NEW YORK (AP) — U.S. inventory indexes are emerging Wednesday as Wall Side road waits to listen to what the Federal Reserve will say within the afternoon about the place rates of interest could also be heading. The S&P 500 was once up 0.7% in morning buying and selling. The Dow Jones Commercial Moderate was once up 237 issues, or 0.6%, as of 10:30 a.m. Japanese time, and the Nasdaq composite was once 0.9% upper. The slightly quiet buying and selling is a respite following weeks of sharp and frightening swings for the U.S. inventory marketplace. Uncertainty is top about how a lot ache President Donald Trump will permit the economic system to bear to be able to remake the gadget as he desires. He’s stated he desires production jobs again in america and a ways fewer other people running for the government. Trump’s barrage of bulletins on price lists and different insurance policies have created such a lot uncertainty that economists concern U.S. companies and families would possibly freeze and pull again on their spending.

If the economic system will get too susceptible, the Fed may just decrease rates of interest to be able to give it a spice up, because it has in such a lot of prior downturns. It has various room to chop, with its primary rate of interest sitting at a spread between 4.25% and four.50%.

However prerequisites could also be extra difficult for the Fed this time round. But even so goosing the economic system, decreasing charges would additionally push inflation upward, and worries are already top about inflation as a result of price lists. The Fed does now not have a excellent instrument to mend what’s referred to as “ stagflation,” the place the economic system is stagnating however inflation stays top.

Nearly all of Wall Side road is anticipating the Fed to announce no trade to its primary rate of interest this afternoon, because it waits to look how prerequisites play out. For the instant, the activity marketplace appears to be slightly forged general after the economic system closed ultimate 12 months working at a forged tempo. What’s going to be extra essential for traders is the set of forecasts the central financial institution will liberate after the assembly is over. That can display the place Fed officers see rates of interest, the economic system and inflation heading in upcoming years.

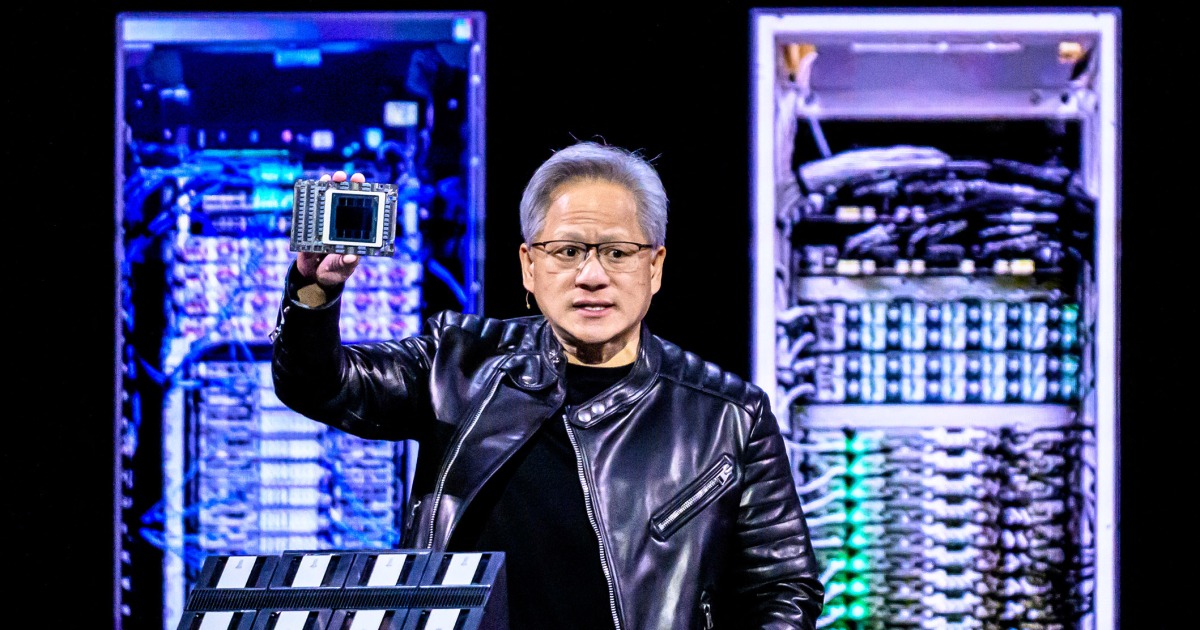

The expectancy amongst buyers is that the Fed will lower charges no less than two or thrice by means of the tip of 2025. On Wall Side road, Nvidia helped enhance the marketplace after emerging 1.4% to chop its loss for the 12 months up to now to twelve.9%. It hosted an tournament Tuesday the place it in large part “did a pleasing activity laying out the roadmap” and combating again towards hypothesis the artificial-intelligence business is seeing a slowdown in call for for computing energy, in line with UBS analysts led by means of Timothy Arcuri. Tesla additionally rose 2.7%, following two immediately losses of more or less 5%. It’s nonetheless down 42.7% for 2025 up to now. It’s been suffering on worries that buyers are became off by means of CEO Elon Musk’s main efforts to slash spending by means of the U.S. executive. Large Tech has most often been on the middle of the marketplace’s fresh sell-off, as shares whose momentum had previous gave the impression unstoppable have since dropped sharply following grievance that they had merely grown too pricey. At the dropping aspect of Wall Side road Wednesday was once Common Turbines, which fell 2.3% in spite of reporting a more potent benefit for the most recent quarter than analysts anticipated.

The cereal and snack maker’s income fell wanting analysts’ goals, partly as a result of a slowdown in gross sales for snacks. Common Turbines additionally lower monetary forecasts for income and benefit over its complete fiscal 12 months, in part as it expects “macroeconomic uncertainty” to proceed to impact its shoppers.In inventory markets in a foreign country, Japan’s Nikkei 225 slipped 0.2% after the Financial institution of Japan held stable by itself rates of interest, as was once extensively anticipated. Japan additionally reported a industry surplus for February, with exports emerging greater than 11% as producers rushed to overcome emerging price lists imposed by means of Trump.Different indexes have been combined throughout Europe and Asia.Within the bond marketplace, the yield at the 10-year Treasury edged all the way down to 4.30% from 4.31% past due Tuesday.___AP Industry Writers Yuri Kageyama and Matt Ott contributed.