Frontline’s income for that quarter. The corporate had $415 million on the best line, down 21% year-over-year and greater than $5 million underneath the forecast. On a greater observe, the corporate’s adjusted benefit for the quarter, at $102.2 million, got here to 46 cents consistent with percentage.This used to be greater than sufficient to hide the common percentage dividend, which used to be declared on February 28 for a fee on March 27, at a price of 37 cents consistent with percentage. This declaration represents a 23% building up from the former quarter, and the annualized dividend, of $1.48, provides a yield of 6.4%. Frontline has a historical past of fixing its dividend fee to stay it in step with present income.In his protection for Jefferies, analyst Nokta is inspired by way of the corporate’s talent to constantly deal with a excessive dividend payout ratio. He says of the inventory, “Frontline is among the biggest crude tanker operators on this planet with a tender fleet and excessive scrubber publicity. We see more potent dynamics forward for tankers, particularly with rising non-OPEC manufacturing volumes and the possibility of further OPEC+ exports. We predict dividends to stay a central a part of the Frontline tale and be expecting shareholders to have the benefit of its unofficial dividend payout ratio of 80% of quarterly income.”Having a look forward, Nokta provides this inventory, like DHT above, an upgraded ranking, from Cling to Purchase. His value goal right here, set at $30, suggests a possible one-year upside of 30%.All in all, Frontline has 5 fresh analyst opinions, together with 4 Buys to one Cling, for a Robust Purchase consensus ranking from the Boulevard’s analysts. The inventory’s moderate goal value of $28.61 and its present buying and selling value of $23.04 in combination indicate a one-year achieve of 24%. (See FRO inventory forecast)

To search out just right concepts for dividend shares buying and selling at sexy valuations, discuss with TipRanks’ Absolute best Shares to Purchase, a device that unites all of TipRanks’ fairness insights.Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.

To search out just right concepts for dividend shares buying and selling at sexy valuations, discuss with TipRanks’ Absolute best Shares to Purchase, a device that unites all of TipRanks’ fairness insights.Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.