US shares titled increased on Monday because the Nasdaq Composite (^IXIC) clinched a report shut buoyed by way of stocks of Nvidia (NVDA) forward of the chipmaker’s extremely expected income later this week.The wider S&P 500 (^GSPC) index rose 0.1% whilst the Dow Jones Commercial Moderate (^DJI) dipped underneath 40,000, weighed by way of a drop in JPMorgan (JPM) stocks. The blue-chip benchmark dropped 0.5% following a report shut on Friday.Shares have received as traders transform extra constructive that the Federal Reserve will quickly lower rates of interest, regardless of phrases of warning from policymakers. Even certainly one of Wall Boulevard’s largest bears has lifted his forecast for the S&P 500 following report highs.A key query for traders is whether or not that outlook is sustainable or whether or not it is getting forward of the place the Fed is headed. A key check comes on Wednesday, with the discharge of mins from the Fed assembly in Might, as Yahoo Finance’s Josh Schafer studies.On Monday Fed Vice Chair Philip Jefferson and Fed Vice Chair of Supervision Michael Barr pointed to disappointing inflation within the first quarter as a explanation why for containing charges the place they’re, permitting extra time for restrictive coverage to paintings.Learn extra: How does the exertions marketplace have an effect on inflation?The marketplace is bracing for closely expected quarterly effects from Nvidia on Wednesday, eyed as a key catalyst for the rally in shares. Expectancies for the AI chipmaker’s income and earnings are sky-high — for expansion of 400% and 240%, respectively — and the focal point is on whether or not it could once more reside as much as the hype.JPMorgan inventory slid greater than 4% following the financial institution’s funding day the place CEO Jamie Dimon signaled his retirement is also nearer than in the past expected by way of Wall Boulevard.On the similar time, rallies in commodity markets are fueling fears of a knock-on upward push for US inflation. Copper costs at the LME crowned $11,000 a ton for the primary time, hovering to their highest-ever degree as a looming provide scarcity attracts in traders. In the meantime, gold costs (GC=F) jumped to faucet an intraday report at round $2,450 an oz..Live15 updates Mon, Might 20, 2024 at 1:05 PM PDTNasdaq closes at report excessive, Dow dips underneath 40,000 levelUS shares ended the consultation combined on Monday with the Nasdaq Composite (^IXIC) ultimate at a report excessive whilst the Dow Jones Commercial Moderate (^DJI) fell underneath 40,000 after ultimate above the landmark degree for the primary time on Friday.The tech-heavy Nasdaq Composite climbed about 0.7% as Nvidia (NVDA) stocks received forward of the chipmaker’s extremely expected income later this week. The S&P 500 (^GSPC) rose 0.1% whilst the Dow fell 0.5%.JPMorgan (JPM) inventory weighed at the blue-chip index after the financial institution’s investor day. In resolution to a query about his retirement, CEO Jamie Dimon signaled it is nearer than in the past expected by way of Wall Boulevard.Dimon mentioned “the timetable isn’t 5 years anymore.” He added succession plans are “nicely at the method.”Microsoft (MSFT) received about 1% after the corporate introduced a brand new class of PCs known as Copilot+ PCs. The brand new number of computer systems come provided with so-called AI PC chips and run Microsoft’s newest model of Home windows 11 and its Copilot AI device.Bitcoin (BTC-USD) received greater than 2% during the last 24 hours. The cryptocurrency climbed again above $68,000 according to token Monday, a degree now not observed in over a month.In the meantime, metals persevered their climb, with gold (GC=F) touching a report $2,450 according to ounce. Silver (SI=F) rallied to a close to 12-year excessive, emerging above $32 according to ounce.Copper (HG=F) additionally hit report highs throughout Monday buying and selling.

Mon, Might 20, 2024 at 1:05 PM PDTNasdaq closes at report excessive, Dow dips underneath 40,000 levelUS shares ended the consultation combined on Monday with the Nasdaq Composite (^IXIC) ultimate at a report excessive whilst the Dow Jones Commercial Moderate (^DJI) fell underneath 40,000 after ultimate above the landmark degree for the primary time on Friday.The tech-heavy Nasdaq Composite climbed about 0.7% as Nvidia (NVDA) stocks received forward of the chipmaker’s extremely expected income later this week. The S&P 500 (^GSPC) rose 0.1% whilst the Dow fell 0.5%.JPMorgan (JPM) inventory weighed at the blue-chip index after the financial institution’s investor day. In resolution to a query about his retirement, CEO Jamie Dimon signaled it is nearer than in the past expected by way of Wall Boulevard.Dimon mentioned “the timetable isn’t 5 years anymore.” He added succession plans are “nicely at the method.”Microsoft (MSFT) received about 1% after the corporate introduced a brand new class of PCs known as Copilot+ PCs. The brand new number of computer systems come provided with so-called AI PC chips and run Microsoft’s newest model of Home windows 11 and its Copilot AI device.Bitcoin (BTC-USD) received greater than 2% during the last 24 hours. The cryptocurrency climbed again above $68,000 according to token Monday, a degree now not observed in over a month.In the meantime, metals persevered their climb, with gold (GC=F) touching a report $2,450 according to ounce. Silver (SI=F) rallied to a close to 12-year excessive, emerging above $32 according to ounce.Copper (HG=F) additionally hit report highs throughout Monday buying and selling. Mon, Might 20, 2024 at 12:50 PM PDTS&P 500, Nasdaq hover close to highsThe markets had been sitting close to information on Monday. With simply 10 mins left of the buying and selling consultation, the S&P 500 (^GSPC) used to be issues clear of its prior report shut from remaining Wednesday of five,308.15.In the meantime the Nasdaq Composite (^IXIC) used to be on course to peak its prior report shut of 16,742.39 on Might 15.The Dow Jones Commercial Moderate (^DJI) used to be down about 0.4% after ultimate at a report remaining Friday. The blue-chip index used to be weighed by way of JPMorgan (JPM), down 4% following the financial institution’s investor day.

Mon, Might 20, 2024 at 12:50 PM PDTS&P 500, Nasdaq hover close to highsThe markets had been sitting close to information on Monday. With simply 10 mins left of the buying and selling consultation, the S&P 500 (^GSPC) used to be issues clear of its prior report shut from remaining Wednesday of five,308.15.In the meantime the Nasdaq Composite (^IXIC) used to be on course to peak its prior report shut of 16,742.39 on Might 15.The Dow Jones Commercial Moderate (^DJI) used to be down about 0.4% after ultimate at a report remaining Friday. The blue-chip index used to be weighed by way of JPMorgan (JPM), down 4% following the financial institution’s investor day. Mon, Might 20, 2024 at 11:57 AM PDTJPMorgan inventory falls 4% throughout financial institution’s funding day, CEO hints at retirementJPMorgan (JPM) inventory slid to consultation lows Monday after CEO Jamie Dimon signaled his retirement is nearer than in the past expected by way of Wall Boulevard.In line with a query throughout the financial institution’s funding day, Dimon mentioned “the timetable isn’t 5 years anymore.” He added succession plans are “nicely at the method.”Wall Boulevard has lengthy speculated who will take over as soon as Dimon retires and when that can occur. Prior to now, on every occasion requested about his retirement, the CEO has joked, “In 5 years.”JPMorgan inventory sank to consultation lows in afternoon buying and selling. The Dow part dragged at the broader blue-chip index, which fell kind of 0.4%.

Mon, Might 20, 2024 at 11:57 AM PDTJPMorgan inventory falls 4% throughout financial institution’s funding day, CEO hints at retirementJPMorgan (JPM) inventory slid to consultation lows Monday after CEO Jamie Dimon signaled his retirement is nearer than in the past expected by way of Wall Boulevard.In line with a query throughout the financial institution’s funding day, Dimon mentioned “the timetable isn’t 5 years anymore.” He added succession plans are “nicely at the method.”Wall Boulevard has lengthy speculated who will take over as soon as Dimon retires and when that can occur. Prior to now, on every occasion requested about his retirement, the CEO has joked, “In 5 years.”JPMorgan inventory sank to consultation lows in afternoon buying and selling. The Dow part dragged at the broader blue-chip index, which fell kind of 0.4%. Mon, Might 20, 2024 at 11:11 AM PDTMicrosoft debuts new Copilot+ PCs the usage of OpenAI’s GPT-4o whilst taking photographs at AppleYahoo Finance’s Dan Howley studies: Microsoft (MSFT) goes all in on AI for the PC.The corporate on Monday introduced a brand new class of PCs known as Copilot+ PCs, a brand new number of computer systems provided with so-called AI PC chips and working Microsoft’s newest model of Home windows 11 and its Copilot AI device.Microsoft additionally published that its Copilot+ PCs will now run on OpenAI’s GPT-4o style, permitting the assistant to have interaction together with your PC by way of textual content, video, and voice. Customers will even be capable of percentage their display with Copilot and feature a herbal dialog with the app.”The richest AI stories will harness the ability of the cloud and the threshold running in combination in live performance. This in flip will result in a brand new class of gadgets that flip the arena itself right into a recommended,” Microsoft CEO Satya Nadella mentioned throughout the corporate’s Construct match on Monday. “For us, this imaginative and prescient begins with our maximum loved and most generally used canvas: Home windows.”Microsoft additionally touted the efficiency of its Copilot+ PCs and hammered house what it sees as a efficiency benefit over identical Apple (AAPL) gadgets.Microsoft stocks received about 1% Monday.Learn the entire article right here.

Mon, Might 20, 2024 at 11:11 AM PDTMicrosoft debuts new Copilot+ PCs the usage of OpenAI’s GPT-4o whilst taking photographs at AppleYahoo Finance’s Dan Howley studies: Microsoft (MSFT) goes all in on AI for the PC.The corporate on Monday introduced a brand new class of PCs known as Copilot+ PCs, a brand new number of computer systems provided with so-called AI PC chips and working Microsoft’s newest model of Home windows 11 and its Copilot AI device.Microsoft additionally published that its Copilot+ PCs will now run on OpenAI’s GPT-4o style, permitting the assistant to have interaction together with your PC by way of textual content, video, and voice. Customers will even be capable of percentage their display with Copilot and feature a herbal dialog with the app.”The richest AI stories will harness the ability of the cloud and the threshold running in combination in live performance. This in flip will result in a brand new class of gadgets that flip the arena itself right into a recommended,” Microsoft CEO Satya Nadella mentioned throughout the corporate’s Construct match on Monday. “For us, this imaginative and prescient begins with our maximum loved and most generally used canvas: Home windows.”Microsoft additionally touted the efficiency of its Copilot+ PCs and hammered house what it sees as a efficiency benefit over identical Apple (AAPL) gadgets.Microsoft stocks received about 1% Monday.Learn the entire article right here.  Mon, Might 20, 2024 at 10:15 AM PDTBitcoin good points 2%, climbs again above $68,000Bitcoin (BTC-USD) received greater than 2% during the last 24 hours. The cryptocurrency climbed again above $68,000 according to token Monday, a degree now not observed in over a month.Bitcoin has rallied about 17% for the reason that get started of Might.

Mon, Might 20, 2024 at 10:15 AM PDTBitcoin good points 2%, climbs again above $68,000Bitcoin (BTC-USD) received greater than 2% during the last 24 hours. The cryptocurrency climbed again above $68,000 according to token Monday, a degree now not observed in over a month.Bitcoin has rallied about 17% for the reason that get started of Might. Mon, Might 20, 2024 at 9:46 AM PDTTrending tickers MondayNvidia (NVDA) Nvidia inventory used to be a peak ticker on Yahoo Finance’s trending tickers web page Monday. The chip large is about to file income on Wednesday after the ultimate bell. Buyers have excessive expectancies for the AI darling because the extremely expected print is usually a market-moving catalyst.”AI goes to modify issues up to the web did when it happened 30, 40 years in the past,” Randy Frederick, marketplace strategist and founding father of RandyFrederickMedia.com, informed Yahoo Finance on Monday.Li Auto (LI)Li Auto stocks plunged 12% Monday after the Chinese language electrical automobile maker posted a drop in quarterly income in comparison to the similar length remaining yr. The corporate’s gross sales additionally ignored analyst expectancies.12 months thus far, the inventory is down 37%.Norwegian Cruise Line (NCLH)Stocks of Norwegian Cruise Line jumped 8% after the corporate raised its full-year income outlook for the second one time in a month amid report bookings. The cruise operator mentioned its quarterly income according to percentage will now are available at $1.42, about $0.10 increased than a previous estimate.“We have now persevered to peer very sturdy call for and report bookings,” mentioned Norwegian Cruise Line’s CFO Mark Kempa in a commentary.

Mon, Might 20, 2024 at 9:46 AM PDTTrending tickers MondayNvidia (NVDA) Nvidia inventory used to be a peak ticker on Yahoo Finance’s trending tickers web page Monday. The chip large is about to file income on Wednesday after the ultimate bell. Buyers have excessive expectancies for the AI darling because the extremely expected print is usually a market-moving catalyst.”AI goes to modify issues up to the web did when it happened 30, 40 years in the past,” Randy Frederick, marketplace strategist and founding father of RandyFrederickMedia.com, informed Yahoo Finance on Monday.Li Auto (LI)Li Auto stocks plunged 12% Monday after the Chinese language electrical automobile maker posted a drop in quarterly income in comparison to the similar length remaining yr. The corporate’s gross sales additionally ignored analyst expectancies.12 months thus far, the inventory is down 37%.Norwegian Cruise Line (NCLH)Stocks of Norwegian Cruise Line jumped 8% after the corporate raised its full-year income outlook for the second one time in a month amid report bookings. The cruise operator mentioned its quarterly income according to percentage will now are available at $1.42, about $0.10 increased than a previous estimate.“We have now persevered to peer very sturdy call for and report bookings,” mentioned Norwegian Cruise Line’s CFO Mark Kempa in a commentary. Mon, Might 20, 2024 at 9:00 AM PDTWall Boulevard’s largest undergo flips, raises S&P 500 worth goal by way of 20percentMorgan Stanley’s Mike Wilson is finished calling for US shares to fall off a cliff.After sitting at one of the vital lowest S&P 500 (^GSPC) year-end objectives for the previous yr, Morgan Stanley’s leader funding officer modified his song in a word to shoppers on Sunday.Wilson now sees the S&P 500 hitting 5,400 within the subsequent three hundred and sixty five days, up from his prior name that the index would fall to 4,500. Wilson’s new goal displays about 2% upside within the index over the following three hundred and sixty five days, with valuations falling and income proceeding to upward push.”Our 2024 and 2025 income expansion forecasts (8% and 13%, respectively) think wholesome, mid-single-digit top-line expansion along with margin growth in each years as sure running leverage resumes (in particular in 2025),” Wilson wrote within the word.”Modest valuation compression (from ~20x to ~19x within the base case) as income modify increased is standard in a mid-to-late-cycle backdrop (came about within the mid-Nineteen Nineties, mid-2000s, and 2018 maximum not too long ago).”Learn extra right here.

Mon, Might 20, 2024 at 9:00 AM PDTWall Boulevard’s largest undergo flips, raises S&P 500 worth goal by way of 20percentMorgan Stanley’s Mike Wilson is finished calling for US shares to fall off a cliff.After sitting at one of the vital lowest S&P 500 (^GSPC) year-end objectives for the previous yr, Morgan Stanley’s leader funding officer modified his song in a word to shoppers on Sunday.Wilson now sees the S&P 500 hitting 5,400 within the subsequent three hundred and sixty five days, up from his prior name that the index would fall to 4,500. Wilson’s new goal displays about 2% upside within the index over the following three hundred and sixty five days, with valuations falling and income proceeding to upward push.”Our 2024 and 2025 income expansion forecasts (8% and 13%, respectively) think wholesome, mid-single-digit top-line expansion along with margin growth in each years as sure running leverage resumes (in particular in 2025),” Wilson wrote within the word.”Modest valuation compression (from ~20x to ~19x within the base case) as income modify increased is standard in a mid-to-late-cycle backdrop (came about within the mid-Nineteen Nineties, mid-2000s, and 2018 maximum not too long ago).”Learn extra right here. Mon, Might 20, 2024 at 8:27 AM PDT2 Fed governors see preserving charges increased for longer amid slow-moving inflationYahoo Finance’s Jennifer Schonberger studies: Two Federal Reserve governors reiterated Monday they see preserving charges at present ranges till there’s extra proof inflation is falling, the most recent central financial institution officers to fret a higher-for-longer stance.Fed Vice Chair Philip Jefferson and Fed Vice Chair of Supervision Michael Barr pointed to disappointing inflation within the first quarter as a explanation why for containing charges the place they’re, permitting extra time for restrictive coverage to paintings.”I believe we’re in a excellent place to carry secure and intently watch how stipulations evolve,” Barr mentioned in a speech at an Atlanta Fed convention being held in Florida.Learn the entire article right here.

Mon, Might 20, 2024 at 8:27 AM PDT2 Fed governors see preserving charges increased for longer amid slow-moving inflationYahoo Finance’s Jennifer Schonberger studies: Two Federal Reserve governors reiterated Monday they see preserving charges at present ranges till there’s extra proof inflation is falling, the most recent central financial institution officers to fret a higher-for-longer stance.Fed Vice Chair Philip Jefferson and Fed Vice Chair of Supervision Michael Barr pointed to disappointing inflation within the first quarter as a explanation why for containing charges the place they’re, permitting extra time for restrictive coverage to paintings.”I believe we’re in a excellent place to carry secure and intently watch how stipulations evolve,” Barr mentioned in a speech at an Atlanta Fed convention being held in Florida.Learn the entire article right here.  Mon, Might 20, 2024 at 7:38 AM PDTNasdaq Composite hits new intraday highThe Nasdaq Composite (^IXIC) hit a brand new intraday excessive Monday as tech shares received.The S&P 500 Generation Sector Make a selection (XLK) additionally touched a brand new report throughout the consultation. XLK is up greater than 14% yr thus far whilst the Nasdaq is up greater than 13% throughout the similar length.Semiconductor-related shares rose Monday forward of Nvidia’s (NVDA) extremely expected income due out on Wednesday after the marketplace shut.

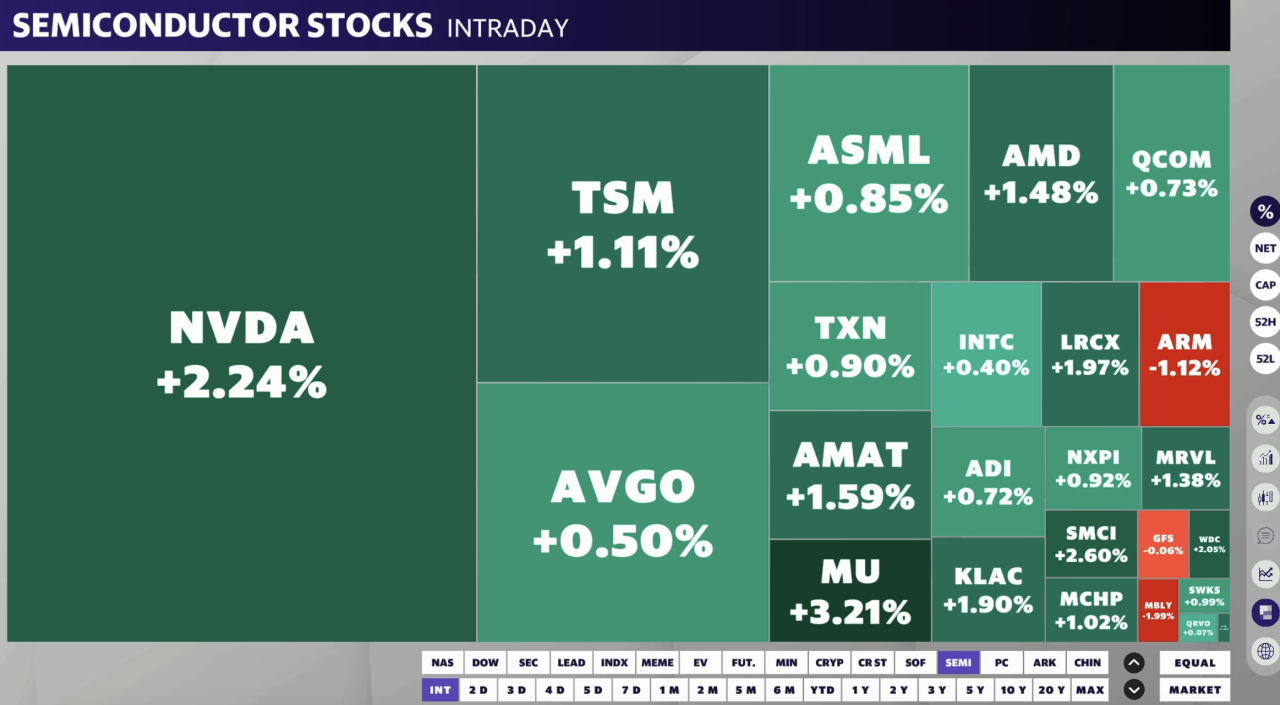

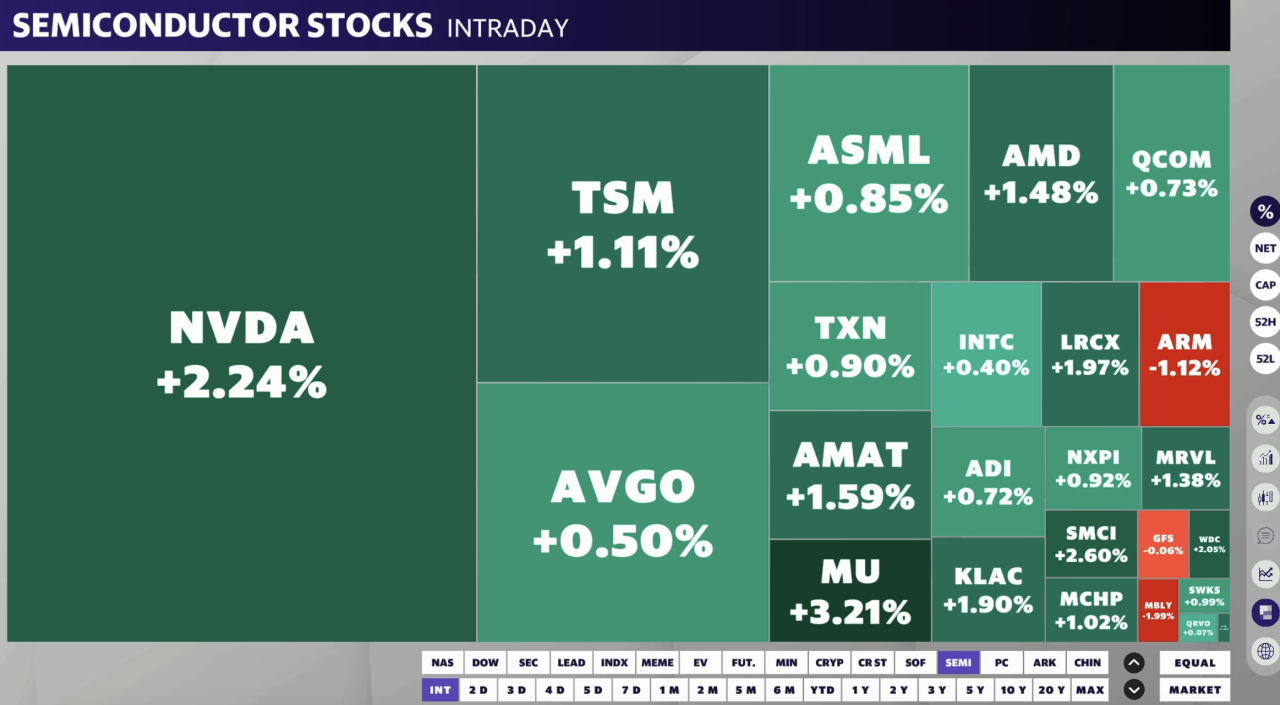

Mon, Might 20, 2024 at 7:38 AM PDTNasdaq Composite hits new intraday highThe Nasdaq Composite (^IXIC) hit a brand new intraday excessive Monday as tech shares received.The S&P 500 Generation Sector Make a selection (XLK) additionally touched a brand new report throughout the consultation. XLK is up greater than 14% yr thus far whilst the Nasdaq is up greater than 13% throughout the similar length.Semiconductor-related shares rose Monday forward of Nvidia’s (NVDA) extremely expected income due out on Wednesday after the marketplace shut. Mon, Might 20, 2024 at 7:00 AM PDTNvidia good points 2% forward of chip large’s income this weekNvidia (NVDA) inventory received greater than 2% forward of the chipmaker’s extremely expected income file anticipated on Wednesday.Hopes are excessive for the AI corporate as its effects is usually a key catalyst for markets. Nvidia stocks are up greater than 90% yr thus far.Different chipmakers within the inexperienced territory on Monday come with Micron (MU) and Complicated Micro Gadgets (AMD). Positive aspects in semiconductor shares helped the Nasdaq Composite (^IXIC) climb 0.5% throughout the morning consultation.

Mon, Might 20, 2024 at 7:00 AM PDTNvidia good points 2% forward of chip large’s income this weekNvidia (NVDA) inventory received greater than 2% forward of the chipmaker’s extremely expected income file anticipated on Wednesday.Hopes are excessive for the AI corporate as its effects is usually a key catalyst for markets. Nvidia stocks are up greater than 90% yr thus far.Different chipmakers within the inexperienced territory on Monday come with Micron (MU) and Complicated Micro Gadgets (AMD). Positive aspects in semiconductor shares helped the Nasdaq Composite (^IXIC) climb 0.5% throughout the morning consultation.

Semiconductors achieve forward of Nvidia’s income anticipated on Wednesday

Semiconductors achieve forward of Nvidia’s income anticipated on Wednesday Mon, Might 20, 2024 at 6:32 AM PDTStocks little modified as Dow dips underneath 40,000 degree US shares opened combined Monday because the Dow Jones Commercial Moderate (^DJI) struggled so as to add to Friday’s good points.The blue-chip index opened reasonably underneath the flatline after ultimate above 40,000 for the primary time on Friday.The S&P 500 (^GPSC) received reasonably whilst the tech-heavy Nasdaq Composite (^IXIC) rose kind of 0.4%.Buyers have their eye on Nvidia (NVDA) income due out on Wednesday. Investors also are observing the metals marketplace after gold (GC=F) touched new intraday highs this morning. Silver (SI=F) hovered round 12-year highs and copper (HG=F) additionally received amid an power transition that can require metals for commercial use.

Mon, Might 20, 2024 at 6:32 AM PDTStocks little modified as Dow dips underneath 40,000 degree US shares opened combined Monday because the Dow Jones Commercial Moderate (^DJI) struggled so as to add to Friday’s good points.The blue-chip index opened reasonably underneath the flatline after ultimate above 40,000 for the primary time on Friday.The S&P 500 (^GPSC) received reasonably whilst the tech-heavy Nasdaq Composite (^IXIC) rose kind of 0.4%.Buyers have their eye on Nvidia (NVDA) income due out on Wednesday. Investors also are observing the metals marketplace after gold (GC=F) touched new intraday highs this morning. Silver (SI=F) hovered round 12-year highs and copper (HG=F) additionally received amid an power transition that can require metals for commercial use. Mon, Might 20, 2024 at 6:13 AM PDTGold in brief touches report excessive as metals marketplace continues to climbGold (GC=F) rose simply above a report $2,450 according to ounce in early Monday’s buying and selling prior to paring good points.The valuable steel rallied to surpass its April nominal highs amid expectancies the Federal Reserve will lower rates of interest this yr. Prime call for from central banks and Asian consumers has additionally helped gold costs upward push kind of 17% yr thus far.In the meantime, silver (SI=F) hovered at its best possible degree since December 2012, in brief surpassing $32 an oz. on Monday after a powerful rally on Friday. Not like gold, silver has commercial makes use of, for functions comparable to construction sun panels.Copper (HG=F) hit report highs Monday on considerations of a provide scarcity amid an power transition. 12 months thus far, the steel is up about 30%. Whilst the rally has most probably attracted speculators in contemporary days, the availability basic hasn’t modified, in line with Wells Fargo head of actual asset technique John LaForge.“We frankly don’t seem to be generating sufficient copper, and but there are consumers far and wide for this copper around the globe,” LaForge not too long ago informed Yahoo Finance.“It doesn’t subject if it’s China, India, the US. Everyone seems to be pushing to head inexperienced, and copper is the No. 1 steel for in terms of that form of long term.”

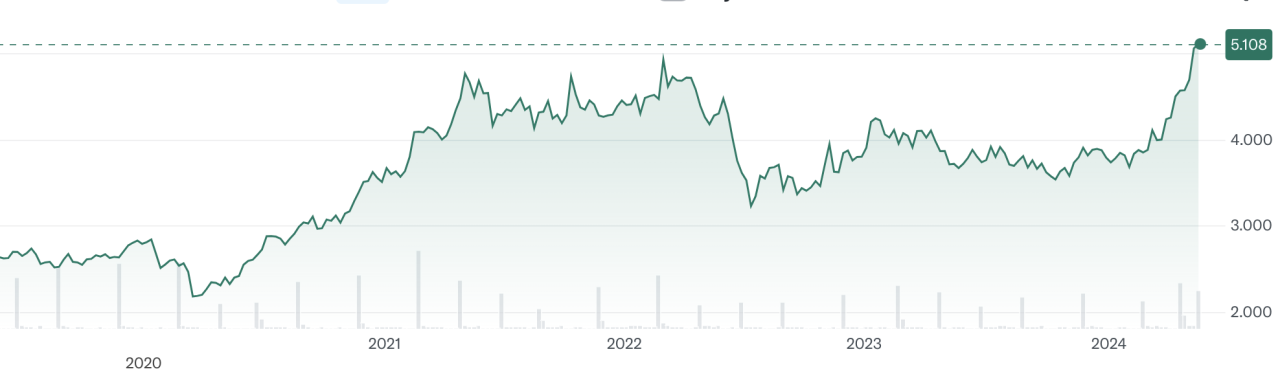

Mon, Might 20, 2024 at 6:13 AM PDTGold in brief touches report excessive as metals marketplace continues to climbGold (GC=F) rose simply above a report $2,450 according to ounce in early Monday’s buying and selling prior to paring good points.The valuable steel rallied to surpass its April nominal highs amid expectancies the Federal Reserve will lower rates of interest this yr. Prime call for from central banks and Asian consumers has additionally helped gold costs upward push kind of 17% yr thus far.In the meantime, silver (SI=F) hovered at its best possible degree since December 2012, in brief surpassing $32 an oz. on Monday after a powerful rally on Friday. Not like gold, silver has commercial makes use of, for functions comparable to construction sun panels.Copper (HG=F) hit report highs Monday on considerations of a provide scarcity amid an power transition. 12 months thus far, the steel is up about 30%. Whilst the rally has most probably attracted speculators in contemporary days, the availability basic hasn’t modified, in line with Wells Fargo head of actual asset technique John LaForge.“We frankly don’t seem to be generating sufficient copper, and but there are consumers far and wide for this copper around the globe,” LaForge not too long ago informed Yahoo Finance.“It doesn’t subject if it’s China, India, the US. Everyone seems to be pushing to head inexperienced, and copper is the No. 1 steel for in terms of that form of long term.” Mon, Might 20, 2024 at 3:31 AM PDTWatching Dr. CopperIf the financial system is poised for a preelection slowdown, you don’t seem to be seeing it commercial steel copper.Copper costs have touched report highs.Copper play Rio Tinto (RIO) is eyeing a one-year excessive.

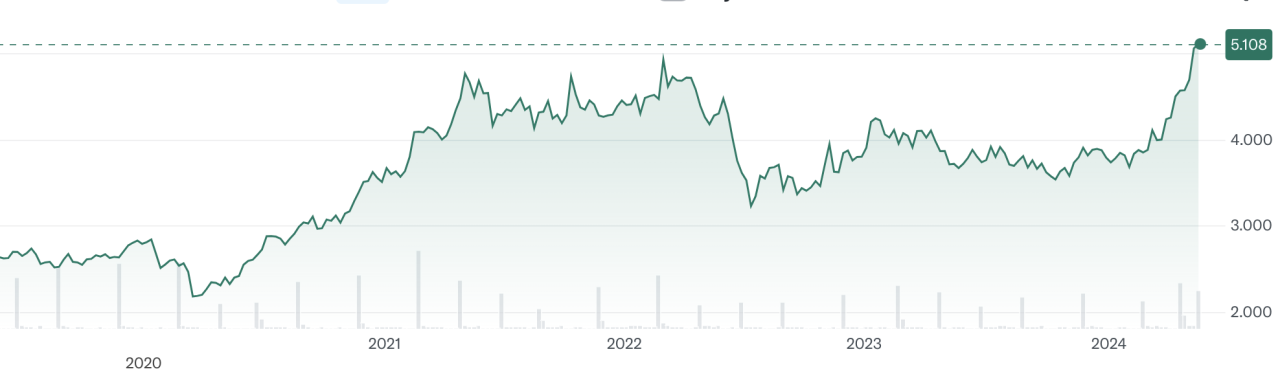

Mon, Might 20, 2024 at 3:31 AM PDTWatching Dr. CopperIf the financial system is poised for a preelection slowdown, you don’t seem to be seeing it commercial steel copper.Copper costs have touched report highs.Copper play Rio Tinto (RIO) is eyeing a one-year excessive.

A five-year have a look at copper costs displays report highs. (Yahoo Finance)

A five-year have a look at copper costs displays report highs. (Yahoo Finance) Mon, Might 20, 2024 at 2:45 AM PDTNvidia expectancies are tremendous highWe conscious nowadays to seek out Nvidia (NVDA) because the 3rd trending ticker at the Yahoo Finance platform forward of its income file on Wednesday.Obviously, the retail investor group is bracing for every other spectacular income day (effects + steerage) appearing from the AI darling.Necessary level, alternatively, from Financial institution of The us Vivek Arya this morning: Nice from Nvidia is probably not nice sufficient.Says Arya:”In accordance with bullish traders we spoke with, expectancies appear well-above consensus estimates as same old, with $26 billion in gross sales anticipated for reported fiscal first quarter (April), or 6% forward of consensus $24.6 billion, with steerage anticipated to be just about $28 billion or 5% forward of $26.7 billion. 2nd, gross margins are anticipated to height at 77% within the fiscal first quarter, with well-expected outlook for a decline to 75%-76% within the fiscal 2nd quarter (normalization after some one-off components driven it above 75% previous couple of quarters). On the other hand, although Nvidia had been to doubtlessly ship on those bullish expectancies, the inventory may nonetheless react unfavorably as bears will most probably whinge that: 1) Nvidia’s sequential gross sales expansion will slow down to “handiest” 7%-8% quarter over quarter within the fiscal 2nd quarter (July) outlook, nicely underneath the mid-teens or higher the previous couple of quarters, 2) Gross margin is peaking and decline is an indication of pricing power, destructive combine (extra China H20 shipments and/or extra inference devices) and slowing call for/easing provide.”

Mon, Might 20, 2024 at 2:45 AM PDTNvidia expectancies are tremendous highWe conscious nowadays to seek out Nvidia (NVDA) because the 3rd trending ticker at the Yahoo Finance platform forward of its income file on Wednesday.Obviously, the retail investor group is bracing for every other spectacular income day (effects + steerage) appearing from the AI darling.Necessary level, alternatively, from Financial institution of The us Vivek Arya this morning: Nice from Nvidia is probably not nice sufficient.Says Arya:”In accordance with bullish traders we spoke with, expectancies appear well-above consensus estimates as same old, with $26 billion in gross sales anticipated for reported fiscal first quarter (April), or 6% forward of consensus $24.6 billion, with steerage anticipated to be just about $28 billion or 5% forward of $26.7 billion. 2nd, gross margins are anticipated to height at 77% within the fiscal first quarter, with well-expected outlook for a decline to 75%-76% within the fiscal 2nd quarter (normalization after some one-off components driven it above 75% previous couple of quarters). On the other hand, although Nvidia had been to doubtlessly ship on those bullish expectancies, the inventory may nonetheless react unfavorably as bears will most probably whinge that: 1) Nvidia’s sequential gross sales expansion will slow down to “handiest” 7%-8% quarter over quarter within the fiscal 2nd quarter (July) outlook, nicely underneath the mid-teens or higher the previous couple of quarters, 2) Gross margin is peaking and decline is an indication of pricing power, destructive combine (extra China H20 shipments and/or extra inference devices) and slowing call for/easing provide.” Mon, Might 20, 2024 at 2:24 AM PDTNvidia memoriesDeutsche Financial institution strategist Jim Reid with a second of mirrored image forward of Nvidia’s (NVDA) intently watched income file on Wednesday:”Bear in mind this time remaining yr the mainstream AI frenzy started across the time of Nvidia’s effects the place the corporate climbed over 20% on effects day and has now tripled in worth over three hundred and sixty five days.”Nvidia stocks are up 197% since that Might 24, 2023, income file.

Mon, Might 20, 2024 at 2:24 AM PDTNvidia memoriesDeutsche Financial institution strategist Jim Reid with a second of mirrored image forward of Nvidia’s (NVDA) intently watched income file on Wednesday:”Bear in mind this time remaining yr the mainstream AI frenzy started across the time of Nvidia’s effects the place the corporate climbed over 20% on effects day and has now tripled in worth over three hundred and sixty five days.”Nvidia stocks are up 197% since that Might 24, 2023, income file.

Semiconductors achieve forward of Nvidia’s income anticipated on Wednesday

A five-year have a look at copper costs displays report highs. (Yahoo Finance)