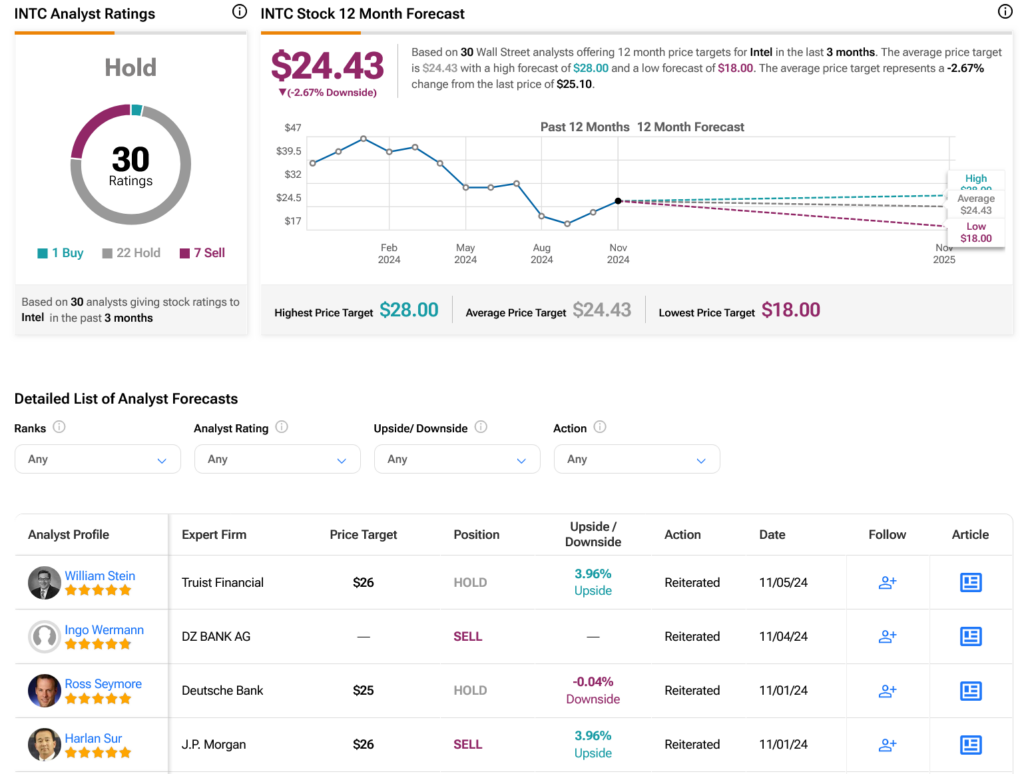

So, it is some unhealthy information for chip inventory Intel (INTC) as of late. Whilst the “Espresso Debacle” was once placed on grasp, we now be told that the Arrow Lake release “did not move as deliberate.” Worse, Intel additionally faces new festival in a box that has been out for years. That each one added as much as unhealthy information for Intel shareholders, which despatched stocks up just about 4.5% in Monday afternoon buying and selling. A record from The Verge printed that the Core Extremely 9 200S line of chips isn’t doing neatly, according to opinions. If truth be told, on a number of events, they’re dropping out on chips from Complicated Micro Units (AMD), one in all Intel’s competition. Intel knew this will be the case, and there are plans to segment out the chips quickly. There were different advantages, the record stated. On the other hand, the “complete model” that can pop out in the following few weeks must clear up the issue absolutely. Intel famous that solving this entrance is as simple as “…flashing the BIOS and converting Home windows kinda.” Sounds Like Doom Then, issues took a flip for the more severe. A record from Techradar says that none rather then Nvidia (NVDA) is ready to make a pivot and would possibly glance to leap into PC processors, a marketplace that Intel created two decades in the past. The Nvidia chips, the record, the record, is also from ARM, and is also to be had someday in 2026. We must know extra about those chips someday in 2025, which shall be controlled via Qualcomm (QCOM) dropping its contract with Arm. growing Home windows instrument processors. The sort of transfer would have compelled Intel into an already huge marketplace and left it in a nasty place going ahead. Is Intel a Purchase, Hang, or Promote? Turning to Wall Side road, analysts have a Hang consensus on INTC inventory according to Purchase, 22 Holds, and 7 Sells issued previously 3 months, as proven within the determine underneath. After a 33.7% loss in its proportion value ultimate 12 months, INTC’s moderate value of $24.43 in keeping with proportion manner 2.67% problem chance.

See extra of the INTC analyst rankings Disclosure