US shares headed for extra losses on Thursday as lingering considerations about higher-for-longer rates of interest and a Salesforce (CRM) sell-off put a damper on buyers’ spirits.The Dow Jones Business Reasonable (^DJI) sank 0.7%, or just about 300 issues, after losing over 400 to steer Wednesday’s inventory marketplace slide. The S&P 500 (^GSPC) fell 0.2%, whilst the tech-heavy Nasdaq Composite (^IXIC) dropped about 0.3%.Shares have misplaced steam amid renewed gloom in regards to the odds for price cuts, stoked via knowledge appearing much less cooling in inflation than the Federal Reserve desires. On the similar time, hopes that Nvidia’s (NVDA) blockbuster income would spur a broader inventory rally have been dissatisfied.That charges angst drove US bond yields this week to their best possible ranges since early Might, lifting the 10-year Treasury (^TNX) again above 4.5%. Regardless that the benchmark yield retreated on Thursday, it nonetheless held above the important thing degree buying and selling round 4.6%.Salesforce’s (CRM) effects sparked different worries about most probably losers within the AI increase. The instrument maker’s stocks slid 15% after it stated gross sales expansion will stall to the slowest in its historical past.In the meantime, the United States financial system grew at a slower tempo than to start with concept all over the primary quarter. The Bureau of Financial Research’s 2d estimate of first quarter US gross home product (GDP) confirmed the financial system grew at an annualized tempo of one.3% all over the duration, down from a primary studying of one.6% expansion in April.Learn extra: How does the hard work marketplace impact inflation?A wave of retail income ahead of the bell gave different clues to shopper resilience and financial well being. Kohl’s (KSS) stocks cratered after the dept retailer chain’s marvel quarterly loss and lower to its annual gross sales forecast. In the meantime, Very best Purchase (BBY) posted a larger drop in similar gross sales than anticipated as American citizens get picky about spending on non-essentials.Live8 updates Thu, Might 30, 2024 at 7:30 AM PDTWhite Area: Extending Trump’s tax cuts could be an ‘inflation bomb’Yahoo Finance’s Ben Wurschkul reviews:The White Home is liberating a brand new public memo to allies Thursday that seeks to hyperlink the extension of Trump-era tax cuts to inflation, a top-of-mind factor for electorate.The Republican push to increase and deepen tax cuts enacted in 2017 represents “a MAGAnomics financial schedule that will cause an ‘inflation bomb’ and lift prices for center elegance households,” White Area senior deputy press secretary Andrew Bates stated within the word being launched to newshounds and activists.The memo used to be equipped first to Yahoo Finance.Learn extra right here.

Thu, Might 30, 2024 at 7:30 AM PDTWhite Area: Extending Trump’s tax cuts could be an ‘inflation bomb’Yahoo Finance’s Ben Wurschkul reviews:The White Home is liberating a brand new public memo to allies Thursday that seeks to hyperlink the extension of Trump-era tax cuts to inflation, a top-of-mind factor for electorate.The Republican push to increase and deepen tax cuts enacted in 2017 represents “a MAGAnomics financial schedule that will cause an ‘inflation bomb’ and lift prices for center elegance households,” White Area senior deputy press secretary Andrew Bates stated within the word being launched to newshounds and activists.The memo used to be equipped first to Yahoo Finance.Learn extra right here.  Thu, Might 30, 2024 at 6:42 AM PDTNelson Peltz sells whole Disney stake after proxy struggle lossActivist investor Nelson Peltz has bought his whole Disney (DIS) stake, consistent with a supply acquainted with the subject.Peltz bought his place at a value of round $120 a proportion, which yielded a go back of about $1 billion, the supply stated.The advance, first reported via CNBC, comes after Disney effectively fended off Peltz in his quest to protected board seats on the corporate, formally finishing a extremely contested proxy struggle that plagued the leisure massive for months.Peltz were combating to protected board seats for himself and previous Disney CFO Jay Rasulo however used to be in the end unsuccessful. On the corporate’s annual shareholder assembly in early April, Disney stated the present board would stay intact following a stockholder vote that gave the corporate’s slate a win “via a considerable margin.”Disney stocks are up about 12% for the reason that get started of the yr however have fallen more or less 15% for the reason that corporate defeated Peltz in its proxy struggle.Learn extra right here.

Thu, Might 30, 2024 at 6:42 AM PDTNelson Peltz sells whole Disney stake after proxy struggle lossActivist investor Nelson Peltz has bought his whole Disney (DIS) stake, consistent with a supply acquainted with the subject.Peltz bought his place at a value of round $120 a proportion, which yielded a go back of about $1 billion, the supply stated.The advance, first reported via CNBC, comes after Disney effectively fended off Peltz in his quest to protected board seats on the corporate, formally finishing a extremely contested proxy struggle that plagued the leisure massive for months.Peltz were combating to protected board seats for himself and previous Disney CFO Jay Rasulo however used to be in the end unsuccessful. On the corporate’s annual shareholder assembly in early April, Disney stated the present board would stay intact following a stockholder vote that gave the corporate’s slate a win “via a considerable margin.”Disney stocks are up about 12% for the reason that get started of the yr however have fallen more or less 15% for the reason that corporate defeated Peltz in its proxy struggle.Learn extra right here.

Nelson Peltz founding spouse of Trian Fund Control LP. talk on the WSJD Reside convention in Laguna Seashore, California October 25, 2016. REUTERS/Mike Blake (REUTERS / Reuters)

Nelson Peltz founding spouse of Trian Fund Control LP. talk on the WSJD Reside convention in Laguna Seashore, California October 25, 2016. REUTERS/Mike Blake (REUTERS / Reuters) Thu, Might 30, 2024 at 6:32 AM PDTDow slides 300 issues as Salesforce inventory tanks 18p.cThe Dow Jones Business Reasonable (^DJI) fell about 300 issues on the open, weighed via stocks of Salesforce (CRM).The blue-chip index fell Thursday after losing 400 issues within the prior consultation. The S&P 500 (^GSPC) diminished 0.3%, whilst the tech-heavy Nasdaq Composite (^IXIC) additionally slipped 0.4%.Salesforce inventory tumbled up to 18% on the open after the cloud-based instrument corporate ignored on 2d quarter steering, elevating considerations over the macro setting and pushing out deal signings.Hovering stocks of AI chip darling Nvidia’s (NVDA) have not been ready to raise the whole markets. Rising considerations of upper for longer rates of interest amid bumpy inflation reads have put a lid on contemporary rallies.The bond marketplace has struggled because the 10-year Treasury (^TNX) moved again above 4.5%, placing drive on shares.

Thu, Might 30, 2024 at 6:32 AM PDTDow slides 300 issues as Salesforce inventory tanks 18p.cThe Dow Jones Business Reasonable (^DJI) fell about 300 issues on the open, weighed via stocks of Salesforce (CRM).The blue-chip index fell Thursday after losing 400 issues within the prior consultation. The S&P 500 (^GSPC) diminished 0.3%, whilst the tech-heavy Nasdaq Composite (^IXIC) additionally slipped 0.4%.Salesforce inventory tumbled up to 18% on the open after the cloud-based instrument corporate ignored on 2d quarter steering, elevating considerations over the macro setting and pushing out deal signings.Hovering stocks of AI chip darling Nvidia’s (NVDA) have not been ready to raise the whole markets. Rising considerations of upper for longer rates of interest amid bumpy inflation reads have put a lid on contemporary rallies.The bond marketplace has struggled because the 10-year Treasury (^TNX) moved again above 4.5%, placing drive on shares. Thu, Might 30, 2024 at 5:39 AM PDTGDP: US financial system grew slower than to start with concept in Q1 The USA financial system grew at a slower tempo than to start with concept all over the primary quarter.The Bureau of Financial Research’s 2d estimate of first quarter US gross home product (GDP) confirmed the financial system grew at an annualized tempo of one.3% all over the duration, down from a primary studying of one.6% expansion in April. However it used to be in keeping with the decline from the primary studying that economists had anticipated. First quarter GDP in 2024 got here in considerably not up to fourth quarter GDP, which used to be revised as much as 3.4%.The replace to the primary quarter expansion metric “basically mirrored a downward revision to shopper spending,” according to the BEA. Non-public intake within the first quarter grew at 2%, down from a previous studying of two.5%.The cushy GDP comes at a time when markets had been delicate to any readings that the financial system is also operating too sizzling for the Federal Reserve’s liking, as inflation has proved stickier than anticipated.Particularly, even though, many forecasters do not see the primary quarter financial expansion slowdown as the beginning of a broader development. Goldman Sachs entered Thursday’s studying anticipating 3.2% annualized expansion in the second one quarter. In the meantime, the Atlanta Fed’s GDPNow forecaster is these days projecting 3.5% annualized expansion within the first quarter.Financial institution of The us US economist Michael Gapen, wrote in a word to shoppers closing Friday that his group anticipated a downward revision to first quarter GDP however that did not function a reason for fear for financial expansion transferring ahead.”The hot button is that the financial system moderated quite within the first quarter, however it stays on a strong footing total,” Gapen wrote on Friday.

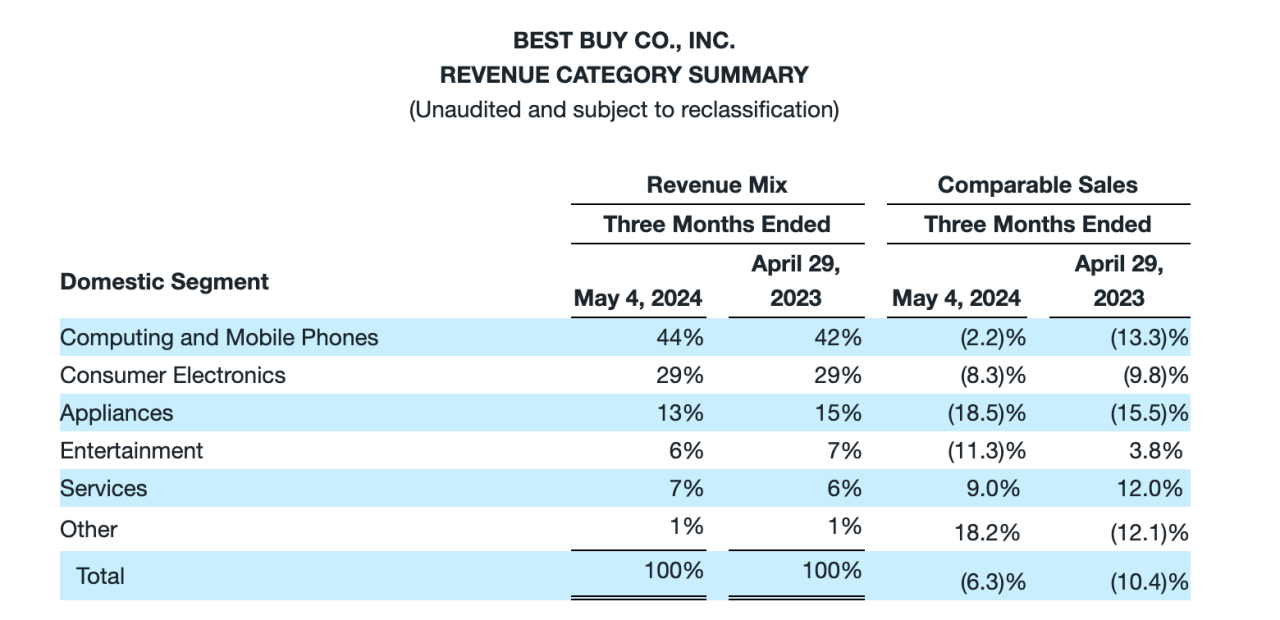

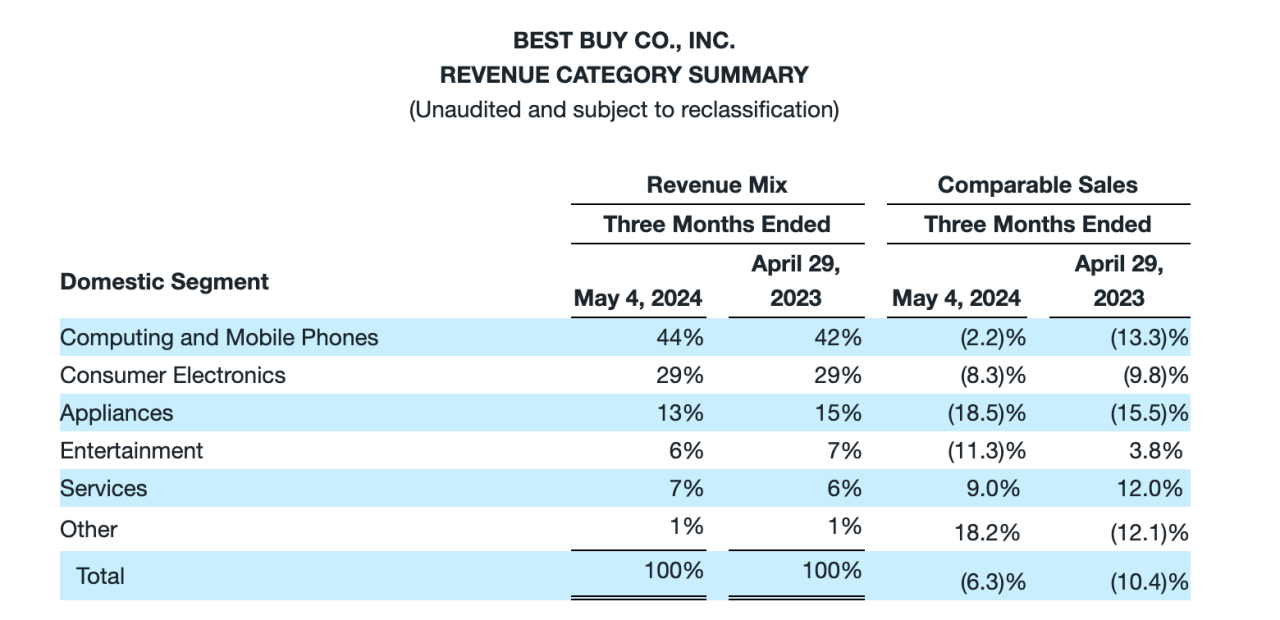

Thu, Might 30, 2024 at 5:39 AM PDTGDP: US financial system grew slower than to start with concept in Q1 The USA financial system grew at a slower tempo than to start with concept all over the primary quarter.The Bureau of Financial Research’s 2d estimate of first quarter US gross home product (GDP) confirmed the financial system grew at an annualized tempo of one.3% all over the duration, down from a primary studying of one.6% expansion in April. However it used to be in keeping with the decline from the primary studying that economists had anticipated. First quarter GDP in 2024 got here in considerably not up to fourth quarter GDP, which used to be revised as much as 3.4%.The replace to the primary quarter expansion metric “basically mirrored a downward revision to shopper spending,” according to the BEA. Non-public intake within the first quarter grew at 2%, down from a previous studying of two.5%.The cushy GDP comes at a time when markets had been delicate to any readings that the financial system is also operating too sizzling for the Federal Reserve’s liking, as inflation has proved stickier than anticipated.Particularly, even though, many forecasters do not see the primary quarter financial expansion slowdown as the beginning of a broader development. Goldman Sachs entered Thursday’s studying anticipating 3.2% annualized expansion in the second one quarter. In the meantime, the Atlanta Fed’s GDPNow forecaster is these days projecting 3.5% annualized expansion within the first quarter.Financial institution of The us US economist Michael Gapen, wrote in a word to shoppers closing Friday that his group anticipated a downward revision to first quarter GDP however that did not function a reason for fear for financial expansion transferring ahead.”The hot button is that the financial system moderated quite within the first quarter, however it stays on a strong footing total,” Gapen wrote on Friday. Thu, Might 30, 2024 at 5:22 AM PDTTerrible quarter from Very best BuyYahoo Finance senior reporter Brooke DiPalma has the entire numbers you wish to have at the Very best Purchase (BBY) quarter right here.I might identical to so as to add this quarter from Very best Purchase truly stunk, once more.The gross sales declines are piling up for the corporate, making me ponder whether there are structural issues that the industry cannot conquer. Gross sales drive has now continued for 2 years or so. I’m additionally questioning if there must be contemporary eyes in th C-suite after this coming vacation buying groceries season.

Thu, Might 30, 2024 at 5:22 AM PDTTerrible quarter from Very best BuyYahoo Finance senior reporter Brooke DiPalma has the entire numbers you wish to have at the Very best Purchase (BBY) quarter right here.I might identical to so as to add this quarter from Very best Purchase truly stunk, once more.The gross sales declines are piling up for the corporate, making me ponder whether there are structural issues that the industry cannot conquer. Gross sales drive has now continued for 2 years or so. I’m additionally questioning if there must be contemporary eyes in th C-suite after this coming vacation buying groceries season.

The harsh gross sales quarters for Very best Purchase proceed. (Very best Purchase)

The harsh gross sales quarters for Very best Purchase proceed. (Very best Purchase) Thu, Might 30, 2024 at 2:21 AM PDTFolo up: ChewyChewy (CHWY) discovered its means into those reside weblog pages on Wednesday, and deservedly so.Stocks exploded 27% at the again of a higher than anticipated quarter (stocks are down fairly within the pre-market as of late). The reaction stuck me somewhat via marvel, as the corporate’s intently watched energetic shoppers metric fell once more yr over yr. If truth be told, the decline sped up as opposed to the drop observed within the previous quarter.Nonetheless, the Boulevard consumed the corporate’s margin growth and observation on an making improvements to call for setting.We stuck up with Chewy CEO Sumit Singh in an in depth interview on Yahoo Finance Reside (complete watch beneath), the place he echoed that development within the call for backdrop.I discovered attention-grabbing the corporate seems all-in on opening vet clinics. It now has 4 in operation that opened within the first quarter, with every other 4 at the means via yr finish.The corporate is easily at the back of Mars, which operates 1000’s of vets (it’s been a consolidator within the house, purchasing family-run practices). However there’s a window of alternative right here for Chewy to supply a greater care setting that hyperlinks to the services and products and merchandise it sells on-line.Additionally one thing to look at: the corporate has begun exams on a paid club program.

Thu, Might 30, 2024 at 2:21 AM PDTFolo up: ChewyChewy (CHWY) discovered its means into those reside weblog pages on Wednesday, and deservedly so.Stocks exploded 27% at the again of a higher than anticipated quarter (stocks are down fairly within the pre-market as of late). The reaction stuck me somewhat via marvel, as the corporate’s intently watched energetic shoppers metric fell once more yr over yr. If truth be told, the decline sped up as opposed to the drop observed within the previous quarter.Nonetheless, the Boulevard consumed the corporate’s margin growth and observation on an making improvements to call for setting.We stuck up with Chewy CEO Sumit Singh in an in depth interview on Yahoo Finance Reside (complete watch beneath), the place he echoed that development within the call for backdrop.I discovered attention-grabbing the corporate seems all-in on opening vet clinics. It now has 4 in operation that opened within the first quarter, with every other 4 at the means via yr finish.The corporate is easily at the back of Mars, which operates 1000’s of vets (it’s been a consolidator within the house, purchasing family-run practices). However there’s a window of alternative right here for Chewy to supply a greater care setting that hyperlinks to the services and products and merchandise it sells on-line.Additionally one thing to look at: the corporate has begun exams on a paid club program. Thu, Might 30, 2024 at 2:11 AM PDTTrend watch: PC call for cycleHP Inc. (HPQ) stocks are getting a three% bump pre-market after a greater than anticipated quarter closing night time.Out of the whole lot I mentioned with HP CEO Enrique Lores (complete interview beneath) following the consequences, it used to be his name out of businesses upgrading computer systems forward of the pulling of fortify for Home windows 10 that left an affect. Apparently the race is on to switch computer systems forward of that second in October 2025.The creation of HP’s first crop of AI PCs this month to the marketplace is most probably additional put fuel on that improve cycle.”We proceed to assume HPQ stays neatly located to get pleasure from the PC upcycle, which will have to simplest boost up in the second one part and in FY25,” EvercoreISI analyst Amit Daryanani wrote in a consumer word this morning.

Thu, Might 30, 2024 at 2:11 AM PDTTrend watch: PC call for cycleHP Inc. (HPQ) stocks are getting a three% bump pre-market after a greater than anticipated quarter closing night time.Out of the whole lot I mentioned with HP CEO Enrique Lores (complete interview beneath) following the consequences, it used to be his name out of businesses upgrading computer systems forward of the pulling of fortify for Home windows 10 that left an affect. Apparently the race is on to switch computer systems forward of that second in October 2025.The creation of HP’s first crop of AI PCs this month to the marketplace is most probably additional put fuel on that improve cycle.”We proceed to assume HPQ stays neatly located to get pleasure from the PC upcycle, which will have to simplest boost up in the second one part and in FY25,” EvercoreISI analyst Amit Daryanani wrote in a consumer word this morning. Thu, Might 30, 2024 at 2:05 AM PDTSalesforce crashingSalesforce inventory (CRM) is getting hammered premarket to the track of 16%.The sell-off is warranted.Salesforce ignored on its key efficiency tasks metric, appearing 10% expansion as opposed to estimates for 11%. The convention name used to be affected by considerations in regards to the macro setting, which is pushing out deal signings.2nd quarter steering in need of consensus displays those considerations (optimistically for control’s sake).”Regardless that Q1 has been constantly weaker for instrument, magnitude of the omit might recommend extra idiosyncratic problems (seat-exposure, down-sells, festival) which might proceed to weigh at the industry in the second one quarter, particularly with FY25 income now taking a look competitive (implying 2d part acceleration vs. 2Q),” Citi analyst Tyler Radke wrote in a consumer word. “Valuation is undemanding at 20x EPS, 18x endeavor price/loose money float (on FY25 estimates), however with slowing expansion, loss of de-risked estimates and extra energetic M&A we’re comfy at the sidelines anticipating making improvements to expansion or extra proof of Knowledge Cloud/GenAI momentum/monetization.”All in all, a stunning quarter from Salesforce that wasn’t telegraphed. The inventory is prone to keep within the penalty field till indicators of a extra strong macro backdrop emerge.

Thu, Might 30, 2024 at 2:05 AM PDTSalesforce crashingSalesforce inventory (CRM) is getting hammered premarket to the track of 16%.The sell-off is warranted.Salesforce ignored on its key efficiency tasks metric, appearing 10% expansion as opposed to estimates for 11%. The convention name used to be affected by considerations in regards to the macro setting, which is pushing out deal signings.2nd quarter steering in need of consensus displays those considerations (optimistically for control’s sake).”Regardless that Q1 has been constantly weaker for instrument, magnitude of the omit might recommend extra idiosyncratic problems (seat-exposure, down-sells, festival) which might proceed to weigh at the industry in the second one quarter, particularly with FY25 income now taking a look competitive (implying 2d part acceleration vs. 2Q),” Citi analyst Tyler Radke wrote in a consumer word. “Valuation is undemanding at 20x EPS, 18x endeavor price/loose money float (on FY25 estimates), however with slowing expansion, loss of de-risked estimates and extra energetic M&A we’re comfy at the sidelines anticipating making improvements to expansion or extra proof of Knowledge Cloud/GenAI momentum/monetization.”All in all, a stunning quarter from Salesforce that wasn’t telegraphed. The inventory is prone to keep within the penalty field till indicators of a extra strong macro backdrop emerge.

Nelson Peltz founding spouse of Trian Fund Control LP. talk on the WSJD Reside convention in Laguna Seashore, California October 25, 2016. REUTERS/Mike Blake (REUTERS / Reuters)

The harsh gross sales quarters for Very best Purchase proceed. (Very best Purchase)