US shares popped on Wednesday after a contemporary studying on inflation confirmed client costs higher lower than anticipated in Might. The newest snapshot of inflation comes hours earlier than a extremely expected Federal Reserve assembly within the afternoon will give you the newest sign at the trail of rates of interest.The S&P 500 (^GSPC) constructed on a twenty seventh file shut of the yr, emerging greater than 0.8%. The tech-heavy Nasdaq Composite (^IXIC) rose just about 0.9%, additionally including to a file shut from the prior day. The Dow Jones Commercial Moderate (^DJI) additionally popped about 0.9%.The Client Value Index (CPI) remained flat over the former month and rose 3.3% over the prior yr in Might — a deceleration from April’s 0.3% month-over-month build up and three.4% annual acquire in costs. Each measures beat economist expectancies. On a “core” foundation, which strips out the extra unstable prices of meals and fuel, costs in Might climbed 0.2% over the prior month and three.4% over closing yr — cooler than April’s information. Each measures additionally got here in higher than economist estimates.This shifted marketplace expectancies for Fed price cuts this yr. Following the knowledge’s unlock, markets have been pricing in a more or less 69% likelihood the Federal Reserve starts to chop charges by means of its September assembly, in step with information from the CME FedWatch Instrument. That is up from a few 53% likelihood the day prior.Therefore, pastime rate-sensitive spaces of the marketplace soared. Actual Property (XLRE) led the 11 sectors, emerging greater than 2%.Learn extra: How does the exertions marketplace have an effect on inflation?However all that might shift later this afternoon. The Fed’s determination is all however positive — the central financial institution is predicted to stay charges at their present 23-year-high ranges. Traders shall be extra intently looking at the discharge of the Fed’s up to date financial projections in its “dot plot” — in particular, what number of price cuts it tasks for the remainder of the yr.Remaining we heard, in March, it was once 3. Policymakers are nearly positive to slash that, thank you partly to the aforementioned inflation’s stickiness to start out this yr. The ones projections, at the side of what Fed Chair Jerome Powell says in his press convention, might be the closing market-moving occasions in a very busy day.Live6 updatesWed, June 12, 2024 at 6:32 AM PDTStocks upward push on the open as yields fallUS shares popped on Wednesday after a contemporary studying on inflation confirmed client costs higher lower than anticipated in Might. The newest snapshot of inflation comes hours earlier than a extremely expected Federal Reserve assembly within the afternoon will give you the newest sign at the trail of rates of interest.The S&P 500 (^GSPC) constructed on a twenty seventh file shut of the yr, emerging greater than 0.8%. The tech-heavy Nasdaq Composite (^IXIC) rose just about 0.9%, additionally including to a file shut from the prior day. The Dow Jones Commercial Moderate (^DJI) additionally popped about 0.9%.The ten-year Treasury yield (^TNX) fell about 10 foundation issues to 4.3%. Wed, June 12, 2024 at 5:54 AM PDTIt’s chance on in markets after the CPI printStock futures shot upper after the cooler-than-expected studying on client costs for the month of Might.S&P 500 futures (ES=F) constructed on a twenty seventh file shut of the yr, emerging 0.7%. Futures at the tech-heavy Nasdaq 100 (NQ=F) rose just about 0.9%, additionally pointing to features after a file shut for the index. Dow Jones Commercial Moderate futures (YM=F) received 0.6%.Particularly, pastime rate-sensitive spaces of the marketplace noticed the largest features. Futures tied to the Russell 2000 (RT=F) have been up about 2.3%.This got here as traders briefly recalibrated their expectancies for price cuts this yr. Following the knowledge’s unlock, markets have been pricing in a more or less 69% likelihood the Federal Reserve starts to chop charges by means of its September assembly, in step with information from the CME FedWatch Instrument. That is up from a few 53% likelihood the day prior.

Wed, June 12, 2024 at 5:54 AM PDTIt’s chance on in markets after the CPI printStock futures shot upper after the cooler-than-expected studying on client costs for the month of Might.S&P 500 futures (ES=F) constructed on a twenty seventh file shut of the yr, emerging 0.7%. Futures at the tech-heavy Nasdaq 100 (NQ=F) rose just about 0.9%, additionally pointing to features after a file shut for the index. Dow Jones Commercial Moderate futures (YM=F) received 0.6%.Particularly, pastime rate-sensitive spaces of the marketplace noticed the largest features. Futures tied to the Russell 2000 (RT=F) have been up about 2.3%.This got here as traders briefly recalibrated their expectancies for price cuts this yr. Following the knowledge’s unlock, markets have been pricing in a more or less 69% likelihood the Federal Reserve starts to chop charges by means of its September assembly, in step with information from the CME FedWatch Instrument. That is up from a few 53% likelihood the day prior. Wed, June 12, 2024 at 5:32 AM PDTInflation pressures ease greater than anticipated US client worth will increase cooled right through the month of Might, in step with the newest information from the Bureau of Exertions Statistics launched Wednesday morning.The Client Value Index (CPI) was once flat over the former month and three.3% over the prior yr in Might, a deceleration from April’s 3.4%, and less than the three.4% year-over-year trade economists had anticipated.Might’s per month build up got here in less than economist forecasts of a zero.1% uptick.On a “core” foundation, which strips out the extra unstable prices of meals and fuel, costs in Might climbed 0.2% over the prior month and three.4% over closing yr — cooler than April’s information. Each measures have been less than economist expectancies.

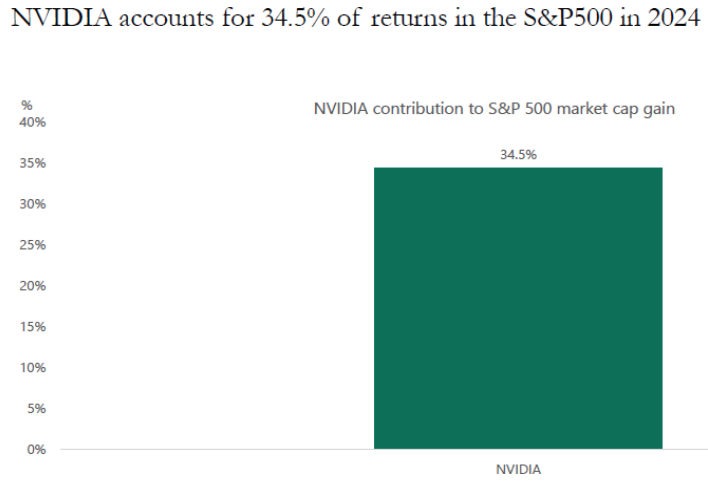

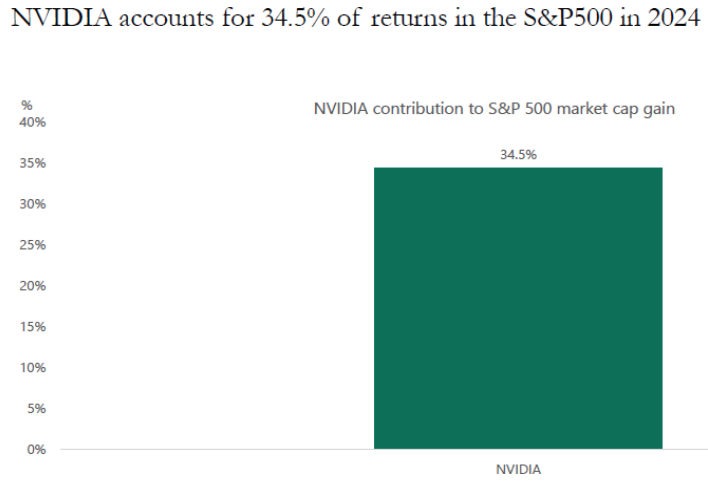

Wed, June 12, 2024 at 5:32 AM PDTInflation pressures ease greater than anticipated US client worth will increase cooled right through the month of Might, in step with the newest information from the Bureau of Exertions Statistics launched Wednesday morning.The Client Value Index (CPI) was once flat over the former month and three.3% over the prior yr in Might, a deceleration from April’s 3.4%, and less than the three.4% year-over-year trade economists had anticipated.Might’s per month build up got here in less than economist forecasts of a zero.1% uptick.On a “core” foundation, which strips out the extra unstable prices of meals and fuel, costs in Might climbed 0.2% over the prior month and three.4% over closing yr — cooler than April’s information. Each measures have been less than economist expectancies. Wed, June 12, 2024 at 4:24 AM PDTNvidia because the solar…A tip of the hat to Apollo leader economist Torsten Slok for this vibe test at the S&P 500.Obviously, Nvidia (NVDA) is the solar that 499 different firms revolve round.Word: Apollo is the mum or dad corporate of Yahoo Finance.

Wed, June 12, 2024 at 4:24 AM PDTNvidia because the solar…A tip of the hat to Apollo leader economist Torsten Slok for this vibe test at the S&P 500.Obviously, Nvidia (NVDA) is the solar that 499 different firms revolve round.Word: Apollo is the mum or dad corporate of Yahoo Finance.

It is an Nvidia marketplace. (Apollo)

It is an Nvidia marketplace. (Apollo) Wed, June 12, 2024 at 3:35 AM PDTJP Morgan weighs in at the Musk pay package deal voteThe Tesla (TSLA) shareholder vote on Elon Musk’s $56 billion pay package deal is coming all the way down to the twine.Forward of the vote on Thursday, Tesla simply dropped this put up on Musk owned X detailing its CEO’s accomplishments (word that is bizarre to peer from a company X account, however howdy, that is Musk we’re speaking about right here).A brand new Yahoo Finance ballot is recently appearing 96% of the folk that experience voted suppose Musk’s pay package deal should not be licensed.Period in-between, JP Morgan analyst Ryan Brinkman is weighing in with a word this morning:”Whilst each ISS and Glass Lewis, in addition to a number of distinguished institutional and retail shareholders, have voiced opposition to the 2024 ratification of Mr. Musk’s 2018 repayment plan, we quite suspect it is going to cross, albeit with a lesser approval price than in 2018 and possibly by means of a lesser margin than popularly imagined. We base this expectation on anecdotal proof of robust retail shareholder enhance and in accordance with our conversations with institutional traders whose reasoning, at the entire, turns out very similar to when requested to vote in choose of the Sun Town acquisition. Traders we spoke with then in large part didn’t enhance the Sun Town acquisition, however anxious there can be a extra adverse percentage worth response within the tournament the transaction have been voted down, given the belief of a vote of no self assurance.”Brinkman reiterated an underweight ranking (promote an identical) on Tesla stocks and a $115 worth goal, which assumes about 32% problem from present worth ranges.Learn extra right here at the Musk vote and key CEO pay package deal votes from Yahoo Finance senior criminal reporter Alexis Keenan.

Wed, June 12, 2024 at 3:35 AM PDTJP Morgan weighs in at the Musk pay package deal voteThe Tesla (TSLA) shareholder vote on Elon Musk’s $56 billion pay package deal is coming all the way down to the twine.Forward of the vote on Thursday, Tesla simply dropped this put up on Musk owned X detailing its CEO’s accomplishments (word that is bizarre to peer from a company X account, however howdy, that is Musk we’re speaking about right here).A brand new Yahoo Finance ballot is recently appearing 96% of the folk that experience voted suppose Musk’s pay package deal should not be licensed.Period in-between, JP Morgan analyst Ryan Brinkman is weighing in with a word this morning:”Whilst each ISS and Glass Lewis, in addition to a number of distinguished institutional and retail shareholders, have voiced opposition to the 2024 ratification of Mr. Musk’s 2018 repayment plan, we quite suspect it is going to cross, albeit with a lesser approval price than in 2018 and possibly by means of a lesser margin than popularly imagined. We base this expectation on anecdotal proof of robust retail shareholder enhance and in accordance with our conversations with institutional traders whose reasoning, at the entire, turns out very similar to when requested to vote in choose of the Sun Town acquisition. Traders we spoke with then in large part didn’t enhance the Sun Town acquisition, however anxious there can be a extra adverse percentage worth response within the tournament the transaction have been voted down, given the belief of a vote of no self assurance.”Brinkman reiterated an underweight ranking (promote an identical) on Tesla stocks and a $115 worth goal, which assumes about 32% problem from present worth ranges.Learn extra right here at the Musk vote and key CEO pay package deal votes from Yahoo Finance senior criminal reporter Alexis Keenan. Wed, June 12, 2024 at 3:20 AM PDTAffirm nonetheless at the transfer after giant Apple dealAffirm (AFRM) continues to be one of the crucial warmer tickers at the Yahoo Finance platform after information dropped Tuesday of an integration into Apple (AAPL) Pay. Stocks are up 1.5% pre-market following an 11% pop the previous day.I stuck up closing night time with Confirm’s founder and CEO Max Levchin for a brand new taping of my ‘Opening Bid’ podcast. The whole episode (which works into Levchin’s perspectives on AI and the political vibes in Silicon Valley) will unlock on Friday morning on Yahoo Finance and main podcast platforms.However I put a clip under of Levchin’s feedback at the tie-up under for you to take a look at.Levchin stops in need of sharing how this deal will financially have an effect on Confirm (might be giant given the 1.4 billion iPhones out within the wild international), however hinted it is usually a robust top- and bottom-line contributor through the years.He did recognize the deal “validates” the purchase now, pay later area — which has been below siege from regulators and different events nearly since inception.

Wed, June 12, 2024 at 3:20 AM PDTAffirm nonetheless at the transfer after giant Apple dealAffirm (AFRM) continues to be one of the crucial warmer tickers at the Yahoo Finance platform after information dropped Tuesday of an integration into Apple (AAPL) Pay. Stocks are up 1.5% pre-market following an 11% pop the previous day.I stuck up closing night time with Confirm’s founder and CEO Max Levchin for a brand new taping of my ‘Opening Bid’ podcast. The whole episode (which works into Levchin’s perspectives on AI and the political vibes in Silicon Valley) will unlock on Friday morning on Yahoo Finance and main podcast platforms.However I put a clip under of Levchin’s feedback at the tie-up under for you to take a look at.Levchin stops in need of sharing how this deal will financially have an effect on Confirm (might be giant given the 1.4 billion iPhones out within the wild international), however hinted it is usually a robust top- and bottom-line contributor through the years.He did recognize the deal “validates” the purchase now, pay later area — which has been below siege from regulators and different events nearly since inception.

It is an Nvidia marketplace. (Apollo)