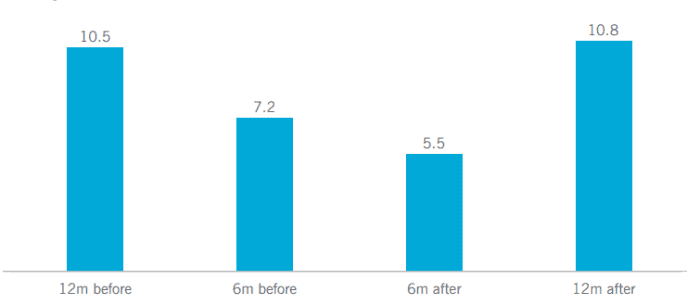

Right here’s some excellent information for traders fretting over what guarantees to be a extremely contentious 2024 U.S. presidential election: Historical past displays shares have a tendency to rally within the yr prior to Election Day.However there’s a rub, famous Saira Malik, leader funding officer at Nuveen, which has $1.2 trillion in belongings beneath control: Whilst the S&P 500

SPX

has observed a mean overall go back of round 10% in presidential election years in keeping with information going again to 1928, the large-cap benchmark had already rallied through greater than that between early November and the tip of closing yr.

In different phrases, the ones pre-election positive aspects can have already came about. “That’s more or less a captivating statistic and probably the most many causes we’re just a little bit extra fascinated by equities getting into the start of 2024,” Malik advised MarketWatch in a telephone interview.

Nuveen

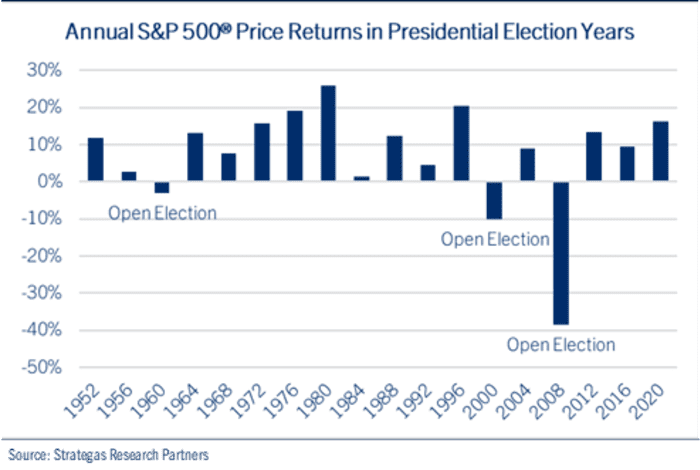

The ones different causes come with an inclination for markets to be extra unstable in election years, in addition to issues that traders are nonetheless pricing in additional rate of interest cuts than the Federal Reserve is more likely to ship, Malik stated. Additionally, shares are expensive, with the S&P 500 buying and selling at a couple of 20% top rate to its moderate valuation since 2010, she famous. Traders additionally know the 2024 election could be extremely contentious. Donald Trump heads into Tuesday’s Republican number one because the transparent front-runner for his celebration’s nomination as he seeks a November rematch with President Joe Biden. Washington Watch: New Hampshire GOP number one: Haley tries to show the tide, as Trump cruises towards the 2024 nomination Trump is campaigning amid a large number of prison woes. Trump faces fees in Washington, D.C., and Georgia’s Fulton County in election-interference circumstances and used to be indicted closing yr in a hush-money case and a classified-documents case. He has denied wrongdoing and argued the prosecutions are politically motivated, whilst repeating false claims about his 2020 election loss. Biden faces low approval scores, together with inside of his personal celebration. An ABC Information ballot this week discovered 57% of Democrats and Democrat-leaning independents can be happy with a Biden nomination, whilst 72% of Republican-aligned adults can be happy with having Trump as their celebration’s nominee. In the meantime, worries over U.S. political disorder are on the upward push. Ultimate yr’s federal debt-ceiling showdown and the following ouster of Kevin McCarthy from his submit as speaker of the Space underlined issues amongst some traders that self belief in U.S. establishments and governance used to be starting to erode. See: What U.S. political disorder method for the inventory marketplace and traders Because the election attracts close to, an an increasing number of contentious political backdrop generally is a recipe for upper marketplace volatility. A contested election outcome, may pressure that volatility even upper, Malik stated. Presidential election years additionally imply traders will have to be ready for an avalanche of charts and tables examining ancient marketplace efficiency across the quadrennial tournament. Acknowledging the “possibility of a jinx,” John Lynch, leader funding officer at Comerica Wealth Control, highlighted the only under appearing that shares have by no means posted a every year decline when an incumbent president — win or lose — ran for re-election. That incorporates 2020, when shares suffered a February-March crash caused through the onset of the COVID-19 pandemic, however quickly recovered to submit a every year achieve.

Strategas Analysis Companions

Going again to 1952, the index has suffered a every year fall in an election yr simplest thrice — 1960, 2000 and 2008. All 3 have been years have been “open” election years, with out a incumbent working for re-election, Lynch famous. Nonetheless, the efficiency of the marketplace, in so far as it displays the financial system, can also be telling a couple of candidate’s possibilities. Lynch famous that each and every president who controlled to keep away from recession within the two years prior to their re-election went directly to win a 2d time period, whilst each and every president that skilled recession in that reach ended up dropping. He famous that shares usually outperform in presidential election years when the incumbent wins. In the end, a robust financial system and marketplace most likely method voter sentiment is in the back of the sitting president. The trend in years when incumbents lose, in the meantime, has a tendency to contain a couple of selloffs, one all over the peak of number one season in early spring and every other following the celebration conventions in overdue summer season. That’s left the inventory marketplace with apparently robust predictive energy, Lynch stated. In 24 presidential elections since 1928, the course of the index has telegraphed the election end result, Lynch stated, mentioning information from Strategas. If the S&P 500 used to be sure within the 3 months main as much as the election, the incumbent or the candidate of the incumbent’s celebration gained. Of the 4 occasions the indicator used to be wrong, the index rose however the incumbent celebration’s candidate nonetheless misplaced. U.S. shares noticed a robust rally in 2023, consistent with the so-called presidential cycle that usually sees forged positive aspects within the 3rd yr of a president’s time period. Equities consolidated to start out the brand new yr, however completed closing week on a robust observe, with the S&P 500 logging its first file shut in additional than two years. See: After S&P 500’s new file top, right here’s what historical past says may occur subsequent The Dow Jones Business Moderate

DJIA

additionally logged a file shut, emerging 0.7% for the week, whilst the Nasdaq Composite

COMP

noticed a 2.3% weekly advance as tech stocks reasserted their management. The robust tech efficiency, in the meantime, might replicate issues concerning the endurance of the patron, stated Nuveen’s Malik. The company contends the combo of cyclical possibility and politically impressed volatility provides a case for taking part in protection. That incorporates that specialize in shares of dividend growers — firms that experience constantly raised their dividends over the years — in addition to international infrastructure performs that stand to peer additional advantages from tendencies favoring reshoring, nearshoring and different adjustments to offer chains. Dividend-growth and international infrastructure shares have traditionally weathered down markets rather neatly, Malik stated, emphasizing Nuveen’s issues about the possibility of a drawdown following the “remarkably robust” fairness rally observed over the general two months of 2023.