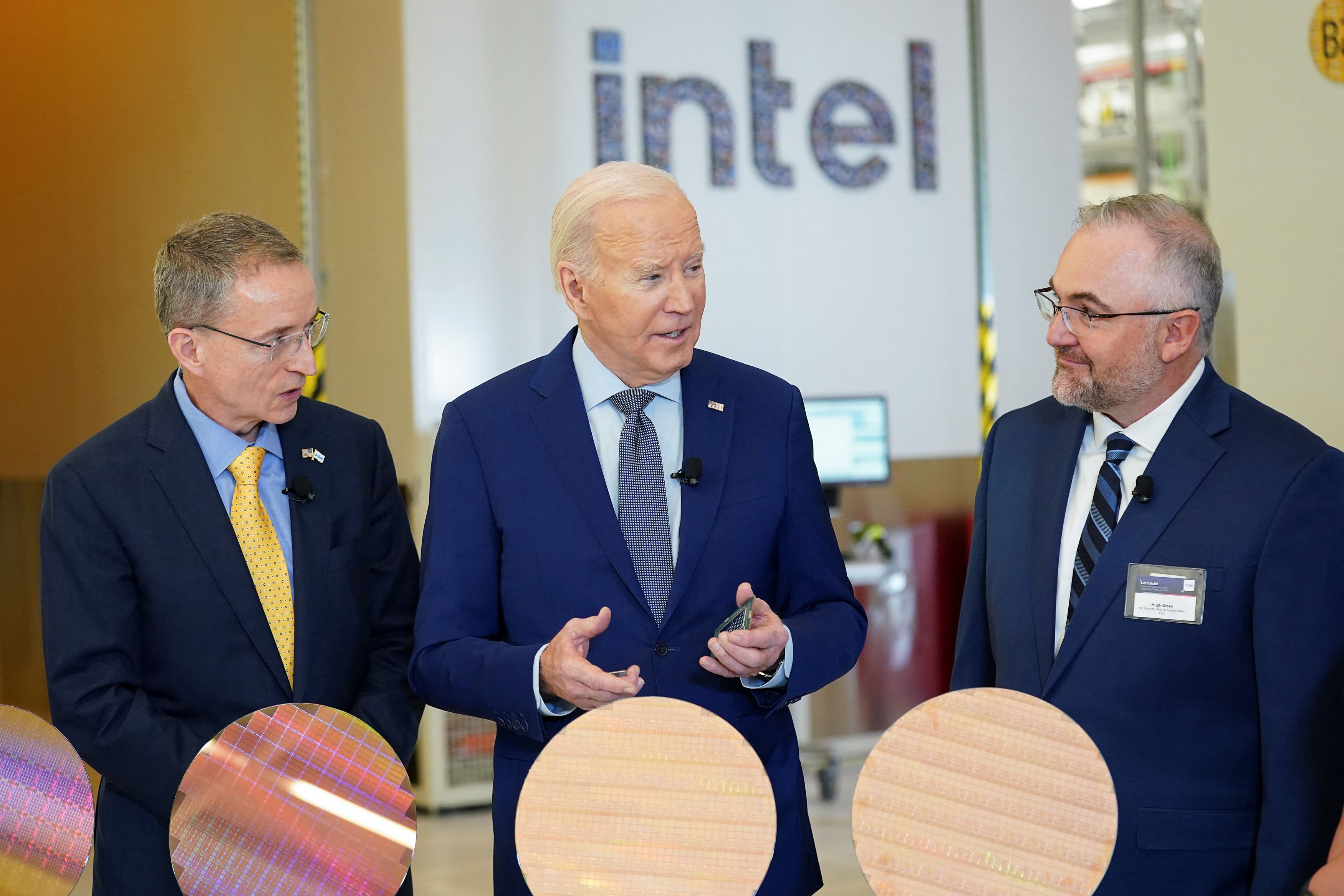

That is the primary time that Intel has disclosed income totals for its foundry industry by myself. Traditionally, Intel has each designed its personal chips in addition to carried out its personal production, and reported ultimate chip gross sales to buyers. Different American semiconductor corporations equivalent to Nvidia and AMD design their chips however ship them off to Asian foundries — regularly Taiwan’s TSMC — for production.Intel has been pitching buyers below CEO Patrick Gelsinger on a plan the place it could proceed to make its personal processors, however would additionally get started an exterior foundry industry to make chips for different corporations. Intel’s position as probably the most most effective U.S. corporations doing state of the art semiconductor production on American soil used to be a large reason it secured just about $20 billion in CHIPS and Science Act investment closing month.A lot of Intel’s foundry income these days comes from its personal operations, the chipmaker stated on Tuesday. Intel additionally restated its merchandise divisions to document its prices as though it had been a so-called “fabless” corporate that has to account for foundry as a value.Intel stated the newly arranged Merchandise department, which principally is composed of processors for PCs and servers, reported $11.3 billion in running source of revenue on $47.7 in gross sales in 2023.Intel stated on Tuesday that it anticipated its foundry’s losses to height in 2024 and sooner or later break-even “halfway” between this quarter and the top of 2030. The corporate prior to now stated that Microsoft would use its foundry products and services, and that it has $15 billion of income for foundry already booked.”Intel Foundry goes to power substantial income expansion for Intel over the years. 2024 is the trough for foundry running losses,” Gelsinger stated on a decision with buyers on Tuesday.Intel stated in a promo video that a lot of the loss of profitability for its foundry industry used to be because of the “weight of previous selections,” and one after the other, Gelsinger cited the corporate’s previous “sluggish” adoption of a era referred to as EUV, which is used to take advantage of complicated chips.

Intel stocks fall after corporate unearths $7 billion running loss in foundry industry