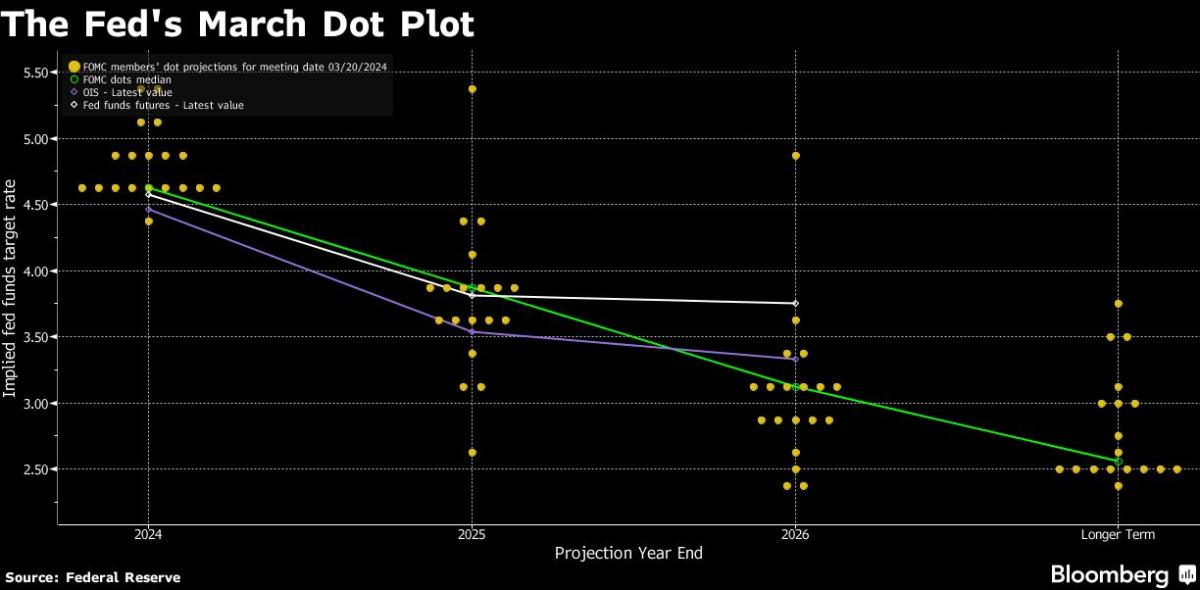

(Bloomberg) — US shares futures received and gold soared to an all-time prime as closing week’s slowing inflation information bolstered hopes that the Federal Reserve will minimize rates of interest this 12 months.Maximum Learn from BloombergS&P 500 contracts added 0.4%, whilst markets in Europe, Australia and Hong Kong have been close for the Easter vacation. Nvidia Corp., Complicated Micro Gadgets Inc. and Microsoft Corp. complex in pre-market buying and selling, pointing to a powerful open in tech shares. Gold crowned $2,265 ounce on Monday, up 1.6% from Thursday’s shut, whilst an index of the greenback inched decrease. Bitcoin slipped underneath $70,000.A cooldown within the Fed’s most popular gauge of underlying inflation closing month, coupled with a rebound in family spending, means that the bullish narrative that propelled shares to data this 12 months stays intact. The so-called core private intake expenditures value index, which strips out the risky meals and effort elements, rose 0.3% from the prior month, slowing from January’s strangely robust studying.“You could have a Fed that this present day is very information dependent,” mentioned Matthew Luzzetti, leader US economist at Deutsche Financial institution. “Till we get both affirmation or a distinct view on what the information are going to be, it’s more or less arduous to gauge precisely the place we finally end up from a Fed coverage point of view.”At an match on Friday, Fed Chair Jerome Powell repeated that the United States central financial institution isn’t in any rush to chop rates of interest as policymakers watch for extra proof that inflation is contained.Learn Extra: Bullish Shares Narrative Noticed Intact After US Inflation DataMeanwhile, Jap equities fell after a document confirmed self belief a number of the nation’s massive producers weakened rather.Tale continuesChinese shares rallied as a rebound in production job bolstered hopes that the country’s financial restoration could also be beginning to acquire traction. The benchmark CSI 300 Index rose 1.6% to steer good points in Asia. “Rising optimism about China is actual,” mentioned Vishnu Varathan, leader economist for Asia ex-Japan at Mizuho Financial institution in Singapore.Key occasions this week:US development spending, ISM Production, MondayBank of Canada problems trade outlook and survey of client expectancies, MondayEurozone S&P World Production PMI, TuesdayFrance S&P World Production PMI, TuesdayGermany S&P World / BME Production PMI, CPI, TuesdayIndia HSBC/S&P World Production PMI, TuesdayMexico world reserves, TuesdaySouth Korea CPI, TuesdaySpain unemployment, TuesdayUK S&P World / CIPS Production PMI, TuesdayUS manufacturing unit orders, mild car gross sales, JOLTS process openings, TuesdayBrazil business manufacturing, WednesdayEurozone CPI, unemployment, WednesdayHong Kong retail gross sales, WednesdayUS ISM Products and services, WednesdayEurozone S&P World Products and services PMI, PPI, ThursdayIndia services and products PMI, ThursdayUS preliminary jobless claims, industry, ThursdayEurozone retail gross sales, FridayFrance business manufacturing, FridayGermany manufacturing unit orders, FridayHong Kong PMI, FridayIndia price determination, FridayJapan family spending, FridayPhilippines CPI, FridayRussia GDP, FridaySingapore retail gross sales, FridaySouth Korea present account stability, FridayUS unemployment, nonfarm payrolls, FridaySome of the principle strikes in markets:StocksS&P 500 futures rose 0.4% as of five:31 a.m. New York timeNasdaq 100 futures rose 0.5percentFutures at the Dow Jones Business Reasonable rose 0.4percentThe MSCI International index fell 0.1percentCurrenciesThe Bloomberg Greenback Spot Index was once little changedThe euro was once little modified at $1.0787The British pound was once little modified at $1.2620The Jap yen was once little modified at 151.37 consistent with dollarCryptocurrenciesBitcoin fell 1.9% to $69,492.95Ether fell 2.4% to $3,545.44BondsThe yield on 10-year Treasuries declined one foundation level to 4.19percentGermany’s 10-year yield was once little modified at 2.30percentBritain’s 10-year yield was once little modified at 3.93percentCommoditiesWest Texas Intermediate crude was once little changedSpot gold rose 1.1% to $2,254.12 an ounceThis tale was once produced with the help of Bloomberg Automation.–With the aid of John Cheng and Aya Wagatsuma.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Inventory Futures Rally With Gold on Price Lower Hopes: Markets Wrap

/cdn.vox-cdn.com/uploads/chorus_asset/file/24007991/acastro_STK082_qualcomm_01.jpg)