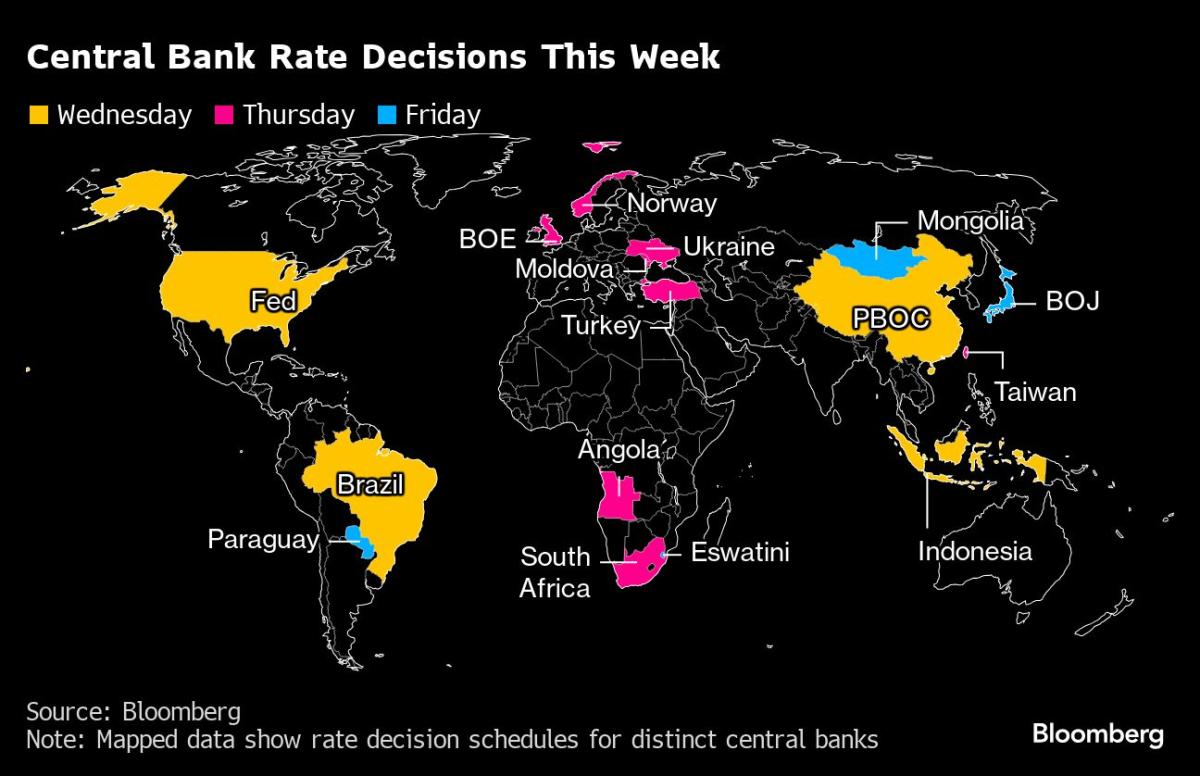

(Bloomberg) — The arena economic system’s tectonic plates will shift this week when a US easing cycle starts, simply as officers from Europe to Asia set coverage in opposition to a backdrop of brittle markets.Maximum Learn from BloombergA 36-hour financial rollercoaster will get started with the Federal Reserve’s possible choice to chop rates of interest on Wednesday, and end on Friday with the result of the Financial institution of Japan’s first assembly because it raised borrowing prices and helped sow the seeds of a world selloff.Alongside the best way, central banking friends within the Crew of 20 and past which are poised to regulate their very own coverage levers come with Brazil, the place officers would possibly tighten for the primary time in 3 1/2 years, and the Financial institution of England. The United Kingdom central financial institution faces a gentle judgment at the tempo of its balance-sheet unwind, and may additionally sign how able it’s to ease additional.South African policymakers are expected to chop borrowing prices for the primary time since 2020, whilst opposite numbers in Norway and Turkey would possibly stay them unchanged.The Fed choice will take heart degree, with jittery investors debating whether or not officers will pass judgement on a quarter-point reduce to be ok drugs for an economic system appearing indicators of shedding momentum, or whether or not they’ll go for a half-point transfer as a substitute. Clues at the Fed’s long term intentions can also be pivotal.However for all of the finish to suspense that america announcement will convey, traders are more likely to keep on edge no less than till the BOJ is completed, in a call that’s certain to be scrutinized for clues on its subsequent hike.What Bloomberg Economics Says:“We predict Fed Chair Jerome Powell helps a 50-basis level reduce. Alternatively, the loss of a transparent sign from New York Fed President John Williams prior to the pre-meeting blackout duration makes us assume Powell doesn’t have the entire committee’s improve.”—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For complete research, click on hereFocusing minds will likely be reminiscences of marketplace ructions a couple of weeks in the past amid the unwind of yen-centered bring trades after its fee build up in July.And that’s now not all: China might be within the limelight too, with a financial announcement by means of officers there expected sooner or later — days after knowledge confirmed that the arena’s second-biggest economic system is struggling indicators of spiraling deflation.Tale continuesClick right here for what came about prior to now week, and underneath is our wrap of what’s bobbing up within the world economic system.US and CanadaWhen Fed policymakers sit down down Tuesday for the beginning in their two-day assembly, they’ll have contemporary figures at the state of shopper call for. Whilst general retail gross sales in August have been most probably held again by means of slower process at auto sellers, receipts at different traders most definitely posted a wholesome advance.In spite of indicators of shopper resilience, a Fed file out the similar day is anticipated to turn lingering malaise in manufacturing unit output. Looming November elections and still-high borrowing prices are restraining capital spending.On Wednesday, executive figures are noticed appearing that housing begins firmed up remaining month after sliding in July to the bottom stage since Might 2020. Nationwide Affiliation of Realtors knowledge on Thursday will most definitely display contract closings on up to now owned house gross sales remained susceptible, despite the fact that.Canada’s inflation studying for August is more likely to display persisted deceleration in each headline and core measures. A slight uptick wouldn’t knock the Financial institution of Canada off its easing trail, on the other hand, whilst cooler-than-expected knowledge would possibly spice up requires deeper fee cuts.AsiaBOJ leader Kazuo Ueda is certain to get a large number of consideration after the board units coverage on Friday.Whilst economists are unanimous in predicting no alternate to borrowing prices, how the governor characterizes the trajectory may jolt Japan’s forex, which has already spooked yen-carry investors by means of outperforming its friends up to now this month.Somewhere else, 1-year medium-term lending and mortgage top charges in China are anticipated to be saved unchanged, and Indonesia’s central financial institution is tipped to carry its coverage fee stable for a 5th month. Government in Taiwan make a decision the bargain fee on Thursday.At the knowledge entrance, Japan’s key shopper inflation gauge is noticed ticking upper a tad in August, backing the case for the BOJ to eye a fee hike in coming months.Japan, Singapore, Indonesia and Malaysia will unlock business figures, whilst New Zealand is ready to file second-quarter knowledge that can display the economic system gotten smaller a smidgeon as opposed to the prior quarter.Europe, Center East, AfricaSeveral central financial institution choices are scheduled within the wake of the Fed’s most probably easing. Given their dependence on dollar-denominated power exports, Gulf states would possibly practice america lead mechanically with fee cuts of their very own.Right here’s a handy guide a rough roundup of alternative bulletins due in Europe, the Center East and Africa, principally on Thursday:Whilst no fee alternate is anticipated from the BOE, traders anticipate a an important judgment on whether or not it is going to boost up the wind-down of its bond portfolio to stay gilt gross sales stable prior to a 12 months when an surprisingly excessive quantity of debt matures. Hints at the tempo of long term fee cuts can also be eagerly awaited, amid hypothesis that officers will quickly ramp up easing to assist the economic system.Norges Financial institution is noticed maintaining its deposit fee at 4.5%, with analysts that specialize in any changes to projections for alleviating early subsequent 12 months. Whilst slowing inflation has larger bets on a primary reduce in December, Norwegian officers would possibly stick with their hawkish stance with the hard work marketplace powerful and the krone close to multi-year lows.Central banks in Ukraine and Moldova also are scheduled for choices.Turning south, Turkey’s central financial institution is ready to stay its key fee at 50% for a 6th immediately assembly because it waits for inflation to sluggish additional. The tempo of annual worth expansion has dropped from 75% in Might, however stays as excessive as 52%. Officers hope to get it with reference to 40% by means of year-end.With knowledge on Wednesday predicted to turn South Africa’s inflation slowed to 4.5% in August, the central financial institution would possibly reduce borrowing prices for the primary time since 2020 an afternoon later. Governor Lesetja Kganyago has stated the establishment will modify charges as soon as worth expansion is firmly on the 4.5% midpoint of its goal vary, the place it prefers to anchor expectancies. Ahead-rate agreements, used to take a position on borrowing prices, are totally pricing in a possibility of a 25-basis-point fee reduce.Angola’s choice could also be an in depth name between a hike and a dangle. Whilst inflation is easing, the forex has weakened nearly 7% since August in opposition to the greenback.On Friday, Eswatini, whose forex is pegged to South Africa’s rand, is anticipated to practice its neighbor and decrease charges.Somewhere else, feedback from Ecu Central Financial institution officers could also be scrutinized for any hints at the trail of long term easing after a moment reduce to borrowing prices. A number of governors are scheduled to look, and President Christine Lagarde will ship a speech in Washington on Friday.Different issues to observe come with euro-area shopper self assurance on Friday, and out of doors the forex zone, Swiss executive forecasts on Thursday.Turning south, knowledge on Sunday are anticipated to turn Israel’s inflation remained stable at 3.2% in August, nonetheless above the federal government’s goal of one% to a few%. The economic system is weakening, however the conflict in Gaza is inflicting supply-side constraints and executive spending is hovering, maintaining inflationary pressures excessive.In Nigeria on Monday, knowledge will most probably display inflation slowed for a moment immediately month in August, to 32.3%. That’s because the affect on costs of a forex devaluation and transient elimination of gas subsidies remaining 12 months proceed to wane.The measures have been a part of reforms presented by means of President Bola Tinubu after he took administrative center in Might 2023.Latin AmericaBrazil’s central financial institution meets in opposition to the backdrop of an overheating economic system, above-target inflation, unmoored CPI expectancies and executive fiscal largesse.Placing all of it in combination, traders and analysts be expecting to peer tighter financial coverage for first time in 3 1/2 years on Wednesday. The consensus is for a 25 basis-point hike to ten.75%, with any other 75 foundation issues of tightening to practice by means of year-end, taking the important thing fee to 11.5%.Six July financial stories from Colombia must underscore the resilience of home call for that has analysts marking up their third- and fourth-quarter expansion forecasts.The tempo of retail gross sales would possibly construct on June’s certain print, which snapped a 16-month slide, whilst the early consensus has GDP-proxy knowledge appearing a rebound in process after June’s delicate stoop.Paraguay’s fee setters meet with inflation operating somewhat above the 4% goal. Analysts surveyed by means of the central financial institution see a 25 basis-point reduce by means of year-end.After kind of 10 months of President Javier Milei’s so-called surprise treatment, this week is ready to provide some telling knowledge at the state of Argentina’s economic system.Finances knowledge would possibly display the federal government posted an 8th immediately per thirty days funds surplus in August, whilst that very same scorched-earth austerity contributed to a 3rd immediately quarterly contraction in output.–With the aid of Brian Fowler, Vince Golle, Robert Jameson, Laura Dhillon Kane, Jane Pong, Piotr Skolimowski and Monique Vanek.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

International Braces for Fed Easing Amid 36-Hour Fee Rollercoaster