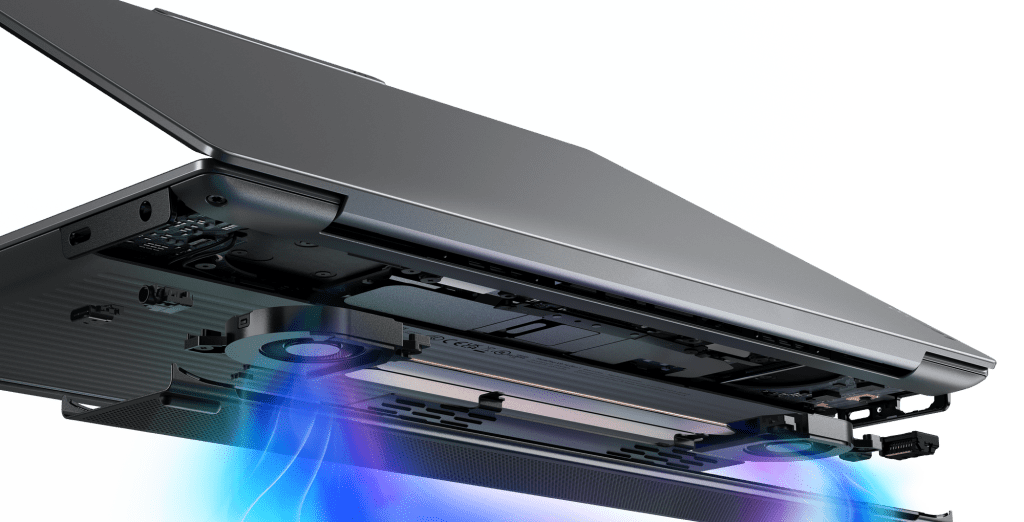

Pat Gelsinger, the CEO of Intel, reassures investors who are selling off the stock due to a disappointing first-quarter outlook that the company’s turnaround is still gaining momentum and has not stalled. Gelsinger describes the market’s sharp reaction as an overreaction and believes that the issues causing near-term sales and profit challenges will subside in the second quarter with the launch of new chips to support AI workloads and hardware. However, some analysts on Wall Street are skeptical and believe that Intel’s “growth businesses” are not growing and might even be contracting. Despite this, Gelsinger remains optimistic, anticipating 40 million shipments of AI PCs in 2024 and confirming that all of the company’s planned chip launches for the year are on track. Intel has also presented a range of AI-focused products and services, including the Gaudi3 and Core Ultra processor, aimed at the emerging AI PC market. Additionally, Gelsinger shared that Intel’s new foundry business has a line of sight into $10 billion in orders and is expected to be consistently profitable beginning in 2025. While there are positive signs in the quarter, some on Wall Street maintain a cautious stance, viewing Intel as a “show-me” investment story. Analyst Harlan Sur from JPMorgan reiterated an Underweight rating on Intel’s stock with a $37 price target, which is approximately 16% lower than the current levels. The company’s earnings rundown shows a 10% increase in net sales and better-than-expected results in various segments, but the weak first-quarter guidance has been a cause for concern. Pat Gelsinger, CEO of Intel, responds to a question during a keynote conversation at CES 2024. (Steve Marcus/REUTERS) (REUTERS / Reuters) The earnings rundown:

– Net Sales: +10% year over year to $15.4 billion vs. estimate of $15.11 billion

– Client Computing Sales: $8.84 billion vs. estimate of $8.42 billion

– Data Center & AI Sales: $4 billion vs. $4.08 billion

– Network & Edge Sales: $1.47 billion vs. $1.55 billion

– Mobileye Sales: $637 million vs. $627.2 million

– Intel Foundry Sales: $291 million vs. $342.5 million

– Adjusted Gross Margin: 48.8% vs. 46.5% estimate

– Adjusted EPS: $0.54 ($0.15 a year ago) vs. estimate of $0.44

[https://s.yimg.com/ny/api/res/1.2/Nz7eQZp56ejFW7UOfTpIfg–/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTYxNg–/https://s.yimg.com/os/creatr-uploaded-images/2024-01/73738e20-bc81-11ee-afbf-c708abca17d6/]

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on Twitter/X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com. Click here for the latest technology news that will impact the stock market. Read the latest financial and business news from Yahoo Finance