MATIC’s worth fell through greater than 7% within the ultimate 24 hours

Metrics hinted at an additional drop in its worth quickly

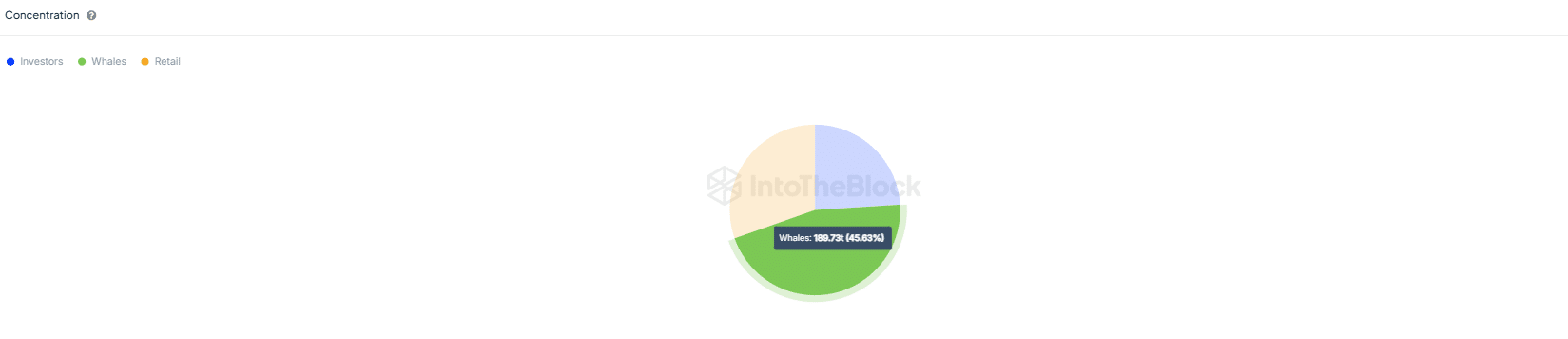

MATIC has dissatisfied its traders considerably with its worth motion in recent years. On the other hand, whilst bears took keep an eye on of the altcoin’s worth at the charts, Polygon’s efficiency within the DeFi house appeared commendable. Therefore, the query – Can the latter lend a hand begin a pattern reversal for MATIC?

Polygon’s fresh setback

CoinMarketCap’s knowledge printed that MATIC’s worth depreciated through over 5% within the ultimate seven days. On the other hand, it quickly were given worse because the altcoin misplaced every other 7% of its worth within the ultimate 24 hours on my own. On the time of writing, MATIC used to be buying and selling at $0.6622 with a marketplace capitalization of over $6.5 billion, making it the 18th biggest crypto.

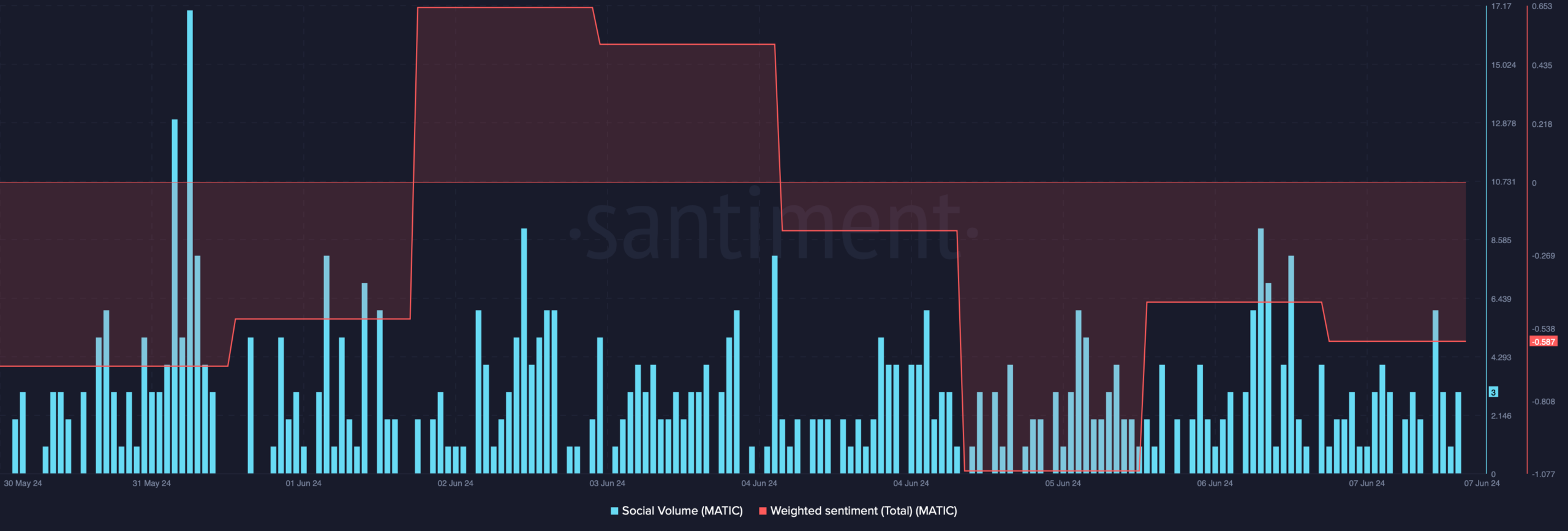

The associated fee decline additionally had an have an effect on at the token’s social metrics. For example, its social quantity dropped, reflecting a dip in its reputation. Its weighted sentiment additionally remained within the destructive zone – An indication that bearish sentiment retained its dominance available in the market.

Supply: Santiment

Supply: Santiment

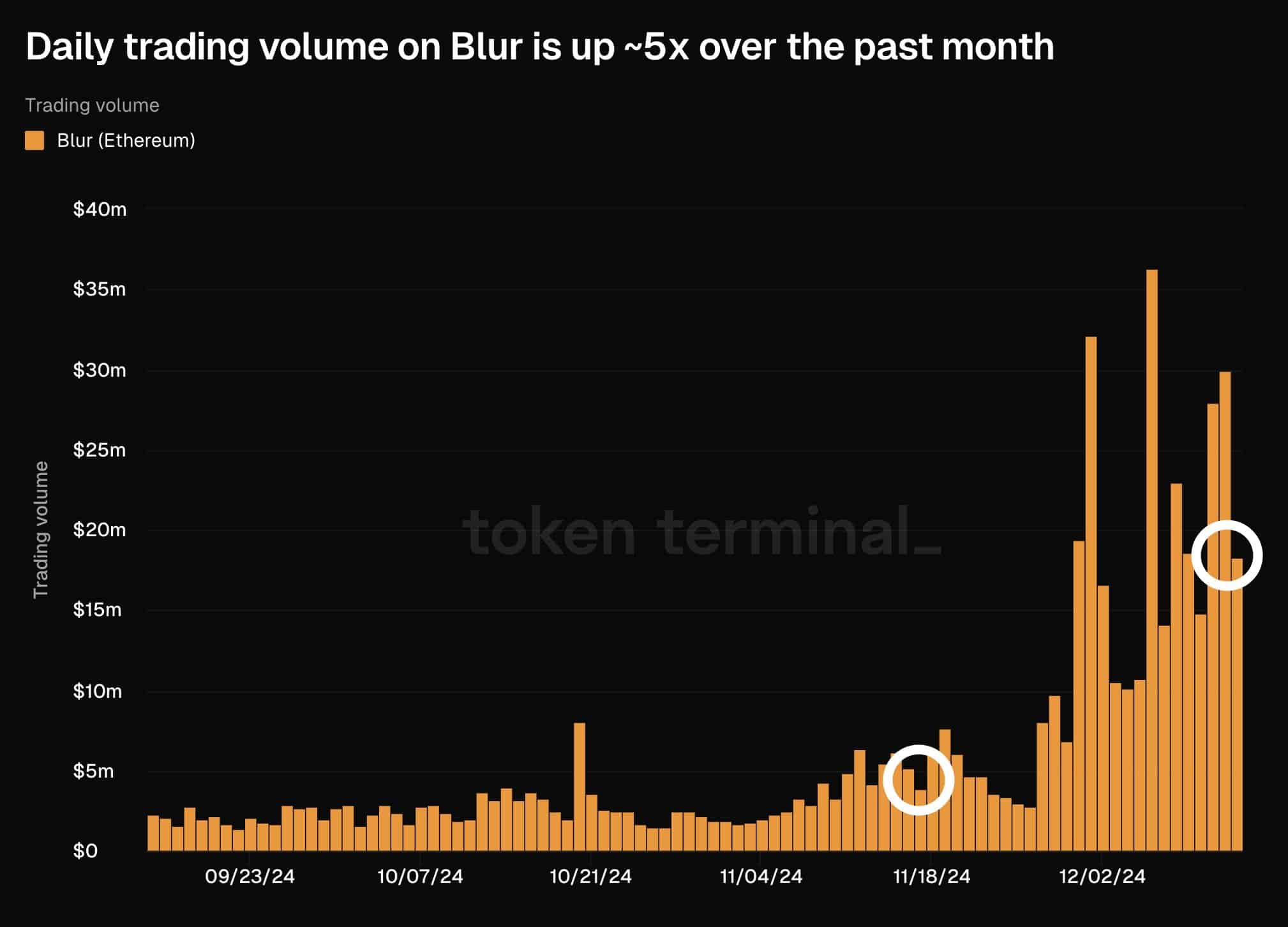

The worst information used to be that whilst the token’s worth dropped, its buying and selling quantity higher. This legitimized the associated fee decline and indicated that the probabilities of the rage proceeding had been prime.

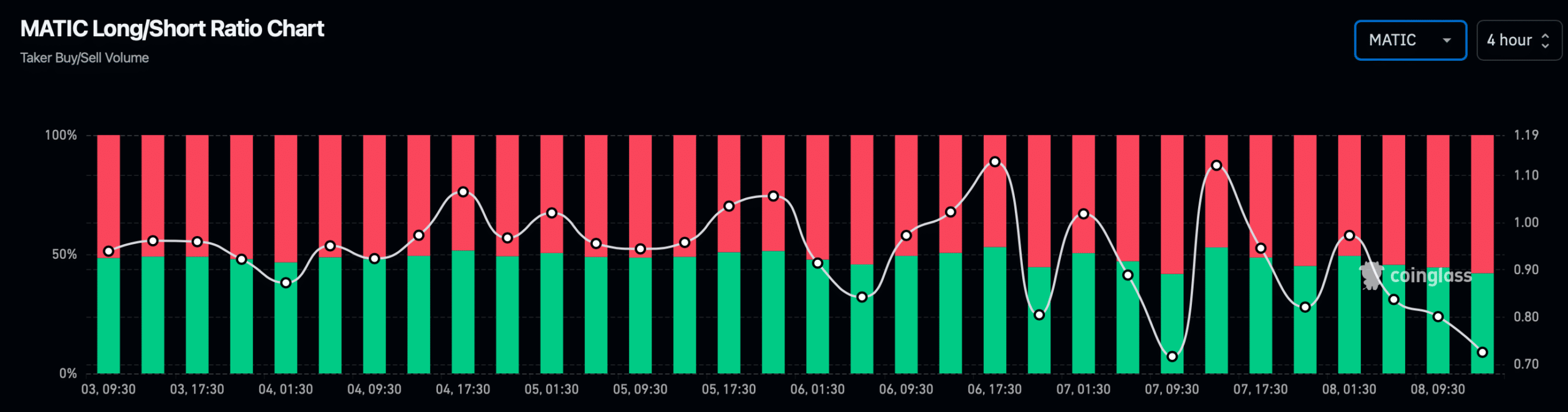

On most sensible of that, AMBCrypto’s take a look at Coinglass’ knowledge printed that the altcoin’s lengthy/brief ratio dropped during the last 4 hours. A low ratio is an indication of bearish sentiment, one the place there’s extra passion in promoting or shorting property.

Supply: Coinglass

Supply: Coinglass

And the great phase is…

Whilst the token’s worth dropped, Polygon shared a tweet highlighting the blockchain’s efficiency within the DeFi house. Consistent with the similar, Polygon PoS, zkEVM, and CDK have emerged as most sensible possible choices for DeFi developers, offering builders with scalable networks and equipment to construct monetary answers.

Aave used to be the most important DeFi protocol on Polygon through general worth locked with a worth of $460 million. Azuro protocol used to be offered to EVM chains supporting prediction app ecosystems. Inside of simply 14 months on Polygon, Azuro now boasts 25+ are living apps, $300 million in quantity, and over $3.2 million in earnings.

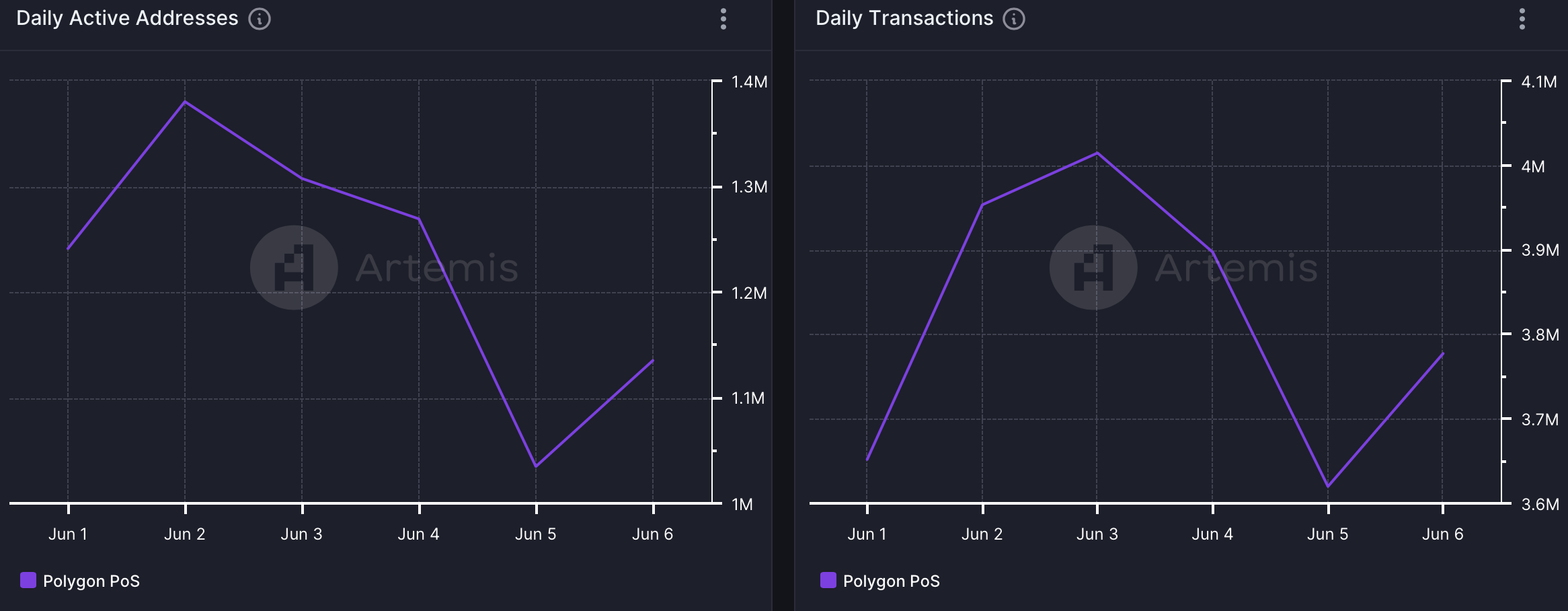

And but, in spite of having such robust pillars within the DeFi house, Polygon’s community task dropped ultimate week.

Lifelike or no longer, right here’s MATIC’s marketplace cap in ETH phrases

In any case, AMBCrypto’s research of Artemis’ knowledge printed that MATIC’s day-to-day lively addresses dropped too. Because of the similar, the blockchain’s day-to-day transactions fell during the last 7 days.

Supply: Artemis

Supply: Artemis

What this implies is that whilst Polygon’s DeFi efficiency has been commendable, if no longer best, it’s no longer but sufficient to steer MATIC’s worth to bullish territory by itself. Therefore, the altcoin’s marketplace pattern is more likely to persist for now.