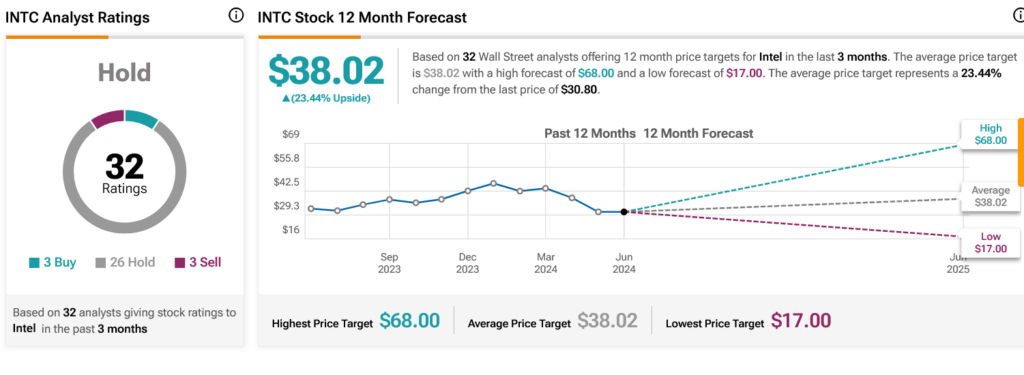

Chip maker Intel (NASDAQ:INTC) has made spectacular growth in recent years, and that places it in an ideal place to battle off the rising selection of competition it is dealing with. However contemporary experiences recommend it is a double-edged sword, and Intel humbly dropped the inside track. So, here is a new tale about Intel’s new chips, the Arrow Lake line. The excellent news is that the road—particularly the road of PC chips—is set to have upper clock speeds than older fashions like Meteor Lake and the 14th-gen line. The next clock velocity implies that the processor can do extra with out pushing it too exhausting and lengthening its likelihood of failure. On the other hand, there’s a downside with this; whilst Arrow Lake’s base clock is top, its spice up clock — its most velocity underneath heavy load — will probably be not up to its predecessor, and that might make for a difficult promote sooner or later. Must I Purchase, Promote, or Grasp Intel? Turning to Wall Boulevard, analysts have a Grasp consensus on INTC inventory in keeping with 3 Buys, 26 Holds, and 3 Sells issued up to now 3 months, as proven within the chart beneath. After a lack of 6.63% in its percentage worth closing yr, INTC’s moderate worth of $38.02 in line with percentage approach 23.44% doable.

Disclosure

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/25805714/Captura_de_pantalla__2045_.png)