BTC’ greatest danger at the moment is a decline in institutional backing at a time when volatility is expanding.

If this development continues, $90K may just function the native enhance stage.

Bitcoin’s fresh value motion has demonstrated resilience, with the marketplace staying bullish regardless of Bitcoin [BTC] getting into the final month of the 12 months with out breaking throughout the $100K barrier. Sturdy call for continues to soak up sell-side drive, reinforcing this optimism.

Moreover, whilst numerous susceptible palms have exited the cycle after securing large income, absence of a forged pullback highlights a strong sense of FOMO amongst traders.

Then again, even with metrics indicating a gentle trajectory towards $100K and the predicted Fed charge lower including to the optimism, AMBCrypto delves into whether or not a possible retracement to $90K may just act because the vital catalyst for Bitcoin’s subsequent main transfer.

Lack of institutional enhance may just pose a big danger

Lately, Bitcoin stands at a important crossroads, with its trajectory hinging on sustained enhance fueled via stable accumulation from each retail and institutional traders.

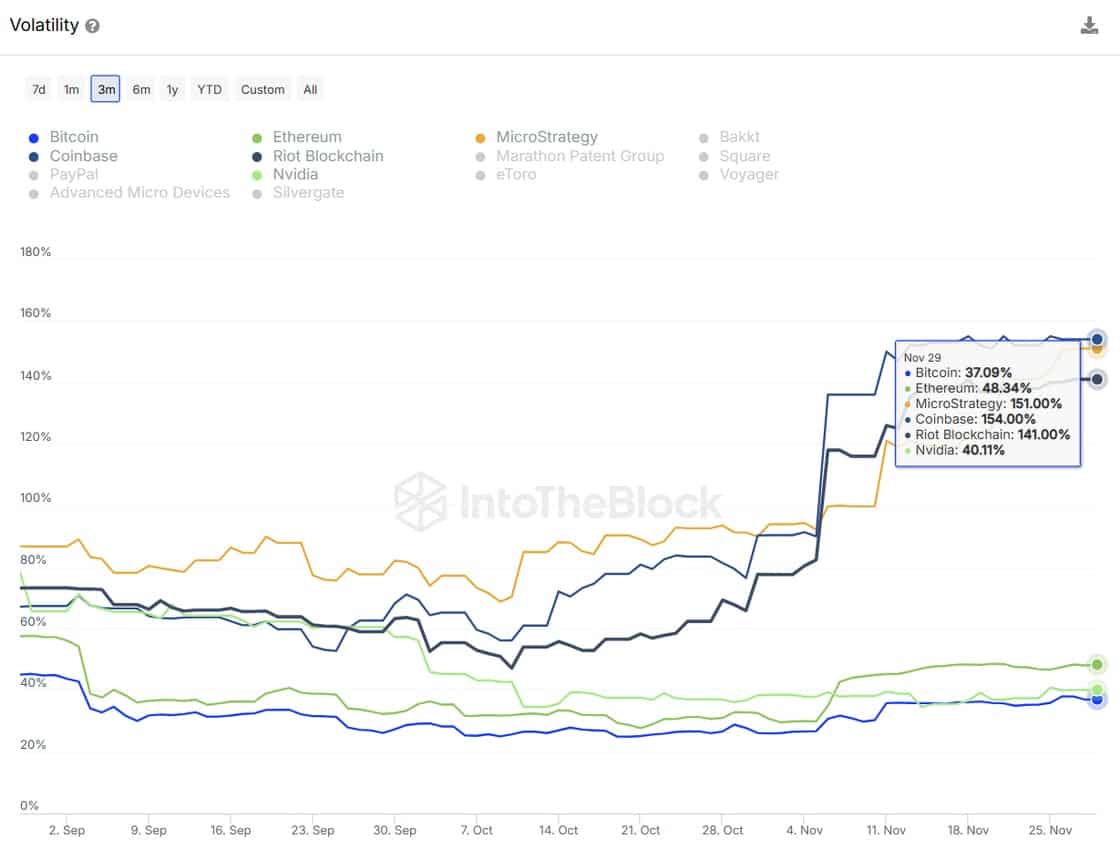

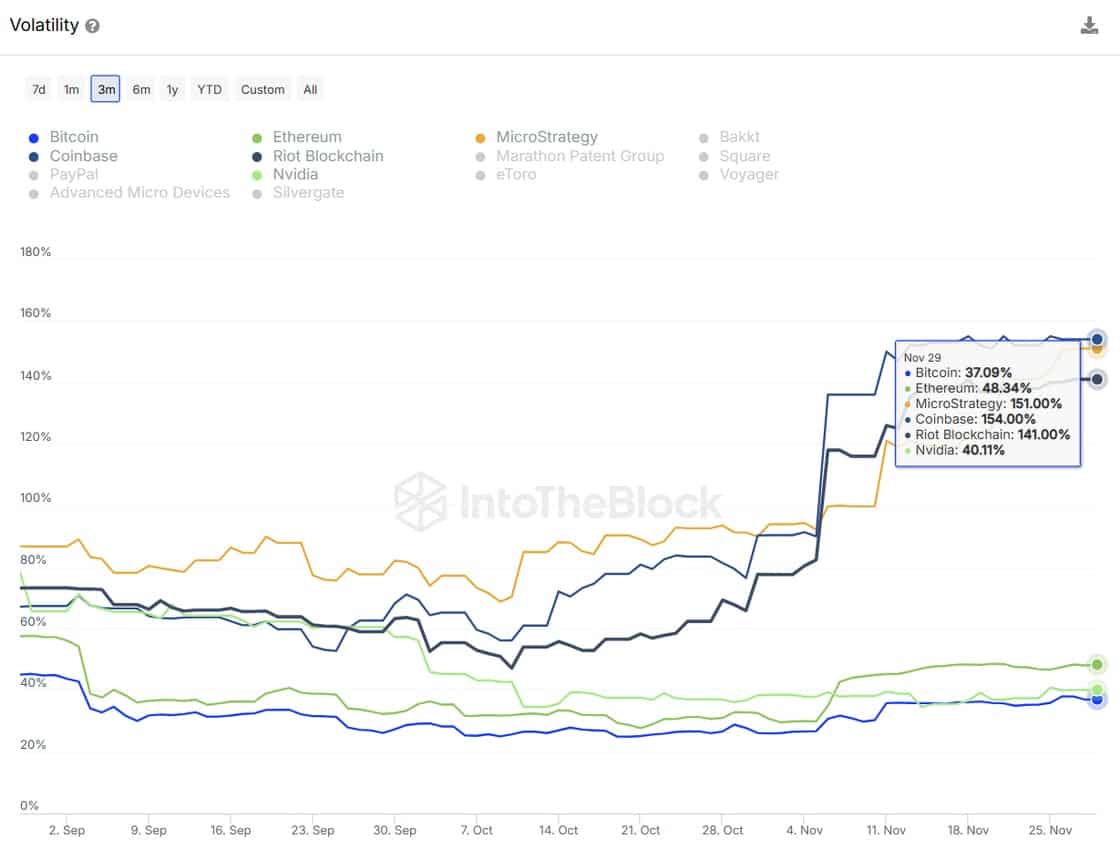

Microstrategy, being an organization closely invested in BTC, sees its inventory [MSTR] react extra dramatically to adjustments in Bitcoin’s worth.

As highlighted within the chart underneath, MSTR’s volatility being 4 instances that of BTC means that MicroStrategy’s inventory value is predicted to differ roughly 4 instances up to Bitcoin’s, introducing a heightened and calculable threat for its traders.

Supply : IntoTheBlock

Supply : IntoTheBlock

On this local weather, Bitcoin’s enchantment as a shop of worth may just weaken, probably triggering institutional sell-offs and liquidations.

This comes as MicroStrategy’s inventory turns into extra risky, prompting traders to think again their publicity to BTC, in particular thru MSTR, which might result in a broader marketplace correction.

Because of this, MSTR’s top rate BTC holdings have dropped from a height of 240 on twentieth November to 135 in just below seven buying and selling days. If this promoting drive continues unchecked, it would cause vital losses for Bitcoin holders, probably riding the fee right into a deeper pullback.

So, stay the volatility in test

At 63, the crypto volatility index signifies noticeable, however now not excessive, marketplace volatility. Then again, this follows a rebound simply two days in the past from the 60 threshold, which has traditionally been an important enhance stage.

Supply : CryptoVolatilityIndex

Supply : CryptoVolatilityIndex

In easy phrases, if the volatility index rebounds strongly, it would upward thrust in opposition to or above the former rejection level of round 70. A CVI above 70 alerts upper anticipated value fluctuations and larger marketplace uncertainty.

Whilst this might be both bullish or bearish, inspecting Bitcoin’s present value chart, which displays serious fluctuations during the last week, means that heightened volatility may undermine institutional self belief in a parabolic run.

Traditionally, a volatility index hitting a height has coincided with Bitcoin achieving a backside.

This additional helps AMBCrypto’s previous thesis that Bitcoin may just hit a neighborhood backside, resulting in a wholesome retracement, decrease volatility, greater institutional FOMO, and a possible breakout from inconsistent value motion.

The place may just BTC see a wholesome retracement?

In a contemporary file, $90K was once recognized as a key enhance stage, marking an important backside formation, pushed via tough retail accumulation and backing from ETFs.

This means that if volatility strikes into the ‘excessive’ zone, the place vital swings can happen in a short while, the possibility of a pullback stays excessive.

In this sort of situation, $90K may just function a powerful liquidity pool, attracting each swing investors and institutional process, resulting in a possible uptick in value.

Additionally, with the impending Fed assembly, investors are expanding their bets on a 25-basis level charge lower in December. The marketplace is now pricing in a 64.7% probability of this taking place, up from 55.7% only a week in the past.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Indisputably, this macroeconomic transfer is prone to cause surprising swings within the spinoff marketplace, with the potential for a brief squeeze final excessive. A pointy uptick in value may just drive short-sellers to near their positions.

Because of this, marketplace volatility is prone to upward thrust, developing favorable prerequisites for a wholesome retracement as many establishments might pull again from collecting Bitcoin on this ‘high-risk’ surroundings.

Earlier: Is Filecoin set for a big rally? Examining the trail to $28

Subsequent: XRP’s explosive upward thrust leaves Binance reeling: Will BNB get well?

/cdn.vox-cdn.com/uploads/chorus_asset/file/25462005/STK155_OPEN_AI_CVirginia_B.jpg)