US shares have been jumbled in early buying and selling on Tuesday, with techs serving as a vibrant spot whilst Wall Boulevard kicked off a holiday-shortened week by means of specializing in a coming inflation record watched carefully by means of the Federal Reserve.The benchmark S&P 500 (^GSPC) hugged the flatline, whilst the tech-heavy Nasdaq Composite (^IXIC) added more or less 0.5% after cast last positive factors on Friday. The Dow Jones Business Reasonable (^DJI), which lists fewer tech names, slipped about 0.3%.The foremost gauges are regrouping after a unstable week as buyers go back from the Memorial Day spoil. Shares had been buffeted from side to side by means of two impulses: fading optimism for charge cuts on one hand, and top hopes for AI at the different. The latter is led by means of Nvidia (NVDA), whose stocks persisted a post-earnings tear, gaining about 5%.Buyers are actually firmly again on inflation watch, counting all the way down to the discharge of the Federal Reserve’s most popular PCE gauge on Friday. Fed officers have despatched out a drumbeat of warnings that knowledge will have to display actual cooling in inflation to cause a coverage shift, with Neel Kashkari the newest to enroll in them.Learn extra: How does the exertions marketplace have an effect on inflation?The ones feedback, along hotter-than-expected financial prints and hawkish Fed mins, have induced buyers to as soon as once more cut back bets on rate of interest cuts this 12 months. Knowledge chasers gets updates on first quarter GDP and shopper self assurance later this week that might end up catalysts.In different particular person movers, GameStop (GME) shares soared up to 22% on Tuesday. The video games store on Friday mentioned it had introduced in no longer a ways off $1 billion from a percentage sale throughout the meme rally previous in Would possibly. In the meantime, Apple (AAPL) rose following knowledge appearing iPhone gross sales in China jumped over 50% in April as retail companions reduce costs.Live8 updates Tue, Would possibly 28, 2024 at 8:45 AM PDTNvidia stocks climb above $1,100 for first time everNvidia (NVDA) stocks traded above $1,100 for the primary time ever on Tuesday.The milestone second comes because the inventory won about 5% after Elon Musk’s synthetic intelligence startup xAI raised $6 billion in a Collection B investment spherical, the corporate introduced in a weblog put up. The investment brings the valuation of xAI to $24 billion.The rise of AI pageant has persisted to spice up Nvidia’s expansion charge because the chip maker continues its record-setting rally.Ultimate week, Nvidia reported first quarter effects that inspired Wall Boulevard. The corporate additionally introduced a 10-for-1 inventory cut up and an larger dividend.

Tue, Would possibly 28, 2024 at 8:45 AM PDTNvidia stocks climb above $1,100 for first time everNvidia (NVDA) stocks traded above $1,100 for the primary time ever on Tuesday.The milestone second comes because the inventory won about 5% after Elon Musk’s synthetic intelligence startup xAI raised $6 billion in a Collection B investment spherical, the corporate introduced in a weblog put up. The investment brings the valuation of xAI to $24 billion.The rise of AI pageant has persisted to spice up Nvidia’s expansion charge because the chip maker continues its record-setting rally.Ultimate week, Nvidia reported first quarter effects that inspired Wall Boulevard. The corporate additionally introduced a 10-for-1 inventory cut up and an larger dividend. Tue, Would possibly 28, 2024 at 8:15 AM PDTGameStop stocks surge on crowning glory of just about $1 billion inventory sale GameStop (GME) inventory surged up to 22% on Tuesday with stocks opening at round $23. The strikes come after the online game store mentioned it raised virtually $1 billion from its newest fairness providing.Despite the fact that stocks are nonetheless smartly under the close to $65 degree reached previous this month throughout a short-lived meme rally, the inventory motion displays investor exuberance over the meme industry.Yahoo Finance’s Ines Ferré studies:“If this have been an ordinary marketplace, other folks could be a bit of freaked out,” Steve Sosnick, Interactive Agents leader strategist informed Yahoo Finance.He added, “You don’t promote inventory into the marketplace in the event you assume your inventory is undervalued. You do it whilst you assume your inventory is overestimated.”GameStop is a closely shorted inventory, with brief pastime simply above 21% of the glide.The corporate took good thing about mid-Would possibly’s surprising meme rally, promoting 45 million stocks to herald about $933 million, in line with a Friday remark.GameStop mentioned it intends to make use of the online proceeds for basic company functions, which might come with acquisitions and investments.The providing was once first introduced on Would possibly 17 together with the corporate’s initial monetary effects, sending stocks tanking up to 30% that day.The providing was once observed as a good move by means of some Wall Boulevard analysts amid the video-game store’s suffering financials. GameStop’s quarterly gross sales fell sharply from the 12 months precedent days, in line with its most up-to-date income record.

Tue, Would possibly 28, 2024 at 8:15 AM PDTGameStop stocks surge on crowning glory of just about $1 billion inventory sale GameStop (GME) inventory surged up to 22% on Tuesday with stocks opening at round $23. The strikes come after the online game store mentioned it raised virtually $1 billion from its newest fairness providing.Despite the fact that stocks are nonetheless smartly under the close to $65 degree reached previous this month throughout a short-lived meme rally, the inventory motion displays investor exuberance over the meme industry.Yahoo Finance’s Ines Ferré studies:“If this have been an ordinary marketplace, other folks could be a bit of freaked out,” Steve Sosnick, Interactive Agents leader strategist informed Yahoo Finance.He added, “You don’t promote inventory into the marketplace in the event you assume your inventory is undervalued. You do it whilst you assume your inventory is overestimated.”GameStop is a closely shorted inventory, with brief pastime simply above 21% of the glide.The corporate took good thing about mid-Would possibly’s surprising meme rally, promoting 45 million stocks to herald about $933 million, in line with a Friday remark.GameStop mentioned it intends to make use of the online proceeds for basic company functions, which might come with acquisitions and investments.The providing was once first introduced on Would possibly 17 together with the corporate’s initial monetary effects, sending stocks tanking up to 30% that day.The providing was once observed as a good move by means of some Wall Boulevard analysts amid the video-game store’s suffering financials. GameStop’s quarterly gross sales fell sharply from the 12 months precedent days, in line with its most up-to-date income record. Tue, Would possibly 28, 2024 at 7:38 AM PDTSan Diego sees absolute best positive factors in house pricesAs house costs notched a brand new all-time top in March, positive towns remained extra at risk of emerging prices.Domestically, San Diego persisted to record the absolute best year-over-year acquire some of the 20 main towns, emerging 11.1% in March. New York and Cleveland additionally larger 9.2% and eight.8%, respectively.Increased loan charges, top house costs, and restricted housing inventory have challenged homebuyers. In March, loan charges hovered across the mid-6% vary. Ultimate week, they fell under 7% for the primary time since early April.In spite of pent-up call for for properties, low stock stays an issue, which hasn’t allowed house costs to ease. However that dynamic is predicted to modify.”Despite the fact that we think loan charges to glide decrease in the following few years, we additionally be expecting stock to regularly normalise which must assist cool the marketplace,” Thomas Ryan, North American economist at Capital Economics, wrote in a observe to purchasers after the discharge. Ryan and his group be expecting house costs to climb by means of 3% in 2025 and a pair of.5% in 2026.

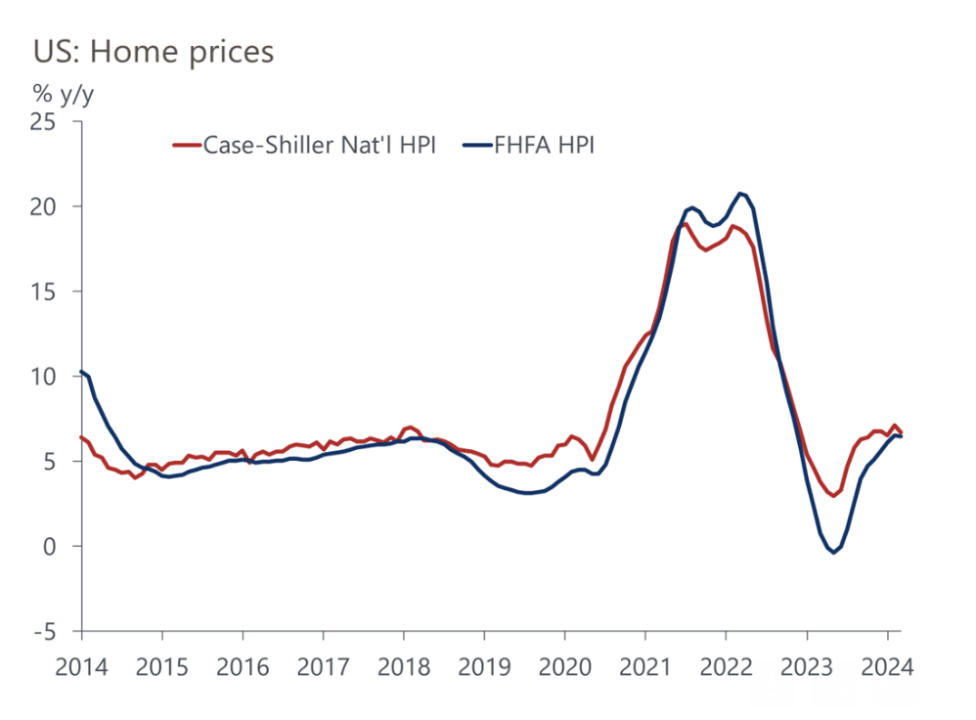

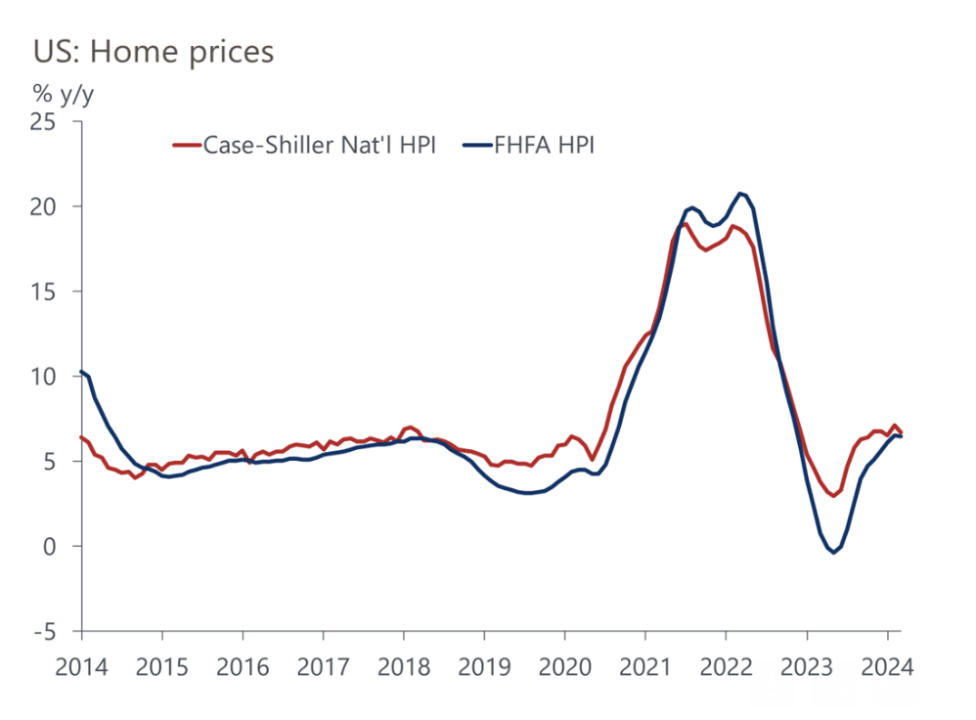

Tue, Would possibly 28, 2024 at 7:38 AM PDTSan Diego sees absolute best positive factors in house pricesAs house costs notched a brand new all-time top in March, positive towns remained extra at risk of emerging prices.Domestically, San Diego persisted to record the absolute best year-over-year acquire some of the 20 main towns, emerging 11.1% in March. New York and Cleveland additionally larger 9.2% and eight.8%, respectively.Increased loan charges, top house costs, and restricted housing inventory have challenged homebuyers. In March, loan charges hovered across the mid-6% vary. Ultimate week, they fell under 7% for the primary time since early April.In spite of pent-up call for for properties, low stock stays an issue, which hasn’t allowed house costs to ease. However that dynamic is predicted to modify.”Despite the fact that we think loan charges to glide decrease in the following few years, we additionally be expecting stock to regularly normalise which must assist cool the marketplace,” Thomas Ryan, North American economist at Capital Economics, wrote in a observe to purchasers after the discharge. Ryan and his group be expecting house costs to climb by means of 3% in 2025 and a pair of.5% in 2026. Tue, Would possibly 28, 2024 at 7:28 AM PDTHome costs hit new data, knowledge showsThe seasonally adjusted S&P CoreLogic Case-Shiller nationwide house worth index (HPI) rose 0.3% month over month in March and jumped 6.5% on a year-over-year foundation — the second one most powerful annual acquire since overdue 2022, Oxford Economics mentioned in a observe to purchasers following the knowledge’s unencumber.”We think house worth expansion to stay certain within the quarters forward, with dangers skewed to the upside,” Oxford Economics lead economist Bernard Yaros wrote. “Scarce provide within the resale marketplace, a robust exertions marketplace, and pent-up call for from Millennials growing old into their high household-formation years argue for probably less assailable area worth positive factors than in our baseline forecast.”In line with the knowledge, costs within the 20 greatest US metro spaces hit some other all-time top in March.

Tue, Would possibly 28, 2024 at 7:28 AM PDTHome costs hit new data, knowledge showsThe seasonally adjusted S&P CoreLogic Case-Shiller nationwide house worth index (HPI) rose 0.3% month over month in March and jumped 6.5% on a year-over-year foundation — the second one most powerful annual acquire since overdue 2022, Oxford Economics mentioned in a observe to purchasers following the knowledge’s unencumber.”We think house worth expansion to stay certain within the quarters forward, with dangers skewed to the upside,” Oxford Economics lead economist Bernard Yaros wrote. “Scarce provide within the resale marketplace, a robust exertions marketplace, and pent-up call for from Millennials growing old into their high household-formation years argue for probably less assailable area worth positive factors than in our baseline forecast.”In line with the knowledge, costs within the 20 greatest US metro spaces hit some other all-time top in March.

(Supply: Oxford Economics/Haver Analytics)Yaros added that even supposing he expects “declines in loan charges as the primary charge reduce by means of the Federal Reserve comes into view” costs must proceed to stay increased amid a “traditionally tight” provide of houses on the market.In the meantime, the seasonally adjusted Federal Housing Finance Company (FHFA) Area Worth Index additionally rose throughout the month of March however at a slower tempo in comparison to earlier months. The index climbed simply 0.1% after emerging 1.2% month over month in February.”Regardless that base results have began to develop into much less favorable for the FHFA index, it’s nonetheless emerging on an annual foundation sooner than it did for many of 2023,” Yaros mentioned.

(Supply: Oxford Economics/Haver Analytics)Yaros added that even supposing he expects “declines in loan charges as the primary charge reduce by means of the Federal Reserve comes into view” costs must proceed to stay increased amid a “traditionally tight” provide of houses on the market.In the meantime, the seasonally adjusted Federal Housing Finance Company (FHFA) Area Worth Index additionally rose throughout the month of March however at a slower tempo in comparison to earlier months. The index climbed simply 0.1% after emerging 1.2% month over month in February.”Regardless that base results have began to develop into much less favorable for the FHFA index, it’s nonetheless emerging on an annual foundation sooner than it did for many of 2023,” Yaros mentioned. Tue, Would possibly 28, 2024 at 7:08 AM PDTConsumer self assurance rebounds for first time in 3 monthsConsumer self assurance abruptly rose in Would possibly.The newest index studying from the Convention Board was once 102, above 97.5 in April and better than the 96 economists surveyed by means of Bloomberg had anticipated. The Would possibly studying ended 3 months of declines for the index.”Customers’ overview of present industry stipulations was once fairly much less certain than final month,” the Convention Board leader economist Dana Peterson mentioned within the unencumber. “Then again, the sturdy exertions marketplace persisted to strengthen shoppers’ total overview of the current scenario. Perspectives of present exertions marketplace stipulations progressed in Would possibly, as fewer respondents mentioned jobs have been ‘arduous to get.'”Peterson added: “Fewer shoppers anticipated deterioration in long run industry stipulations, activity availability, and revenue, leading to an build up within the Expectation Index.”

Tue, Would possibly 28, 2024 at 7:08 AM PDTConsumer self assurance rebounds for first time in 3 monthsConsumer self assurance abruptly rose in Would possibly.The newest index studying from the Convention Board was once 102, above 97.5 in April and better than the 96 economists surveyed by means of Bloomberg had anticipated. The Would possibly studying ended 3 months of declines for the index.”Customers’ overview of present industry stipulations was once fairly much less certain than final month,” the Convention Board leader economist Dana Peterson mentioned within the unencumber. “Then again, the sturdy exertions marketplace persisted to strengthen shoppers’ total overview of the current scenario. Perspectives of present exertions marketplace stipulations progressed in Would possibly, as fewer respondents mentioned jobs have been ‘arduous to get.'”Peterson added: “Fewer shoppers anticipated deterioration in long run industry stipulations, activity availability, and revenue, leading to an build up within the Expectation Index.” Tue, Would possibly 28, 2024 at 6:32 AM PDTDow falls, Nasdaq positive factors at openUS shares opened blended on Tuesday, with tech serving as a vibrant spot forward of a important inflation record due later this week.The benchmark S&P 500 (^GSPC) climbed about 0.2%, whilst the tech-heavy Nasdaq Composite (^IXIC) added more or less 0.4% after cast last positive factors on Friday. The Dow Jones Business Reasonable (^DJI) was once the largest laggard of the morning, slipping 0.3%.

Tue, Would possibly 28, 2024 at 6:32 AM PDTDow falls, Nasdaq positive factors at openUS shares opened blended on Tuesday, with tech serving as a vibrant spot forward of a important inflation record due later this week.The benchmark S&P 500 (^GSPC) climbed about 0.2%, whilst the tech-heavy Nasdaq Composite (^IXIC) added more or less 0.4% after cast last positive factors on Friday. The Dow Jones Business Reasonable (^DJI) was once the largest laggard of the morning, slipping 0.3%. Tue, Would possibly 28, 2024 at 3:53 AM PDTFoot Locker is not out of the woodsFoot Locker (FL) has had a horrendous twelve months.Deficient monetary performances have resulted in strangely deficient outlooks, sending stocks down 16% up to now 12 months.The Boulevard is bracing for some other dreadful quarter from the sneaker and sports clothing store when it studies Thursday morning.Evercore ISI analyst Michael Binetti mentioned traders must be expecting a “very difficult quarter.” The corporate may warn once more for the overall 12 months.He pointed to a number of explanation why:”Along with stressed low-income shoppers, we expect key product launches like Air Max DN underperformed, and the hot Jordan 4 Business Blue is promoting under MSRP within the resale channel ($185 vs $215 MSRP).”

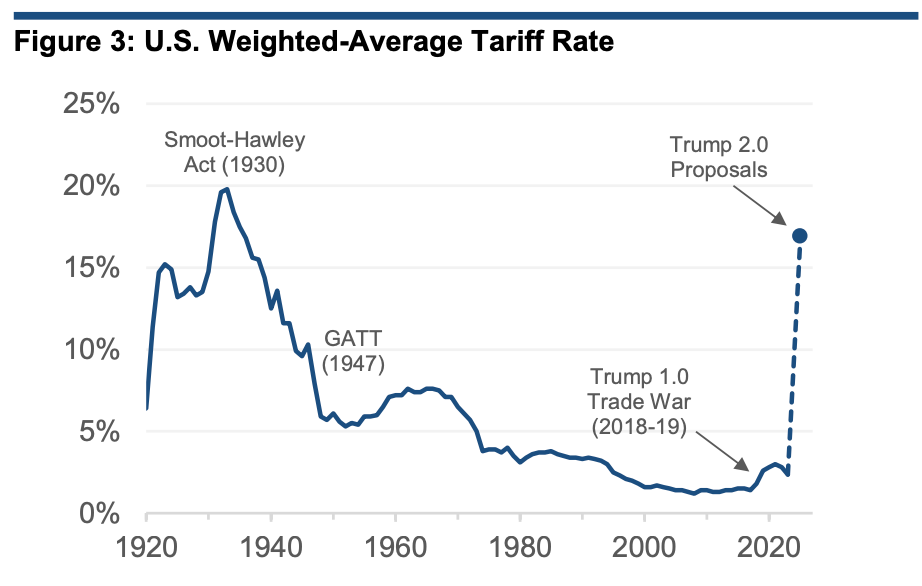

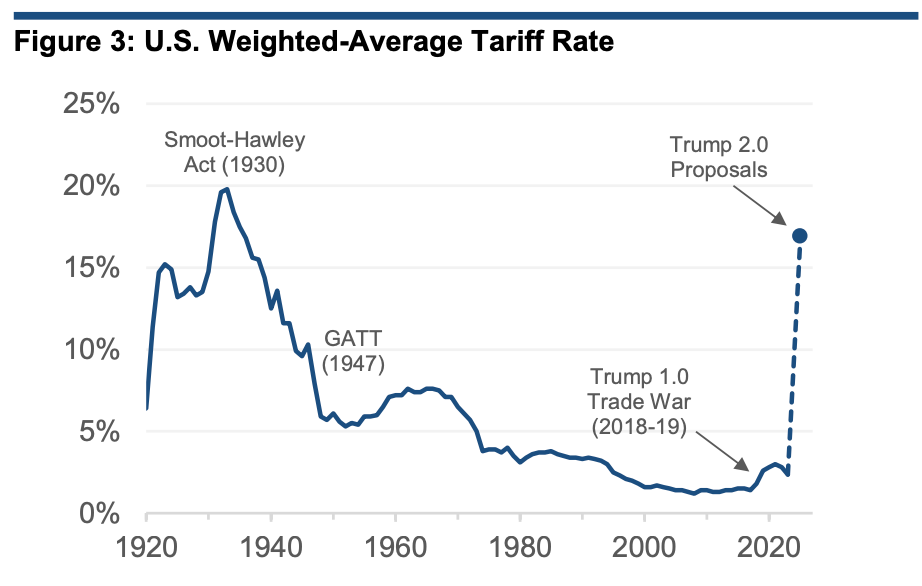

Tue, Would possibly 28, 2024 at 3:53 AM PDTFoot Locker is not out of the woodsFoot Locker (FL) has had a horrendous twelve months.Deficient monetary performances have resulted in strangely deficient outlooks, sending stocks down 16% up to now 12 months.The Boulevard is bracing for some other dreadful quarter from the sneaker and sports clothing store when it studies Thursday morning.Evercore ISI analyst Michael Binetti mentioned traders must be expecting a “very difficult quarter.” The corporate may warn once more for the overall 12 months.He pointed to a number of explanation why:”Along with stressed low-income shoppers, we expect key product launches like Air Max DN underperformed, and the hot Jordan 4 Business Blue is promoting under MSRP within the resale channel ($185 vs $215 MSRP).” Tue, Would possibly 28, 2024 at 3:47 AM PDTEvercore ISI’s tackle Trump 2.0 tariffsWe have began to peer Wall Boulevard crunch the numbers at the financial affect of the brand new price lists that former President Trump could be all for enforcing if he have been to win a 2d time period.Nowadays Evercore ISI weighs in with its take:”Presidents hardly enact or put into effect the overall entirety of any marketing campaign concept and Trump specifically likes to make use of daring concepts as a launching off. However, it’s important to know what a dramatic place to begin Trump has put ahead as that has implications for the place lets in the long run land. Taken at face price, the combo of the proposed 10% across-the-board tariff and the 60% China tariff would result in an total U.S. weighted moderate tariff charge of just about 17%, the absolute best for the reason that Thirties Smoot-Hawley technology. On a static foundation (i.e., no longer assuming any dynamic financial results), price lists would upward thrust from 0.3% of GDP to at least one.9% of GDP – an build up of greater than $400 billion once a year. Any such dramatic transfer would virtually definitely result in main retaliation by means of buying and selling companions.”

Tue, Would possibly 28, 2024 at 3:47 AM PDTEvercore ISI’s tackle Trump 2.0 tariffsWe have began to peer Wall Boulevard crunch the numbers at the financial affect of the brand new price lists that former President Trump could be all for enforcing if he have been to win a 2d time period.Nowadays Evercore ISI weighs in with its take:”Presidents hardly enact or put into effect the overall entirety of any marketing campaign concept and Trump specifically likes to make use of daring concepts as a launching off. However, it’s important to know what a dramatic place to begin Trump has put ahead as that has implications for the place lets in the long run land. Taken at face price, the combo of the proposed 10% across-the-board tariff and the 60% China tariff would result in an total U.S. weighted moderate tariff charge of just about 17%, the absolute best for the reason that Thirties Smoot-Hawley technology. On a static foundation (i.e., no longer assuming any dynamic financial results), price lists would upward thrust from 0.3% of GDP to at least one.9% of GDP – an build up of greater than $400 billion once a year. Any such dramatic transfer would virtually definitely result in main retaliation by means of buying and selling companions.”

Are markets under-pricing a brand new Trump industry conflict? (EvercoreISI)

Are markets under-pricing a brand new Trump industry conflict? (EvercoreISI)

(Supply: Oxford Economics/Haver Analytics)Yaros added that even supposing he expects “declines in loan charges as the primary charge reduce by means of the Federal Reserve comes into view” costs must proceed to stay increased amid a “traditionally tight” provide of houses on the market.In the meantime, the seasonally adjusted Federal Housing Finance Company (FHFA) Area Worth Index additionally rose throughout the month of March however at a slower tempo in comparison to earlier months. The index climbed simply 0.1% after emerging 1.2% month over month in February.”Regardless that base results have began to develop into much less favorable for the FHFA index, it’s nonetheless emerging on an annual foundation sooner than it did for many of 2023,” Yaros mentioned.

Are markets under-pricing a brand new Trump industry conflict? (EvercoreISI)

:max_bytes(150000):strip_icc()/GettyImages-2189656777-d7193ca7dfd346829c38970cc27194ed.jpg)