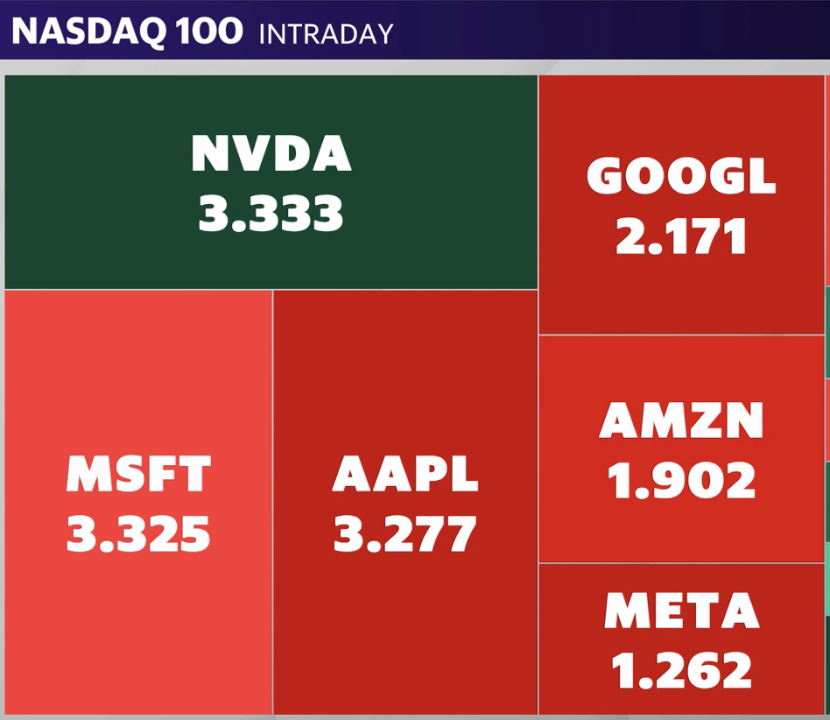

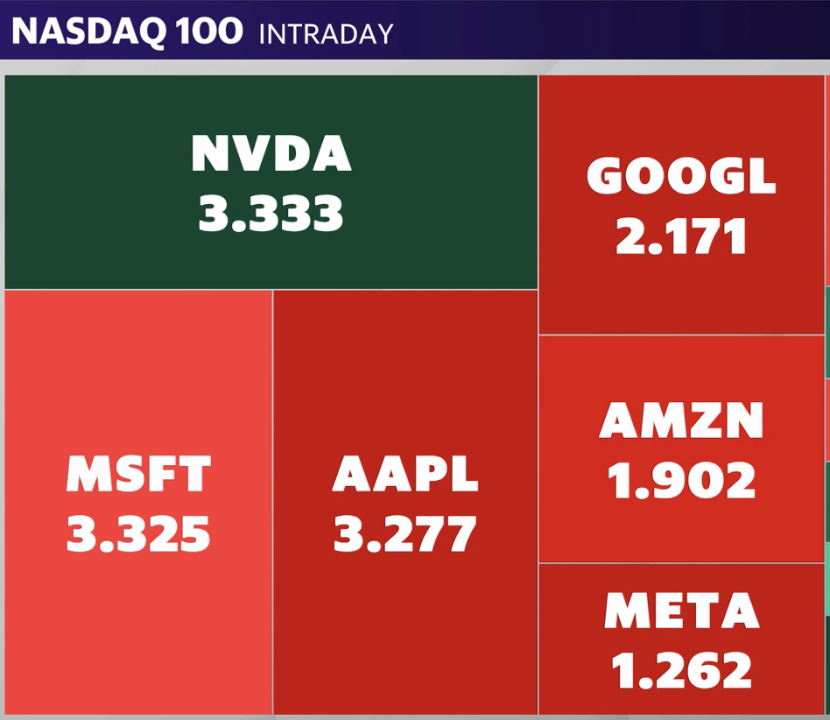

US shares held close to report highs on Tuesday, as Nvidia (NVDA) surpassed Microsoft (MSFT) to grow to be essentially the most precious public corporate. Each the S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) climbed in afternoon buying and selling, up about 0.3% and nil.2%, respectively, after the benchmark index secured its thirtieth report shut of 2024 whilst the tech-heavy Nasdaq goals to construct on a 6th immediately report shut.The Dow Jones Business Moderate (^DJI) additionally moved upper, up more or less 0.1%.As of afternoon buying and selling, Nvidia’s inventory value rose greater than 3.5% to north of $135 according to proportion, giving the chipmaker a marketplace capitalization simply over $3.34 trillion. With a nil.2% slide on Tuesday, Microsoft’s marketplace cap stood at round $3.33 trillion.Techs have persisted to steer an AI-driven rally that, as Yahoo Finance’s Myles Udland wrote, traders merely cannot have enough money to fail to see. The passion is main a number of Wall Side road banks to chase their year-end S&P objectives upper, with one strategist announcing the AI revolution continues to be in its “early innings.Nonetheless, it wasn’t all certain information after Might’s retail gross sales numbers disillusioned.Executive information launched on Tuesday confirmed that retail gross sales larger simply 0.1%, lacking economist expectancies, Yahoo Finance’s Josh Schafer reported. In the meantime, April’s numbers have been revised to turn a decline. It can be a signal of extra shopper pressure amid top rates of interest and consistently cussed inflation.Additionally on Tuesday, a roster of Fed officers presented extra remark at the trail of rates of interest. Fed governor Ariana Kugler stated she remained “positive that bettering provide and cooling call for will strengthen persisted disinflation.””If the economic system evolves as I’m anticipating, it is going to most probably grow to be suitable to start out easing coverage someday later this yr,” she stated.To this point the message after final week’s price choice and forecast replace has been transparent: Be expecting one price minimize in 2024. Buyers reputedly have not but taken this to center, with over 60% nonetheless anticipating two cuts by means of the top of the yr, in line with the CME FedWatch instrument.Live8 updates Tue, June 18, 2024 at 10:35 AM PDTNvidia surpasses Microsoft to grow to be most beneficial stockNvidia (NVDA) is now essentially the most precious public corporate on the planet.The chip maker surpassed Microsoft’s (MSFT) marketplace cap on Tuesday, simply two weeks after it took the quantity two spot from Apple (AAPL).Yahoo Finance’s Josh Schafer and Dan Howley with the tale:Nvidia’s inventory value rose greater than 3.5% to north of $135 according to proportion, giving the chipmaker a marketplace capitalization simply over $3.33 trillion. With a nil.3% slide on Tuesday, Microsoft’s marketplace cap stood at $3.32 trillion.

Tue, June 18, 2024 at 10:35 AM PDTNvidia surpasses Microsoft to grow to be most beneficial stockNvidia (NVDA) is now essentially the most precious public corporate on the planet.The chip maker surpassed Microsoft’s (MSFT) marketplace cap on Tuesday, simply two weeks after it took the quantity two spot from Apple (AAPL).Yahoo Finance’s Josh Schafer and Dan Howley with the tale:Nvidia’s inventory value rose greater than 3.5% to north of $135 according to proportion, giving the chipmaker a marketplace capitalization simply over $3.33 trillion. With a nil.3% slide on Tuesday, Microsoft’s marketplace cap stood at $3.32 trillion.

Nvidia surpasses Microsoft in marketplace capShares of Nvidia are up greater than 215% during the last three hundred and sixty five days and greater than 3,400% during the last 5 years. Yr up to now, Nvidia has won 173%; Microsoft inventory is up simply not up to 19% in 2024.Nvidia’s surge has made it a peak weighting within the S&P 500 (^GSPC), and the chipmaker has served a pivotal function within the benchmark index hitting report highs in 2024.Up till Might, the S&P 500 had traded with a near-perfect correlation to Nvidia’s value motion, that means that as Nvidia’s inventory rose, so did the wider index. As of Monday, Nvidia’s inventory positive factors on my own had contributed about one-third of the S&P 500’s year-to-date upward thrust, in line with information from Citi’s fairness analysis staff.Nvidia, which is the tech business’s go-to provider for AI chips and built-in device, finished a 10-for-1 cut up on June 10.

Nvidia surpasses Microsoft in marketplace capShares of Nvidia are up greater than 215% during the last three hundred and sixty five days and greater than 3,400% during the last 5 years. Yr up to now, Nvidia has won 173%; Microsoft inventory is up simply not up to 19% in 2024.Nvidia’s surge has made it a peak weighting within the S&P 500 (^GSPC), and the chipmaker has served a pivotal function within the benchmark index hitting report highs in 2024.Up till Might, the S&P 500 had traded with a near-perfect correlation to Nvidia’s value motion, that means that as Nvidia’s inventory rose, so did the wider index. As of Monday, Nvidia’s inventory positive factors on my own had contributed about one-third of the S&P 500’s year-to-date upward thrust, in line with information from Citi’s fairness analysis staff.Nvidia, which is the tech business’s go-to provider for AI chips and built-in device, finished a 10-for-1 cut up on June 10. Tue, June 18, 2024 at 10:20 AM PDTBerkshire Hathaway scoops up extra stocks in Occidental Petroleum Warren Buffett’s Berkshire Hathaway (BRK-A, BRK-B) has larger its stake in Occidental Petroleum (OXY) to just about 29% of the corporate.Yahoo Finance’s Ines Ferré stories:Buffett has stated Berkshire has little interest in purchasing keep an eye on of Occidental, however the conglomerate has been a repeat dip purchaser of the Houston-based corporate because the inventory sits more or less 12% off its April top. Previous to the Monday submitting, Berkshire disclosed 3 separate purchases final week totaling 7.3 million stocks for $176 million.Buffett has stated Berkshire has little interest in purchasing keep an eye on of Occidental, however the conglomerate has been a repeat dip purchaser of the Houston-based corporate because the inventory sits more or less 12% off its April top. Previous to the Monday submitting, Berkshire disclosed 3 separate purchases final week totaling 7.3 million stocks for $176 million.Occidental inventory won greater than 1% on Tuesday to business above the $61 degree.“Mr. Buffett seems to step in and purchase extra OXY stocks on every occasion the proportion value falls close to or underneath $60. This bid certain seems to have set a flooring at the proportion value,” James Shanahan, fairness analyst at Edward Jones, advised Yahoo Finance.Shanahan notes Berkshire’s $15.4 billion place makes Occidental its sixth-largest inventory retaining. The corporate’s peak retaining is Apple (AAPL), which recently sits at more or less 20% of Berkshire’s marketplace cap, after Berkshire trimmed its place within the iPhone maker in Might.Berkshire continues to be extremely taken with power performs, as Chevron (CVX) stays a top-five retaining in spite of the corporate promoting a few of its place as lately as March.“In conjunction with the most well liked proportion funding in OXY, Berkshire’s wager on oil is nearly $43 billion. Apparently, this overall has been $41-51 billion on the finish of each and every quarter courting again to March 2022, which used to be the quarter when Berkshire started to shop for OXY,” stated Shanahan.Buffett has been a vocal backer of Occidental Petroleum, publicly praising the corporate’s CEO Vicki Hollub. He used to be additionally instrumental in serving to finance Occidental’s acquisition of Anadarko Petroleum in 2019.Learn extra right here.

Tue, June 18, 2024 at 10:20 AM PDTBerkshire Hathaway scoops up extra stocks in Occidental Petroleum Warren Buffett’s Berkshire Hathaway (BRK-A, BRK-B) has larger its stake in Occidental Petroleum (OXY) to just about 29% of the corporate.Yahoo Finance’s Ines Ferré stories:Buffett has stated Berkshire has little interest in purchasing keep an eye on of Occidental, however the conglomerate has been a repeat dip purchaser of the Houston-based corporate because the inventory sits more or less 12% off its April top. Previous to the Monday submitting, Berkshire disclosed 3 separate purchases final week totaling 7.3 million stocks for $176 million.Buffett has stated Berkshire has little interest in purchasing keep an eye on of Occidental, however the conglomerate has been a repeat dip purchaser of the Houston-based corporate because the inventory sits more or less 12% off its April top. Previous to the Monday submitting, Berkshire disclosed 3 separate purchases final week totaling 7.3 million stocks for $176 million.Occidental inventory won greater than 1% on Tuesday to business above the $61 degree.“Mr. Buffett seems to step in and purchase extra OXY stocks on every occasion the proportion value falls close to or underneath $60. This bid certain seems to have set a flooring at the proportion value,” James Shanahan, fairness analyst at Edward Jones, advised Yahoo Finance.Shanahan notes Berkshire’s $15.4 billion place makes Occidental its sixth-largest inventory retaining. The corporate’s peak retaining is Apple (AAPL), which recently sits at more or less 20% of Berkshire’s marketplace cap, after Berkshire trimmed its place within the iPhone maker in Might.Berkshire continues to be extremely taken with power performs, as Chevron (CVX) stays a top-five retaining in spite of the corporate promoting a few of its place as lately as March.“In conjunction with the most well liked proportion funding in OXY, Berkshire’s wager on oil is nearly $43 billion. Apparently, this overall has been $41-51 billion on the finish of each and every quarter courting again to March 2022, which used to be the quarter when Berkshire started to shop for OXY,” stated Shanahan.Buffett has been a vocal backer of Occidental Petroleum, publicly praising the corporate’s CEO Vicki Hollub. He used to be additionally instrumental in serving to finance Occidental’s acquisition of Anadarko Petroleum in 2019.Learn extra right here.  Tue, June 18, 2024 at 9:05 AM PDTApple discontinues purchase now, pay later provider forward of Confirm integrationApple is scrapping its purchase now, pay later (BNPL) provider — simply over a yr after its US release.The provider, referred to as Apple Pay Later, debuted in March 2023 and allowed iPhone customers to separate purchases of as much as $1,000 into 4 equivalent bills over six weeks and not using a added charges or hobby.Amid the provider’s discontinuation, the corporate will depend on BNPL platforms like Confirm and Klarna, which have been as soon as threatened by means of Apple’s front into the gap. The tech massive lately introduced plans to combine Confirm into Apple Pay the place customers will have the ability to get right of entry to loans during the third-party app.“With the creation of this new international installment mortgage providing, we can now not be offering Apple Pay Later within the U.S.,” the corporate stated in a commentary overdue Monday.“Our center of attention is still on offering our customers with get right of entry to to simple, safe and personal cost choices with Apple Pay, and this answer will allow us to carry versatile bills to extra customers, in additional puts around the globe, in collaboration with Apple Pay enabled banks and lenders.”Stocks of each Apple and Confirm have been down greater than 1% on Tuesday.

Tue, June 18, 2024 at 9:05 AM PDTApple discontinues purchase now, pay later provider forward of Confirm integrationApple is scrapping its purchase now, pay later (BNPL) provider — simply over a yr after its US release.The provider, referred to as Apple Pay Later, debuted in March 2023 and allowed iPhone customers to separate purchases of as much as $1,000 into 4 equivalent bills over six weeks and not using a added charges or hobby.Amid the provider’s discontinuation, the corporate will depend on BNPL platforms like Confirm and Klarna, which have been as soon as threatened by means of Apple’s front into the gap. The tech massive lately introduced plans to combine Confirm into Apple Pay the place customers will have the ability to get right of entry to loans during the third-party app.“With the creation of this new international installment mortgage providing, we can now not be offering Apple Pay Later within the U.S.,” the corporate stated in a commentary overdue Monday.“Our center of attention is still on offering our customers with get right of entry to to simple, safe and personal cost choices with Apple Pay, and this answer will allow us to carry versatile bills to extra customers, in additional puts around the globe, in collaboration with Apple Pay enabled banks and lenders.”Stocks of each Apple and Confirm have been down greater than 1% on Tuesday. Tue, June 18, 2024 at 8:21 AM PDTFund managers bullish on ‘cushy touchdown’ in subsequent yr: BofABank of The usa’s World Fund Supervisor survey for June used to be essentially the most bullish since November 2021, pushed by means of low 4% money ranges & large fairness allocation.In keeping with the survey, launched Tuesday, traders be expecting international expansion to be unchanged over the following three hundred and sixty five days with 73% of respondents predicting no recession. A “no touchdown” chance has peaked at 26% whilst maximum respondents look ahead to a “cushy touchdown” at 64%. Simply 5% see a “exhausting touchdown” situation, a brand new low.As a refresher, a cushy touchdown would materialize if the Fed is in a position to carry inflation down with out inflicting a recession or an important bounce in unemployment. A troublesome touchdown would outcome if inflation comes down however on the expense of the USA economic system. A no touchdown would materialize if inflation does no longer come down in any respect.Simply 8% of respondents say no Fed cuts within the subsequent three hundred and sixty five days. 8 out of ten traders be expecting two, 3 or extra cuts with the primary minimize forecast on Sept. 18.Upper inflation is fading as the largest possibility with geopolitics and the USA election on the upward thrust at 22% and 16%, respectively.When requested which coverage spaces will maximum affect the impending US election, 38% stated business, 20% stated geopolitics, 13% stated immigration, 9% stated taxation and seven% replied executive spending.

Tue, June 18, 2024 at 8:21 AM PDTFund managers bullish on ‘cushy touchdown’ in subsequent yr: BofABank of The usa’s World Fund Supervisor survey for June used to be essentially the most bullish since November 2021, pushed by means of low 4% money ranges & large fairness allocation.In keeping with the survey, launched Tuesday, traders be expecting international expansion to be unchanged over the following three hundred and sixty five days with 73% of respondents predicting no recession. A “no touchdown” chance has peaked at 26% whilst maximum respondents look ahead to a “cushy touchdown” at 64%. Simply 5% see a “exhausting touchdown” situation, a brand new low.As a refresher, a cushy touchdown would materialize if the Fed is in a position to carry inflation down with out inflicting a recession or an important bounce in unemployment. A troublesome touchdown would outcome if inflation comes down however on the expense of the USA economic system. A no touchdown would materialize if inflation does no longer come down in any respect.Simply 8% of respondents say no Fed cuts within the subsequent three hundred and sixty five days. 8 out of ten traders be expecting two, 3 or extra cuts with the primary minimize forecast on Sept. 18.Upper inflation is fading as the largest possibility with geopolitics and the USA election on the upward thrust at 22% and 16%, respectively.When requested which coverage spaces will maximum affect the impending US election, 38% stated business, 20% stated geopolitics, 13% stated immigration, 9% stated taxation and seven% replied executive spending. Tue, June 18, 2024 at 7:21 AM PDT’Uneven loan price setting’ hits Lennar margin outlookLennar inventory (LEN) used to be down greater than 2% in early buying and selling after the homebuilder’s 1/3 quarter outlook for gross margin on house gross sales disillusioned traders.The corporate projected gross margin of 23% for the duration, underneath analyst estimates of 24%, according to Bloomberg information.“We suspect the most probably perpetrator is the uneven loan price setting that resulted in Might, which required increased incentives that may waft via in 3Q closings,” Dollar Horne, Raymond James analyst, wrote in a word.Learn extra: Loan charges as of late, June 18, 2024: Charges move upHomebuilders like Lennar have pulled out all of the stops to trap patrons as top loan charges stay each would-be patrons and dealers at the sidelines. Whilst incentives like loan price buydowns have helped corporations within the area promote houses, Wall Side road is fascinated about builder benefit margins taking a success.Lennar expects deliveries to vary from 20,500 to 21,000 within the 1/3 quarter, with a median last value of $420,000 to $425,000.The Miami-based homebuilder reported 2nd quarter income of $3.45 according to proportion, upper than estimates for $3.19 according to proportion. Income rose 10% to $8.8 billion, beating analysts estimates of $8.5 billion.“The macroeconomic setting remained moderately in keeping with employment closing robust, housing provide closing chronically quick because of manufacturing deficits over a decade, and insist energy pushed by means of robust family formation,” Stuart Miller, govt chairman and co-C of Lennar, stated in a commentary.

Tue, June 18, 2024 at 7:21 AM PDT’Uneven loan price setting’ hits Lennar margin outlookLennar inventory (LEN) used to be down greater than 2% in early buying and selling after the homebuilder’s 1/3 quarter outlook for gross margin on house gross sales disillusioned traders.The corporate projected gross margin of 23% for the duration, underneath analyst estimates of 24%, according to Bloomberg information.“We suspect the most probably perpetrator is the uneven loan price setting that resulted in Might, which required increased incentives that may waft via in 3Q closings,” Dollar Horne, Raymond James analyst, wrote in a word.Learn extra: Loan charges as of late, June 18, 2024: Charges move upHomebuilders like Lennar have pulled out all of the stops to trap patrons as top loan charges stay each would-be patrons and dealers at the sidelines. Whilst incentives like loan price buydowns have helped corporations within the area promote houses, Wall Side road is fascinated about builder benefit margins taking a success.Lennar expects deliveries to vary from 20,500 to 21,000 within the 1/3 quarter, with a median last value of $420,000 to $425,000.The Miami-based homebuilder reported 2nd quarter income of $3.45 according to proportion, upper than estimates for $3.19 according to proportion. Income rose 10% to $8.8 billion, beating analysts estimates of $8.5 billion.“The macroeconomic setting remained moderately in keeping with employment closing robust, housing provide closing chronically quick because of manufacturing deficits over a decade, and insist energy pushed by means of robust family formation,” Stuart Miller, govt chairman and co-C of Lennar, stated in a commentary. Tue, June 18, 2024 at 7:15 AM PDTRetail gross sales leave out presentations ‘the tension of increased rates of interest’The disappointing retail gross sales document “is appearing the tension of increased rates of interest, with housing-related classes of spending proceeding to say no in Might,” Oxford Economics stated in a word early Tuesday.”There used to be additionally a wonder decline in spending at eating places and bars [which declined 0.4% during the month], even though different proof suggests spending on different products and services continues to be retaining up neatly. A worth-related fall in fuel station gross sales additionally weighed at the headline determine,” wrote Michael Pearce, Oxford Economics deputy leader US economist.Retail gross sales in Might larger simply 0.1%, falling shy of the 0.3% economists polled by means of Bloomberg had anticipated. In April, retail gross sales ticked down 0.2%, in line with revised information from the Trade Division.Except for vehicles and gasoline, retail gross sales edged up 0.1%, underneath estimates for a nil.4% building up however above the 0.3% decline observed in April.”Shopper spending is slowing as a result of actual source of revenue expansion is moderating and since some shoppers are turning into credit score constrained amid increased rates of interest and emerging bank card usage,” Pearce stated. “Then again, with unemployment not likely to upward thrust a lot and the state of families stability sheets nonetheless taking a look robust in mixture, we think shopper spending expansion will stay as regards to its present tempo in the second one part of the yr.”Raymond James’ leader economist Eugenio Aleman used to be somewhat extra pessimistic: “The downward revisions to April presentations an overly vulnerable get started by means of the USA shopper right through the second one quarter of the yr, which is in keeping with our view of the USA economic system.”Ultimate week, the Federal Reserve signaled it will decrease rates of interest only one time this yr, down from the 3 cuts the central financial institution expected in its earlier March projection.The central financial institution nonetheless expects a powerful economic system to finish the yr. Officers see the unemployment price retaining secure at 4% in 2024, matching the former forecast. Unemployment is predicted to tick upper to 4.2% in 2025 sooner than coming all the way down to 4.1% in 2026.The Fed maintained its earlier forecast for US financial expansion, with the economic system anticipated to develop at an annualized tempo of two.1% this yr sooner than ticking down relatively to two% in 2025 and closing at that degree via 2026.

Tue, June 18, 2024 at 7:15 AM PDTRetail gross sales leave out presentations ‘the tension of increased rates of interest’The disappointing retail gross sales document “is appearing the tension of increased rates of interest, with housing-related classes of spending proceeding to say no in Might,” Oxford Economics stated in a word early Tuesday.”There used to be additionally a wonder decline in spending at eating places and bars [which declined 0.4% during the month], even though different proof suggests spending on different products and services continues to be retaining up neatly. A worth-related fall in fuel station gross sales additionally weighed at the headline determine,” wrote Michael Pearce, Oxford Economics deputy leader US economist.Retail gross sales in Might larger simply 0.1%, falling shy of the 0.3% economists polled by means of Bloomberg had anticipated. In April, retail gross sales ticked down 0.2%, in line with revised information from the Trade Division.Except for vehicles and gasoline, retail gross sales edged up 0.1%, underneath estimates for a nil.4% building up however above the 0.3% decline observed in April.”Shopper spending is slowing as a result of actual source of revenue expansion is moderating and since some shoppers are turning into credit score constrained amid increased rates of interest and emerging bank card usage,” Pearce stated. “Then again, with unemployment not likely to upward thrust a lot and the state of families stability sheets nonetheless taking a look robust in mixture, we think shopper spending expansion will stay as regards to its present tempo in the second one part of the yr.”Raymond James’ leader economist Eugenio Aleman used to be somewhat extra pessimistic: “The downward revisions to April presentations an overly vulnerable get started by means of the USA shopper right through the second one quarter of the yr, which is in keeping with our view of the USA economic system.”Ultimate week, the Federal Reserve signaled it will decrease rates of interest only one time this yr, down from the 3 cuts the central financial institution expected in its earlier March projection.The central financial institution nonetheless expects a powerful economic system to finish the yr. Officers see the unemployment price retaining secure at 4% in 2024, matching the former forecast. Unemployment is predicted to tick upper to 4.2% in 2025 sooner than coming all the way down to 4.1% in 2026.The Fed maintained its earlier forecast for US financial expansion, with the economic system anticipated to develop at an annualized tempo of two.1% this yr sooner than ticking down relatively to two% in 2025 and closing at that degree via 2026. Tue, June 18, 2024 at 6:33 AM PDTStocks muted at opening bell, hover close to recordsUS shares hovered close to report highs as all 3 primary indexes hugged the flatline.The benchmark S&P 500 (^GSPC), which secured its thirtieth report shut of 2024, used to be muted on the opening bell, together with The Dow Jones Business Moderate (^DJI). The tech-heavy Nasdaq Composite (^IXIC) in a similar way wavered because the tech-heavy index regarded to construct on a 6th immediately report shut.

Tue, June 18, 2024 at 6:33 AM PDTStocks muted at opening bell, hover close to recordsUS shares hovered close to report highs as all 3 primary indexes hugged the flatline.The benchmark S&P 500 (^GSPC), which secured its thirtieth report shut of 2024, used to be muted on the opening bell, together with The Dow Jones Business Moderate (^DJI). The tech-heavy Nasdaq Composite (^IXIC) in a similar way wavered because the tech-heavy index regarded to construct on a 6th immediately report shut. Tue, June 18, 2024 at 6:03 AM PDTRetail gross sales building up not up to anticipated in MayRetail gross sales larger at a slower-than-expected tempo in Might as top rates of interest and inflation persisted to weigh on shoppers.Retail gross sales larger 0.1%, not up to the 0.3% economists had anticipated. In April, retail gross sales ticked down 0.2%, in line with revised information from the Trade Division.Except for vehicles and gasoline, retail gross sales larger 0.1%, underneath estimates for a nil.4% building up however above the 0.3% decline in April.Capital Economics leader North The usa economist Paul Ashworth famous Tuesday’s retail gross sales studying provides to “indicators that customers are suffering slightly.””The cushy Might retail gross sales information strengthen our view that, after a disappointing first quarter, GDP expansion stays slightly lackluster in the second one quarter too,” Ashworth stated.

Tue, June 18, 2024 at 6:03 AM PDTRetail gross sales building up not up to anticipated in MayRetail gross sales larger at a slower-than-expected tempo in Might as top rates of interest and inflation persisted to weigh on shoppers.Retail gross sales larger 0.1%, not up to the 0.3% economists had anticipated. In April, retail gross sales ticked down 0.2%, in line with revised information from the Trade Division.Except for vehicles and gasoline, retail gross sales larger 0.1%, underneath estimates for a nil.4% building up however above the 0.3% decline in April.Capital Economics leader North The usa economist Paul Ashworth famous Tuesday’s retail gross sales studying provides to “indicators that customers are suffering slightly.””The cushy Might retail gross sales information strengthen our view that, after a disappointing first quarter, GDP expansion stays slightly lackluster in the second one quarter too,” Ashworth stated.

Nvidia surpasses Microsoft in marketplace capShares of Nvidia are up greater than 215% during the last three hundred and sixty five days and greater than 3,400% during the last 5 years. Yr up to now, Nvidia has won 173%; Microsoft inventory is up simply not up to 19% in 2024.Nvidia’s surge has made it a peak weighting within the S&P 500 (^GSPC), and the chipmaker has served a pivotal function within the benchmark index hitting report highs in 2024.Up till Might, the S&P 500 had traded with a near-perfect correlation to Nvidia’s value motion, that means that as Nvidia’s inventory rose, so did the wider index. As of Monday, Nvidia’s inventory positive factors on my own had contributed about one-third of the S&P 500’s year-to-date upward thrust, in line with information from Citi’s fairness analysis staff.Nvidia, which is the tech business’s go-to provider for AI chips and built-in device, finished a 10-for-1 cut up on June 10.