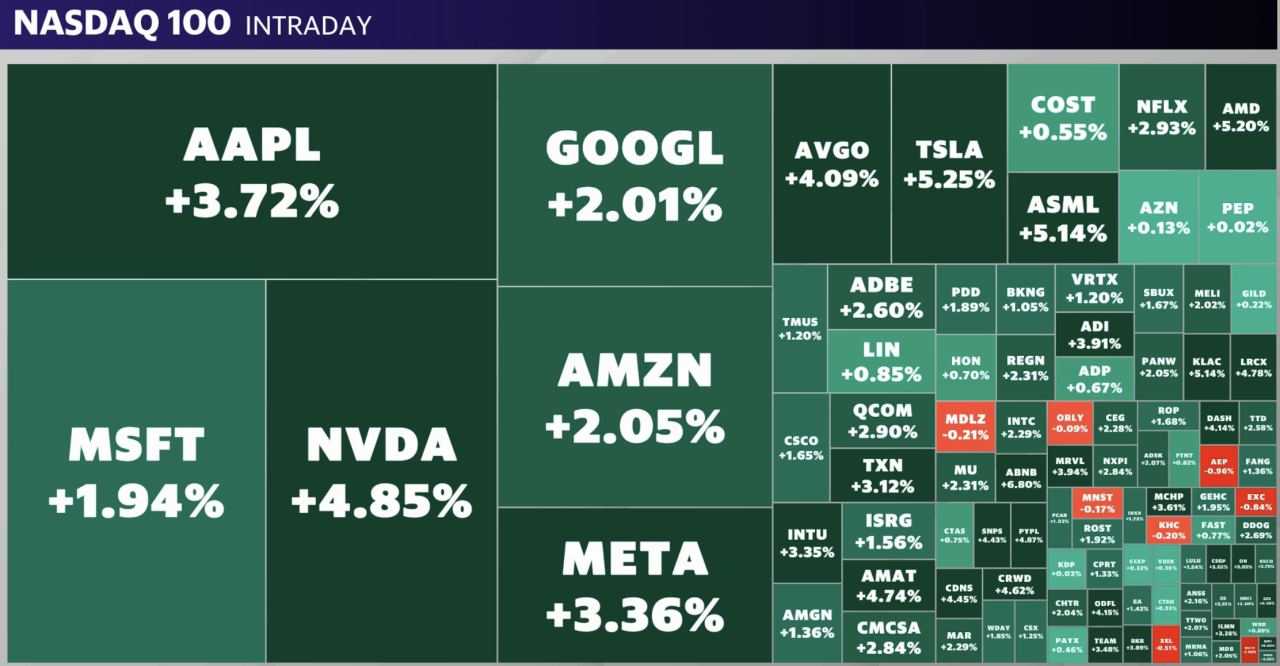

US shares soared on Thursday amid rising optimism that the Federal Reserve’s jumbo rate of interest minimize will ship a “cushy touchdown” for the USA economic system.The S&P 500 (^GSPC) climbed more or less 1.5%, whilst the Dow Jones Business Reasonable (^IXIC) rose just about 1% with each buying and selling close to document highs. The tech-heavy Nasdaq Composite (^IXIC) led the features, up 2.5%.Shares are rallying as traders take a more in-depth take a look at the Fed’s determination to kick-start its new charge cycle with 50 foundation level minimize. After Wednesday’s coverage announcement, the gauges swayed ahead of last decrease.Wall Boulevard has absorbed Chair Jerome Powell’s message {that a} deep minimize in a reasonably sturdy economic system will in the long run fend off the danger of recession — and is an indication of religion, now not panic about present stipulations.Financial institution of The united states now believes the Fed will cross on to chop charges via 0.75% via the tip of the yr, as opposed to the 0.50% it up to now forecast. By means of comparability, the central financial institution’s personal “dot plot” signifies policymakers be expecting a half-percentage-point relief.Learn extra: What the Fed charge minimize method for financial institution accounts, CDs, loans, and credit score cardsRate-sensitive expansion shares climbed in premarket buying and selling, with Large Tech megacaps that fueled this yr’s rally making features. Alphabet (GOOG), Microsoft (MSFT), and Meta (META) had been all up more or less 2%, whilst Apple (AAPL) added over 3%. Tesla (TSLA) and Nvidia (NVDA) rose just about 5%.With the Fed pivot finished, some available in the market have returned to looking at information releases as they brace for attainable volatility. A weekly Exertions Division document on preliminary jobless claims on Thursday morning confirmed a fall to the bottom degree in 4 months. The determine for the week ended Sept. 19 got here in at 219,000, whilst the prior week’s overall used to be revised 1,000 upper to 231,000.Live6 updates Thu, September 19, 2024 at 8:29 AM PDTBank shares upward push on Fed rate-cut rallyYahoo Finance’ David Hollerith stories: US financial institution shares surged Thursday following a jumbo charge minimize from the Federal Reserve, an indication of bullishness amongst traders who now be expecting an easing of economic coverage will spice up Wall Boulevard giants and smaller regional lenders.Goldman Sachs (GS), Capital One (COF) and Citigroup (C) every rose greater than 3% Thursday morning, adopted via smaller rises for Wells Fargo (WFC), Financial institution of The united states (BAC), JPMorgan Chase (JPM) and Morgan Stanley (MS).Learn extra right here.

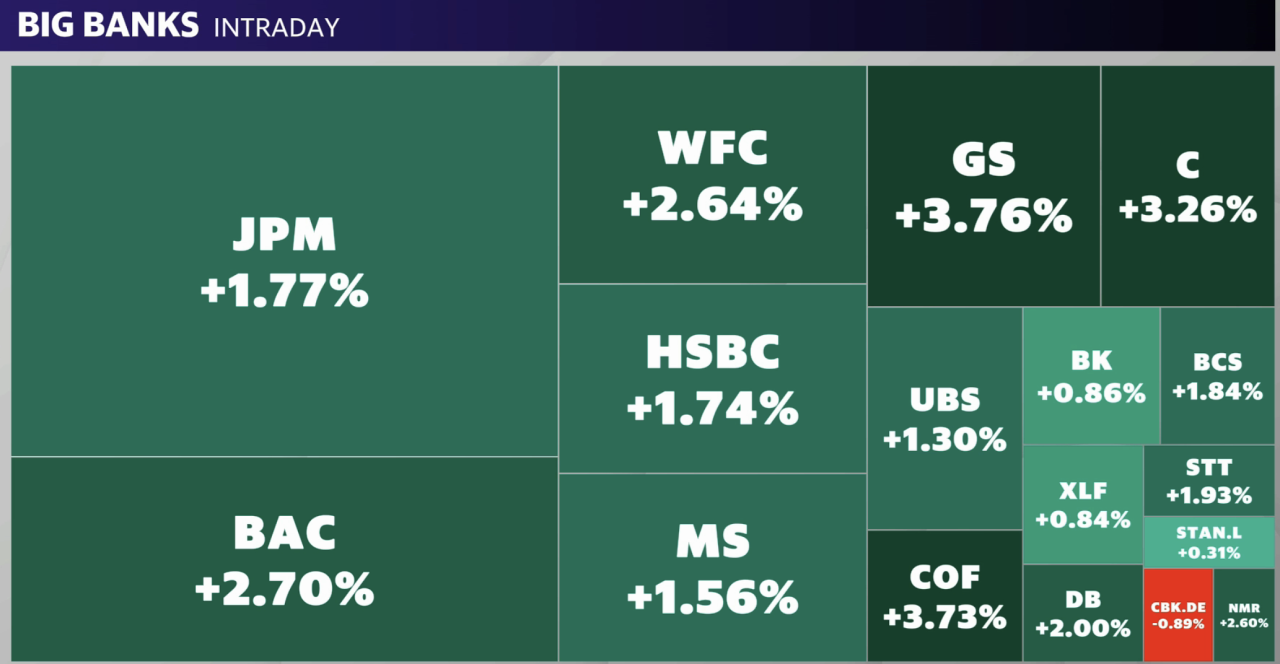

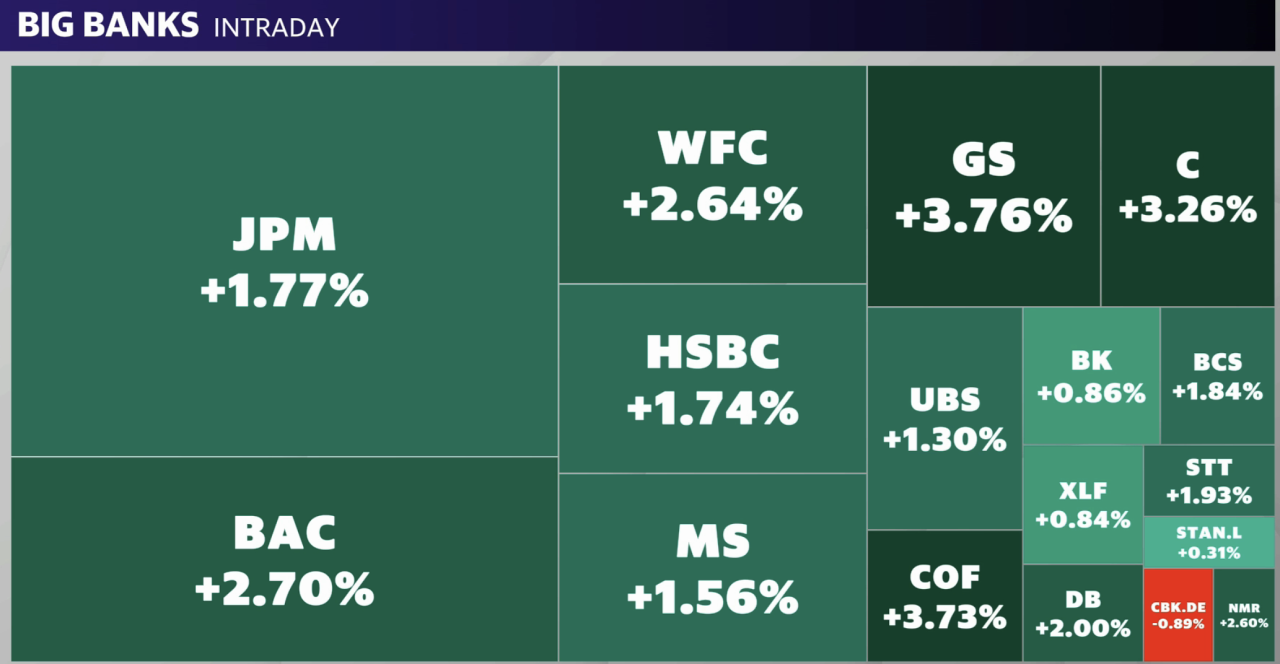

Thu, September 19, 2024 at 8:29 AM PDTBank shares upward push on Fed rate-cut rallyYahoo Finance’ David Hollerith stories: US financial institution shares surged Thursday following a jumbo charge minimize from the Federal Reserve, an indication of bullishness amongst traders who now be expecting an easing of economic coverage will spice up Wall Boulevard giants and smaller regional lenders.Goldman Sachs (GS), Capital One (COF) and Citigroup (C) every rose greater than 3% Thursday morning, adopted via smaller rises for Wells Fargo (WFC), Financial institution of The united states (BAC), JPMorgan Chase (JPM) and Morgan Stanley (MS).Learn extra right here.

Financial institution shares rose on Thursday following the central financial institution’s charge minimize.

Financial institution shares rose on Thursday following the central financial institution’s charge minimize. Thu, September 19, 2024 at 8:17 AM PDTJobless claims the bottom in 4 months, a excellent signal for the roles marketInvestors in search of indicators of a ‘cushy touchdown’ pointed to the most recent preliminary jobless claims information which confirmed a fall to the bottom degree since Might.The Exertions Division’s document for the week finishing Sept. 19 got here in at 219,000, as opposed to expectation of 230,000. The prior week’s overall used to be revised 1,000 upper to 231,000.A fall in preliminary jobless claims alerts the exertions marketplace could also be protecting up higher than anticipated.On Wednesday the Federal Reserve minimize rates of interest via 50 foundation issues, elevating questions about whether or not coverage makers had been choosing the larger relief amid a weakening jobs marketplace.Throughout Wednesday’s press convention Fed Chair Jerome Powell highlighted the unemployment charge has moved up however continues to be reasonably low at 4.2%. Powell described the economic system as “mainly effective.”

Thu, September 19, 2024 at 8:17 AM PDTJobless claims the bottom in 4 months, a excellent signal for the roles marketInvestors in search of indicators of a ‘cushy touchdown’ pointed to the most recent preliminary jobless claims information which confirmed a fall to the bottom degree since Might.The Exertions Division’s document for the week finishing Sept. 19 got here in at 219,000, as opposed to expectation of 230,000. The prior week’s overall used to be revised 1,000 upper to 231,000.A fall in preliminary jobless claims alerts the exertions marketplace could also be protecting up higher than anticipated.On Wednesday the Federal Reserve minimize rates of interest via 50 foundation issues, elevating questions about whether or not coverage makers had been choosing the larger relief amid a weakening jobs marketplace.Throughout Wednesday’s press convention Fed Chair Jerome Powell highlighted the unemployment charge has moved up however continues to be reasonably low at 4.2%. Powell described the economic system as “mainly effective.” Thu, September 19, 2024 at 7:47 AM PDTStocks close to consultation highs as tech fuels post-rate minimize rallyStocks rose Thursday morning because the tech-heavy Nasdaq Composite (^IXIC) led the marketplace features following the Federal Reserve’s charge minimize announcement within the prior consultation.The Nasdaq received up to 2.7% as generation shares, which generally take pleasure in a decrease interestrate surroundings, rose.The Dow (^DJI) climbed greater than 1% to hit an all-time intraday prime whilst the S&P 500 (^GSPC) additionally touched a document in early buying and selling.

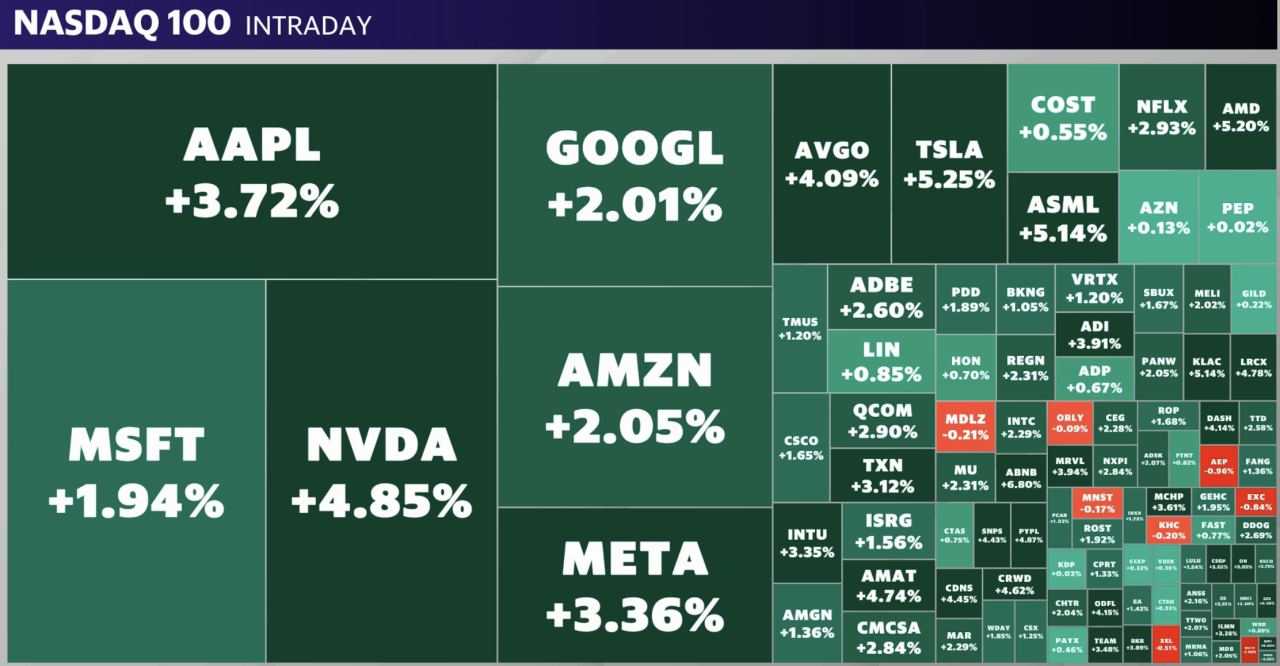

Thu, September 19, 2024 at 7:47 AM PDTStocks close to consultation highs as tech fuels post-rate minimize rallyStocks rose Thursday morning because the tech-heavy Nasdaq Composite (^IXIC) led the marketplace features following the Federal Reserve’s charge minimize announcement within the prior consultation.The Nasdaq received up to 2.7% as generation shares, which generally take pleasure in a decrease interestrate surroundings, rose.The Dow (^DJI) climbed greater than 1% to hit an all-time intraday prime whilst the S&P 500 (^GSPC) additionally touched a document in early buying and selling.

Tech shares led the marketplace features on Thursday.

Tech shares led the marketplace features on Thursday. Thu, September 19, 2024 at 7:00 AM PDTExisting house gross sales fall in August amid decrease loan ratesSales of current houses fell in August as area hunters remained at the sidelines in spite of loan charges hitting their lowest degree in over a yr.Current house gross sales dropped 2.5% from July to a seasonally adjusted annual charge of three.86 million, the Nationwide Affiliation of Realtors mentioned Thursday, the bottom degree since October. Economists polled via Bloomberg anticipated current house gross sales to hit a tempo of three.9 million in August.On a every year foundation, gross sales of up to now owned houses retreated 4.2% in August. The median house worth larger 3.1% from closing August to $416,700, the 14th consecutive month of annual worth will increase.The mix of scarce stock, escalating costs, and increased loan charges continues to weigh on gross sales job — for now.“House gross sales had been disappointing once more in August, however the contemporary construction of decrease loan charges coupled with expanding stock is a formidable aggregate that may give you the surroundings for gross sales to transport upper in long run months,” NAR leader economist Lawrence Yun mentioned in a press unencumber.Then again, economists at Fannie Mae don’t be expecting gross sales job to show round this yr in spite of decrease loan charges.We “be expecting 2024 current house gross sales to fall to the slowest annual tempo since 1995,” they mentioned.

Thu, September 19, 2024 at 7:00 AM PDTExisting house gross sales fall in August amid decrease loan ratesSales of current houses fell in August as area hunters remained at the sidelines in spite of loan charges hitting their lowest degree in over a yr.Current house gross sales dropped 2.5% from July to a seasonally adjusted annual charge of three.86 million, the Nationwide Affiliation of Realtors mentioned Thursday, the bottom degree since October. Economists polled via Bloomberg anticipated current house gross sales to hit a tempo of three.9 million in August.On a every year foundation, gross sales of up to now owned houses retreated 4.2% in August. The median house worth larger 3.1% from closing August to $416,700, the 14th consecutive month of annual worth will increase.The mix of scarce stock, escalating costs, and increased loan charges continues to weigh on gross sales job — for now.“House gross sales had been disappointing once more in August, however the contemporary construction of decrease loan charges coupled with expanding stock is a formidable aggregate that may give you the surroundings for gross sales to transport upper in long run months,” NAR leader economist Lawrence Yun mentioned in a press unencumber.Then again, economists at Fannie Mae don’t be expecting gross sales job to show round this yr in spite of decrease loan charges.We “be expecting 2024 current house gross sales to fall to the slowest annual tempo since 1995,” they mentioned. Thu, September 19, 2024 at 6:54 AM PDTGrowth-chasing Campbell Soup is in for a struggle towards personal labels and big-name rivalsYahoo Finance’s Brooke DiPalma stories:With merchandise from stuffing-flavored chips to ghost pepper rooster noodle soup, firms are ramping up the contest within the grocery aisles.Whilst outlets like Walmart (WMT) and Goal (TGT) are plowing forward with personal labels, Campbell’s (CPB) is doubling down on innovation, advertising and marketing, and larger distribution to promote its well-known manufacturers like Goldfish.”All of it comes all the way down to … developing the appropriate worth, which [is] now not dependent only on a value level,” CEO Mark Clouse advised Yahoo Finance at Campbell’s investor day closing week. “It’s about how will we upload worth in techniques which can be extra differentiated and sustainable?”Learn extra right here.

Thu, September 19, 2024 at 6:54 AM PDTGrowth-chasing Campbell Soup is in for a struggle towards personal labels and big-name rivalsYahoo Finance’s Brooke DiPalma stories:With merchandise from stuffing-flavored chips to ghost pepper rooster noodle soup, firms are ramping up the contest within the grocery aisles.Whilst outlets like Walmart (WMT) and Goal (TGT) are plowing forward with personal labels, Campbell’s (CPB) is doubling down on innovation, advertising and marketing, and larger distribution to promote its well-known manufacturers like Goldfish.”All of it comes all the way down to … developing the appropriate worth, which [is] now not dependent only on a value level,” CEO Mark Clouse advised Yahoo Finance at Campbell’s investor day closing week. “It’s about how will we upload worth in techniques which can be extra differentiated and sustainable?”Learn extra right here.  Thu, September 19, 2024 at 6:31 AM PDTDow, S&P 500 soar to intraday document highs as shares bounce on jumbo charge cutThe Dow (^DJI) and the S&P 500 (^GSPC) touched document highs on Thursday as traders digested the Federal Reserve’s announcement all the way through the prior consultation — a 50 foundation level charge minimize.The S&P 500 climbed more or less 1.7%, whilst the Dow rose greater than 1%, each achieving document highs. The tech-heavy Nasdaq Composite (^IXIC) led the features, up greater than 2.3%.The main averages seesawed all the way through the prior consultation following the Fed’s determination to chop charges.Gold (CG=F) hovered close to all-time highs. The valuable steel and different commodities climbed because the greenback declined.

Thu, September 19, 2024 at 6:31 AM PDTDow, S&P 500 soar to intraday document highs as shares bounce on jumbo charge cutThe Dow (^DJI) and the S&P 500 (^GSPC) touched document highs on Thursday as traders digested the Federal Reserve’s announcement all the way through the prior consultation — a 50 foundation level charge minimize.The S&P 500 climbed more or less 1.7%, whilst the Dow rose greater than 1%, each achieving document highs. The tech-heavy Nasdaq Composite (^IXIC) led the features, up greater than 2.3%.The main averages seesawed all the way through the prior consultation following the Fed’s determination to chop charges.Gold (CG=F) hovered close to all-time highs. The valuable steel and different commodities climbed because the greenback declined.

Financial institution shares rose on Thursday following the central financial institution’s charge minimize.

Tech shares led the marketplace features on Thursday.

Thu, September 19, 2024 at 7:00 AM PDTExisting house gross sales fall in August amid decrease loan ratesSales of current houses fell in August as area hunters remained at the sidelines in spite of loan charges hitting their lowest degree in over a yr.Current house gross sales dropped 2.5% from July to a seasonally adjusted annual charge of three.86 million, the Nationwide Affiliation of Realtors mentioned Thursday, the bottom degree since October. Economists polled via Bloomberg anticipated current house gross sales to hit a tempo of three.9 million in August.On a every year foundation, gross sales of up to now owned houses retreated 4.2% in August. The median house worth larger 3.1% from closing August to $416,700, the 14th consecutive month of annual worth will increase.The mix of scarce stock, escalating costs, and increased loan charges continues to weigh on gross sales job — for now.“House gross sales had been disappointing once more in August, however the contemporary construction of decrease loan charges coupled with expanding stock is a formidable aggregate that may give you the surroundings for gross sales to transport upper in long run months,” NAR leader economist Lawrence Yun mentioned in a press unencumber.Then again, economists at Fannie Mae don’t be expecting gross sales job to show round this yr in spite of decrease loan charges.We “be expecting 2024 current house gross sales to fall to the slowest annual tempo since 1995,” they mentioned.