US shares closed decrease on Monday as traders girded for per week the place Federal Reserve Chair Jerome Powell’s testimony and the per month jobs document may just put fairness features to the take a look at.The S&P 500 (^GSPC) fell slightly below the flatline after finishing Friday with its sixteenth weekly win in 18 weeks. The Dow Jones Business Reasonable (^DJI) declined 0.2%. The Nasdaq Composite (^IXIC) fell 0.4% as drop in each Apple (AAPL) and Tesla (TSLA) stocks weighed at the tech heavy index.Shares have racked up features amid a constant AI-spurred run-up in techs, which helped the Nasdaq Composite (^IXIC) in spite of everything nail a contemporary all-time top after a years lengthy wait final week.The tech rally, and Nvidia’s (NVDA) breakneck upward thrust to a $2 trillion valuation particularly, has brought on issues a couple of construction bubble — even though some analysts are much less frightened. Stocks of the chipmaker rose 6% to new all time highs all through Monday’s consultation.Additionally on Monday, bitcoin (BTC-USD) rose greater than 7% to hover above $67,000 because the cryptocurrency inched nearer against a file top, whilst Japan’s Nikkei 225 inventory index (^N225) breached the important thing 40,000 stage for the primary time.Gold futures (GC=F) won on Monday as April contracts settled at a file $2117.70 in keeping with ounce.A dose of fact may just lie forward for the top hopes and the hype, when the Fed’s Powell steps as much as discuss and the February jobs knowledge arrives. Each will play into calculations for rate of interest cuts and make clear whether or not the United States economic system is headed for a “cushy touchdown” or stagflation. Powell is about to present testimony to Congress on Wednesday, whilst the exertions knowledge is due on Friday.In a shot around the bows for Large Tech, EU antitrust regulators fined Apple about $2 billion over App Retailer restrictions on Spotify (SPOT) and different track streaming services and products. Apple stocks slipped 2.5% after the inside track.Amongst giant movers, stocks in Tremendous Micro Laptop (SMCI) popped up to 25% to a brand new all-time top on Monday forward of the AI server maker’s access at the S&P 500.Tale continuesMacy’s (M) inventory jumped about 14% after bidders Arkhouse and Brigade raised their buyout be offering to $6.6 billion, a 33% top class to the ultimate value on Friday.Spirit Airways (SAVE) stocks fell greater than 10% and JetBlue inventory (JBLU) rose up to 5% after the low cost carriers introduced the termination in their $3.8 billion merger settlement. A federal pass judgement on blocked the deal again in January.Live15 updates Mon, March 4, 2024 at 1:05 PM PSTS&P 500, Nasdaq dip, bitcoin approaches new highsThe main averages retreated from final week’s file closes whilst bitcoin inched nearer to new highs on Monday.The S&P 500 (^GSPC) fell slightly below the flatline whilst the Dow Jones Business Reasonable (^DJI) declined 0.3%. The Nasdaq Composite (^IXIC) fell 0.4%, weighed via a drop in stocks of Apple (AAPL) and Tesla (TSLA).The EV maker’s inventory dropped to new multi-week lows as slowing China shipments and new value cuts trace at troubles for the EV stalwart on this planet’s greatest automotive marketplace.Apple stocks slid about 3% after the iPhone maker used to be hit with a $2 billion Eu Fee (EC) fantastic for allegedly breaking pageant regulations out of the country. The tech massive may be bracing for a sweeping lawsuit from the Justice Division in the United States.Nvidia (NVDA) inventory touched new highs amid persevered enthusiasm for semiconductors and synthetic intelligence. Complex Micro Units (AMD) stocks additionally rose greater than 1%.In the meantime Tremendous Micro Laptop (SMCI) inventory popped 18% after surging greater than 26% all through buying and selling forward of the AI server maker’s access at the S&P 500.Buyers had been protecting an in depth eye on bitcoin (BTC-US) on Monday because the cryptocurrency rose up to 7% to hover above $67,000 in keeping with token, inching nearer to all-time highs.

Mon, March 4, 2024 at 1:05 PM PSTS&P 500, Nasdaq dip, bitcoin approaches new highsThe main averages retreated from final week’s file closes whilst bitcoin inched nearer to new highs on Monday.The S&P 500 (^GSPC) fell slightly below the flatline whilst the Dow Jones Business Reasonable (^DJI) declined 0.3%. The Nasdaq Composite (^IXIC) fell 0.4%, weighed via a drop in stocks of Apple (AAPL) and Tesla (TSLA).The EV maker’s inventory dropped to new multi-week lows as slowing China shipments and new value cuts trace at troubles for the EV stalwart on this planet’s greatest automotive marketplace.Apple stocks slid about 3% after the iPhone maker used to be hit with a $2 billion Eu Fee (EC) fantastic for allegedly breaking pageant regulations out of the country. The tech massive may be bracing for a sweeping lawsuit from the Justice Division in the United States.Nvidia (NVDA) inventory touched new highs amid persevered enthusiasm for semiconductors and synthetic intelligence. Complex Micro Units (AMD) stocks additionally rose greater than 1%.In the meantime Tremendous Micro Laptop (SMCI) inventory popped 18% after surging greater than 26% all through buying and selling forward of the AI server maker’s access at the S&P 500.Buyers had been protecting an in depth eye on bitcoin (BTC-US) on Monday because the cryptocurrency rose up to 7% to hover above $67,000 in keeping with token, inching nearer to all-time highs. Mon, March 4, 2024 at 12:33 PM PSTTesla inventory falls amid cargo hunch, new value cuts in ChinaTesla (TSLA) stocks dropped to new multi-week lows as slowing China shipments and new value cuts there trace at troubles for the EV stalwart on this planet’s greatest automotive marketplace.Tesla shipped 60,365 cars from its Giga Shanghai manufacturing unit in February, in keeping with initial knowledge from China’s PCA (Passenger Automobile Affiliation) by way of Bloomberg. The February shipments constitute a 16% drop from a month in the past, and a couple of 19% drop from a 12 months in the past.Tesla stocks are down kind of 7% in overdue afternoon buying and selling, hitting ranges now not noticed since overdue January.Learn extra right here from Yahoo Finance’s Pras Subramanian.

Mon, March 4, 2024 at 12:33 PM PSTTesla inventory falls amid cargo hunch, new value cuts in ChinaTesla (TSLA) stocks dropped to new multi-week lows as slowing China shipments and new value cuts there trace at troubles for the EV stalwart on this planet’s greatest automotive marketplace.Tesla shipped 60,365 cars from its Giga Shanghai manufacturing unit in February, in keeping with initial knowledge from China’s PCA (Passenger Automobile Affiliation) by way of Bloomberg. The February shipments constitute a 16% drop from a month in the past, and a couple of 19% drop from a 12 months in the past.Tesla stocks are down kind of 7% in overdue afternoon buying and selling, hitting ranges now not noticed since overdue January.Learn extra right here from Yahoo Finance’s Pras Subramanian. Mon, March 4, 2024 at 12:15 PM PSTNvidia rallies to new highs, semis gainNvidia inventory (NVDA) hit new all-time highs on Monday amid persevered enthusiasm for semiconductors and synthetic intelligence. The chipmaker used to be presenting at a Morgan Stanley convention on Monday. Stocks won greater than 6% to the touch an intraday file of $876.95 every.Complex Micro Units (AMD) additionally rose greater than 4% to the touch file ranges of $211.01.In the meantime, Tremendous Micro Laptop (SMCI) popped up to 26% to hit new highs forward of the AI server maker’s access at the S&P 500. Tremendous Micro Laptop stocks have surged greater than 290% for the reason that get started of the 12 months amid an ongoing craze over synthetic intelligence.Good points within the semiconductor house helped take care of the Nasdaq Composite (^IXIC) across the flatline in afternoon buying and selling.

Mon, March 4, 2024 at 12:15 PM PSTNvidia rallies to new highs, semis gainNvidia inventory (NVDA) hit new all-time highs on Monday amid persevered enthusiasm for semiconductors and synthetic intelligence. The chipmaker used to be presenting at a Morgan Stanley convention on Monday. Stocks won greater than 6% to the touch an intraday file of $876.95 every.Complex Micro Units (AMD) additionally rose greater than 4% to the touch file ranges of $211.01.In the meantime, Tremendous Micro Laptop (SMCI) popped up to 26% to hit new highs forward of the AI server maker’s access at the S&P 500. Tremendous Micro Laptop stocks have surged greater than 290% for the reason that get started of the 12 months amid an ongoing craze over synthetic intelligence.Good points within the semiconductor house helped take care of the Nasdaq Composite (^IXIC) across the flatline in afternoon buying and selling. Mon, March 4, 2024 at 11:25 AM PSTApple will get squeezed via antitrust regulators on either side of the AtlanticApple is getting squeezed via antitrust regulators on either side of the Atlantic.Yahoo Finance’s Alexis Keenan studies the iPhone maker used to be hit Monday with a $2 billion Eu Fee (EC) fantastic for allegedly breaking pageant regulations out of the country — simply because it used to be bracing for a sweeping lawsuit from the Justice Division in the United States.Apple intends to struggle the verdict from the Eu Union’s antitrust regulator. It additionally has been seeking to persuade Justice Division officers to not record their swimsuit, in keeping with media studies.The corporate and its legal professionals even met with Assistant Lawyer Basic Jonathan Kanter in overdue February to make a last-ditch argument, in keeping with the ones studies.Apple stocks had been down 3% on Monday.Learn extra right here.

Mon, March 4, 2024 at 11:25 AM PSTApple will get squeezed via antitrust regulators on either side of the AtlanticApple is getting squeezed via antitrust regulators on either side of the Atlantic.Yahoo Finance’s Alexis Keenan studies the iPhone maker used to be hit Monday with a $2 billion Eu Fee (EC) fantastic for allegedly breaking pageant regulations out of the country — simply because it used to be bracing for a sweeping lawsuit from the Justice Division in the United States.Apple intends to struggle the verdict from the Eu Union’s antitrust regulator. It additionally has been seeking to persuade Justice Division officers to not record their swimsuit, in keeping with media studies.The corporate and its legal professionals even met with Assistant Lawyer Basic Jonathan Kanter in overdue February to make a last-ditch argument, in keeping with the ones studies.Apple stocks had been down 3% on Monday.Learn extra right here.  Mon, March 4, 2024 at 11:07 AM PSTGas costs: ‘Stark will increase’ anticipated amid ‘stunted’ refineries, upper oilGasoline costs have noticed sharp will increase amid contemporary refinery constraints and better oil costs.The nationwide reasonable on the pump sat at $3.35 in keeping with gallon on Monday, up $0.09 from per week in the past, however nonetheless $0.05 decrease from precisely 12 months in the past, in keeping with AAA knowledge.”US refining has been stunted via critical climate and a few energy losses at key vegetation. We would possibly in the following couple of days see US retail gasoline costs at a better quantity than year-ago,” Tom Kloza, world head of power research at OPIS, informed Yahoo Finance.West Texas Intermediate (CL=F) futures had been buying and selling slightly below the $79 stage on Monday whilst Brent (BZ=F) fell to industry underneath $83 in keeping with barrel.Crude dipped regardless of an settlement via oil alliance OPEC+ to increase output cuts of two.2 million in keeping with day into the second one quarter. Expectancies that the cartel would proceed with the discounts had lifted contract costs in prior periods.On Friday US crude futures surged above $80 in keeping with barrel for the primary time since November.Learn extra right here.

Mon, March 4, 2024 at 11:07 AM PSTGas costs: ‘Stark will increase’ anticipated amid ‘stunted’ refineries, upper oilGasoline costs have noticed sharp will increase amid contemporary refinery constraints and better oil costs.The nationwide reasonable on the pump sat at $3.35 in keeping with gallon on Monday, up $0.09 from per week in the past, however nonetheless $0.05 decrease from precisely 12 months in the past, in keeping with AAA knowledge.”US refining has been stunted via critical climate and a few energy losses at key vegetation. We would possibly in the following couple of days see US retail gasoline costs at a better quantity than year-ago,” Tom Kloza, world head of power research at OPIS, informed Yahoo Finance.West Texas Intermediate (CL=F) futures had been buying and selling slightly below the $79 stage on Monday whilst Brent (BZ=F) fell to industry underneath $83 in keeping with barrel.Crude dipped regardless of an settlement via oil alliance OPEC+ to increase output cuts of two.2 million in keeping with day into the second one quarter. Expectancies that the cartel would proceed with the discounts had lifted contract costs in prior periods.On Friday US crude futures surged above $80 in keeping with barrel for the primary time since November.Learn extra right here. Mon, March 4, 2024 at 11:00 AM PSTBitcoin approaches all-time highsInvestors had been protecting an in depth eye on Bitcoin (BTC-US) on Monday because the cryptocurrency rose up to 7% previously 24 hours, inching nearer to all-time highs.Sizable quantities of latest investor cash has poured into spot bitcoin exchange-traded price range since they had been licensed via the Securities and Trade Fee in January.The token used to be buying and selling at simply round $54,000 one week in the past. It has rallied greater than 20% since then to hover above $66,500 on Monday afternoon.Bitcoin’s all-time file top of $68,789.63 used to be reached in November 2021.Different corners of the crypto marketplace have additionally rallied. Ethereum (ETH-USD) used to be up greater than 2% on Monday to industry above $3,500.

Mon, March 4, 2024 at 11:00 AM PSTBitcoin approaches all-time highsInvestors had been protecting an in depth eye on Bitcoin (BTC-US) on Monday because the cryptocurrency rose up to 7% previously 24 hours, inching nearer to all-time highs.Sizable quantities of latest investor cash has poured into spot bitcoin exchange-traded price range since they had been licensed via the Securities and Trade Fee in January.The token used to be buying and selling at simply round $54,000 one week in the past. It has rallied greater than 20% since then to hover above $66,500 on Monday afternoon.Bitcoin’s all-time file top of $68,789.63 used to be reached in November 2021.Different corners of the crypto marketplace have additionally rallied. Ethereum (ETH-USD) used to be up greater than 2% on Monday to industry above $3,500. Mon, March 4, 2024 at 10:15 AM PSTFord inventory rises as US gross sales leap 10.5% in FebruaryFord (F) inventory rose greater than 3% on Monday after a upward thrust within the automaker’s February gross sales, making the Dearborn-based automaker the No. 1 dealer in The usa for the second one immediately month.As Yahoo Finance’s Pras Subramanian studies, Ford additionally famous hybrid and EV gross sales features, highlighting the significance of its electrified powertrains.Ford reported February gross sales had been up 10.5% to 174,192 cars, topping Toyota’s overall of 159,262.Curiously, hybrid gross sales jumped 31.5%, to somewhat over 12,000 gadgets, powered via file gross sales of the Maverick hybrid compact pickup and the Ford Break out small SUV hybrid.Learn extra right here.

Mon, March 4, 2024 at 10:15 AM PSTFord inventory rises as US gross sales leap 10.5% in FebruaryFord (F) inventory rose greater than 3% on Monday after a upward thrust within the automaker’s February gross sales, making the Dearborn-based automaker the No. 1 dealer in The usa for the second one immediately month.As Yahoo Finance’s Pras Subramanian studies, Ford additionally famous hybrid and EV gross sales features, highlighting the significance of its electrified powertrains.Ford reported February gross sales had been up 10.5% to 174,192 cars, topping Toyota’s overall of 159,262.Curiously, hybrid gross sales jumped 31.5%, to somewhat over 12,000 gadgets, powered via file gross sales of the Maverick hybrid compact pickup and the Ford Break out small SUV hybrid.Learn extra right here. Mon, March 4, 2024 at 9:30 AM PSTTrending tickers on MondayTesla (TSLA)Stocks of Tesla slid kind of 6% on Monday following a decline within the EV maker’s February car shipments out of its Shanghai manufacturing unit along side contemporary studies of an escalating price battle in China. Tesla stocks are down 23% 12 months to this point.Tremendous Micro Laptop (SMCI)Tremendous Micro Laptop inventory popped up to 26% on Monday forward of the AI server maker’s access at the S&P 500. Stocks of San Jose, Calif.-based IT corporate have surged greater than 290% for the reason that get started of the 12 months amid an ongoing AI craze.Bitcoin (BTC-US)The token crowned $67,000 on Monday because it inched nearer to all-time highs. Bitcoin has rallied greater than 20% in only one week.The cryptocurrency is not up to a couple of proportion issues clear of attaining its November 2021 all-time top of $68,789.63.

Mon, March 4, 2024 at 9:30 AM PSTTrending tickers on MondayTesla (TSLA)Stocks of Tesla slid kind of 6% on Monday following a decline within the EV maker’s February car shipments out of its Shanghai manufacturing unit along side contemporary studies of an escalating price battle in China. Tesla stocks are down 23% 12 months to this point.Tremendous Micro Laptop (SMCI)Tremendous Micro Laptop inventory popped up to 26% on Monday forward of the AI server maker’s access at the S&P 500. Stocks of San Jose, Calif.-based IT corporate have surged greater than 290% for the reason that get started of the 12 months amid an ongoing AI craze.Bitcoin (BTC-US)The token crowned $67,000 on Monday because it inched nearer to all-time highs. Bitcoin has rallied greater than 20% in only one week.The cryptocurrency is not up to a couple of proportion issues clear of attaining its November 2021 all-time top of $68,789.63. Mon, March 4, 2024 at 8:46 AM PSTBitcoin hovers above $66,000, inches against file highBitcoin (BTC-USD) crowned $66,000 on Monday because the cryptocurrency inches nearer against a file top. The token has rallied kind of 50% for the reason that get started of the 12 months.US-listed bitcoin exchange-traded price range had been licensed via the Securities and Trade Fee in January and feature attracted sizable quantities of latest investor cash over the past month.The token has moved up via greater than 20% in only one week.Bitcoin’s final all-time file top of $68,789.63 used to be reached in November 2021.

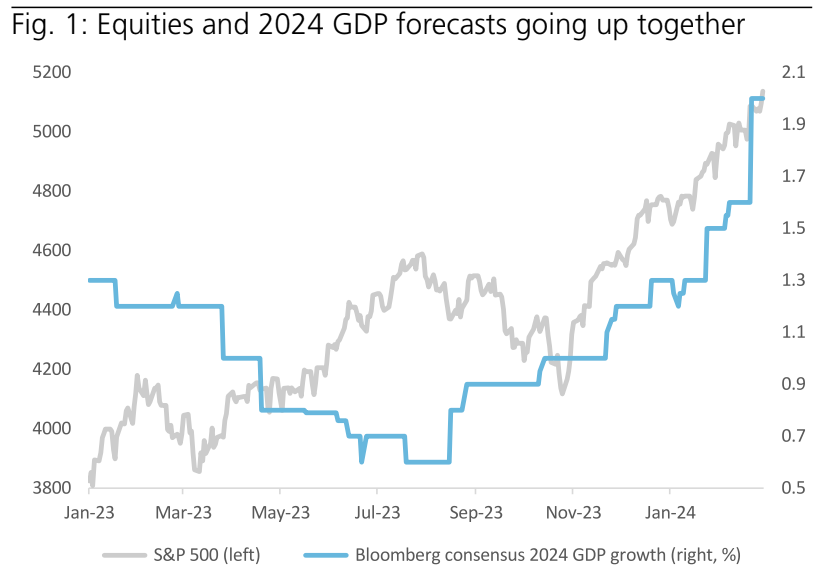

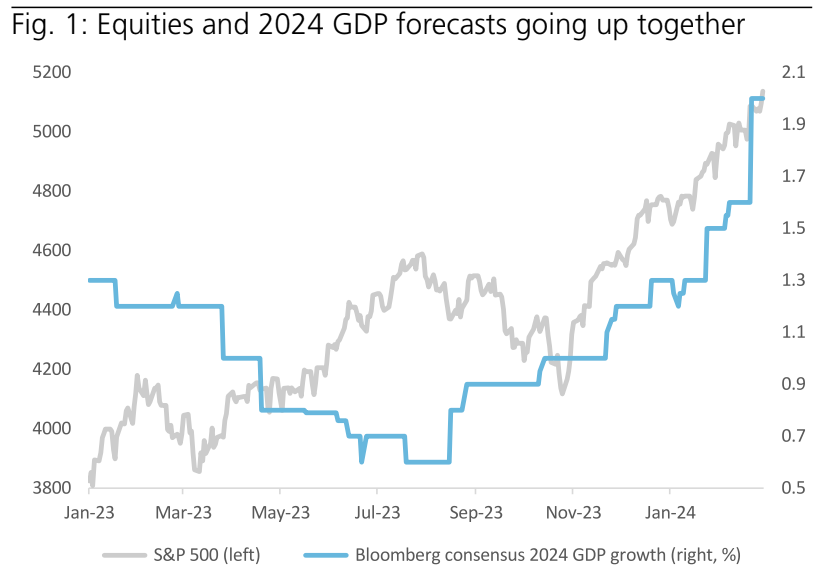

Mon, March 4, 2024 at 8:46 AM PSTBitcoin hovers above $66,000, inches against file highBitcoin (BTC-USD) crowned $66,000 on Monday because the cryptocurrency inches nearer against a file top. The token has rallied kind of 50% for the reason that get started of the 12 months.US-listed bitcoin exchange-traded price range had been licensed via the Securities and Trade Fee in January and feature attracted sizable quantities of latest investor cash over the past month.The token has moved up via greater than 20% in only one week.Bitcoin’s final all-time file top of $68,789.63 used to be reached in November 2021. Mon, March 4, 2024 at 8:00 AM PSTGood level on shares and economic system via UBSFair level via UBS’s Jason Draho in a brand new notice that simply crossed my inbox.Perhaps shares are going up for causes past simply AI hype. Perhaps, simply possibly, the economic system is more potent than anticipated and via extension, income for firms will likely be more potent than anticipated for all of this 12 months.Just right chart underneath from Draho.

Mon, March 4, 2024 at 8:00 AM PSTGood level on shares and economic system via UBSFair level via UBS’s Jason Draho in a brand new notice that simply crossed my inbox.Perhaps shares are going up for causes past simply AI hype. Perhaps, simply possibly, the economic system is more potent than anticipated and via extension, income for firms will likely be more potent than anticipated for all of this 12 months.Just right chart underneath from Draho.

The Side road is elevating their financial forecasts. Will they do it once more after this Friday’s jobs document? (UBS)

The Side road is elevating their financial forecasts. Will they do it once more after this Friday’s jobs document? (UBS) Mon, March 4, 2024 at 7:33 AM PSTBank of The usa newest company to look bullish consequence for shares in 2024Another Wall Side road technique group is out with an positive projection on how a long way shares will run this 12 months.In a notice to shoppers on Sunday, Financial institution of The usa’s US fairness and quantitive technique group led via Savita Subramanian boosted its year-end goal for the S&P 500 (^GSPC) to five,400 from 5,000. This projection along side a up to date name from UBS are probably the most bullish predictions for the benchmark reasonable this 12 months amongst strategists tracked via Yahoo Finance.”Bull markets finish with euphoria — we are not there but,” Subramanian wrote. “Sentiment has advanced, however spaces of euphoria are restricted (AI, GLP-1).”BofA’s transfer is the 5th boosted value goal from strategists tracked via Yahoo Finance within the final month. The extra positive outlooks come as shares have ripped upper to start out the 12 months. The S&P 500 and Nasdaq Composite simply closed out their best possible February since 2015, supported via a 2nd immediately quarter of profits enlargement and an larger self assurance within the trajectory of the United States economic system.Subramanian famous that fourth quarter profits grew 4% in comparison to the 12 months prior and analysts don’t seem to be slicing their forecasts for the present quarter at their customary fee. This comes as Financial institution of The usa’s economics analysis group simply boosted their outlook for enlargement this 12 months too. That aggregate of an larger profits outlook and a extra bullish outlook for the United States economic system has been a commonplace thread within the contemporary S&P 500 year-end goal boosts throughout Wall Side road.

Mon, March 4, 2024 at 7:33 AM PSTBank of The usa newest company to look bullish consequence for shares in 2024Another Wall Side road technique group is out with an positive projection on how a long way shares will run this 12 months.In a notice to shoppers on Sunday, Financial institution of The usa’s US fairness and quantitive technique group led via Savita Subramanian boosted its year-end goal for the S&P 500 (^GSPC) to five,400 from 5,000. This projection along side a up to date name from UBS are probably the most bullish predictions for the benchmark reasonable this 12 months amongst strategists tracked via Yahoo Finance.”Bull markets finish with euphoria — we are not there but,” Subramanian wrote. “Sentiment has advanced, however spaces of euphoria are restricted (AI, GLP-1).”BofA’s transfer is the 5th boosted value goal from strategists tracked via Yahoo Finance within the final month. The extra positive outlooks come as shares have ripped upper to start out the 12 months. The S&P 500 and Nasdaq Composite simply closed out their best possible February since 2015, supported via a 2nd immediately quarter of profits enlargement and an larger self assurance within the trajectory of the United States economic system.Subramanian famous that fourth quarter profits grew 4% in comparison to the 12 months prior and analysts don’t seem to be slicing their forecasts for the present quarter at their customary fee. This comes as Financial institution of The usa’s economics analysis group simply boosted their outlook for enlargement this 12 months too. That aggregate of an larger profits outlook and a extra bullish outlook for the United States economic system has been a commonplace thread within the contemporary S&P 500 year-end goal boosts throughout Wall Side road. Mon, March 4, 2024 at 7:15 AM PSTMacy’s inventory jumps as personal fairness company ups bid to $6.6 billion amid buyout battleMacy’s (M) inventory jumped up to 16% on Monday after activist shareholder Arkhouse Control upped its buyout bid to $6.6 billion for the long-lasting store. Macy’s had rejected a previous $5.8 billion be offering from the personal fairness company and its spouse, Brigade Capital, in overdue January.As Yahoo Finance’s Brooke DiPalma studies, Macy’s (M) is having a look to show over a brand new leaf, however a struggle to take it personal is rising and doubts linger on whether or not the corporate can engineer a comeback with its present plans.Tony Spring, freshly minted as CEO a month in the past, recognizes that the industry wishes to switch.”We aren’t going to depart Macy’s as it’s nowadays. It is foolhardy to assume that leaving the industry because it exists nowadays is a recipe for good fortune someday,” Spring informed Yahoo Finance.Spring stated the emblem will “evolve,” regulate its product providing, and combine its bodily and virtual presence “thoughtfully,” however will accomplish that “with the right motion, … time, and strengthen of our group.”Arkhouse Control’s new bid launched on Sunday presentations the activist investor is not looking ahead to the consequences.Learn extra right here.

Mon, March 4, 2024 at 7:15 AM PSTMacy’s inventory jumps as personal fairness company ups bid to $6.6 billion amid buyout battleMacy’s (M) inventory jumped up to 16% on Monday after activist shareholder Arkhouse Control upped its buyout bid to $6.6 billion for the long-lasting store. Macy’s had rejected a previous $5.8 billion be offering from the personal fairness company and its spouse, Brigade Capital, in overdue January.As Yahoo Finance’s Brooke DiPalma studies, Macy’s (M) is having a look to show over a brand new leaf, however a struggle to take it personal is rising and doubts linger on whether or not the corporate can engineer a comeback with its present plans.Tony Spring, freshly minted as CEO a month in the past, recognizes that the industry wishes to switch.”We aren’t going to depart Macy’s as it’s nowadays. It is foolhardy to assume that leaving the industry because it exists nowadays is a recipe for good fortune someday,” Spring informed Yahoo Finance.Spring stated the emblem will “evolve,” regulate its product providing, and combine its bodily and virtual presence “thoughtfully,” however will accomplish that “with the right motion, … time, and strengthen of our group.”Arkhouse Control’s new bid launched on Sunday presentations the activist investor is not looking ahead to the consequences.Learn extra right here.  Mon, March 4, 2024 at 6:35 AM PSTStocks pause rally, bitcoin tops $65,000Stocks opened decrease on Monday, pausing their contemporary rally because the marketplace prepares for testimony from Federal Reserve Chair Jerome Powell this week and a per month jobs document that might put fairness features to the take a look at.The S&P 500 (^GSPC) shed about 0.2% whilst the Dow Jones Business Reasonable (^DJI) fell 0.5%. The tech-heavy Nasdaq Composit (^IXIC) used to be little modified.Additionally on Monday, bitcoin (BTC-USD) rose to best $65,000, inching nearer to a file top.

Mon, March 4, 2024 at 6:35 AM PSTStocks pause rally, bitcoin tops $65,000Stocks opened decrease on Monday, pausing their contemporary rally because the marketplace prepares for testimony from Federal Reserve Chair Jerome Powell this week and a per month jobs document that might put fairness features to the take a look at.The S&P 500 (^GSPC) shed about 0.2% whilst the Dow Jones Business Reasonable (^DJI) fell 0.5%. The tech-heavy Nasdaq Composit (^IXIC) used to be little modified.Additionally on Monday, bitcoin (BTC-USD) rose to best $65,000, inching nearer to a file top. Mon, March 4, 2024 at 6:19 AM PSTSpirit inventory sinks on termination of JetBlue merger agreementSpirit Airways (SAVE) inventory plunged up to 16% in pre-market buying and selling on Monday after its $3.8 billion merger settlement with JetBlue (JBLU), blocked via a court docket in January, used to be terminated via the low cost carriers.”After discussing our choices with our advisors and JetBlue, we concluded that present regulatory stumbling blocks is not going to allow us to near this transaction in a well timed type beneath the merger settlement,” Spirit’s CEO Ted Christie stated in an organization commentary.JetBlue’s proposed acquisition of Spirit fell aside after a federal pass judgement on blocked the deal on Jan. 16 amid antitrust issues.Stocks of JetBlue won greater than 5% in pre-market buying and selling after the announcement. Spirit stocks are down kind of 60% 12 months to this point.

Mon, March 4, 2024 at 6:19 AM PSTSpirit inventory sinks on termination of JetBlue merger agreementSpirit Airways (SAVE) inventory plunged up to 16% in pre-market buying and selling on Monday after its $3.8 billion merger settlement with JetBlue (JBLU), blocked via a court docket in January, used to be terminated via the low cost carriers.”After discussing our choices with our advisors and JetBlue, we concluded that present regulatory stumbling blocks is not going to allow us to near this transaction in a well timed type beneath the merger settlement,” Spirit’s CEO Ted Christie stated in an organization commentary.JetBlue’s proposed acquisition of Spirit fell aside after a federal pass judgement on blocked the deal on Jan. 16 amid antitrust issues.Stocks of JetBlue won greater than 5% in pre-market buying and selling after the announcement. Spirit stocks are down kind of 60% 12 months to this point. Mon, March 4, 2024 at 4:30 AM PSTThe head-shaking stats round NvidiaSome of the most up to date trending tickers on Yahoo Finance this morning are crypto-related. No marvel as bitcoin has busted thru $65,000 and pleasure builds for a possible halving tournament in April.However to me, the primary tale in markets stays the frenzied industry round AI sweetheart Nvidia (NVDA). As this inventory is going, so too will pass the marketplace in 2024 (and 2025, 2026, 2027…).A couple of stats on Nvidia to get you considering:Nvidia is now 3rd Most worthy US corporate: $2.05 trillion marketplace cap.It handiest took 180 buying and selling days for Nvidia’s marketplace cap to move from $1 trillion to $2 trillion.The inventory is rated “uy” via 92% of the analysts overlaying it.

Mon, March 4, 2024 at 4:30 AM PSTThe head-shaking stats round NvidiaSome of the most up to date trending tickers on Yahoo Finance this morning are crypto-related. No marvel as bitcoin has busted thru $65,000 and pleasure builds for a possible halving tournament in April.However to me, the primary tale in markets stays the frenzied industry round AI sweetheart Nvidia (NVDA). As this inventory is going, so too will pass the marketplace in 2024 (and 2025, 2026, 2027…).A couple of stats on Nvidia to get you considering:Nvidia is now 3rd Most worthy US corporate: $2.05 trillion marketplace cap.It handiest took 180 buying and selling days for Nvidia’s marketplace cap to move from $1 trillion to $2 trillion.The inventory is rated “uy” via 92% of the analysts overlaying it.

The Side road is elevating their financial forecasts. Will they do it once more after this Friday’s jobs document? (UBS)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24401980/STK071_ACastro_apple_0003.jpg)