US shares closed most commonly flat on Monday to kick off a large week full of a Federal Reserve charge choice, the roles record, and Giant Tech profits.The Dow Jones Business Reasonable (^IXIC) closed down 0.1%, coming off a surge of over 650 issues for the blue-chip index on Friday. The S&P 500 (^GSPC) received just about 0.1% whilst the tech-heavy Nasdaq Composite (^IXIC) rose simply above the flatline.Shares kicked off the week at the entrance foot after surging on Friday, as buyers welcomed a promising inflation studying that cemented bets for interest-rate cuts. However after a risky run of classes and an enormous tech sell-off, the watch is on for surprises that would put the delicate rally to the check.No transfer is predicted from the Federal Reserve on the finish of its assembly on Wednesday, regardless of indicators the United States economic system and inflation have hit a candy spot. Many on Wall Side road see different causes for the central financial institution to attend till September to behave.Learn extra: 32 charts that inform the tale of markets and the economic system proper nowThe July nonfarm payrolls record that follows on Friday — anticipated to turn cracks within the jobs marketplace — will play into after-the-fact calculations on timing and intensity of charge cuts in 2024.Looming profits this week from Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), and Meta (META) even have buyers on alert, given the inventory wipeout that adopted the primary pair of “Magnificent Seven” effects.On Monday stocks of EV large Tesla (TSLA) received greater than 5% after Morgan Stanley’s Adam Jonas designated the inventory a ‘most sensible pick out.’ McDonald’s (MCD) inventory rose regardless of an profits omit around the board as shoppers pulled again on spending on the rapid meals chain.LIVE COVERAGE IS OVER13 updates Mon, July 29, 2024 at 1:02 PM PDTStocks finish consultation combined forward of giant week for marketsUS shares ended the consultation combined on Monday, kicking off a large week on Wall Side road amid a Federal Reserve charge choice, the roles record, and Giant Tech profits.The Dow Jones Business Reasonable (^IXIC) fell 0.1% after hovering over 650 issues on Friday. The S&P 500 (^GSPC) received 0.1% whilst the tech-heavy Nasdaq Composite (^IXIC) rose nearly 0.1%.Amongst Monday’s large movers, Tesla (TSLA) stocks received greater than 5% after a bullish name from Morgan Stanley. McDonald’s (MCD) inventory rose greater than 3% regardless of an profits omit around the board as shoppers pulled again on spending on the rapid meals chain.Traders will pay attention from a slew of Giant Tech heavyweights this week, beginning with Microsoft (MSFT) which is ready to record on Tuesday after the ultimate bell. Apple (AAPL), Amazon (AMZN), and Meta (META) will unencumber their quarterly effects later this week.On Wednesday afternoon Federal Reserve officers will announce their rate of interest choice after their two-day assembly. Traders broadly be expecting the central banks to set the degree for a September charge reduce.The July jobs record will probably be launched on Friday.

Mon, July 29, 2024 at 1:02 PM PDTStocks finish consultation combined forward of giant week for marketsUS shares ended the consultation combined on Monday, kicking off a large week on Wall Side road amid a Federal Reserve charge choice, the roles record, and Giant Tech profits.The Dow Jones Business Reasonable (^IXIC) fell 0.1% after hovering over 650 issues on Friday. The S&P 500 (^GSPC) received 0.1% whilst the tech-heavy Nasdaq Composite (^IXIC) rose nearly 0.1%.Amongst Monday’s large movers, Tesla (TSLA) stocks received greater than 5% after a bullish name from Morgan Stanley. McDonald’s (MCD) inventory rose greater than 3% regardless of an profits omit around the board as shoppers pulled again on spending on the rapid meals chain.Traders will pay attention from a slew of Giant Tech heavyweights this week, beginning with Microsoft (MSFT) which is ready to record on Tuesday after the ultimate bell. Apple (AAPL), Amazon (AMZN), and Meta (META) will unencumber their quarterly effects later this week.On Wednesday afternoon Federal Reserve officers will announce their rate of interest choice after their two-day assembly. Traders broadly be expecting the central banks to set the degree for a September charge reduce.The July jobs record will probably be launched on Friday. Mon, July 29, 2024 at 12:35 PM PDTLamborghini dollars softness in luxurious marketplace with file first-half resultsYahoo Finance’s Pras Subramanian reviews: Italian luxurious automaker Lamborghini delivered stellar leads to the primary half of of 2024 regardless of a subdued promoting atmosphere for high-end cars and comfort items normally.Lamborghini, a part of Volkswagen’s (VWAGY) Audi Crew that incorporates Audi, Lamborghini, Ducati, and Bentley, reported file income of one.6 billion euros ($1.762 billion) for the primary six months of 2024, a 14.1% bounce from a yr in the past. Working benefit hit any other file of 458 million euros ($495 million).Lamborghini delivered 5,558 automobiles within the first half of, any other all-time excessive, powered via gross sales of the Revuelto hybrid supercar, outgoing Huracán two-seater, and the Urus SUV that now is available in hybrid SE trim.Learn extra right here.

Mon, July 29, 2024 at 12:35 PM PDTLamborghini dollars softness in luxurious marketplace with file first-half resultsYahoo Finance’s Pras Subramanian reviews: Italian luxurious automaker Lamborghini delivered stellar leads to the primary half of of 2024 regardless of a subdued promoting atmosphere for high-end cars and comfort items normally.Lamborghini, a part of Volkswagen’s (VWAGY) Audi Crew that incorporates Audi, Lamborghini, Ducati, and Bentley, reported file income of one.6 billion euros ($1.762 billion) for the primary six months of 2024, a 14.1% bounce from a yr in the past. Working benefit hit any other file of 458 million euros ($495 million).Lamborghini delivered 5,558 automobiles within the first half of, any other all-time excessive, powered via gross sales of the Revuelto hybrid supercar, outgoing Huracán two-seater, and the Urus SUV that now is available in hybrid SE trim.Learn extra right here.  Mon, July 29, 2024 at 12:00 PM PDTTesla jumps greater than 5% on bullish name from Morgan StanleyTesla (TSLA) inventory received greater than 5% on Monday following a bullish name from Morgan Stanley’s Adam Jonas.The analyst designated the electrical car maker as a most sensible pick out, mentioning Tesla’s possible to generate sure money drift after imposing cost-cutting and restructuring measures.Tesla stocks rallied for a lot of June however began to turn indicators of pullback previous this month. The inventory tanked greater than 12% in a single consultation final week after the corporate posted combined 2nd quarter effects revealing expansion this yr could be “significantly decrease” than what it noticed in 2023.

Mon, July 29, 2024 at 12:00 PM PDTTesla jumps greater than 5% on bullish name from Morgan StanleyTesla (TSLA) inventory received greater than 5% on Monday following a bullish name from Morgan Stanley’s Adam Jonas.The analyst designated the electrical car maker as a most sensible pick out, mentioning Tesla’s possible to generate sure money drift after imposing cost-cutting and restructuring measures.Tesla stocks rallied for a lot of June however began to turn indicators of pullback previous this month. The inventory tanked greater than 12% in a single consultation final week after the corporate posted combined 2nd quarter effects revealing expansion this yr could be “significantly decrease” than what it noticed in 2023. Mon, July 29, 2024 at 11:20 AM PDTApple provides builders first style of Apple Intelligence with iOS 18.1 developer betaYahoo Finance’s Dan Howley reviews: Apple (AAPL) is giving builders an early have a look at its upcoming Apple Intelligence AI platform with the discharge of its newest developer betas for iOS, iPadOS, and MacOS on Monday. The betas, known as iOS 18.1, iPadOS 18.1, and macOS Sequoia, are the primary to incorporate Apple’s extremely expected Apple Intelligence device, which the corporate debuted at its International Developer Convention (WWDC) in June.Apple’s developer beta program provides app creators get entry to to imminent variations of the corporate’s device to check it and incorporate its options into their very own apps. Apple additionally releases public betas for normal customers to take a look at its newest device choices ahead of making them normally to be had within the fall.Learn extra right here.

Mon, July 29, 2024 at 11:20 AM PDTApple provides builders first style of Apple Intelligence with iOS 18.1 developer betaYahoo Finance’s Dan Howley reviews: Apple (AAPL) is giving builders an early have a look at its upcoming Apple Intelligence AI platform with the discharge of its newest developer betas for iOS, iPadOS, and MacOS on Monday. The betas, known as iOS 18.1, iPadOS 18.1, and macOS Sequoia, are the primary to incorporate Apple’s extremely expected Apple Intelligence device, which the corporate debuted at its International Developer Convention (WWDC) in June.Apple’s developer beta program provides app creators get entry to to imminent variations of the corporate’s device to check it and incorporate its options into their very own apps. Apple additionally releases public betas for normal customers to take a look at its newest device choices ahead of making them normally to be had within the fall.Learn extra right here.  Mon, July 29, 2024 at 10:39 AM PDTTrending tickers MondayMcDonald’s (MCD) McDonald’s stocks soared greater than 4% on Monday regardless of the corporate’s Q2 profits omit as consumers pulled again on eating out.”Shoppers are extra discriminating with their spend,” CEO Chris Kempczinski stated within the profits unencumber.ON Semiconductor (ON)The chip corporate reported 2nd quarter profits crowned analyst estimates and its Q3 steering is set in step with Wall Side road expectancies.ON Semiconductor soared greater than 12% right through Monday’s consultation.Bitcoin (BTC-USD)The cryptocurrency climbed above $69,000 ahead of paring positive aspects on Monday after Republican presidential candidate Donald Trump spoke at a bitcoin convention in Nashville over the weekend.Trump promised pro-crypto projects, together with the status quo of a “strategic nationwide bitcoin stockpile.”

Mon, July 29, 2024 at 10:39 AM PDTTrending tickers MondayMcDonald’s (MCD) McDonald’s stocks soared greater than 4% on Monday regardless of the corporate’s Q2 profits omit as consumers pulled again on eating out.”Shoppers are extra discriminating with their spend,” CEO Chris Kempczinski stated within the profits unencumber.ON Semiconductor (ON)The chip corporate reported 2nd quarter profits crowned analyst estimates and its Q3 steering is set in step with Wall Side road expectancies.ON Semiconductor soared greater than 12% right through Monday’s consultation.Bitcoin (BTC-USD)The cryptocurrency climbed above $69,000 ahead of paring positive aspects on Monday after Republican presidential candidate Donald Trump spoke at a bitcoin convention in Nashville over the weekend.Trump promised pro-crypto projects, together with the status quo of a “strategic nationwide bitcoin stockpile.” Mon, July 29, 2024 at 9:45 AM PDTInvestors are making a bet the Fed will use its July assembly to set the degree for a September cutYahoo Finance’s Jennifer Schonberger reviews: Maximum Federal Reserve watchers don’t be expecting the central financial institution to ease financial coverage this week in Washington, D.C., however what they do be expecting is that policymakers will set the degree for an rate of interest reduce at their subsequent assembly in September.Fed officers have stated they’re getting nearer to having self assurance inflation is sustainably shedding to their 2% objective. They’ve additionally stated they’re paying extra consideration to emerging unemployment, any other signal that cuts could also be nearing.However maximum Fed watchers say the central financial institution nonetheless wishes just a little extra time to make sure, whilst additionally making ready the markets for the numerous motion to come back.”The force is rising for them,” stated former Kansas Town Fed president Esther George. “I feel that they’re going to have a look at September very significantly. It’s having a look to me like we’re coming to a time the place that call is extra essential and it is why I am extra assured.”Learn extra right here.

Mon, July 29, 2024 at 9:45 AM PDTInvestors are making a bet the Fed will use its July assembly to set the degree for a September cutYahoo Finance’s Jennifer Schonberger reviews: Maximum Federal Reserve watchers don’t be expecting the central financial institution to ease financial coverage this week in Washington, D.C., however what they do be expecting is that policymakers will set the degree for an rate of interest reduce at their subsequent assembly in September.Fed officers have stated they’re getting nearer to having self assurance inflation is sustainably shedding to their 2% objective. They’ve additionally stated they’re paying extra consideration to emerging unemployment, any other signal that cuts could also be nearing.However maximum Fed watchers say the central financial institution nonetheless wishes just a little extra time to make sure, whilst additionally making ready the markets for the numerous motion to come back.”The force is rising for them,” stated former Kansas Town Fed president Esther George. “I feel that they’re going to have a look at September very significantly. It’s having a look to me like we’re coming to a time the place that call is extra essential and it is why I am extra assured.”Learn extra right here.  Mon, July 29, 2024 at 9:00 AM PDTS&P 500, Nasdaq climb again into inexperienced territoryStocks rose on Monday after in brief turning detrimental right through the consultation.The Dow Jones Business Reasonable (^DJI) used to be little modified after falling greater than 100 issues in morning buying and selling.The S&P 500 (^GSPC) received 0.2% whilst the tech-heavy Nasdaq Composite (^IXIC) climbed again into inexperienced territory to upward thrust 0.2% after in brief turning detrimental.

Mon, July 29, 2024 at 9:00 AM PDTS&P 500, Nasdaq climb again into inexperienced territoryStocks rose on Monday after in brief turning detrimental right through the consultation.The Dow Jones Business Reasonable (^DJI) used to be little modified after falling greater than 100 issues in morning buying and selling.The S&P 500 (^GSPC) received 0.2% whilst the tech-heavy Nasdaq Composite (^IXIC) climbed again into inexperienced territory to upward thrust 0.2% after in brief turning detrimental. Mon, July 29, 2024 at 8:30 AM PDTStarbucks anticipated to record vulnerable gross sales because it pushes popping pearls and price playsYahoo Finance’s Brooke DiPalma reviews:Starbucks (SBUX) buyers are wary forward of its Tuesday profits record.Its stocks are down just about 28% in comparison to a yr in the past, when the espresso large painted an image of a resilient client with 10% gross sales expansion. Now, other expectancies are on faucet.Q3 income is predicted to develop 0.37% to $9.20 billion, in line with Bloomberg consensus estimates. Adjusted profits in line with proportion are anticipated to be $0.92, in comparison to $1.00 a yr in the past.Learn extra right here.

Mon, July 29, 2024 at 8:30 AM PDTStarbucks anticipated to record vulnerable gross sales because it pushes popping pearls and price playsYahoo Finance’s Brooke DiPalma reviews:Starbucks (SBUX) buyers are wary forward of its Tuesday profits record.Its stocks are down just about 28% in comparison to a yr in the past, when the espresso large painted an image of a resilient client with 10% gross sales expansion. Now, other expectancies are on faucet.Q3 income is predicted to develop 0.37% to $9.20 billion, in line with Bloomberg consensus estimates. Adjusted profits in line with proportion are anticipated to be $0.92, in comparison to $1.00 a yr in the past.Learn extra right here.  Mon, July 29, 2024 at 8:27 AM PDTStocks erase consultation positive aspects, Nasdaq turns detrimental Shares erased previous consultation positive aspects to hover beneath the flatline on Monday.The Dow Jones Business Reasonable (^DJI) misplaced more or less 100 issues after first of all opening upper. The S&P 500 (^GSPC) fell 0.1%, whilst the tech-heavy Nasdaq Composite (^IXIC) additionally fell beneath the flatline after gaining up to 0.9%.

Mon, July 29, 2024 at 8:27 AM PDTStocks erase consultation positive aspects, Nasdaq turns detrimental Shares erased previous consultation positive aspects to hover beneath the flatline on Monday.The Dow Jones Business Reasonable (^DJI) misplaced more or less 100 issues after first of all opening upper. The S&P 500 (^GSPC) fell 0.1%, whilst the tech-heavy Nasdaq Composite (^IXIC) additionally fell beneath the flatline after gaining up to 0.9%. Mon, July 29, 2024 at 7:45 AM PDTBitcoin hovers close to $69,000 following Trump pro-crypto speech Bitcoin (BTC-USD) traded close to the $69,000 in line with token degree on Monday after former President Donald Trump driven a pro-crypto time table at a bitcoin convention over the weekend.Trump used to be the keynote speaker at Bitcoin 2024 on Saturday in Nashville The Republican presidential candidate stated he plans to make the United States the “cryptocurrency capital of the sector” if elected in November. He additionally proposed the advent of a “nationwide bitcoin stockpile.”Learn extra right here.

Mon, July 29, 2024 at 7:45 AM PDTBitcoin hovers close to $69,000 following Trump pro-crypto speech Bitcoin (BTC-USD) traded close to the $69,000 in line with token degree on Monday after former President Donald Trump driven a pro-crypto time table at a bitcoin convention over the weekend.Trump used to be the keynote speaker at Bitcoin 2024 on Saturday in Nashville The Republican presidential candidate stated he plans to make the United States the “cryptocurrency capital of the sector” if elected in November. He additionally proposed the advent of a “nationwide bitcoin stockpile.”Learn extra right here.  Mon, July 29, 2024 at 7:00 AM PDTMcDonald’s inventory rises regardless of Q2 profits omit as shoppers pull again on eating outMcDonald’s (MCD) stocks rose on Monday morning, getting better from an preliminary detrimental response on the marketplace open following the short meals chain’s quarterly effects.Yahoo Finance’s Brooke DiPalma reviews: McDonald’s consumers are tightening their belts once more in Q2, as they grapple with paying up for his or her Giant Mac.On Monday morning, the corporate reported Q2 profits that ignored Wall Side road estimates throughout income, profits, and same-store gross sales, proving no longer even The united states’s maximum dominant rapid meals participant is resistant to the difficult macro stipulations.Learn extra right here. Stocks of the short meals chain first of all opened decrease, however briefly recovered to realize up to 3% in early buying and selling.

Mon, July 29, 2024 at 7:00 AM PDTMcDonald’s inventory rises regardless of Q2 profits omit as shoppers pull again on eating outMcDonald’s (MCD) stocks rose on Monday morning, getting better from an preliminary detrimental response on the marketplace open following the short meals chain’s quarterly effects.Yahoo Finance’s Brooke DiPalma reviews: McDonald’s consumers are tightening their belts once more in Q2, as they grapple with paying up for his or her Giant Mac.On Monday morning, the corporate reported Q2 profits that ignored Wall Side road estimates throughout income, profits, and same-store gross sales, proving no longer even The united states’s maximum dominant rapid meals participant is resistant to the difficult macro stipulations.Learn extra right here. Stocks of the short meals chain first of all opened decrease, however briefly recovered to realize up to 3% in early buying and selling. Mon, July 29, 2024 at 6:30 AM PDTStocks open upper to kick off large week on Wall StreetStocks stepped upper on Monday to kick off a large week full of a Federal Reserve charge choice, the roles record, and tech profits.The Dow Jones Business Reasonable (^DJI) moved up reasonably, coming off a up to date surge of over 650 issues. The S&P 500 (^GSPC) added about 0.3%, whilst the tech-heavy Nasdaq Composite (^IXIC) rose 0.5%.The Federal Open Marketplace Committee will grasp its scheduled two-day assembly this week, and not using a charge transfer anticipated via Federal Reserve officers on Wednesday. Maximum buyers see policymakers ready till September to chop rates of interest.Giant Tech profits are due this week, together with from Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Meta (META).

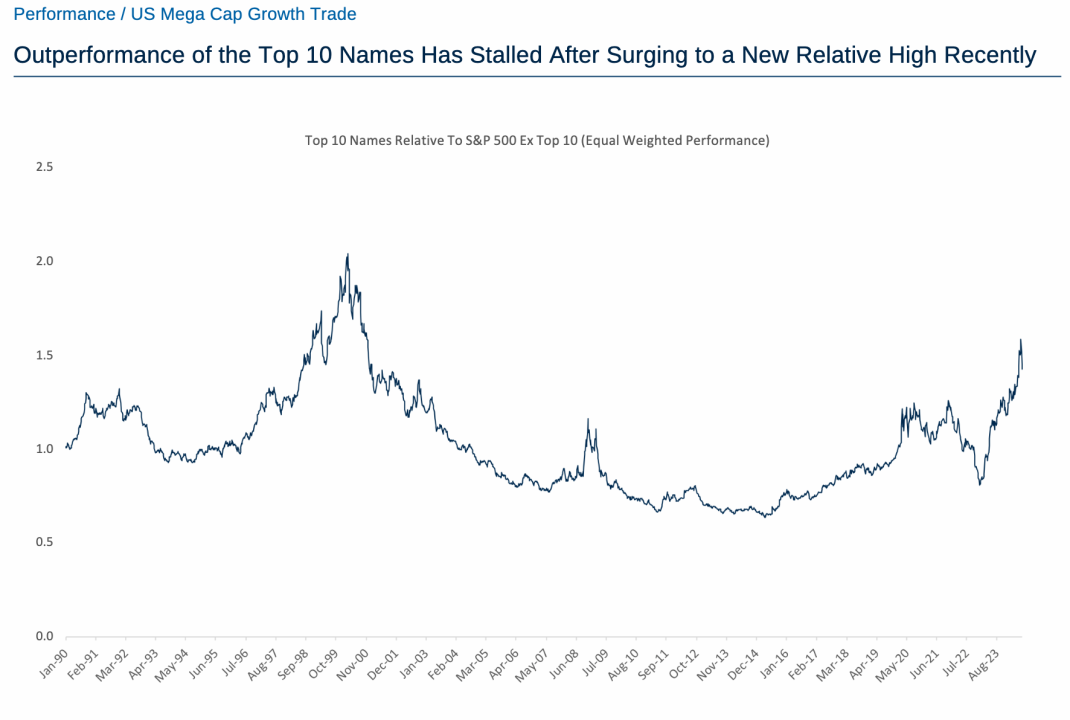

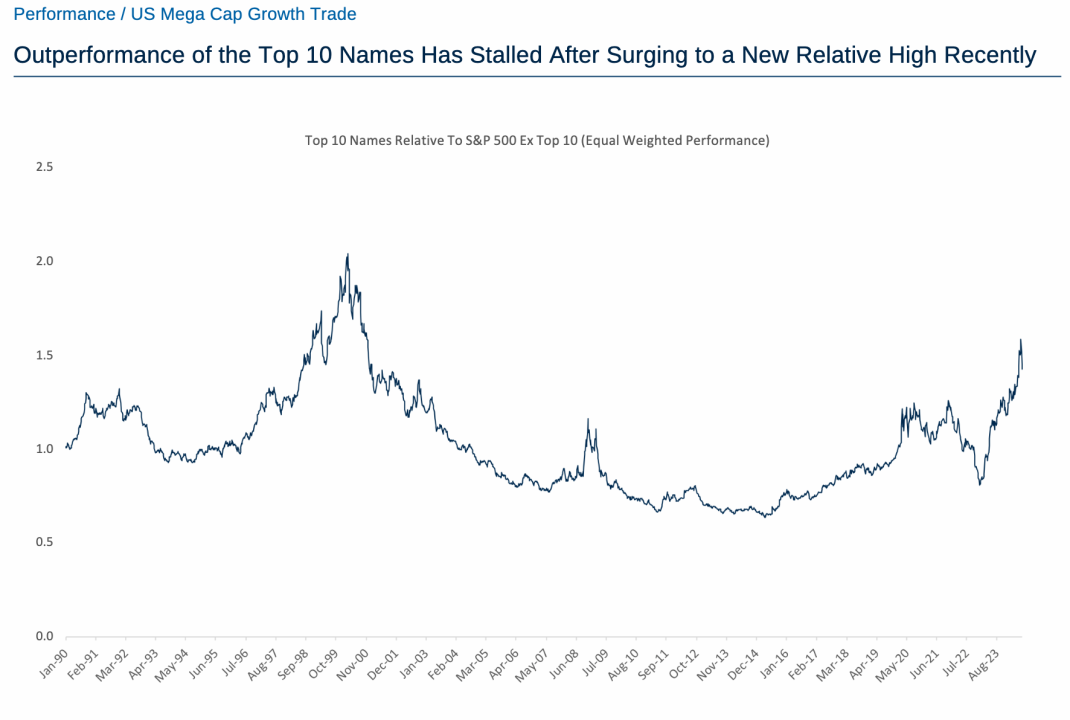

Mon, July 29, 2024 at 6:30 AM PDTStocks open upper to kick off large week on Wall StreetStocks stepped upper on Monday to kick off a large week full of a Federal Reserve charge choice, the roles record, and tech profits.The Dow Jones Business Reasonable (^DJI) moved up reasonably, coming off a up to date surge of over 650 issues. The S&P 500 (^GSPC) added about 0.3%, whilst the tech-heavy Nasdaq Composite (^IXIC) rose 0.5%.The Federal Open Marketplace Committee will grasp its scheduled two-day assembly this week, and not using a charge transfer anticipated via Federal Reserve officers on Wednesday. Maximum buyers see policymakers ready till September to chop rates of interest.Giant Tech profits are due this week, together with from Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Meta (META). Mon, July 29, 2024 at 2:49 AM PDTA morning chart to depart you thinkingAnd so starts an insanely busy week for buyers.Traders get started the week bruised via the wonder tech sell-off final week, which might simply be getting going, reviews Yahoo Finance’s Seana Smith.RBC strategist Lori Calvasina places some context across the tech stall-out beneath.

Mon, July 29, 2024 at 2:49 AM PDTA morning chart to depart you thinkingAnd so starts an insanely busy week for buyers.Traders get started the week bruised via the wonder tech sell-off final week, which might simply be getting going, reviews Yahoo Finance’s Seana Smith.RBC strategist Lori Calvasina places some context across the tech stall-out beneath.

The most up to date shares start to stall in July. (RBC)

The most up to date shares start to stall in July. (RBC)

The most up to date shares start to stall in July. (RBC)