US shares rose towards recent report highs on Monday as Nvidia (NVDA) led a risk-on rally available in the market that permeated via maximum sectors or even into cryptocurrencies.The S&P 500 (^GSPC) moved up 0.7% to go for a recent report after finishing above 5,800 for the primary time on Friday. The tech-heavy Nasdaq Composite (^IXIC) jumped just about 0.9%. The Dow Jones Business Reasonable (^DJI) rose greater than 150 issues, or 0.4%.In crypto, Bitcoin (BTC-USD) used to be up greater than 5% previously 24 hours to the touch above $65,700 in keeping with coin. In the meantime, Ethereum (ETH-USD) has additionally rallied, including just about 8% at the day.Tech shares led the beneficial properties, with chip massive Nvidia emerging towards new highs, up greater than 3% all over the consultation. Different semiconductor shares additionally surged together with chip apparatus maker ASML (ASML), Arm Holdings (ARM) and Implemented Fabrics (AMAT).Income are taking middle level as the primary complete week of 3rd quarter effects will get underway. How the season performs out is observed as key to the rally in shares because the bull marketplace turns 2 years outdated.The Dow and S&P 500 entered this week at new data after JPMorgan Chase (JPM) and Wells Fargo (WFC) income in large part handed Wall Side road’s take a look at. Investor center of attention is staying on large banks with stories from Goldman Sachs (GS), Citi (C), and Financial institution of The us (BAC) on Tuesday’s docket, and Morgan Stanley (MS) due Wednesday.On the similar time, there is nonetheless uncertainty about whether or not the Federal Reserve will reduce rates of interest once more. A benign jobs record and knowledge appearing “sticky” client and wholesale inflation are development a case for no fee reduce in November, some analysts argue. Retail gross sales information later within the week will feed into the controversy as as to whether the economic system has held up within the face of Fed coverage — the most well liked comfortable touchdown.Learn extra: What the Fed fee reduce way for financial institution accounts, CDs, loans, and credit score cardsLive12 updates Mon, October 14, 2024 at 11:30 AM PDTChina enlargement forecast boosted at Goldman Sachs Goldman Sachs upgraded its China enlargement forecast over the weekend, bringing up contemporary stimulus measures and new remark from govt officers that confirmed an openness to spend extra aggressively to restore its economic system.The financial institution raised its full-year China GDP forecast to 4.9% from 4.7% and in addition upped its 2025 enlargement prediction to 4.7% from 4.3%. Beijing has prior to now stated it is aiming for an annual enlargement goal of “round 5%.”On Saturday, China’s finance ministry hinted at every other massive stimulus bundle to beef up the rustic’s ill assets sector and urged extra govt borrowing, despite the fact that the ministry stopped in need of unveiling the precise measurement or scale of spending.Despite the fact that imprecise, the feedback left the door open for a extra competitive fiscal bundle, which buyers are increasingly more having a bet on as Beijing makes an attempt to tug itself out of an extended droop spurred through deflationary pressures from a gradual assets marketplace and vulnerable home call for.Optimism that the federal government will apply via boosted Chinese language shares on Monday with the Shanghai Composite (000888.SS), a key indicator of the total efficiency of the Chinese language inventory marketplace, emerging greater than 2%.In a similar fashion, China’s benchmark CSI 300 (000300.SS) completed the day up just below 2% to get well from closing week’s lows. The index is up 25% over the last month at the heels of China unleashing its maximum competitive financial stimulus for the reason that pandemic.Learn extra right here.

Mon, October 14, 2024 at 11:30 AM PDTChina enlargement forecast boosted at Goldman Sachs Goldman Sachs upgraded its China enlargement forecast over the weekend, bringing up contemporary stimulus measures and new remark from govt officers that confirmed an openness to spend extra aggressively to restore its economic system.The financial institution raised its full-year China GDP forecast to 4.9% from 4.7% and in addition upped its 2025 enlargement prediction to 4.7% from 4.3%. Beijing has prior to now stated it is aiming for an annual enlargement goal of “round 5%.”On Saturday, China’s finance ministry hinted at every other massive stimulus bundle to beef up the rustic’s ill assets sector and urged extra govt borrowing, despite the fact that the ministry stopped in need of unveiling the precise measurement or scale of spending.Despite the fact that imprecise, the feedback left the door open for a extra competitive fiscal bundle, which buyers are increasingly more having a bet on as Beijing makes an attempt to tug itself out of an extended droop spurred through deflationary pressures from a gradual assets marketplace and vulnerable home call for.Optimism that the federal government will apply via boosted Chinese language shares on Monday with the Shanghai Composite (000888.SS), a key indicator of the total efficiency of the Chinese language inventory marketplace, emerging greater than 2%.In a similar fashion, China’s benchmark CSI 300 (000300.SS) completed the day up just below 2% to get well from closing week’s lows. The index is up 25% over the last month at the heels of China unleashing its maximum competitive financial stimulus for the reason that pandemic.Learn extra right here.  Mon, October 14, 2024 at 10:46 AM PDTBitcoin rally pulls crypto-related shares higherBitcoin (BTC-USD) is up greater than 5% previously 24 hours to the touch above $65,700 in keeping with coin. The arena’s biggest cryptocurrency has been surging in contemporary days and is now up about 8% over the last 5 buying and selling periods.Different cryptocurrency Ethereum (ETH-USD) has additionally rallied, including just about 8%, previously 24 hours. Then risk-on rally in crytpo helps crypto-related US equities, catch a bid too.Stocks of Coinbase (COIN) are the chief within the house nowadays, emerging greater than 8%.

Mon, October 14, 2024 at 10:46 AM PDTBitcoin rally pulls crypto-related shares higherBitcoin (BTC-USD) is up greater than 5% previously 24 hours to the touch above $65,700 in keeping with coin. The arena’s biggest cryptocurrency has been surging in contemporary days and is now up about 8% over the last 5 buying and selling periods.Different cryptocurrency Ethereum (ETH-USD) has additionally rallied, including just about 8%, previously 24 hours. Then risk-on rally in crytpo helps crypto-related US equities, catch a bid too.Stocks of Coinbase (COIN) are the chief within the house nowadays, emerging greater than 8%.

Supply: Yahoo Finance

Supply: Yahoo Finance Mon, October 14, 2024 at 10:00 AM PDTDJT inventory is on a tear. Once more. Trump Media & Generation Staff inventory (DJT) prolonged its huge rally on Monday, leaping up to 9% as buyers guess on former president Donald Trump’s advanced odds of profitable the November election.Over the weekend, each home and out of the country having a bet markets shifted in prefer of a Trump victory, with prediction websites like Polymarket, PredictIt and Kalshi all appearing Trump’s presidential possibilities forward of the ones of Democratic nominee and present Vice President Kamala Harris.One after the other, DJT introduced the web-launch of its Fact+ TV streaming provider on Monday. The app is recently to be had to get admission to on Android gadgets and can quickly be launched as a local Apple iOS app.DJT stocks traded at their lowest degree for the reason that corporate’s debut following the expiration of the corporate’s extremely publicized lockup length closing month. The inventory has additionally been beneath force as earlier polling noticed Harris edging relatively forward of the previous president.Trump’s contemporary marketing campaign momentum follows an look through Elon Musk at his rally in Butler, Pa. previous this month. It used to be the similar location the place the previous president survived an assassination try in July.In the meantime, Harris has just lately launched into a flurry of media appearances through which she used to be pressed on how she would fund a few of her proposals surrounding the economic system and immigration.Learn extra right here.

Mon, October 14, 2024 at 10:00 AM PDTDJT inventory is on a tear. Once more. Trump Media & Generation Staff inventory (DJT) prolonged its huge rally on Monday, leaping up to 9% as buyers guess on former president Donald Trump’s advanced odds of profitable the November election.Over the weekend, each home and out of the country having a bet markets shifted in prefer of a Trump victory, with prediction websites like Polymarket, PredictIt and Kalshi all appearing Trump’s presidential possibilities forward of the ones of Democratic nominee and present Vice President Kamala Harris.One after the other, DJT introduced the web-launch of its Fact+ TV streaming provider on Monday. The app is recently to be had to get admission to on Android gadgets and can quickly be launched as a local Apple iOS app.DJT stocks traded at their lowest degree for the reason that corporate’s debut following the expiration of the corporate’s extremely publicized lockup length closing month. The inventory has additionally been beneath force as earlier polling noticed Harris edging relatively forward of the previous president.Trump’s contemporary marketing campaign momentum follows an look through Elon Musk at his rally in Butler, Pa. previous this month. It used to be the similar location the place the previous president survived an assassination try in July.In the meantime, Harris has just lately launched into a flurry of media appearances through which she used to be pressed on how she would fund a few of her proposals surrounding the economic system and immigration.Learn extra right here. Mon, October 14, 2024 at 9:15 AM PDTFed’s Kashkari stated ‘modest’ fee cuts are ‘most likely’ within the coming quartersYahoo Finance’s Jennifer Schonberger stories:Minneapolis Fed president Neel Kashkari stated Monday that it’s “most likely” the central financial institution will make “modest” rate of interest discounts within the “coming quarters.”Financial coverage, he stated whilst talking in Argentina, stays “general restrictive,” even though how restrictive is unclear to him.The process marketplace stays robust, he added, noting that contemporary information confirmed {that a} fast weakening in that marketplace doesn’t seem to be “forthcoming.”Thus, “Apparently most likely that additional modest discounts in our coverage fee shall be suitable within the coming quarters to succeed in either side of our mandate,” Kashkari stated.Learn extra right here.

Mon, October 14, 2024 at 9:15 AM PDTFed’s Kashkari stated ‘modest’ fee cuts are ‘most likely’ within the coming quartersYahoo Finance’s Jennifer Schonberger stories:Minneapolis Fed president Neel Kashkari stated Monday that it’s “most likely” the central financial institution will make “modest” rate of interest discounts within the “coming quarters.”Financial coverage, he stated whilst talking in Argentina, stays “general restrictive,” even though how restrictive is unclear to him.The process marketplace stays robust, he added, noting that contemporary information confirmed {that a} fast weakening in that marketplace doesn’t seem to be “forthcoming.”Thus, “Apparently most likely that additional modest discounts in our coverage fee shall be suitable within the coming quarters to succeed in either side of our mandate,” Kashkari stated.Learn extra right here.  Mon, October 14, 2024 at 8:36 AM PDTDow, S&P 500 dangle close to report as tech, utilities leads rallyTechnology and Application shares rose on Monday, serving to raise the Dow Jones Business Reasonable (^DJI) up 0.3% and the S&P 500 (^GSPC) up 0.6%. Each primary averages have been on tempo to near at a recent report prime.The tech-heavy Nasdaq Composite (^IXIC) rose essentially the most some of the primary averages, up 0.7%.

Mon, October 14, 2024 at 8:36 AM PDTDow, S&P 500 dangle close to report as tech, utilities leads rallyTechnology and Application shares rose on Monday, serving to raise the Dow Jones Business Reasonable (^DJI) up 0.3% and the S&P 500 (^GSPC) up 0.6%. Each primary averages have been on tempo to near at a recent report prime.The tech-heavy Nasdaq Composite (^IXIC) rose essentially the most some of the primary averages, up 0.7%.

Utilities and Generation won on Monday

Utilities and Generation won on Monday Mon, October 14, 2024 at 8:33 AM PDTSoFi inventory soars on $2 billion Castle deal to enlarge mortgage platformSoFi Applied sciences (SOFI) inventory jumped up to 9% after the net lender introduced a $2 billion settlement with Castle Funding Staff to enlarge its mortgage platform trade. The phase refers pre-qualified debtors to mortgage origination companions and connects lenders with debtors.The transfer displays SoFi’s process of diversifying from its roots in pupil mortgage refinancing.”SoFi’s mortgage platform trade is crucial a part of our method to serve the monetary wishes of extra contributors and diversify towards much less capital-intensive and extra fee-based assets of income,” stated Anthony Noto, CEO of SoFi, in a commentary.Of the Wall Side road analysts overlaying the inventory tracked through Bloomberg, handiest six suggest purchasing the inventory, whilst 10 have Dangle scores and 3 have Promote scores. The inventory is up just about 20% from closing 12 months however a ways from its report intraday prime close to $27 upon its IPO in 2021.Analysts see stocks falling to $8.91 over the following 365 days, in keeping with Bloomberg information.

Mon, October 14, 2024 at 8:33 AM PDTSoFi inventory soars on $2 billion Castle deal to enlarge mortgage platformSoFi Applied sciences (SOFI) inventory jumped up to 9% after the net lender introduced a $2 billion settlement with Castle Funding Staff to enlarge its mortgage platform trade. The phase refers pre-qualified debtors to mortgage origination companions and connects lenders with debtors.The transfer displays SoFi’s process of diversifying from its roots in pupil mortgage refinancing.”SoFi’s mortgage platform trade is crucial a part of our method to serve the monetary wishes of extra contributors and diversify towards much less capital-intensive and extra fee-based assets of income,” stated Anthony Noto, CEO of SoFi, in a commentary.Of the Wall Side road analysts overlaying the inventory tracked through Bloomberg, handiest six suggest purchasing the inventory, whilst 10 have Dangle scores and 3 have Promote scores. The inventory is up just about 20% from closing 12 months however a ways from its report intraday prime close to $27 upon its IPO in 2021.Analysts see stocks falling to $8.91 over the following 365 days, in keeping with Bloomberg information. Mon, October 14, 2024 at 7:36 AM PDTDow climbs into inexperienced territory, holds close to recordThe Dow Jones Business Reasonable (^DJI) clawed its approach into inexperienced territory through 10:30 a.m ET to hover at new intraday report highs. The blue-chip index had slipped up to 0.3% in a while after the marketplace open following a report shut on Friday.In the meantime the S&P 500 (^GSPC) won 0.6% Monday, on tempo for every other report shut.

Mon, October 14, 2024 at 7:36 AM PDTDow climbs into inexperienced territory, holds close to recordThe Dow Jones Business Reasonable (^DJI) clawed its approach into inexperienced territory through 10:30 a.m ET to hover at new intraday report highs. The blue-chip index had slipped up to 0.3% in a while after the marketplace open following a report shut on Friday.In the meantime the S&P 500 (^GSPC) won 0.6% Monday, on tempo for every other report shut. Mon, October 14, 2024 at 7:13 AM PDTTSMC inventory hits report prime, rejoins $1 trillion clubNvidia (NVDA) provider TSMC (TSM) noticed stocks of its US-listed fairness upward push greater than 1% in early buying and selling, with the inventory notching a brand new report intraday value of $193.96 in keeping with proportion and rejoining the $1 trillion membership.TSMC stocks prior to now hit an all-time prime above $193 every in July after the Taiwanese contract chipmaker reported 2nd quarter income. That surge in brief put its marketplace capitalization above $1 trillion earlier than stocks pared beneficial properties. The inventory fell again to earth as buyers weighed its prime valuation multiples, geopolitical dangers, and considerations over AI call for.TSMC closing week published 3rd quarter income of 759.7 billion New Taiwan bucks ($23.6 billion). That beat the NT$748.3 ($23.3 billion) anticipated, in keeping with Bloomberg information, in addition to the corporate’s prior steering of $22.4 billion to $23.2 billion.Some 23 Wall Side road analysts overlaying the inventory tracked through Bloomberg suggest purchasing TSMC stocks, whilst just one analyst has a Dangle score. Analysts see stocks emerging to $216.59 every over the following 365 days, in keeping with Bloomberg information.

Mon, October 14, 2024 at 7:13 AM PDTTSMC inventory hits report prime, rejoins $1 trillion clubNvidia (NVDA) provider TSMC (TSM) noticed stocks of its US-listed fairness upward push greater than 1% in early buying and selling, with the inventory notching a brand new report intraday value of $193.96 in keeping with proportion and rejoining the $1 trillion membership.TSMC stocks prior to now hit an all-time prime above $193 every in July after the Taiwanese contract chipmaker reported 2nd quarter income. That surge in brief put its marketplace capitalization above $1 trillion earlier than stocks pared beneficial properties. The inventory fell again to earth as buyers weighed its prime valuation multiples, geopolitical dangers, and considerations over AI call for.TSMC closing week published 3rd quarter income of 759.7 billion New Taiwan bucks ($23.6 billion). That beat the NT$748.3 ($23.3 billion) anticipated, in keeping with Bloomberg information, in addition to the corporate’s prior steering of $22.4 billion to $23.2 billion.Some 23 Wall Side road analysts overlaying the inventory tracked through Bloomberg suggest purchasing TSMC stocks, whilst just one analyst has a Dangle score. Analysts see stocks emerging to $216.59 every over the following 365 days, in keeping with Bloomberg information. Mon, October 14, 2024 at 7:00 AM PDTBoeing slips greater than 2% as aircraft maker plans cuts 10% of staff, strike enters fifth week, Boeing (BA) stocks slipped greater than 2% as buyers wondered the crisis-hit aircraft maker’s long run amid process cuts and a strike this is now in its 5th week.On Friday, the corporate stated it’s going to reduce 17,000 jobs, or about 10% of its staff.”Past navigating our present atmosphere, restoring our corporate calls for difficult selections and we can need to make structural adjustments to make sure we will be able to keep aggressive and ship for our consumers over the long run,” CEO Kelly Ortberg stated in a message to staff posted on Boeing’s web page on Friday.An ongoing strike through Boeing’s greatest union, the Global Affiliation of Machinists and Aerospace Staff (IAM), is proving pricey on a number of fronts for the corporate.S&P International put the associated fee estimate of the strike that began on Sept. 1 at kind of $1 billion monthly. Ultimate week, talks between Boeing and IAM broke down, with the corporate retreating its contract proposal.

Mon, October 14, 2024 at 7:00 AM PDTBoeing slips greater than 2% as aircraft maker plans cuts 10% of staff, strike enters fifth week, Boeing (BA) stocks slipped greater than 2% as buyers wondered the crisis-hit aircraft maker’s long run amid process cuts and a strike this is now in its 5th week.On Friday, the corporate stated it’s going to reduce 17,000 jobs, or about 10% of its staff.”Past navigating our present atmosphere, restoring our corporate calls for difficult selections and we can need to make structural adjustments to make sure we will be able to keep aggressive and ship for our consumers over the long run,” CEO Kelly Ortberg stated in a message to staff posted on Boeing’s web page on Friday.An ongoing strike through Boeing’s greatest union, the Global Affiliation of Machinists and Aerospace Staff (IAM), is proving pricey on a number of fronts for the corporate.S&P International put the associated fee estimate of the strike that began on Sept. 1 at kind of $1 billion monthly. Ultimate week, talks between Boeing and IAM broke down, with the corporate retreating its contract proposal. Mon, October 14, 2024 at 6:46 AM PDTNvidia climbs 2%, hovers close to recordNvidia (NVDA) inventory jumped greater than 2% on the open on Monday, surpassing its June report prime shut of $135.58.The inventory used to be a few bucks clear of its all-time intraday prime simply previous $140.76.

Mon, October 14, 2024 at 6:46 AM PDTNvidia climbs 2%, hovers close to recordNvidia (NVDA) inventory jumped greater than 2% on the open on Monday, surpassing its June report prime shut of $135.58.The inventory used to be a few bucks clear of its all-time intraday prime simply previous $140.76. Mon, October 14, 2024 at 6:30 AM PDTS&P 500 eyes recent report, Dow slips as center of attention shifts to earningsThe primary averages opened blended on Monday as buyers grew to become their center of attention to imminent large financial institution income and different quarterly effects from primary corporations.The S&P 500 (^GSPC) moved up kind of 0.3% to eye a brand new report prime. On Friday, the wider index ended above 5,800 for the primary time.The tech-heavy Nasdaq Composite (^IXIC) used to be up 0.5% quickly after the bell on Monday, whilst the Dow Jones Business Reasonable (^DJI) slipped 0.2% from its Friday report shut.Income season continues in complete swing this week, with Citi (C), United Airways (UAL), AI chip apparatus maker ASML (ASML), Netflix (NFLX), and American Specific (AXP) amongst the ones anticipated to record.Oil futures dropped greater than 2% as OPEC reduce its call for forecast for 2024 and 2025. Investors additionally reacted to a loss of element from China’s Finance Minister over the weekend on any massive new stimulus spending.

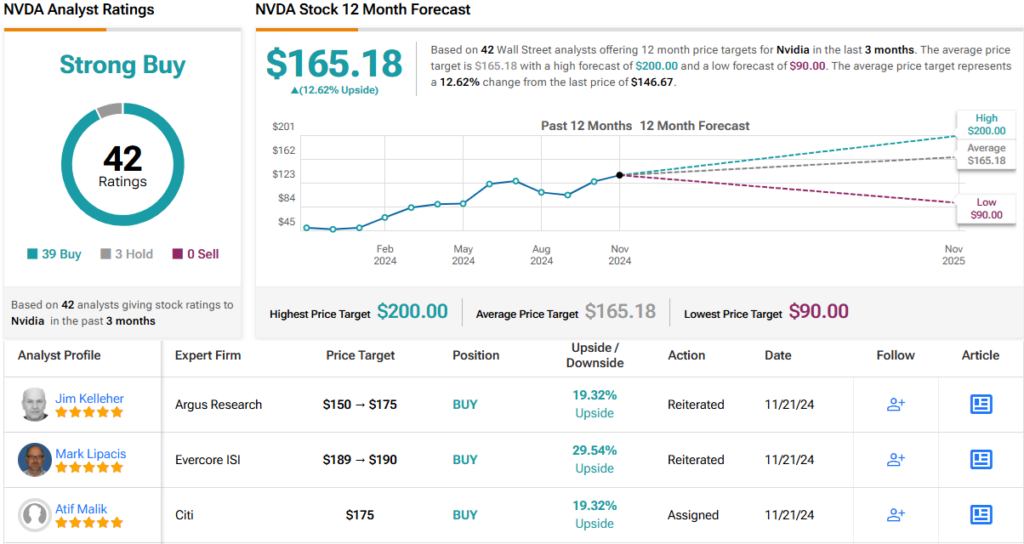

Mon, October 14, 2024 at 6:30 AM PDTS&P 500 eyes recent report, Dow slips as center of attention shifts to earningsThe primary averages opened blended on Monday as buyers grew to become their center of attention to imminent large financial institution income and different quarterly effects from primary corporations.The S&P 500 (^GSPC) moved up kind of 0.3% to eye a brand new report prime. On Friday, the wider index ended above 5,800 for the primary time.The tech-heavy Nasdaq Composite (^IXIC) used to be up 0.5% quickly after the bell on Monday, whilst the Dow Jones Business Reasonable (^DJI) slipped 0.2% from its Friday report shut.Income season continues in complete swing this week, with Citi (C), United Airways (UAL), AI chip apparatus maker ASML (ASML), Netflix (NFLX), and American Specific (AXP) amongst the ones anticipated to record.Oil futures dropped greater than 2% as OPEC reduce its call for forecast for 2024 and 2025. Investors additionally reacted to a loss of element from China’s Finance Minister over the weekend on any massive new stimulus spending. Mon, October 14, 2024 at 6:16 AM PDTNvidia inventory eyes report prime and most sensible spot as most respected corporate forward of AppleNvidia (NVDA) inventory rose 1% in premarket buying and selling to $136.22, hanging the chipmaking massive on the right track to surpass its earlier report ultimate value of $135.58 posted in June.The AI chipmaker’s stocks have made really extensive beneficial properties in October following a large $6.6 billion investment spherical for ChatGPT-maker OpenAI, a lot of which shall be funneled again to Nvidia. AI leaders, together with Nvidia CEO Jensen Huang, have cited livid call for for the corporate’s newest Blackwell chips. Its inventory is up 8% over the last week.Nvidia’s beneficial properties put it on the right track to as soon as once more declare the rank of No. 1 most respected corporate on the planet in relation to marketplace capitalization. It recently holds the No. 2 place at the back of Apple (AAPL). The chipmaker’s marketplace cap stood at $3.3 trillion Monday, whilst Apple’s used to be $3.46 trillion. Apple, Microsoft (MSFT), and Nvidia have traded puts as the highest 3 corporations over the last 12 months.Nvidia is ready to record income on Nov. 19. Wall Side road analysts be expecting it to record income of $33 billion, up 82% from the prior 12 months, in keeping with Bloomberg consensus estimates. Some 90% of the ones overlaying the inventory and tracked through Bloomberg suggest purchasing Nvidia stocks.

Mon, October 14, 2024 at 6:16 AM PDTNvidia inventory eyes report prime and most sensible spot as most respected corporate forward of AppleNvidia (NVDA) inventory rose 1% in premarket buying and selling to $136.22, hanging the chipmaking massive on the right track to surpass its earlier report ultimate value of $135.58 posted in June.The AI chipmaker’s stocks have made really extensive beneficial properties in October following a large $6.6 billion investment spherical for ChatGPT-maker OpenAI, a lot of which shall be funneled again to Nvidia. AI leaders, together with Nvidia CEO Jensen Huang, have cited livid call for for the corporate’s newest Blackwell chips. Its inventory is up 8% over the last week.Nvidia’s beneficial properties put it on the right track to as soon as once more declare the rank of No. 1 most respected corporate on the planet in relation to marketplace capitalization. It recently holds the No. 2 place at the back of Apple (AAPL). The chipmaker’s marketplace cap stood at $3.3 trillion Monday, whilst Apple’s used to be $3.46 trillion. Apple, Microsoft (MSFT), and Nvidia have traded puts as the highest 3 corporations over the last 12 months.Nvidia is ready to record income on Nov. 19. Wall Side road analysts be expecting it to record income of $33 billion, up 82% from the prior 12 months, in keeping with Bloomberg consensus estimates. Some 90% of the ones overlaying the inventory and tracked through Bloomberg suggest purchasing Nvidia stocks.

Mon, October 14, 2024 at 10:46 AM PDTBitcoin rally pulls crypto-related shares higherBitcoin (BTC-USD) is up greater than 5% previously 24 hours to the touch above $65,700 in keeping with coin. The arena’s biggest cryptocurrency has been surging in contemporary days and is now up about 8% over the last 5 buying and selling periods.Different cryptocurrency Ethereum (ETH-USD) has additionally rallied, including just about 8%, previously 24 hours. Then risk-on rally in crytpo helps crypto-related US equities, catch a bid too.Stocks of Coinbase (COIN) are the chief within the house nowadays, emerging greater than 8%.

Supply: Yahoo Finance

Utilities and Generation won on Monday

Mon, October 14, 2024 at 8:33 AM PDTSoFi inventory soars on $2 billion Castle deal to enlarge mortgage platformSoFi Applied sciences (SOFI) inventory jumped up to 9% after the net lender introduced a $2 billion settlement with Castle Funding Staff to enlarge its mortgage platform trade. The phase refers pre-qualified debtors to mortgage origination companions and connects lenders with debtors.The transfer displays SoFi’s process of diversifying from its roots in pupil mortgage refinancing.”SoFi’s mortgage platform trade is crucial a part of our method to serve the monetary wishes of extra contributors and diversify towards much less capital-intensive and extra fee-based assets of income,” stated Anthony Noto, CEO of SoFi, in a commentary.Of the Wall Side road analysts overlaying the inventory tracked through Bloomberg, handiest six suggest purchasing the inventory, whilst 10 have Dangle scores and 3 have Promote scores. The inventory is up just about 20% from closing 12 months however a ways from its report intraday prime close to $27 upon its IPO in 2021.Analysts see stocks falling to $8.91 over the following 365 days, in keeping with Bloomberg information.

Mon, October 14, 2024 at 7:13 AM PDTTSMC inventory hits report prime, rejoins $1 trillion clubNvidia (NVDA) provider TSMC (TSM) noticed stocks of its US-listed fairness upward push greater than 1% in early buying and selling, with the inventory notching a brand new report intraday value of $193.96 in keeping with proportion and rejoining the $1 trillion membership.TSMC stocks prior to now hit an all-time prime above $193 every in July after the Taiwanese contract chipmaker reported 2nd quarter income. That surge in brief put its marketplace capitalization above $1 trillion earlier than stocks pared beneficial properties. The inventory fell again to earth as buyers weighed its prime valuation multiples, geopolitical dangers, and considerations over AI call for.TSMC closing week published 3rd quarter income of 759.7 billion New Taiwan bucks ($23.6 billion). That beat the NT$748.3 ($23.3 billion) anticipated, in keeping with Bloomberg information, in addition to the corporate’s prior steering of $22.4 billion to $23.2 billion.Some 23 Wall Side road analysts overlaying the inventory tracked through Bloomberg suggest purchasing TSMC stocks, whilst just one analyst has a Dangle score. Analysts see stocks emerging to $216.59 every over the following 365 days, in keeping with Bloomberg information.

Mon, October 14, 2024 at 6:16 AM PDTNvidia inventory eyes report prime and most sensible spot as most respected corporate forward of AppleNvidia (NVDA) inventory rose 1% in premarket buying and selling to $136.22, hanging the chipmaking massive on the right track to surpass its earlier report ultimate value of $135.58 posted in June.The AI chipmaker’s stocks have made really extensive beneficial properties in October following a large $6.6 billion investment spherical for ChatGPT-maker OpenAI, a lot of which shall be funneled again to Nvidia. AI leaders, together with Nvidia CEO Jensen Huang, have cited livid call for for the corporate’s newest Blackwell chips. Its inventory is up 8% over the last week.Nvidia’s beneficial properties put it on the right track to as soon as once more declare the rank of No. 1 most respected corporate on the planet in relation to marketplace capitalization. It recently holds the No. 2 place at the back of Apple (AAPL). The chipmaker’s marketplace cap stood at $3.3 trillion Monday, whilst Apple’s used to be $3.46 trillion. Apple, Microsoft (MSFT), and Nvidia have traded puts as the highest 3 corporations over the last 12 months.Nvidia is ready to record income on Nov. 19. Wall Side road analysts be expecting it to record income of $33 billion, up 82% from the prior 12 months, in keeping with Bloomberg consensus estimates. Some 90% of the ones overlaying the inventory and tracked through Bloomberg suggest purchasing Nvidia stocks.