Tech shares led a combined day for markets on Tuesday as buyers digested new information on task openings and absorbed a contemporary wave of income, with Alphabet (GOOG, GOOGL) kicking off the Giant Tech giants after the marketplace shut. Stocks of Alphabet moved round 4% upper in after-hours buying and selling after the corporate beat 3rd quarter income expectancies on each the highest and backside traces whilst its cloud companies endured to make bigger. The Google dad or mum is the primary of 5 “Magnificent Seven” megacaps because of record over the following 3 days, with the effects observed as using the path of shares to kick off November. Previous to Alphabet’s income, the tech-heavy Nasdaq Composite (^IXIC) closed Tuesday’s consultation at a file prime. The index jumped about 0.8%, buoyed by means of Broadcom (AVGO), which received over 4% on experiences it plans to paintings with Microsoft-aligned OpenAI (MSFT) to broaden a brand new synthetic intelligence chip. The benchmark S&P 500 (^GSPC) adopted the Nasdaq’s lead, emerging round 0.2% after first of all opening the day decrease. The Dow Jones Business Reasonable (^DJI) was once the one main index to near within the crimson, falling round 0.4%, or simply over 150 issues. New information from the Bureau of Hard work Statistics launched Tuesday confirmed there have been 7.44 million jobs open on the finish of September, a lower from the 7.86 million observed in August. August’s determine was once revised decrease from the 8.04 million open jobs first of all reported. Traders had been carefully gazing for indicators of additional cooling within the hard work marketplace forward of the Federal Reserve’s subsequent rate of interest choice on Nov. 7. Updates on inflation and the roles marketplace later within the week can be key in figuring out Fed coverage. Within the interim, income are at the leading edge of what is shaping as much as be a the most important week for markets. McDonald’s (MCD), PayPal (PYPL), and Pfizer (PFE) all reported effects earlier than the bell on Tuesday, whilst AMD (AMD), Chipotle (CMG), and Visa (V) reported along Alphabet after the marketplace shut. Learn extra: What the Fed charge lower manner for financial institution accounts, CDs, loans, and bank cards In the meantime, america presidential election is injecting some uncertainty into markets within the ultimate fierce days of campaigning. Trump Media & Era Staff inventory (DJT) received double digits following a temporary buying and selling halt previous within the consultation. Stocks constructed on Monday’s 21% achieve following Donald Trump’s weekend rally in New York. LIVE COVERAGE IS OVER 19 updates  Tue, October 29, 2024 at 8:33 PM UTC Income roundup: AMD, Visa, Chipotle Out of doors of Alphabet (GOOG, GOOGL), listed here are any other shares at the transfer in after-hours buying and selling. AMD (AMD): The inventory dropped 6% after steering got here in softer than anticipated. The corporate expects income for the present quarter to return in between $7.2 billion and $7.8 billion, in comparison to the $7.6 billion analysts had anticipated. Q3 income crowned estimates of $6.7 billion to achieve $6.8 billion, whilst adjusted income met expectancies at $0.92. Visa (V): Stocks rose about 2% after This autumn income beat expectancies of $9.5 billion to achieve $9.6 billion. Income additionally beat estimates of $2.58 to hit $2.71. Chipotle (CMG): Stocks fell 6% after Q3 similar gross sales overlooked estimates. Identical-store gross sales grew 6% in comparison to the 6.4% analysts had expected. Adjusted income of $0.27 got here in quite upper than the $0.25 that was once anticipated, whilst income of $2.8 billion met expectancies.

Tue, October 29, 2024 at 8:33 PM UTC Income roundup: AMD, Visa, Chipotle Out of doors of Alphabet (GOOG, GOOGL), listed here are any other shares at the transfer in after-hours buying and selling. AMD (AMD): The inventory dropped 6% after steering got here in softer than anticipated. The corporate expects income for the present quarter to return in between $7.2 billion and $7.8 billion, in comparison to the $7.6 billion analysts had anticipated. Q3 income crowned estimates of $6.7 billion to achieve $6.8 billion, whilst adjusted income met expectancies at $0.92. Visa (V): Stocks rose about 2% after This autumn income beat expectancies of $9.5 billion to achieve $9.6 billion. Income additionally beat estimates of $2.58 to hit $2.71. Chipotle (CMG): Stocks fell 6% after Q3 similar gross sales overlooked estimates. Identical-store gross sales grew 6% in comparison to the 6.4% analysts had expected. Adjusted income of $0.27 got here in quite upper than the $0.25 that was once anticipated, whilst income of $2.8 billion met expectancies.  Tue, October 29, 2024 at 8:16 PM UTC Alphabet rises on cast Q3 effects Stocks of Google dad or mum Alphabet (GOOG, GOOGL) rose over 4% in after-hours buying and selling at the heels of its Q3 income record. Yahoo Finance’s Hamza Shaban has the main points: Google dad or mum Alphabet (GOOG, GOOGL) reported fiscal 3rd quarter income after the bell on Tuesday that beat analysts’ estimates at the best and backside traces as its cloud companies proceed to make bigger, kicking off Giant Tech income with a powerful appearing. The quest massive reported income according to percentage of $2.12 on income of $88.27 billion. Analysts had been expecting income according to percentage of $1.83 on income of $86.44 billion, in line with information compiled by means of Bloomberg. Promoting income crowned $65.85 billion as opposed to analysts’ expectancies of $65.5 billion, up from the year-ago length’s $59.65 billion. Right here’s what Alphabet reported for a few of its most vital metrics within the fiscal 3rd quarter, in line with Bloomberg information:

Tue, October 29, 2024 at 8:16 PM UTC Alphabet rises on cast Q3 effects Stocks of Google dad or mum Alphabet (GOOG, GOOGL) rose over 4% in after-hours buying and selling at the heels of its Q3 income record. Yahoo Finance’s Hamza Shaban has the main points: Google dad or mum Alphabet (GOOG, GOOGL) reported fiscal 3rd quarter income after the bell on Tuesday that beat analysts’ estimates at the best and backside traces as its cloud companies proceed to make bigger, kicking off Giant Tech income with a powerful appearing. The quest massive reported income according to percentage of $2.12 on income of $88.27 billion. Analysts had been expecting income according to percentage of $1.83 on income of $86.44 billion, in line with information compiled by means of Bloomberg. Promoting income crowned $65.85 billion as opposed to analysts’ expectancies of $65.5 billion, up from the year-ago length’s $59.65 billion. Right here’s what Alphabet reported for a few of its most vital metrics within the fiscal 3rd quarter, in line with Bloomberg information:  Tue, October 29, 2024 at 8:05 PM UTC Nasdaq secures file shut Tech shares led a combined day for markets on Tuesday, with the tech-heavy Nasdaq Composite (^IXIC) last at a file prime, leaping about 0.8%. The benchmark S&P 500 (^GSPC) rose round 0.2%, whilst the Dow Jones Business Reasonable (^DJI) was once the one main index to near within the crimson, falling round 0.4%, or simply over 150 issues.

Tue, October 29, 2024 at 8:05 PM UTC Nasdaq secures file shut Tech shares led a combined day for markets on Tuesday, with the tech-heavy Nasdaq Composite (^IXIC) last at a file prime, leaping about 0.8%. The benchmark S&P 500 (^GSPC) rose round 0.2%, whilst the Dow Jones Business Reasonable (^DJI) was once the one main index to near within the crimson, falling round 0.4%, or simply over 150 issues.  Tue, October 29, 2024 at 7:28 PM UTC Alphabet is about to record income. Here is what to grasp. Yahoo Finance’s Hamza Shaban experiences: Alphabet (GOOG, GOOGL) is about to unlock quarterly effects after the bell on Tuesday, kicking off a large income week for US tech giants after a wobbly run on Wall Side road. The corporate is predicted to supply updates on its efforts to show huge synthetic intelligence investments into new income streams and its place within the huge virtual advert marketplace. Right here’s what Wall Side road is anticipating for a few of Alphabet’s most vital metrics within the corporate’s fiscal 3rd quarter, in line with Bloomberg information: Ultimate yr, Google was once broadly observed as taking part in catch-up to Microsoft (MSFT), which was once some of the first within the tech international to harvest the cultural pleasure round shopper AI chatbots. However within the quarters since, Google has tried to advance its personal management place. Previous this month, Alphabet CEO Sundar Pichai despatched a observe to staff outlining some other inner reorganization that shifted body of workers to prioritize AI building. Learn extra right here.

Tue, October 29, 2024 at 7:28 PM UTC Alphabet is about to record income. Here is what to grasp. Yahoo Finance’s Hamza Shaban experiences: Alphabet (GOOG, GOOGL) is about to unlock quarterly effects after the bell on Tuesday, kicking off a large income week for US tech giants after a wobbly run on Wall Side road. The corporate is predicted to supply updates on its efforts to show huge synthetic intelligence investments into new income streams and its place within the huge virtual advert marketplace. Right here’s what Wall Side road is anticipating for a few of Alphabet’s most vital metrics within the corporate’s fiscal 3rd quarter, in line with Bloomberg information: Ultimate yr, Google was once broadly observed as taking part in catch-up to Microsoft (MSFT), which was once some of the first within the tech international to harvest the cultural pleasure round shopper AI chatbots. However within the quarters since, Google has tried to advance its personal management place. Previous this month, Alphabet CEO Sundar Pichai despatched a observe to staff outlining some other inner reorganization that shifted body of workers to prioritize AI building. Learn extra right here.  Tue, October 29, 2024 at 7:10 PM UTC Gold touches new prime, silver surges as metals ‘momentum’ builds Gold climbed to a brand new prime on Tuesday whilst silver additionally rallied as buyers went lengthy on metals amid US election uncertainty and Wall Side road’s expectancies of decrease rates of interest. Gold futures (GC=F) rose up to 0.8% to hover close to highs of $2,770 according to ounce whilst spot gold inched to a file north of $2,759. Silver futures (SI=F) received greater than 1% to best $34.50 according to ounce, ranges no longer observed in over a decade. “It is very transparent that they have [gold and silver] skilled a prime level of momentum in contemporary weeks and months,” Chris Vecchio, international co-head of macro at buying and selling platform Tastylive, instructed Yahoo Finance. “We’re in point of fact within the early innings nonetheless of a multiyear shift in opposition to valuable metals,” he added. Learn extra right here.

Tue, October 29, 2024 at 7:10 PM UTC Gold touches new prime, silver surges as metals ‘momentum’ builds Gold climbed to a brand new prime on Tuesday whilst silver additionally rallied as buyers went lengthy on metals amid US election uncertainty and Wall Side road’s expectancies of decrease rates of interest. Gold futures (GC=F) rose up to 0.8% to hover close to highs of $2,770 according to ounce whilst spot gold inched to a file north of $2,759. Silver futures (SI=F) received greater than 1% to best $34.50 according to ounce, ranges no longer observed in over a decade. “It is very transparent that they have [gold and silver] skilled a prime level of momentum in contemporary weeks and months,” Chris Vecchio, international co-head of macro at buying and selling platform Tastylive, instructed Yahoo Finance. “We’re in point of fact within the early innings nonetheless of a multiyear shift in opposition to valuable metals,” he added. Learn extra right here.  Tue, October 29, 2024 at 6:47 PM UTC Spotify reaches all-time prime Tune to Spotify’s ears: The inventory has reached some other all-time prime. The corporate received over 3% Tuesday to industry at round $395 a percentage. It is heading in the right direction to near at a file prime. Spotify has had relatively the comeback tale. It spent $1 billion pushing into the podcast marketplace over the last 4 years with splashy A-list offers and $400 million-plus studio acquisitions. That spending took a vital chew out of gross margins and weighed closely on profitability. After its inventory plunged in 2022, the audio massive pledged to beef up its profitability starting in 2023 on a gross margin and running source of revenue foundation. It has since delivered on the ones guarantees. The inventory has surged because of this, with stocks gaining greater than 110% for the reason that get started of the yr and up about 150% on a once a year foundation. Wells Fargo (WFC) lately named Spotify a best select, keeping up an Obese score and elevating its worth goal on stocks to $470 from the prior $420.

Tue, October 29, 2024 at 6:47 PM UTC Spotify reaches all-time prime Tune to Spotify’s ears: The inventory has reached some other all-time prime. The corporate received over 3% Tuesday to industry at round $395 a percentage. It is heading in the right direction to near at a file prime. Spotify has had relatively the comeback tale. It spent $1 billion pushing into the podcast marketplace over the last 4 years with splashy A-list offers and $400 million-plus studio acquisitions. That spending took a vital chew out of gross margins and weighed closely on profitability. After its inventory plunged in 2022, the audio massive pledged to beef up its profitability starting in 2023 on a gross margin and running source of revenue foundation. It has since delivered on the ones guarantees. The inventory has surged because of this, with stocks gaining greater than 110% for the reason that get started of the yr and up about 150% on a once a year foundation. Wells Fargo (WFC) lately named Spotify a best select, keeping up an Obese score and elevating its worth goal on stocks to $470 from the prior $420.  Tue, October 29, 2024 at 6:35 PM UTC Broadcom jumps on record its teaming up with OpenAI Broadcom inventory (AVGO) jumped up to 4% following experiences that Microsoft’s OpenAI (MSFT) is becoming a member of forces with the chipmaker and contract producer Taiwan Semiconductor Production Co. to broaden its first in-house chip, which is able to fortify OpenAI’s synthetic intelligence programs. In line with Reuters, OpenAI, the corporate in the back of ChatGPT, nonetheless plans to make use of Nvidia (NVDA) and AMD (AMD) chips to meet call for. However the information underscores the frenzy to search out possible choices to Nvidia, which has ruled the chip area in recent times. Broadcom, a best 10 inventory within the S&P 500 (^GSPC), helped push the index upper in afternoon buying and selling.

Tue, October 29, 2024 at 6:35 PM UTC Broadcom jumps on record its teaming up with OpenAI Broadcom inventory (AVGO) jumped up to 4% following experiences that Microsoft’s OpenAI (MSFT) is becoming a member of forces with the chipmaker and contract producer Taiwan Semiconductor Production Co. to broaden its first in-house chip, which is able to fortify OpenAI’s synthetic intelligence programs. In line with Reuters, OpenAI, the corporate in the back of ChatGPT, nonetheless plans to make use of Nvidia (NVDA) and AMD (AMD) chips to meet call for. However the information underscores the frenzy to search out possible choices to Nvidia, which has ruled the chip area in recent times. Broadcom, a best 10 inventory within the S&P 500 (^GSPC), helped push the index upper in afternoon buying and selling.  Tue, October 29, 2024 at 6:00 PM UTC Homebuyers ‘take a pause’ amid loan charge swings, election uncertainty, builder says Consumers are hitting the pause button amid upper loan charges and election uncertainty, in line with the biggest US homebuilder. “I do not believe this can be a structural factor with call for. There is simply a large number of noise out there as of late. The velocity of volatility we have observed, mixed with the election information that is in the market, I simply assume we are seeing other folks take a pause,” Paul Romanowski, CEO of DR Horton (DHI), instructed analysts and buyers at the corporate’s fourth quarter income name Tuesday morning. The corporate stated it expects to near 90,000 to 92,000 house gross sales all the way through its 2025 fiscal yr, less than the consensus estimate of 94,653, according to Bloomberg information. DHI expects income of $36 billion to $37.5 billion for the yr, underneath analyst estimates of $38.65 billion. The forecast despatched DHI inventory down greater than 9%. DHI additionally overlooked analyst estimates on EPS and income in This autumn within the 3 months finishing September. Loan charges began to transport decrease in September because the Federal Reserve lower its benchmark charge by means of part a proportion level. Alternatively, loan charges lately had been emerging as buyers think again their expectancies on how aggressively the Fed will lower rates of interest.

Tue, October 29, 2024 at 6:00 PM UTC Homebuyers ‘take a pause’ amid loan charge swings, election uncertainty, builder says Consumers are hitting the pause button amid upper loan charges and election uncertainty, in line with the biggest US homebuilder. “I do not believe this can be a structural factor with call for. There is simply a large number of noise out there as of late. The velocity of volatility we have observed, mixed with the election information that is in the market, I simply assume we are seeing other folks take a pause,” Paul Romanowski, CEO of DR Horton (DHI), instructed analysts and buyers at the corporate’s fourth quarter income name Tuesday morning. The corporate stated it expects to near 90,000 to 92,000 house gross sales all the way through its 2025 fiscal yr, less than the consensus estimate of 94,653, according to Bloomberg information. DHI expects income of $36 billion to $37.5 billion for the yr, underneath analyst estimates of $38.65 billion. The forecast despatched DHI inventory down greater than 9%. DHI additionally overlooked analyst estimates on EPS and income in This autumn within the 3 months finishing September. Loan charges began to transport decrease in September because the Federal Reserve lower its benchmark charge by means of part a proportion level. Alternatively, loan charges lately had been emerging as buyers think again their expectancies on how aggressively the Fed will lower rates of interest.  Tue, October 29, 2024 at 5:15 PM UTC Fewer American citizens see a recession within the subsequent three hundred and sixty five days Client self belief shot upper in October, hitting a studying of 108.7, up from 99.2 in September. This marked the biggest per month achieve in self belief since March 2021, according to the Convention Board. Economists surveyed by means of Bloomberg had anticipated shopper self belief to fall to 98.7 in October. The huge uptick in self belief got here as customers digest contemporary indicators that america economic system stays on cast footing. Shoppers’ perceived chance of a US recession over the following yr hit the bottom degree for the reason that Convention Board started asking the query in June 2022. In October, not up to 65% of respondents stated a recession within the subsequent three hundred and sixty five days was once “moderately or very most likely,” down from the greater than 66% observed in September.

Tue, October 29, 2024 at 5:15 PM UTC Fewer American citizens see a recession within the subsequent three hundred and sixty five days Client self belief shot upper in October, hitting a studying of 108.7, up from 99.2 in September. This marked the biggest per month achieve in self belief since March 2021, according to the Convention Board. Economists surveyed by means of Bloomberg had anticipated shopper self belief to fall to 98.7 in October. The huge uptick in self belief got here as customers digest contemporary indicators that america economic system stays on cast footing. Shoppers’ perceived chance of a US recession over the following yr hit the bottom degree for the reason that Convention Board started asking the query in June 2022. In October, not up to 65% of respondents stated a recession within the subsequent three hundred and sixty five days was once “moderately or very most likely,” down from the greater than 66% observed in September.  Tue, October 29, 2024 at 4:26 PM UTC Sector take a look at: Tech positive aspects whilst Utilities and Power lag Tech (XLK), Verbal exchange Services and products (XLC), and Industrials (XLI) led Tuesday’s sector motion, with markets buying and selling combined as buyers assessed new jobs information and a slew of income experiences. Oil costs had been a standout, with WTI crude (CL=F) falling for the second one immediately consultation to industry above $67 a barrel. Brent crude (BZ=F), the world benchmark, additionally fell to industry slightly below $71 a barrel. Because of this, Power (XLE) was once one of the vital day’s largest laggards, along side Utilities (XLU) and Actual Property (XLRE).

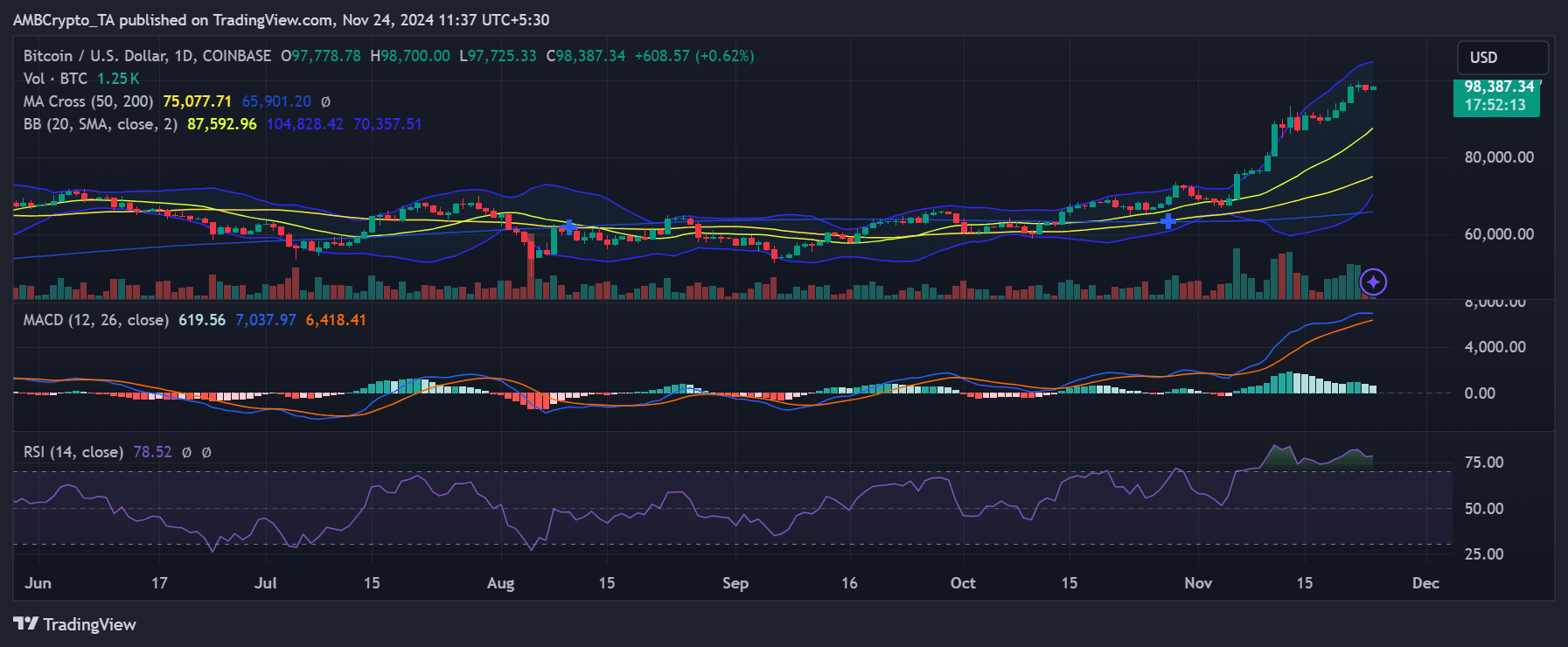

Tue, October 29, 2024 at 4:26 PM UTC Sector take a look at: Tech positive aspects whilst Utilities and Power lag Tech (XLK), Verbal exchange Services and products (XLC), and Industrials (XLI) led Tuesday’s sector motion, with markets buying and selling combined as buyers assessed new jobs information and a slew of income experiences. Oil costs had been a standout, with WTI crude (CL=F) falling for the second one immediately consultation to industry above $67 a barrel. Brent crude (BZ=F), the world benchmark, additionally fell to industry slightly below $71 a barrel. Because of this, Power (XLE) was once one of the vital day’s largest laggards, along side Utilities (XLU) and Actual Property (XLRE).  Tue, October 29, 2024 at 3:35 PM UTC Bitcoin hovers slightly below $72,000 according to token Bitcoin costs (BTC-USD) rose round 5% on Tuesday to surpass a key technical degree and hover slightly below $72,000 according to token, the absolute best since early June. The strikes come as US spot bitcoin ETFs posted $472.6 million in inflows on Monday, extending positive aspects observed remaining week. Crypto-related shares additionally rose in tandem, with Mara Holdings (MARA), MicroStrategy (MSTR), and Rebellion Blockchain (RIOT) all gaining, leaping kind of 2%, 1%, and four%, respectively.

Tue, October 29, 2024 at 3:35 PM UTC Bitcoin hovers slightly below $72,000 according to token Bitcoin costs (BTC-USD) rose round 5% on Tuesday to surpass a key technical degree and hover slightly below $72,000 according to token, the absolute best since early June. The strikes come as US spot bitcoin ETFs posted $472.6 million in inflows on Monday, extending positive aspects observed remaining week. Crypto-related shares additionally rose in tandem, with Mara Holdings (MARA), MicroStrategy (MSTR), and Rebellion Blockchain (RIOT) all gaining, leaping kind of 2%, 1%, and four%, respectively.  Tue, October 29, 2024 at 2:50 PM UTC McDonald’s E. coli outbreak may not have subject matter affect, corporate says McDonald’s beat income expectancies within the 3rd quarter, however Wall Side road stays hyper-focused on its contemporary E. coli outbreak. Stocks are up somewhat over 1% in early buying and selling. Yahoo Finance’s Brooke DiPalma has extra: Since Q3 ended on Sept. 30, the results of the outbreak will likely be observed in This autumn effects. Executives indicated it may not have a subject matter affect at the trade. Thus far, the E. coli outbreak has left 75 other folks inflamed and one particular person lifeless throughout 13 states. On Sunday, McDonald’s introduced it’s going to resume distribution of clean pork patties this week to all eating places after the Colorado Division of Agriculture dominated out that Quarter Pounder patties had been the supply of the E. coli contamination, leaving onions as the prospective offender. Burger King (QSR) preventively got rid of onions from 5% of its eating places regardless of no reported sicknesses. Yum! Manufacturers (YUM) additionally got rid of contemporary onions from make a choice Taco Bell, Pizza Hut, and KFC eating places “out of an abundance of warning,” a spokesperson instructed Yahoo Finance. McDonald’s CEO Chris Kempczinski stated he believes the “swift and decisive movements” McDonald’s took must assist beef up shopper accept as true with. Investor sentiment, despite the fact that, is blended as bears house in on “uncertainty” across the “meals protection fallout,” according to a observe from TD Cowen analyst Andrew Charles earlier than the effects. In the meantime, bulls are inspired by means of the relaunch of the McRib in December, a brand new nationwide worth platform in January, and hen strips and wraps coming in Might or June 2025.

Tue, October 29, 2024 at 2:50 PM UTC McDonald’s E. coli outbreak may not have subject matter affect, corporate says McDonald’s beat income expectancies within the 3rd quarter, however Wall Side road stays hyper-focused on its contemporary E. coli outbreak. Stocks are up somewhat over 1% in early buying and selling. Yahoo Finance’s Brooke DiPalma has extra: Since Q3 ended on Sept. 30, the results of the outbreak will likely be observed in This autumn effects. Executives indicated it may not have a subject matter affect at the trade. Thus far, the E. coli outbreak has left 75 other folks inflamed and one particular person lifeless throughout 13 states. On Sunday, McDonald’s introduced it’s going to resume distribution of clean pork patties this week to all eating places after the Colorado Division of Agriculture dominated out that Quarter Pounder patties had been the supply of the E. coli contamination, leaving onions as the prospective offender. Burger King (QSR) preventively got rid of onions from 5% of its eating places regardless of no reported sicknesses. Yum! Manufacturers (YUM) additionally got rid of contemporary onions from make a choice Taco Bell, Pizza Hut, and KFC eating places “out of an abundance of warning,” a spokesperson instructed Yahoo Finance. McDonald’s CEO Chris Kempczinski stated he believes the “swift and decisive movements” McDonald’s took must assist beef up shopper accept as true with. Investor sentiment, despite the fact that, is blended as bears house in on “uncertainty” across the “meals protection fallout,” according to a observe from TD Cowen analyst Andrew Charles earlier than the effects. In the meantime, bulls are inspired by means of the relaunch of the McRib in December, a brand new nationwide worth platform in January, and hen strips and wraps coming in Might or June 2025.  Tue, October 29, 2024 at 2:03 PM UTC Task openings fall greater than anticipated in September Task openings fell greater than anticipated in September. The knowledge comes as buyers carefully wait for indicators of additional cooling within the hard work marketplace forward of the Federal Reserve’s subsequent rate of interest choice on Nov. 7. New information from the Bureau of Hard work Statistics launched Tuesday confirmed there have been 7.44 million jobs open on the finish of September, a lower from the 7.86 million observed in August. August’s determine was once revised decrease from the 8.04 million open jobs first of all reported. Economists surveyed by means of Bloomberg had anticipated the record to turn 8 million openings in September. Additionally in Tuesday’s information, the quits charge an indication of self belief amongst staff, fell to one.9% in September down from the revised 2% observed in August. In the meantime, the Task Openings and Hard work Turnover Survey (JOLTS) confirmed 5.55 million hires had been made all the way through the month, up from 5..43 million observed in August. The hiring charge hit rose quite to a few.5% in September, up from the three.4% observed in August.

Tue, October 29, 2024 at 2:03 PM UTC Task openings fall greater than anticipated in September Task openings fell greater than anticipated in September. The knowledge comes as buyers carefully wait for indicators of additional cooling within the hard work marketplace forward of the Federal Reserve’s subsequent rate of interest choice on Nov. 7. New information from the Bureau of Hard work Statistics launched Tuesday confirmed there have been 7.44 million jobs open on the finish of September, a lower from the 7.86 million observed in August. August’s determine was once revised decrease from the 8.04 million open jobs first of all reported. Economists surveyed by means of Bloomberg had anticipated the record to turn 8 million openings in September. Additionally in Tuesday’s information, the quits charge an indication of self belief amongst staff, fell to one.9% in September down from the revised 2% observed in August. In the meantime, the Task Openings and Hard work Turnover Survey (JOLTS) confirmed 5.55 million hires had been made all the way through the month, up from 5..43 million observed in August. The hiring charge hit rose quite to a few.5% in September, up from the three.4% observed in August.  Tue, October 29, 2024 at 1:55 PM UTC Ford inventory drops 7% after benefit forecast disappoints Ford Motor (F) inventory dropped over 9% early Tuesday after the automaker diminished its full-year benefit forecast the day earlier than, mentioning prime guaranty prices and provider disruptions. Ford diminished its full-year benefit forecast. The automaker now expects 2024 adjusted EBIT “to be about $10 billion,” which is on the decrease finish of its earlier projection of $10 billion to $12 billion. The automaker stated “provider disruptions,” partly because of the results of hurricanes at the southeastern US, impacted gross sales of its Ford Professional and Ford Blue cars. Moreover, “prices, particularly guaranty, has held again our income energy, however as we bend that curve, there’s vital monetary upside for buyers,” Ford CEO Jim Farley added at the analyst convention name. Ford stocks are nonetheless up greater than 3% from remaining yr, when a strike by means of the United Auto Staff union value the corporate an estimated $1.3 billion. In the meantime, rival Common Motors (GM) inventory is up just about 8% from remaining week as the corporate raised its benefit forecast for the 3rd time this yr all the way through its 3rd quarter income record remaining week. Learn the overall tale right here.

Tue, October 29, 2024 at 1:55 PM UTC Ford inventory drops 7% after benefit forecast disappoints Ford Motor (F) inventory dropped over 9% early Tuesday after the automaker diminished its full-year benefit forecast the day earlier than, mentioning prime guaranty prices and provider disruptions. Ford diminished its full-year benefit forecast. The automaker now expects 2024 adjusted EBIT “to be about $10 billion,” which is on the decrease finish of its earlier projection of $10 billion to $12 billion. The automaker stated “provider disruptions,” partly because of the results of hurricanes at the southeastern US, impacted gross sales of its Ford Professional and Ford Blue cars. Moreover, “prices, particularly guaranty, has held again our income energy, however as we bend that curve, there’s vital monetary upside for buyers,” Ford CEO Jim Farley added at the analyst convention name. Ford stocks are nonetheless up greater than 3% from remaining yr, when a strike by means of the United Auto Staff union value the corporate an estimated $1.3 billion. In the meantime, rival Common Motors (GM) inventory is up just about 8% from remaining week as the corporate raised its benefit forecast for the 3rd time this yr all the way through its 3rd quarter income record remaining week. Learn the overall tale right here.  Tue, October 29, 2024 at 1:54 PM UTC DJT inventory in short halted, extends positive aspects Trump Media & Era Staff inventory (DJT) was once in short halted in early buying and selling on Tuesday after stocks prolonged their five-week surge, emerging round 10% in a while after the outlet bell. The inventory strikes come as buyers wager on advanced probabilities of Donald Trump successful the November presidential election. Stocks closed up greater than 21% on Monday, following the previous president and Republican nominee’s extremely criticized rally at New york’s Madison Sq. Lawn (MSG) over the weekend. At present ranges, the inventory is buying and selling at its absolute best degree since Might, with stocks up about 270% from their September lows. Trump maintains a kind of 60% pastime in DJT. At present ranges of above $52 a percentage, Trump Media boasts a marketplace cap of about $10.3 billion, giving the previous president a stake value round $6.2 billion. Learn extra right here.

Tue, October 29, 2024 at 1:54 PM UTC DJT inventory in short halted, extends positive aspects Trump Media & Era Staff inventory (DJT) was once in short halted in early buying and selling on Tuesday after stocks prolonged their five-week surge, emerging round 10% in a while after the outlet bell. The inventory strikes come as buyers wager on advanced probabilities of Donald Trump successful the November presidential election. Stocks closed up greater than 21% on Monday, following the previous president and Republican nominee’s extremely criticized rally at New york’s Madison Sq. Lawn (MSG) over the weekend. At present ranges, the inventory is buying and selling at its absolute best degree since Might, with stocks up about 270% from their September lows. Trump maintains a kind of 60% pastime in DJT. At present ranges of above $52 a percentage, Trump Media boasts a marketplace cap of about $10.3 billion, giving the previous president a stake value round $6.2 billion. Learn extra right here.  Tue, October 29, 2024 at 1:36 PM UTC Shares open decrease US shares opened decrease on Tuesday as buyers digested a contemporary crop of income and awaited effects from Alphabet (GOOG, GOOGL), due after the bell. The Dow Jones Business Reasonable (^DJI) fell about 0.3%, coming off a pointy achieve finally the gauges closed upper on Monday. The benchmark S&P 500 (^GSPC) and tech-heavy Nasdaq Composite (^IXIC) additionally every dropped round 0.3% on the marketplace open.

Tue, October 29, 2024 at 1:36 PM UTC Shares open decrease US shares opened decrease on Tuesday as buyers digested a contemporary crop of income and awaited effects from Alphabet (GOOG, GOOGL), due after the bell. The Dow Jones Business Reasonable (^DJI) fell about 0.3%, coming off a pointy achieve finally the gauges closed upper on Monday. The benchmark S&P 500 (^GSPC) and tech-heavy Nasdaq Composite (^IXIC) additionally every dropped round 0.3% on the marketplace open.  Tue, October 29, 2024 at 1:26 PM UTC House costs file slowest annual achieve since 2023 US house costs hit some other file prime in August, however the tempo of worth will increase is easing. On an annual foundation, the S&P Case-Shiller Nationwide House Value Index higher 4.2%, down from the 4.8% achieve observed in July. “House worth expansion is starting to display indicators of pressure, recording the slowest annual achieve since loan charges peaked in 2023,” Brian D. Luke, S&P’s head of commodities, actual and virtual property, stated in a press unlock. Costs rose 0.3% over the prior month in August on a seasonally adjusted foundation. This marked the fifteenth consecutive per month building up and an all-time prime for the index. The index monitoring house costs within the 20 biggest metropolitan spaces received 0.4% in August from July, upper than Bloomberg consensus estimates 0.2% per month building up. In the meantime, the 20-city index jumped 5.2% in comparison to remaining August. “As scholars went again to university, house worth consumers seemed much less prepared to push the index upper than in the summertime months. Costs proceed to slow down for the previous six months, pushing appreciation charges underneath their long-run moderate of four.8%,” Luke added.

Tue, October 29, 2024 at 1:26 PM UTC House costs file slowest annual achieve since 2023 US house costs hit some other file prime in August, however the tempo of worth will increase is easing. On an annual foundation, the S&P Case-Shiller Nationwide House Value Index higher 4.2%, down from the 4.8% achieve observed in July. “House worth expansion is starting to display indicators of pressure, recording the slowest annual achieve since loan charges peaked in 2023,” Brian D. Luke, S&P’s head of commodities, actual and virtual property, stated in a press unlock. Costs rose 0.3% over the prior month in August on a seasonally adjusted foundation. This marked the fifteenth consecutive per month building up and an all-time prime for the index. The index monitoring house costs within the 20 biggest metropolitan spaces received 0.4% in August from July, upper than Bloomberg consensus estimates 0.2% per month building up. In the meantime, the 20-city index jumped 5.2% in comparison to remaining August. “As scholars went again to university, house worth consumers seemed much less prepared to push the index upper than in the summertime months. Costs proceed to slow down for the previous six months, pushing appreciation charges underneath their long-run moderate of four.8%,” Luke added.  Tue, October 29, 2024 at 12:36 PM UTC Income roundup: McDonald’s, BP, PayPal shares fall whilst Pfizer and HSBC upward thrust on Q3 effects Every other batch of businesses reported income Tuesday morning. Here is a fast rundown: Right here’s a take a look at how the firms carried out this morning relative to Wall Side road’s expectancies, the usage of Bloomberg consensus estimates: Novartis: Adjusted elementary income according to percentage of $2.06 vs. $1.94 anticipated, income of $12.82 billion vs. $12.68 billion anticipated McDonald’s: Adjusted diluted income according to percentage of $3.23 vs. $3.20 anticipated, income of $6.87 billion vs. $6.81 billion anticipated HSBC: Adjusted diluted income according to percentage of $0.34 vs. $0.30 anticipated, web income of $17.21 billion vs. $16.14 billion anticipated Pfizer: Diluted income according to percentage of $1.06 vs. $0.64 anticipated, income of $17.7 billion vs. $15.08 billion anticipated BP: Adjusted diluted income according to percentage of $0.14 vs. $0.13 anticipated, income of $47.25 billion vs. $46.16 billion anticipated PayPal: Adjusted diluted income according to percentage of $1.20 vs. $1.07 anticipated, income of $7.85 billion vs. $7.89 billion anticipated Google (GOOG) dad or mum Alphabet, AI chipmaker Complex Micro Units (AMD), Visa (V), and Chipotle (CMG) are some of the spherical of businesses set to record income after the bell.

Tue, October 29, 2024 at 12:36 PM UTC Income roundup: McDonald’s, BP, PayPal shares fall whilst Pfizer and HSBC upward thrust on Q3 effects Every other batch of businesses reported income Tuesday morning. Here is a fast rundown: Right here’s a take a look at how the firms carried out this morning relative to Wall Side road’s expectancies, the usage of Bloomberg consensus estimates: Novartis: Adjusted elementary income according to percentage of $2.06 vs. $1.94 anticipated, income of $12.82 billion vs. $12.68 billion anticipated McDonald’s: Adjusted diluted income according to percentage of $3.23 vs. $3.20 anticipated, income of $6.87 billion vs. $6.81 billion anticipated HSBC: Adjusted diluted income according to percentage of $0.34 vs. $0.30 anticipated, web income of $17.21 billion vs. $16.14 billion anticipated Pfizer: Diluted income according to percentage of $1.06 vs. $0.64 anticipated, income of $17.7 billion vs. $15.08 billion anticipated BP: Adjusted diluted income according to percentage of $0.14 vs. $0.13 anticipated, income of $47.25 billion vs. $46.16 billion anticipated PayPal: Adjusted diluted income according to percentage of $1.20 vs. $1.07 anticipated, income of $7.85 billion vs. $7.89 billion anticipated Google (GOOG) dad or mum Alphabet, AI chipmaker Complex Micro Units (AMD), Visa (V), and Chipotle (CMG) are some of the spherical of businesses set to record income after the bell.  Tue, October 29, 2024 at 12:07 PM UTC Excellent morning. Here is what’s taking place as of late. Financial information: S&P CoreLogic 20-city year-over-year NSA, (August); Convention Board shopper self belief, (October); JOLTS task openings, (September); Dallas Fed services and products task, (October) Income: Alphabet (GOOGL, GOOG), AMD (AMD), BP Oil (BP), Chipotle (CMG), Crocs (CROX), McDonald’s (MCD), JetBlue (JBLU), PayPal (PYPL), Pfizer (PFE), Reddit (RDDT), Royal Caribbean Staff (RCL), Snap (SNAP), Sofi (SOFI), Visa (V), D.R. Horton (DHI) Listed here are probably the most largest tales you will have overlooked in a single day and early this morning: McDonald’s beats on income as US gross sales shine CEOs are pronouncing that is as dangerous because it will get for his or her income Climate-hit jobs record presentations reality of monetary information Pfizer raises benefit forecast after beating Q3 estimates Apple exports $6B of iPhones from India in large China shift Boeing raises $21B in capital hike to spice up money pile Trump calls Biden’s chips act ‘so dangerous.’ Harris cites its just right paintings.

Tue, October 29, 2024 at 12:07 PM UTC Excellent morning. Here is what’s taking place as of late. Financial information: S&P CoreLogic 20-city year-over-year NSA, (August); Convention Board shopper self belief, (October); JOLTS task openings, (September); Dallas Fed services and products task, (October) Income: Alphabet (GOOGL, GOOG), AMD (AMD), BP Oil (BP), Chipotle (CMG), Crocs (CROX), McDonald’s (MCD), JetBlue (JBLU), PayPal (PYPL), Pfizer (PFE), Reddit (RDDT), Royal Caribbean Staff (RCL), Snap (SNAP), Sofi (SOFI), Visa (V), D.R. Horton (DHI) Listed here are probably the most largest tales you will have overlooked in a single day and early this morning: McDonald’s beats on income as US gross sales shine CEOs are pronouncing that is as dangerous because it will get for his or her income Climate-hit jobs record presentations reality of monetary information Pfizer raises benefit forecast after beating Q3 estimates Apple exports $6B of iPhones from India in large China shift Boeing raises $21B in capital hike to spice up money pile Trump calls Biden’s chips act ‘so dangerous.’ Harris cites its just right paintings.

Tue, October 29, 2024 at 6:00 PM UTC Homebuyers ‘take a pause’ amid loan charge swings, election uncertainty, builder says Consumers are hitting the pause button amid upper loan charges and election uncertainty, in line with the biggest US homebuilder. “I do not believe this can be a structural factor with call for. There is simply a large number of noise out there as of late. The velocity of volatility we have observed, mixed with the election information that is in the market, I simply assume we are seeing other folks take a pause,” Paul Romanowski, CEO of DR Horton (DHI), instructed analysts and buyers at the corporate’s fourth quarter income name Tuesday morning. The corporate stated it expects to near 90,000 to 92,000 house gross sales all the way through its 2025 fiscal yr, less than the consensus estimate of 94,653, according to Bloomberg information. DHI expects income of $36 billion to $37.5 billion for the yr, underneath analyst estimates of $38.65 billion. The forecast despatched DHI inventory down greater than 9%. DHI additionally overlooked analyst estimates on EPS and income in This autumn within the 3 months finishing September. Loan charges began to transport decrease in September because the Federal Reserve lower its benchmark charge by means of part a proportion level. Alternatively, loan charges lately had been emerging as buyers think again their expectancies on how aggressively the Fed will lower rates of interest.

Tue, October 29, 2024 at 5:15 PM UTC Fewer American citizens see a recession within the subsequent three hundred and sixty five days Client self belief shot upper in October, hitting a studying of 108.7, up from 99.2 in September. This marked the biggest per month achieve in self belief since March 2021, according to the Convention Board. Economists surveyed by means of Bloomberg had anticipated shopper self belief to fall to 98.7 in October. The huge uptick in self belief got here as customers digest contemporary indicators that america economic system stays on cast footing. Shoppers’ perceived chance of a US recession over the following yr hit the bottom degree for the reason that Convention Board started asking the query in June 2022. In October, not up to 65% of respondents stated a recession within the subsequent three hundred and sixty five days was once “moderately or very most likely,” down from the greater than 66% observed in September.

Tue, October 29, 2024 at 2:03 PM UTC Task openings fall greater than anticipated in September Task openings fell greater than anticipated in September. The knowledge comes as buyers carefully wait for indicators of additional cooling within the hard work marketplace forward of the Federal Reserve’s subsequent rate of interest choice on Nov. 7. New information from the Bureau of Hard work Statistics launched Tuesday confirmed there have been 7.44 million jobs open on the finish of September, a lower from the 7.86 million observed in August. August’s determine was once revised decrease from the 8.04 million open jobs first of all reported. Economists surveyed by means of Bloomberg had anticipated the record to turn 8 million openings in September. Additionally in Tuesday’s information, the quits charge an indication of self belief amongst staff, fell to one.9% in September down from the revised 2% observed in August. In the meantime, the Task Openings and Hard work Turnover Survey (JOLTS) confirmed 5.55 million hires had been made all the way through the month, up from 5..43 million observed in August. The hiring charge hit rose quite to a few.5% in September, up from the three.4% observed in August.

Tue, October 29, 2024 at 1:55 PM UTC Ford inventory drops 7% after benefit forecast disappoints Ford Motor (F) inventory dropped over 9% early Tuesday after the automaker diminished its full-year benefit forecast the day earlier than, mentioning prime guaranty prices and provider disruptions. Ford diminished its full-year benefit forecast. The automaker now expects 2024 adjusted EBIT “to be about $10 billion,” which is on the decrease finish of its earlier projection of $10 billion to $12 billion. The automaker stated “provider disruptions,” partly because of the results of hurricanes at the southeastern US, impacted gross sales of its Ford Professional and Ford Blue cars. Moreover, “prices, particularly guaranty, has held again our income energy, however as we bend that curve, there’s vital monetary upside for buyers,” Ford CEO Jim Farley added at the analyst convention name. Ford stocks are nonetheless up greater than 3% from remaining yr, when a strike by means of the United Auto Staff union value the corporate an estimated $1.3 billion. In the meantime, rival Common Motors (GM) inventory is up just about 8% from remaining week as the corporate raised its benefit forecast for the 3rd time this yr all the way through its 3rd quarter income record remaining week. Learn the overall tale right here.

Tue, October 29, 2024 at 1:26 PM UTC House costs file slowest annual achieve since 2023 US house costs hit some other file prime in August, however the tempo of worth will increase is easing. On an annual foundation, the S&P Case-Shiller Nationwide House Value Index higher 4.2%, down from the 4.8% achieve observed in July. “House worth expansion is starting to display indicators of pressure, recording the slowest annual achieve since loan charges peaked in 2023,” Brian D. Luke, S&P’s head of commodities, actual and virtual property, stated in a press unlock. Costs rose 0.3% over the prior month in August on a seasonally adjusted foundation. This marked the fifteenth consecutive per month building up and an all-time prime for the index. The index monitoring house costs within the 20 biggest metropolitan spaces received 0.4% in August from July, upper than Bloomberg consensus estimates 0.2% per month building up. In the meantime, the 20-city index jumped 5.2% in comparison to remaining August. “As scholars went again to university, house worth consumers seemed much less prepared to push the index upper than in the summertime months. Costs proceed to slow down for the previous six months, pushing appreciation charges underneath their long-run moderate of four.8%,” Luke added.

Tue, October 29, 2024 at 12:36 PM UTC Income roundup: McDonald’s, BP, PayPal shares fall whilst Pfizer and HSBC upward thrust on Q3 effects Every other batch of businesses reported income Tuesday morning. Here is a fast rundown: Right here’s a take a look at how the firms carried out this morning relative to Wall Side road’s expectancies, the usage of Bloomberg consensus estimates: Novartis: Adjusted elementary income according to percentage of $2.06 vs. $1.94 anticipated, income of $12.82 billion vs. $12.68 billion anticipated McDonald’s: Adjusted diluted income according to percentage of $3.23 vs. $3.20 anticipated, income of $6.87 billion vs. $6.81 billion anticipated HSBC: Adjusted diluted income according to percentage of $0.34 vs. $0.30 anticipated, web income of $17.21 billion vs. $16.14 billion anticipated Pfizer: Diluted income according to percentage of $1.06 vs. $0.64 anticipated, income of $17.7 billion vs. $15.08 billion anticipated BP: Adjusted diluted income according to percentage of $0.14 vs. $0.13 anticipated, income of $47.25 billion vs. $46.16 billion anticipated PayPal: Adjusted diluted income according to percentage of $1.20 vs. $1.07 anticipated, income of $7.85 billion vs. $7.89 billion anticipated Google (GOOG) dad or mum Alphabet, AI chipmaker Complex Micro Units (AMD), Visa (V), and Chipotle (CMG) are some of the spherical of businesses set to record income after the bell.