A tech-led rally introduced new report highs for the S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) Thursday as traders digested a contemporary rate of interest lower from the Federal Reserve and Donald Trump’s electoral victory. In a broadly anticipated transfer, the Fed lower rates of interest by means of 25 foundation issues on Thursday, reducing its benchmark fee to a variety of four.5% to 4.75%. The S&P 500 rose more or less 0.7%, whilst the tech-heavy Nasdaq Composite moved just about 1.5% as stocks of chip heavyweight Nvidia (NVDA) and e-commerce large Amazon (AMZN) rose to new highs. In the meantime, the Dow Jones Commercial Moderate (^DJI) traded proper across the flat line, at the heels of a 1,500-point achieve that marked the blue-chip gauge’s highest day since 2022. In bonds, a up to date transfer upper in yields took a breather, with the 10-year Treasury yield (^TNX) falling about 8 foundation issues to 4.34%. Spirits nonetheless gave the impression buoyant after Trump’s presidential election win, which despatched all 3 primary inventory gauges hovering to contemporary report highs on Wednesday. His plans for company tax cuts and deregulation have fueled optimism for a spice up to the financial system that may feed into shares. Powell was once requested more than one instances on Thursday about how an incoming Trump management may just have an effect on the Fed’s trail ahead. “Within the close to time period, the election will don’t have any impact on our coverage selections,” Powell mentioned. When wondered whether or not he’d step down as Fed chair if requested to take action by means of Trump, Powell merely mentioned “no.” LIVE 23 updates Thu, November 7, 2024 at 9:07 PM UTC The Magnificent Seven are at an all-time prime too Throughout a roaring rally over the last two classes, a lot has been made about trades like financials that would have the benefit of President-elect Donald Trump’s coverage. However one of the crucial marketplace’s greatest movers this week have as soon as once more been from the marketplace’s greatest shares. Roundhill’s Magnificent Seven ETF (MAGS) — which tracks Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), Tesla (TSLA), and Nvidia (NVDA) — hit a contemporary report prime on Thursday. The index is up over 8% during the last 5 days, outperforming the S&P 500’s (^GSPC) 4.69%.

Thu, November 7, 2024 at 8:19 PM UTC Shares head for information submit Powell press convention All 3 of the key inventory indexes have been headed for report closes on Thursday as traders digested a subdued press convention from Federal Reserve Chair Jerome Powell. The S&P 500 (^GSPC) rose more or less 0.9%, whilst the tech-heavy Nasdaq Composite (^IXIC) moved up greater than 1.6% and stocks of chip heavyweight Nvidia (NVDA) and e-commerce large Amazon (AMZN) rose to new highs. In the meantime, the Dow Jones Commercial Moderate (^DJI) rose about 0.2% at the heels of a 1,500-point achieve that marked the blue-chip gauge’s highest day since 2022. Each and every moderate moved upper as Powell’s presser ended.

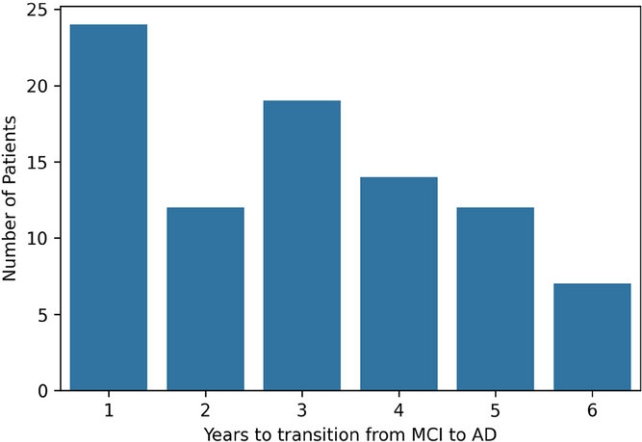

Thu, November 7, 2024 at 8:00 PM UTC One chart displays the growth on inflation the Fed is bringing up The most recent studying of the Fed’s most well-liked inflation gauge confirmed year-over-year worth will increase did not fall in September. The core Non-public Intake Expenditures (PCE) index, which strips out the price of meals and effort and is carefully watched by means of the Federal Reserve, rose 2.7% in September, above Wall Boulevard’s expectancies for two.6% and consistent with the two.7% observed in August. However right through Thursday’s press convention Fed Chair Jerome Powell famous that the Fed additionally seems to be on the three- and six-month annualized charges of Core PCE to spot tendencies. Our chart beneath displays the three- and six-month annualized charges are at 2.3%. Widely, Powell mentioned the knowledge is appearing “that we in reality have made important growth.”

Thu, November 7, 2024 at 7:51 PM UTC Powell says upper bond yields no longer pushed by means of emerging inflation expectancies For the reason that Fed started chopping rates of interest, the 10-year Treasury yield (^TNX) rose more or less 80 foundation issues to hit a up to date prime of about 4.47%. On Thursday, Fed Chair Jerome Powell mentioned that transfer upper was once most likely no longer “mainly about upper inflation expectancies.” He reasoned the transfer upper was once much more likely pushed by means of better-than-expected financial expansion. Powell later added that for upper bond yields to have an effect on Fed coverage they’d wish to see “subject material adjustments in monetary stipulations that “ultimate” and “are continual.” “We do not know that about those what we now have observed to this point,” Powell mentioned.

Thu, November 7, 2024 at 7:04 PM UTC Fed cuts charges by means of quarter of a share level In a broadly expected transfer, the Federal Reserve lower rates of interest by means of 1 / 4 of a share level on Thursday. After a part a share level lower in September, Thursday’s unanimous resolution transfer brings the central financial institution’s benchmark fee right down to a variety of four.5% to 4.75%. Yahoo Finance’s Jennifer Schonberger experiences: This new lower was once justified, in keeping with the Fed’s Federal Open Marketplace Committee, in enhance of its targets to handle solid costs and whole employment. Alternatively, the central financial institution got rid of language from its coverage observation that the “committee has won larger self belief that inflation is shifting sustainably against 2%,” elevating questions concerning the tempo and choice of long run fee cuts. As an alternative the coverage observation learn: “the Committee judges that the dangers to reaching its employment and inflation targets are more or less in steadiness.” Learn extra right here.

Thu, November 7, 2024 at 6:39 PM UTC Tech leads shares into Fed resolution The Fed’s subsequent coverage resolution is lower than half-hour away. Here is a take a look at the place markets take a seat sooner than Federal Reserve Chair Jerome Powell’s carefully adopted press convention at 2:30 p.m. ET. The S&P 500 (^GSPC) was once up 0.6%, whilst the tech-heavy Nasdaq Composite (^IXIC) moved up than 1.2% as stocks of chip heavyweight Nvidia (NVDA) and e-commerce large Amazon (AMZN) rose to new highs. Widely, Giant Tech led the marketplace motion, with all the “Magnificent Seven” tech shares up greater than 1% at the day, led by means of greater than 3% pop in Meta (META). In bonds, a up to date transfer upper in yields took a breather, with the 10-year Treasury yield (^TNX) falling about 7 foundation issues to 4.35%. Under is a take a look at the field motion for the day the place Knowledge Era (XLK) is main the best way.

Thu, November 7, 2024 at 6:15 PM UTC What to understand forward of the Fed resolution Yahoo Finance’s Jennifer Schonberger experiences: The Federal Reserve is anticipated to chop rates of interest by means of 25 foundation issues Thursday and steer clear of any useless surprises lower than two days after the election of Donald Trump as the following president. “They might quite simply lower, stay their heads down and no longer say anything else all that new,” mentioned Luke Tilley, leader economist for Wilmington Consider. Nonetheless, that doesn’t imply the dialogue as of late in Washington will essentially be a easy one. Fed policymakers should make sense of latest knowledge indicating a robust financial system, continual inflation, and a muddled jobs marketplace disrupted by means of climate and employee moves. And there can be a debate between those that wish to lower, those that may just enhance a pause, and those that would enhance a lower blended with language designed to keep up a correspondence a extra slow method to long run discounts. Learn extra right here.

Thu, November 7, 2024 at 5:45 PM UTC Inventory marketplace ‘exuberance’ looms forward with Trump win The inventory marketplace’s feverish rally following Donald Trump’s presidential election victory could have simply been an early appetizer for a robust few months of features. “Exuberance lies forward,” Julian Emanuel, who leads the fairness, derivatives, and quantitative technique workforce at Evercore ISI, wrote in a notice to purchasers Wednesday night time. “President-Elect Trump will transfer speedy on coverage projects, and shares will transfer speedy in reaction.” Emanuel, who already had a 6,000 name at the S&P 500 for 2024, now sees the S&P 500 hitting 6,600 by means of the top of June 2025, about an 11% building up from its present degree. A “public reengaged in hypothesis,” as evidenced by means of Wednesday’s marketplace motion with bitcoin (BTC-USD) hitting 76,000 for the primary time and Tesla (TSLA) inventory hovering 14%, may just lend a hand force the benchmark index upper, in keeping with Emanuel. Learn extra right here.

Thu, November 7, 2024 at 5:25 PM UTC Loan charges upward thrust once more amid election volatility Yahoo Finance’s Claire Boston experiences: Loan charges rose for a 6th consecutive week, following Treasury yields as they climbed upper during the presidential election. The common 30-year fixed-rate loan rose to six.79% via Wednesday, up from 6.72% every week previous, in keeping with Freddie Mac knowledge. The common 15-year fixed-rate loan was once necessarily unchanged, to six% from 5.99%. Loan charges in most cases replicate 10-year Treasury yields, which rose temporarily in fresh weeks as buyers grew an increasing number of assured that former President Donald Trump would win Tuesday’s election and put into effect inflationary insurance policies like price lists. Learn extra right here.

Thu, November 7, 2024 at 5:15 PM UTC Corporate leaders are getting ready for Trump’s coverage plans About 24 hours after Donald Trump received the presidential election, American CEOs are already weighing on how the president-elect’s insurance policies may just have an effect on their industry. For one, Trump’s proposed will increase on price lists are anticipated to weigh on shops. On Wednesday, Steve Madden (SHOO) CEO Edward Rosenfeld mentioned his corporate has been “making plans for a possible situation during which we must transfer items out of China extra temporarily.” “Our function over the following 12 months is to scale back that share of products that we sourced from China by means of roughly 40% to 45%, this means that that if we’re ready to reach that and we predict we’ve got the plan to do it, {that a} 12 months from as of late, we might be taking a look at simply over 1 / 4 of our industry that will be matter to attainable price lists on Chinese language items,” the shoemaker’s CEO mentioned. Trump’s presidency may be anticipated to be much less restrictive on mergers and acquisitions. Warner Bros. Discovery (WBD) CEO David Zaslav mentioned Thursday Trump’s 2nd time period may just provide a chance for extra consolidation within the media business. “We’ve got an upcoming new management, and it is too early to inform, however it should be offering a tempo of trade and a chance for consolidation that can be moderately other,” Zaslav mentioned on a choice with analysts following the corporate’s 3rd quarter effects.

Thu, November 7, 2024 at 4:51 PM UTC Homebuilder DHI hit with downgrade after Trump election win Raymond James analysts on Thursday downgraded stocks of DHI (DHI), announcing that within the wake of Trump’s election win, they view loan charges staying “upper for longer” and constraining housing affordability. The funding company downgraded DHI to Marketplace Carry out from Outperform however saved the similar worth goal at $195.00. It decreased its fiscal 12 months 2025 EPS estimates to $13.25 from $15.80 and tasks an EPS estimate of $15.00 within the fiscal 12 months of 2026. Because of “the near-term pressures we see on access degree homebuilders, whose core first-time consumers are more likely to face even larger affordability demanding situations this spring,” Dollar Horne, director at Raymond James & Friends, wrote in a notice to purchasers. “Popping out of a unstable October, DHI was once already dealing with power from a extra aggressive stock atmosphere, emerging charges, and consumers’ election anxiousness,” Horne added. The bearish name comes as DHI reported weaker-than-expected house orders for its fiscal fourth quarter as prime loan charges dampened purchaser affordability.

Thu, November 7, 2024 at 4:18 PM UTC Lyft inventory soars on profits beat Lyft (LYFT) stocks soared greater than 25% after its 3rd quarter profits beat expectancies. Lyft’s adjusted profits in keeping with percentage of $0.29 have been forward of the $0.20 anticipated, whilst quarterly earnings of $1.5 billion beat Wall Boulevard’s estimate of $1.4 billion, in keeping with Bloomberg consensus estimates. Rides for the length ended Sept. 30 totaled 217 million, above the 213 million anticipated. On Wednesday, Lyft introduced partnerships with self sustaining car firms because it seems to be to safe a foothold within the burgeoning marketplace, including driverless cabs to its community in Atlanta in 2025. Wall Boulevard analysts in notes to traders Thursday gave kudos to Lyft’s expansions past ride-hailing. “LYFT is not a ride-hailing pure-play with it now embarking on partnerships in meals supply and AVs,” mentioned RBC Capital Markets analyst and Lyft bull Brad Erickson. Lyft just lately unveiled a partnership with DoorDash (DASH). Nonetheless, analysts general maintained Impartial scores at the inventory, with Wedbush analyst Scott Devitt, writing, “[W]e watch for transparent proof of a extra sustainable expansion trajectory for the industry.” Lyft stocks are up 74% from ultimate 12 months however a ways beneath highs within the $60 vary in 2021.

Thu, November 7, 2024 at 2:35 PM UTC Income roundup: Moderna, WBD shares surge on Q3 effects, Hershey drops Every other batch of businesses reported profits Thursday morning. Moderna (MRNA) jumped 5% on the marketplace open as its profits beat expectancies in part because of better-than-anticipated COVID vaccine gross sales. Warner Bros. (WBD) jumped 10% because of streaming expansion as Max subscribers soared. In the meantime, Hershey (HSY) fell greater than 1% after sinking up to 3% premarket as prime cocoa costs lower into its gross sales outlook for the 12 months. Right here’s a more in-depth take a look at how the firms carried out: Hershey: Adjusted profits in keeping with percentage of $2.34 vs. $2.56 in keeping with percentage anticipated, earnings of $2.99 billion vs. $3.07 billion anticipated Moderna: Income in keeping with percentage of $0.03 vs. a lack of $1.98 in keeping with percentage anticipated, earnings of $1.86 billion vs. $1.25 billion anticipated Warner Bros.: Adjusted profits in keeping with percentage of $0.05 vs. a lack of $0.12 in keeping with percentage anticipated, earnings of $9.62 billion vs. $9.81 billion anticipated In the meantime, power firms traded flattish after appearing combined effects as herbal screw ups impacted a few of their companies. Duke Power (DUK) noticed its earnings hit by means of storm prices, whilst Pacific Gasoline & Electrical (PCG) neglected on earnings simply because it close off energy in Northern California amid hearth dangers. Nuclear energy supplier Vistra soared 11% after an profits beat because it recovers from previous losses.